I should have something profound to say.

I could point you towards the best whatever list of 2008, the worst whatever list of 2008, or I could make some fantastic new years resolution.

I won't.

What will 2009 bring us?

Thursday.

As I get older the years start to blend a little.

I do think 2009 will be very interesting, hopefully not as "interesting" as 2008. We are supposed to look back over a just completed year and think of all we learned, what we would do different, and what we would do the same. We do that for a while and then I think we forget it all rather quickly.

One way to help remember is to write it down. I do a year end balance sheet (net worth statement) for our family. I maintain this throughout the year but then again I'm weird. I would suggest you take some time in the first week of January and complete your balance sheet. It is the only way I know of to determine if you are making financial progress or not.

From a financial standpoint you don't know where your going and how your going to get there if you don't know where you were.

Or something like that.

The EIT told me only an old banker would do something as strange as a family balance sheet so to him I say a hearty BAH HUMBUG!.

And a HAPPY NEW YEAR!!

Ok ok, if I have to pick something I'll take a pass on the worst and choose the best.

THE BEST

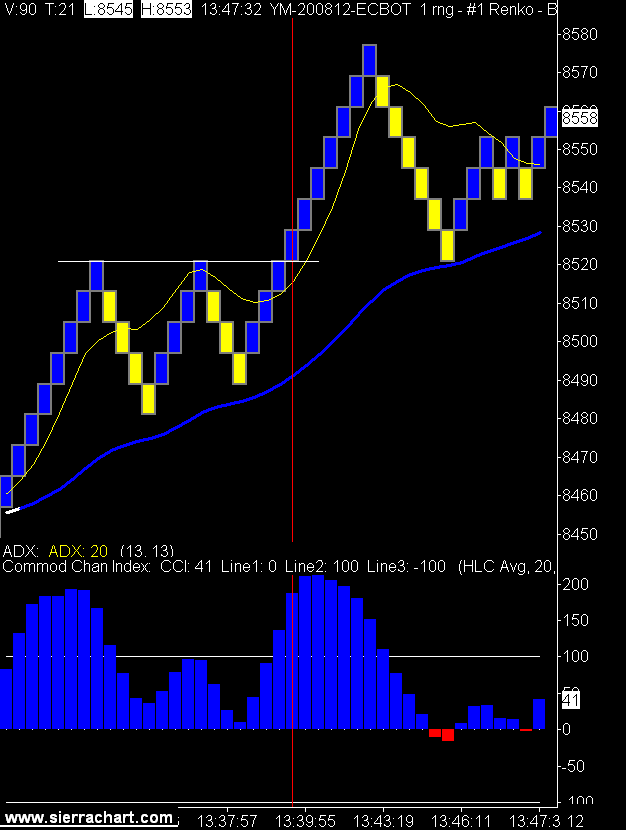

The best picture of 2008 and the best story. The picture says it all, but read the story anyway.

The best picture of 2008 and the best story. The picture says it all, but read the story anyway. It is simply wonderful.