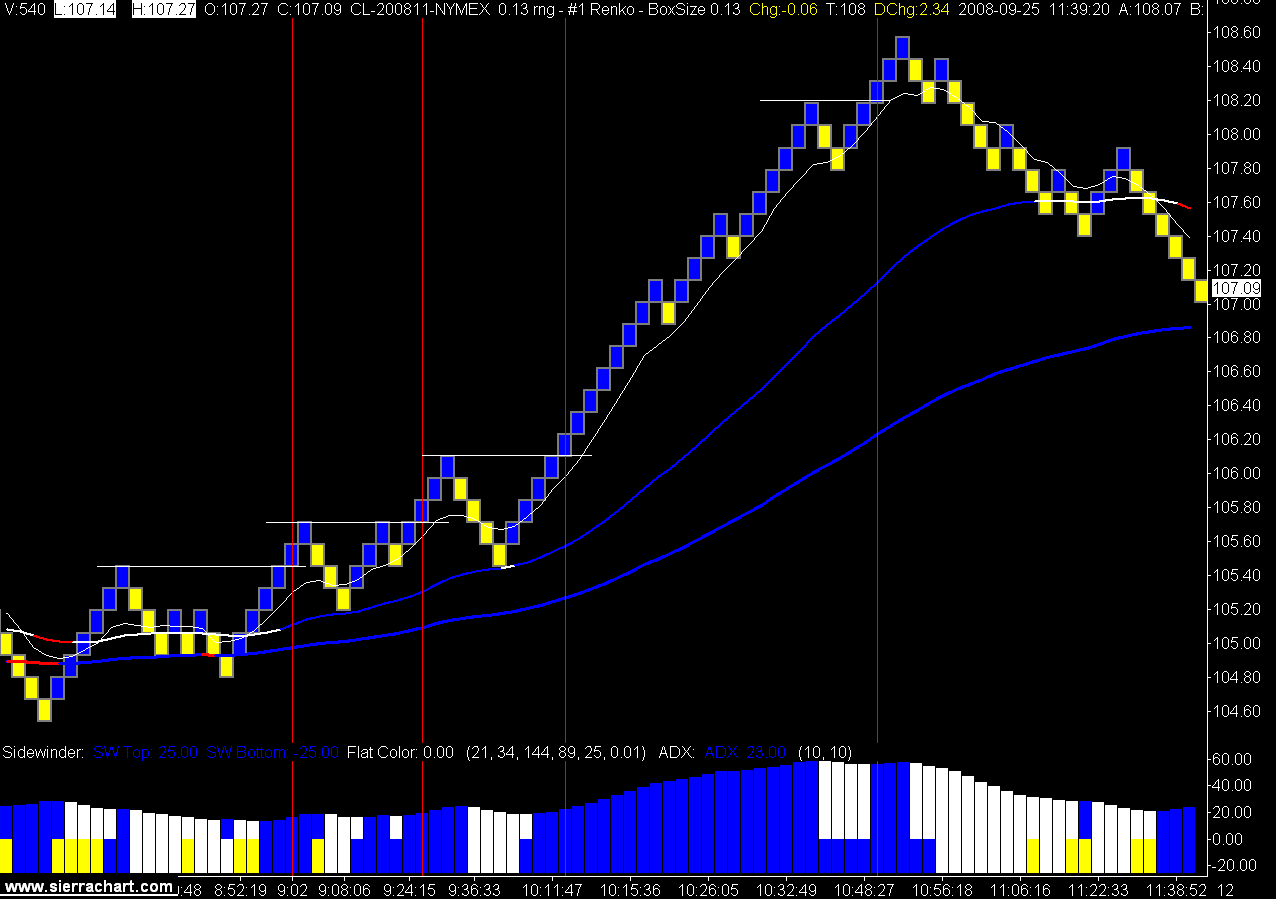

The daily chart has run into the 34 EMA (white line) and looks like it could revert back to the downside. Either that or its waiting for the U.S bailout package to be finalized and all will be well in the neighborhood.

I think demand for oil will continue to drop, and when the gulf production gets back to 100% oil could be headed south.

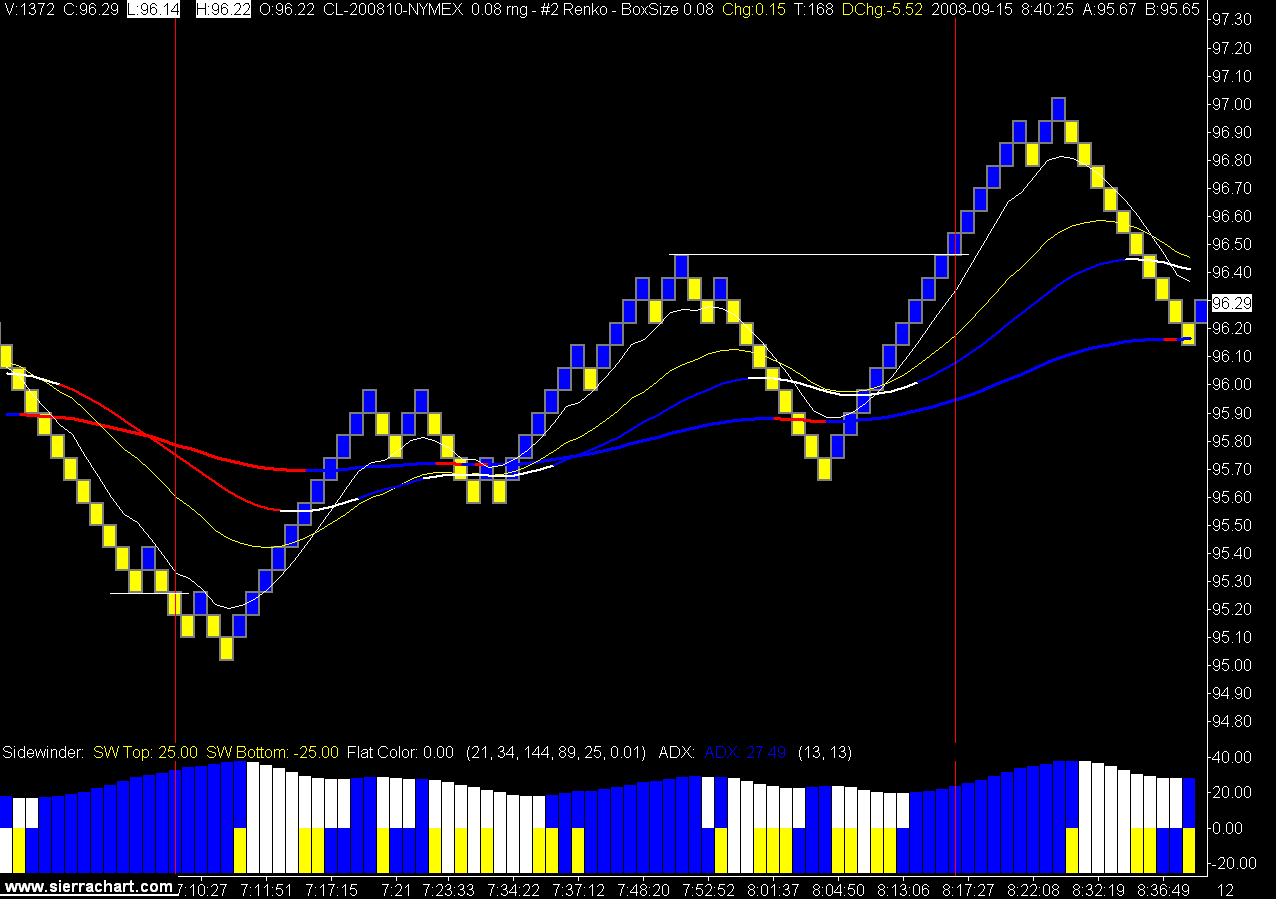

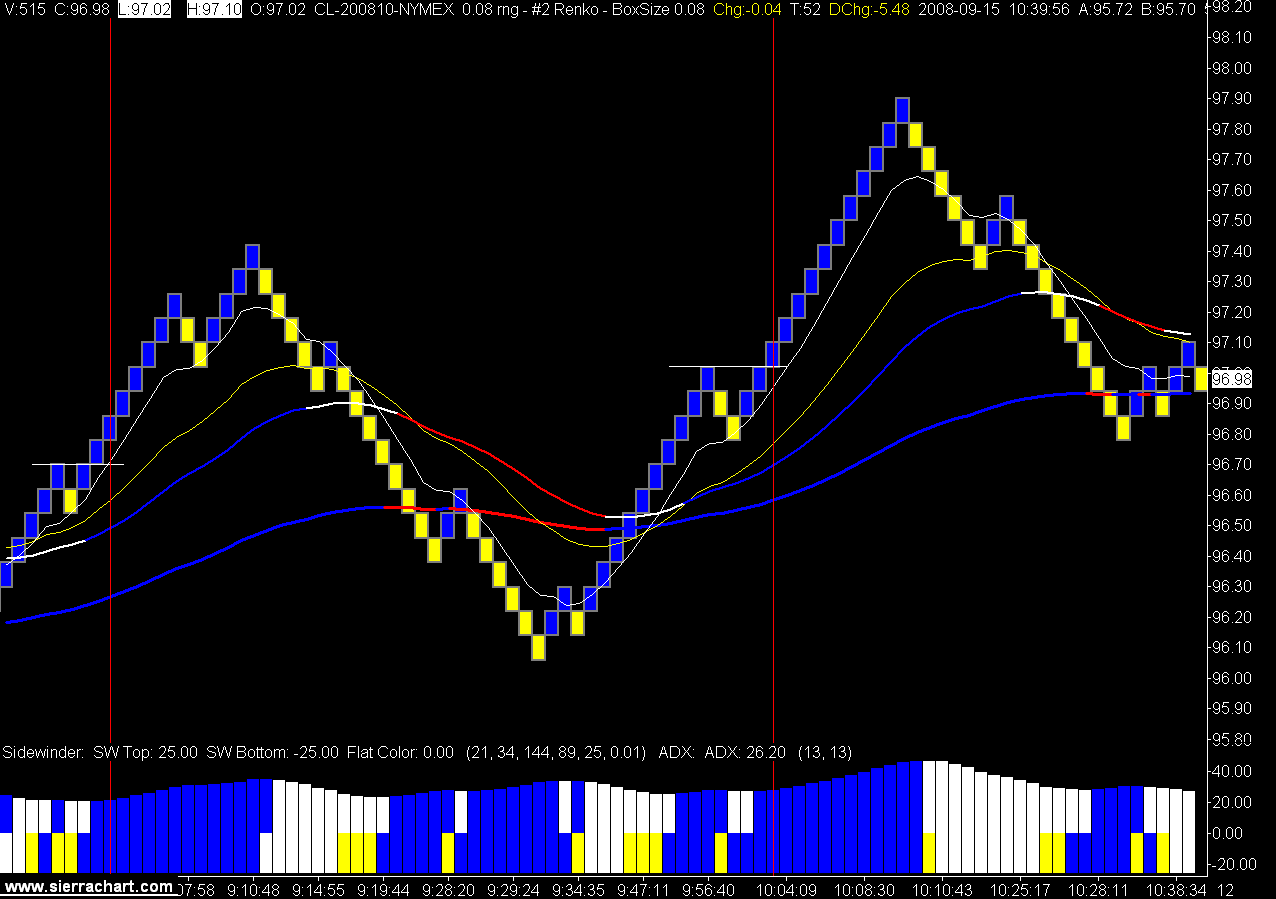

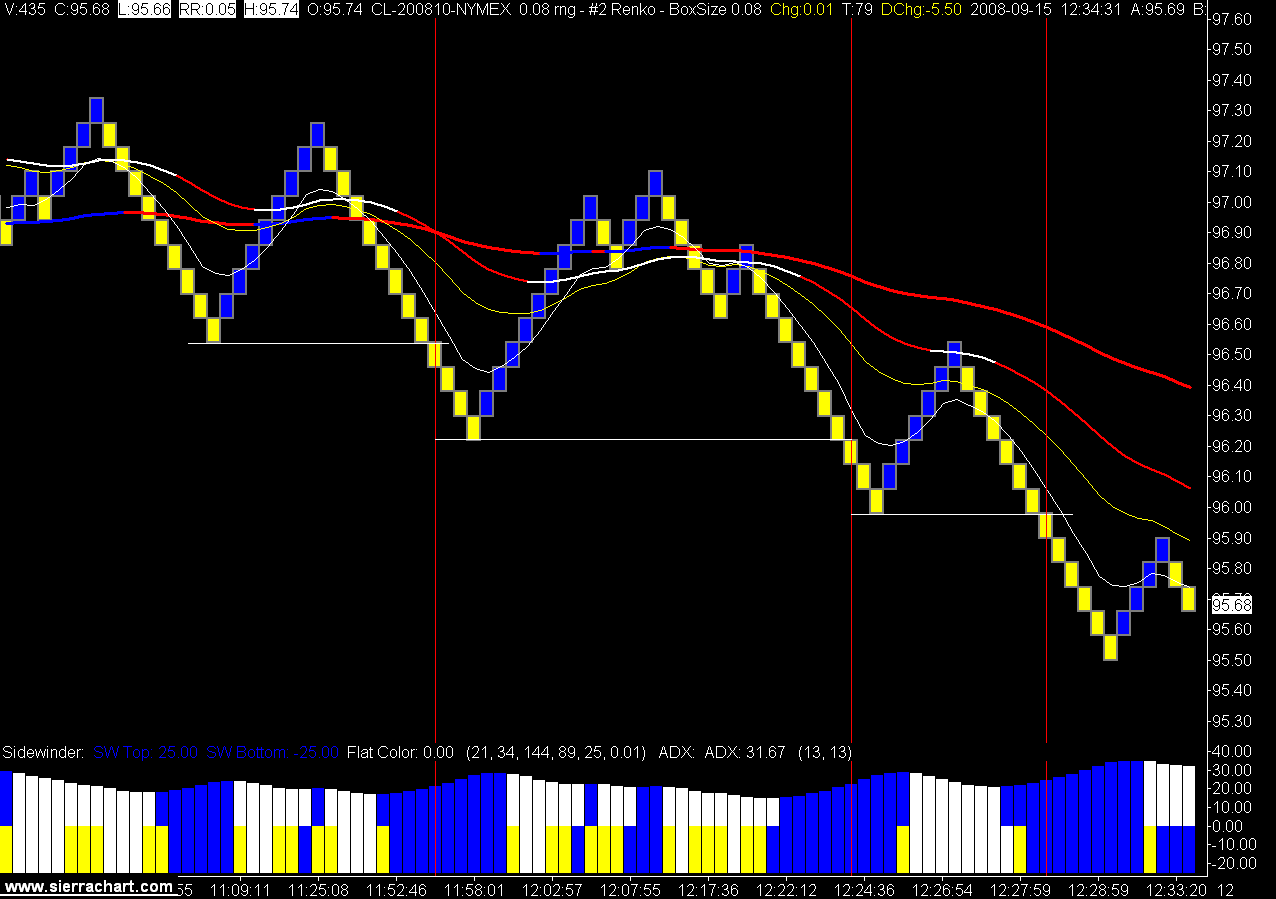

13 Tick Crude Oil Renko Chart

The oil trade was very quiet with a couple of strong long moves today. I was not in the first move as it started to far south. It took 3 cracks before the second long move got going, but going it did get.

I have been taking a look at the YM (Mini Dow) this week as an "exceptional Irish trader" tells me its the thing to trade since the ER2 (Mini Russell) moved to the ICE platform.

My interest is due to the smaller tick value and the idea of a multiple contract system. Not sure if I will proceed, but don't be shocked if you see a YM chart showing up sometime.