12/31/2010

12/27/2010

12/23/2010

12/20/2010

12/15/2010

When all else fails......

Try the truth.

The report confirms Dr. House's mantra, "everybody lies".

Governments, environmentalists, companies, everyone.

The problems start when we fall for the lies, we then make some rather large mistakes. The Alberta govt has been beating the oilsand companies over the head to reduce carbon emissions. What they should have been doing is beating them over the head to reclaim the mined areas as the companies are so fond of telling us they have been doing.

Our only hope is that good old common sense survives this world of lies. Commons sense that told me there was no way these oilsand plants could be the largest carbon emitters in the world.

Turns out that even Canada's little coal fired power plants emit more carbon than the oil sands. Canada has roughly 30 million people, imagine what the American's coal fired plants pump out. China?, India?

Canada would like to build another pipeline to send more oil to our American friends. Oil that comes from the oilsands. Americans are saying no thanks.

China is saying please send it our way, and we have a plan to do that. (sort of)

Over 4000 Americans have come home from Iraq in body bags (sorry) in order to secure "American interests" in the Middle East.

What interests?

Oil, of course.

No Americans have to die to get Canada's oil.

Yet, some American politicians are saying no to Canada's oil.

Maybe you should talk to them.

The report confirms Dr. House's mantra, "everybody lies".

Governments, environmentalists, companies, everyone.

The problems start when we fall for the lies, we then make some rather large mistakes. The Alberta govt has been beating the oilsand companies over the head to reduce carbon emissions. What they should have been doing is beating them over the head to reclaim the mined areas as the companies are so fond of telling us they have been doing.

Our only hope is that good old common sense survives this world of lies. Commons sense that told me there was no way these oilsand plants could be the largest carbon emitters in the world.

Turns out that even Canada's little coal fired power plants emit more carbon than the oil sands. Canada has roughly 30 million people, imagine what the American's coal fired plants pump out. China?, India?

Canada would like to build another pipeline to send more oil to our American friends. Oil that comes from the oilsands. Americans are saying no thanks.

China is saying please send it our way, and we have a plan to do that. (sort of)

Over 4000 Americans have come home from Iraq in body bags (sorry) in order to secure "American interests" in the Middle East.

What interests?

Oil, of course.

No Americans have to die to get Canada's oil.

Yet, some American politicians are saying no to Canada's oil.

Maybe you should talk to them.

12/14/2010

Choice

You can watch this, or, just ignore it.

Once the video starts click on watch full program.

Or, just ignore it.

Once the video starts click on watch full program.

Or, just ignore it.

12/09/2010

12/06/2010

The Prize

The Prize, written by Daniel Yergin, is the best history of oil I have read. PBS turned the book into a 8 hour mini series designed especially for day traders needing to kill several hours per day.

Enjoy.

Enjoy.

11/24/2010

11/16/2010

11/15/2010

11/12/2010

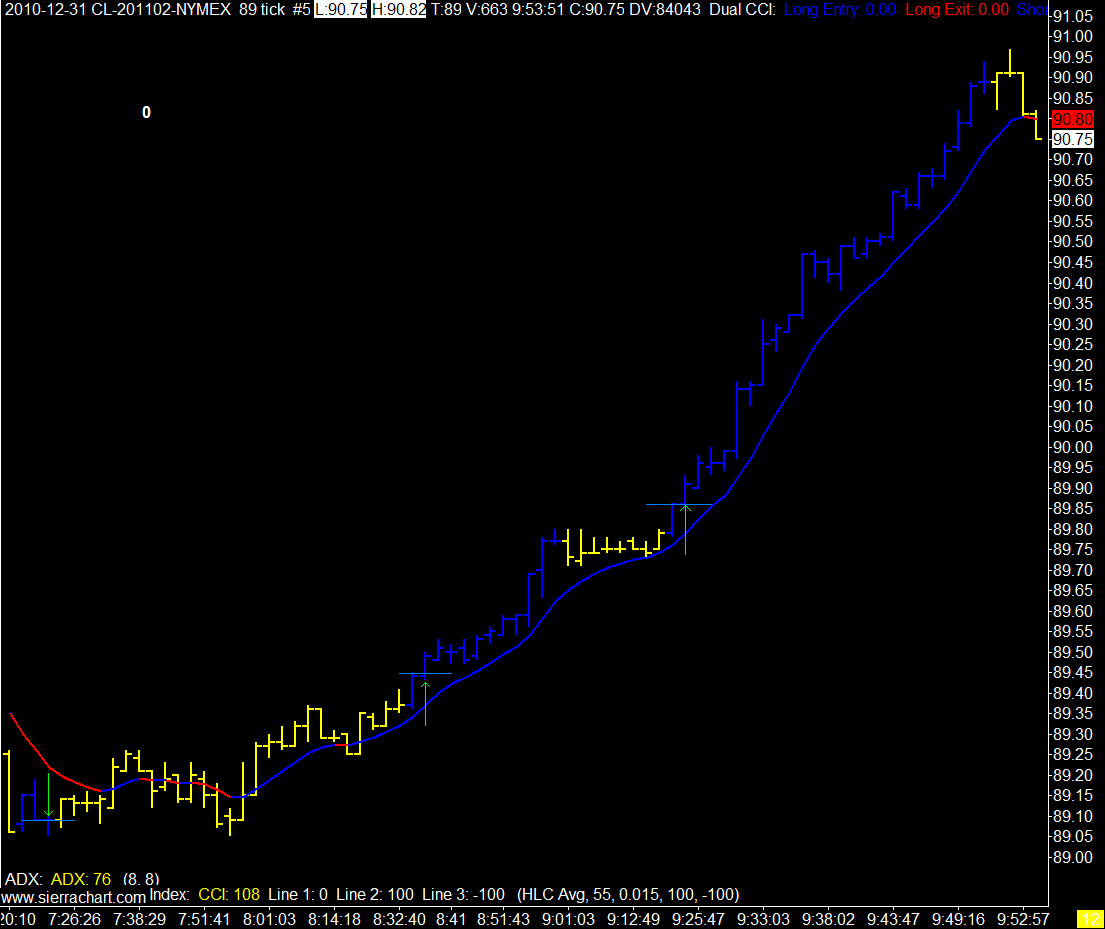

What is this?

I think it's a intraday trend.

I thought they were extinct.

In celebration of this new found trend like object I suggest we all listen to SRV at a volume level that disturbs the neighbors.

I thought they were extinct.

In celebration of this new found trend like object I suggest we all listen to SRV at a volume level that disturbs the neighbors.

11/02/2010

Hello America

It's time to vote again.

Once again you my fine American friends have the opportunity to cash in.

Vote for your favourite politician, you know the one that promises to spend more money, and of course, promises to take less of yours.

"Democracy will last until the public realizes that it can vote itself ..... ?(wealth)? from the public largesse." Alexis de Tocqueville

You can't tax the rich, you can't tax the middle class, you certainly can't tax the poor.

So......

You cut expenses.

Nope.

People get cranky if you do that.

So... you do....

Nothing.

Good luck with that.

If only someone could come up with a better system.

10/27/2010

Bill Gross

This guy is amazing. Thanks to Khalid for bringing this to me.

You can sum up his message in the fact that he was not afraid to fail.

Or to put it another way, he was prepared to be wrong. :)

You can sum up his message in the fact that he was not afraid to fail.

Or to put it another way, he was prepared to be wrong. :)

10/23/2010

10/22/2010

Mark Douglas

This could be the most important video you ever watch about trading.

If you're a trader that is. :)

Forget the wizetrade stuff and just buy the book.

If you're a trader that is. :)

Forget the wizetrade stuff and just buy the book.

10/21/2010

10/19/2010

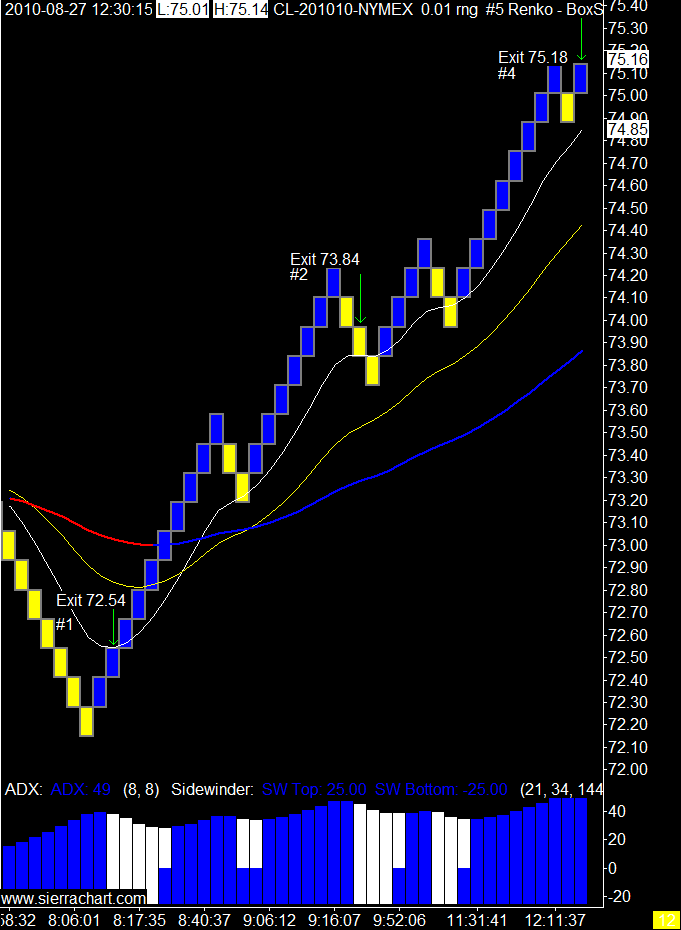

8/27/2010

The Boy Who Cried Wolf

The week is done. A week of trading with all the fear, greed, regret, happiness, sorrow, and every other emotion you can think of.

The weeks are all pretty much like that.

How we handle the changes in our emotional environment determines our success or failure.

The market has nothing to do with our success or failure.

P.S.

This is not a good bye post, because I don't do good bye posts anymore. I have had a few of those and then always came back to the blog. So if it was a good bye post you would have no reason to believe me.

Right.

The weeks are all pretty much like that.

How we handle the changes in our emotional environment determines our success or failure.

The market has nothing to do with our success or failure.

P.S.

This is not a good bye post, because I don't do good bye posts anymore. I have had a few of those and then always came back to the blog. So if it was a good bye post you would have no reason to believe me.

Right.

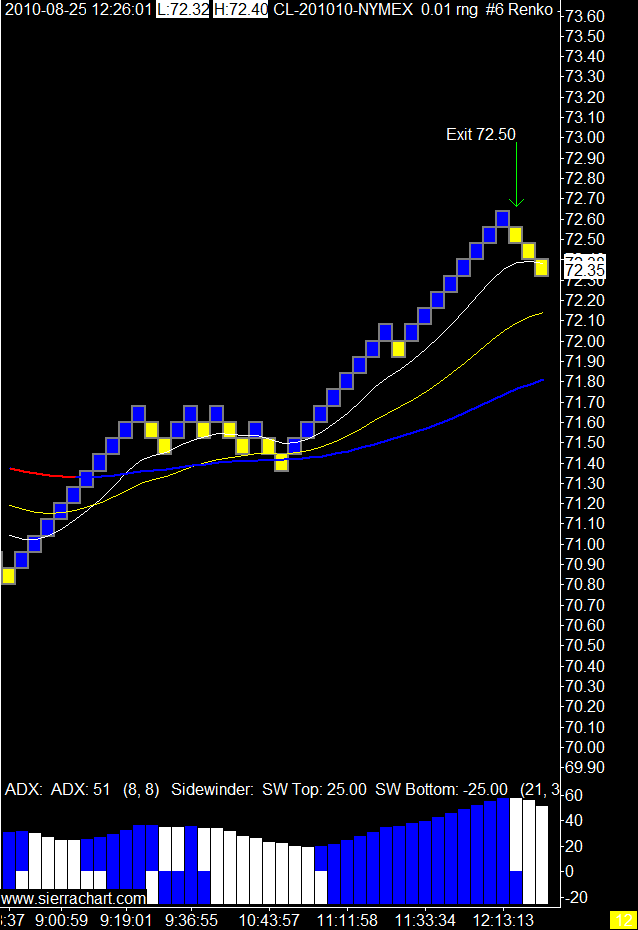

8/26/2010

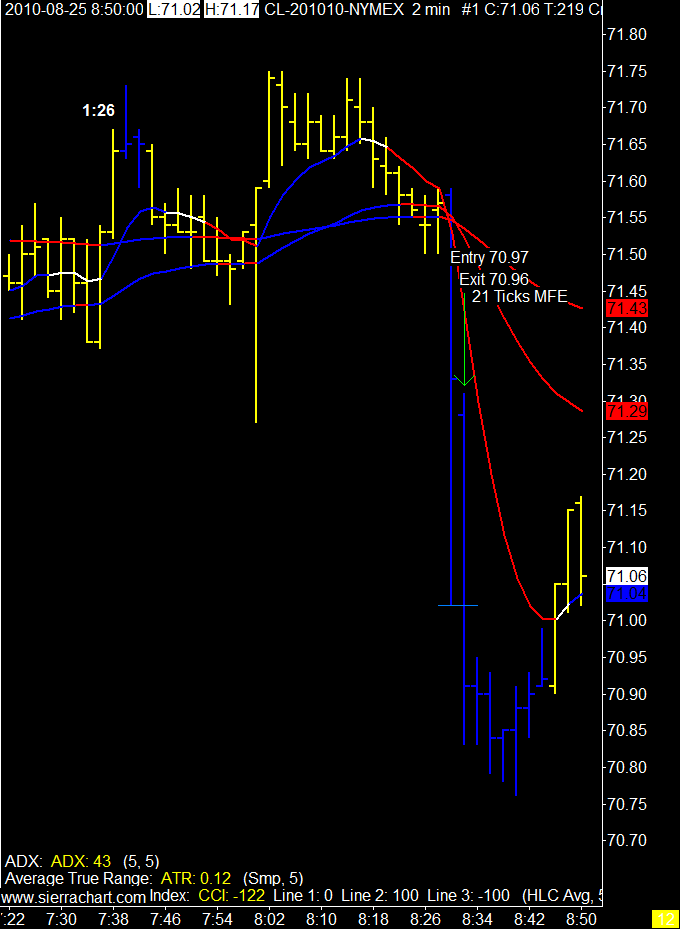

8/25/2010

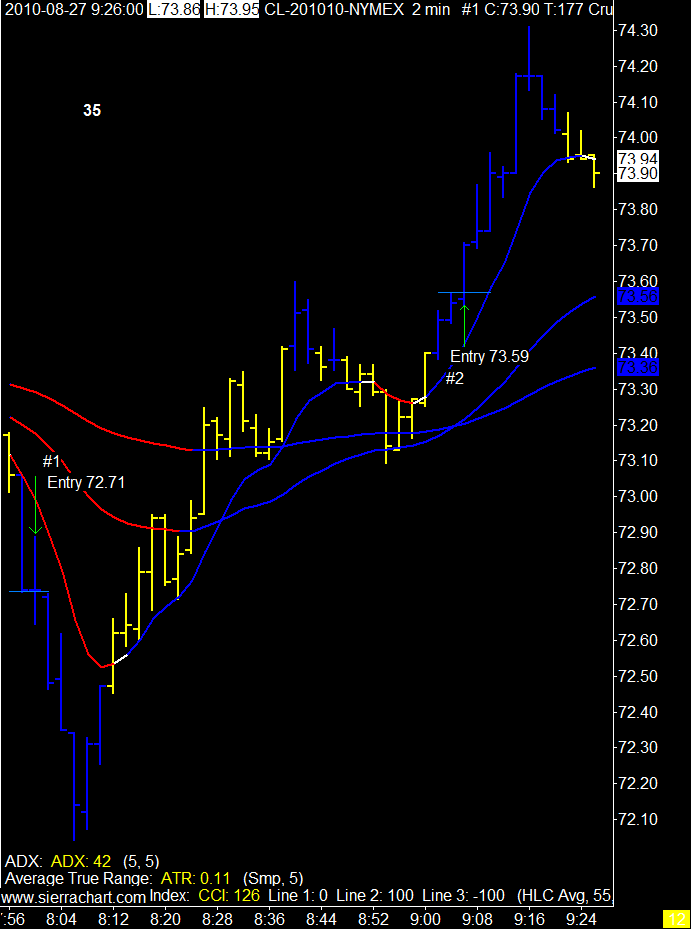

An Odd Business

Barrel count didn't work out and I thought the day was done.

Good thing I was "prepared to be wrong" as the day worked out well.

Good thing I was "prepared to be wrong" as the day worked out well.

8/24/2010

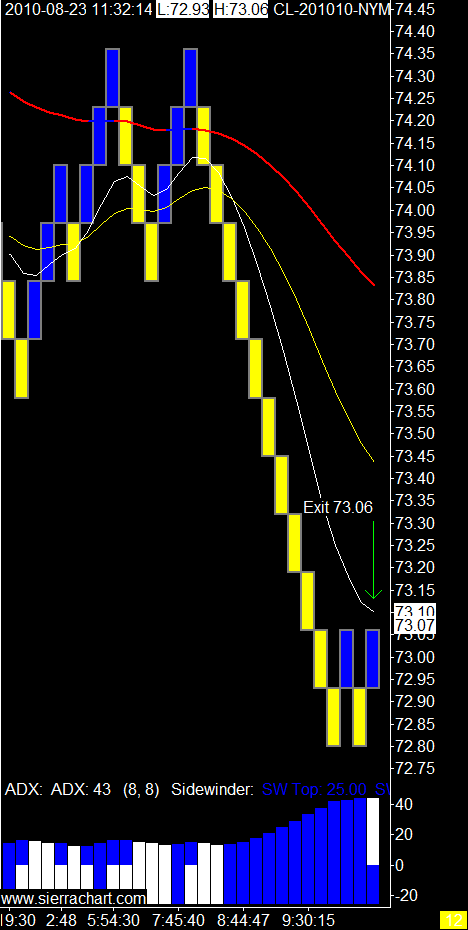

8/23/2010

Or

Waiting

Serene, I fold my hands and wait,

Nor care for wind, nor tide, nor sea;

I rave no more 'gainst time or fate,

For lo! my own shall come to me.

I stay my haste, I make delays,

For what avails this eager pace?

I stand amid the eternal ways,

And what is mine shall know my face.

Asleep, awake, by night or day,

The friends I seek are seeking me;

No wind can drive my bark astray,

Nor change the tide of destiny.

What matter if I stand alone?

I wait with joy the coming years;

My heart shall reap where it hath sown,

And garner up its fruit of tears.

The waters know their own and draw

The brook that springs in yonder height;

So flows the good with equal law

Unto the soul of pure delight.

The stars come nightly to the sky;

The tidal wave unto the sea;

Nor time, nor space, nor deep, nor high,

Can keep my own away from me.

John Burroughs

Serene, I fold my hands and wait,

Nor care for wind, nor tide, nor sea;

I rave no more 'gainst time or fate,

For lo! my own shall come to me.

I stay my haste, I make delays,

For what avails this eager pace?

I stand amid the eternal ways,

And what is mine shall know my face.

Asleep, awake, by night or day,

The friends I seek are seeking me;

No wind can drive my bark astray,

Nor change the tide of destiny.

What matter if I stand alone?

I wait with joy the coming years;

My heart shall reap where it hath sown,

And garner up its fruit of tears.

The waters know their own and draw

The brook that springs in yonder height;

So flows the good with equal law

Unto the soul of pure delight.

The stars come nightly to the sky;

The tidal wave unto the sea;

Nor time, nor space, nor deep, nor high,

Can keep my own away from me.

John Burroughs

8/21/2010

7/20/2010

7/17/2010

The Wild West

The Calgary Stampede ends tomorrow, somehow that rodeo reminded me of the crude oil pit.

Both a little wild at times.

So the next time you complain about your trading be thankful you don't do this for a living.

Both a little wild at times.

So the next time you complain about your trading be thankful you don't do this for a living.

7/12/2010

Shhhh

All blogging and trading is now being done in the cone of silence.

Wild Cackling.

Can you hear the madness?

Wild Cackling.

Can you hear the madness?

6/30/2010

6/22/2010

Creation

Creation:I think the ability to create is the greatest attribute we humans have. To create makes us human, whether it is art, music, writing, or money. If you think about it there are two types of people in this world, those who create and those who live off of those who create.

1: the act of creating; especially: the act of bringing the world into ordered existence

2: the act of making, inventing, or producing: as a: the act of investing with a new rank or office b: the first representation of a dramatic role

3: something that is created: as a: world b: creatures singly or in aggregate c: an original work of art d: a new usually striking article of clothing. Merriam-Webster

Who do you think lives the more complete, happy, and satisfied life?

So the next time you make a trade that creates a dollar for you where none existed before take a moment and congratulate yourself on this beautiful thing you have created.

6/07/2010

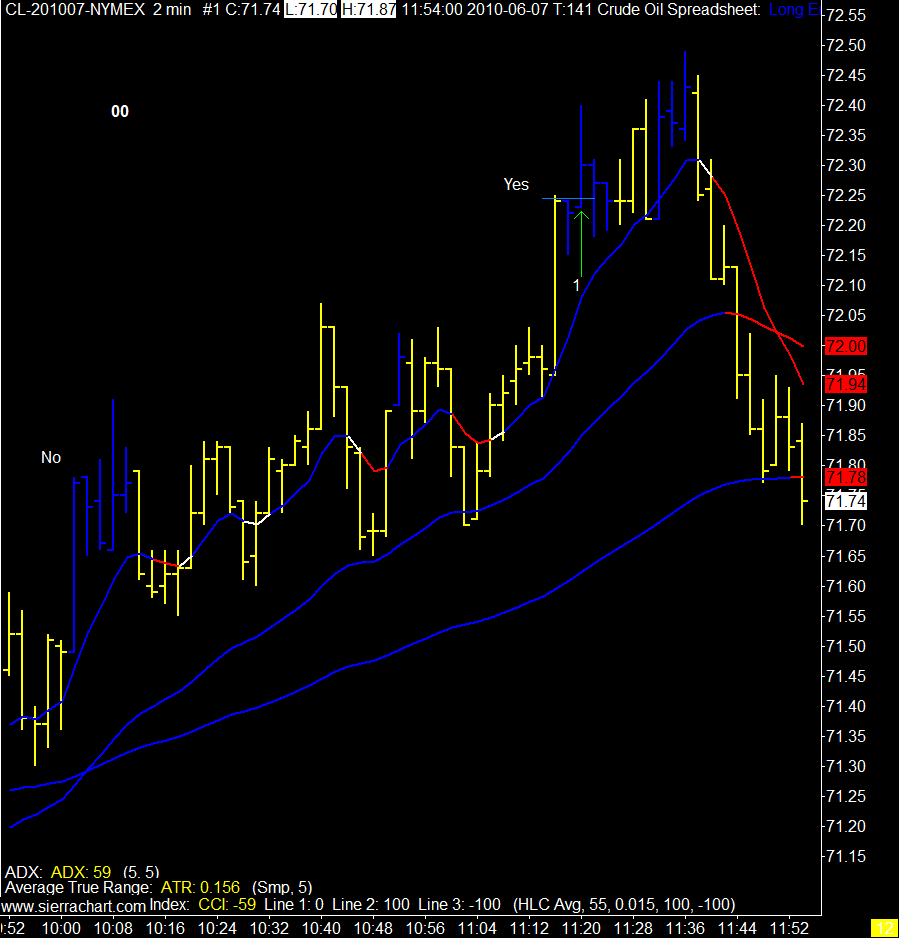

No, No, No, No, Yes

Internal Memo

To: Trader Solfest

From: Lonnie Wron, Vice President Compliance Dept

You live another day.

6/05/2010

Compliance

Since I've now begun to expropriate other peoples blogs with trading thoughts I guess I should just grow up and return to an open discussion in this blog.

That includes trading.

Either that or just delete the whole thing and go away.

Na.

What has got me talking you may ask?

Since I quit talking about trading roughly 3 months ago I have come to one very important conclusion about this business. It's nothing new or revolutionary, it is a very common issue known by all traders.

Compliance.

"In general, compliance means conforming to a rule, such as a specification, policy, standard or law." Wikipedia

We all know that you cannot trade without a plan. So we make a plan. Then we do not comply with our plan.

Why?

Why indeed.

Jules got me thinking about my Myers Briggs personality type again, and LW got me thinking about my identity as a trader.

These thoughts took me back to my very rational thoughts that should have insured my compliance issues were all taken care of. I wrote about them, therefore they must be "handled".

Know Thyself

Whose Game are You Playing?

Well, they're not "handled".

How do I know this?

I track the trade results of all valid patterns.

IB tracks the trade results of all the "patterns".

In May there was a 91 tick difference between IB's statement and my "statement".

I don't need to tell you that my "statement" was the one with the 91 extra ticks.

So being a rational INTJer I made note of this, I stated this is unacceptable, these are not the actions of a professional trader, this is amateur stuff.

I was going to make this note to self a note to you in a blog at the end of May. State publicly my disgrace and ask you to hold me accountable for the month of June.

Accountable to the plan.

Or

In compliance.

But I didn't write the post, instead I told myself to just do it. Stop being an idiot and only take valid patterns. How hard can that be? Just do it. The math is right in front of you, you are not smarter than the market, you are not smarter than the plan, you made the plan, you traded full time for 3 years building the plan, the plan works, trade the plan.

Right.

June 1.

Traded the plan. I am in compliance. Go eat ice cream.

Good boy.

June 2.

Took non valid trade.

CAN'T EVEN DO TWO BLOODY DAYS!

So, here we are. Once you enter the world of non compliance you lose all sense of right and wrong. You are now an outlaw, living on the edge, all the cool guys in movies live out here, no rules, take no prisoners, go ahead... make my day.

Today is June 5th, we've had 4 days of trading in June, my June IB statement has 21 ticks profit. My valid patterns only statement has 82 ticks profit. Those 82 ticks look nice, but we can't eat them.

My name is Solfest and I'm not in compliance.

I lie here under my desk waiting for the surprise audit. (old bankers joke)

I tell myself I'm an outlaw, women love outlaws, rules, we don't need no stinkin rules.

Except I'm not an outlaw. I'm a trader. Traders have a risk management department and a compliance department. Both are very angry with me.

There is now a letter in my file. I'm on notice, shape up or ship out.

Labels:

compliance department,

day trading,

risk management

5/31/2010

A Blog About.....

If this was a blog about t...... instead of a blog about..... this video might have some correlation about why t...... is so difficult.

But since this is not a blog about t...... and instead a blog about..... forget about it.

But since this is not a blog about t...... and instead a blog about..... forget about it.

5/30/2010

5/28/2010

Another Amazing Human

In case you missed this other amazing human.

I guess I'm fascinated by artists because I have no artistic ability what so ever.

5/27/2010

5/25/2010

5/21/2010

4/21/2010

Sidney and Me

Goldman Sachs is in the news again, although I think they would prefer not to be on this one.

Somehow that got me thinking about their old janitor.

In 1907 Sidney Weinberg, a grade 7 drop out, started work at Goldman Sachs as an assistant janitor.

After a stint in the Navy during WW I he came back to Goldman and started working as a trader.

In 1927 he became a partner and in 1930 became the head of the firm where he remained until his death in 1969.

During WW II and the Korean War Sidney was also the President of the United States choice for Vice Chairman of the War Production Board.

I wonder what would happen to Sidney if he and his partial grade 7 education started work as an assistant janitor for Goldman Sachs in 2010?

Would he even get the job as the assistant janitor?

You know by now I'm still thinking about my last post on education. Thinking as my daughter enters high school and now has to make choices as far as education goes.

The boys in the tr....g room were asking me how I became a banker if I'm not good at math. Note to boys, read the entire post not just the failure part. Sheesh.

Banking is not about math, banking is about people. A true banker is someone who can decline a loan for a client and still keep that client as a happy customer.

I doubt there are many quants who can do that.

Being able to do the math is not necessary as the machines do it for you. Being able to understand why the machines are spitting out the result is important. You need to know.... (my favourite word).. WHY. Since I wanted to know why I learned the math behind the answers.

As I said I only learn what is relevant to me.

Is this reductionist science as LW stated? I guess so, but I only reduce the mechanical stuff to what is necessary. As far as the history, people, and culture of the business I'm in, I go all out to learn everything. I have read the history of money, gold, oil, banking, bankers, traders, and the corporate histories of the two banks I worked for.

Does that sound like a reductionist?

Sounds more like a nut case.

I find it relevant, so I'm all in, I devour every thing I can get my hands on. I even read about my clients industries if I was not that familiar with them.

I guess the point I am making, and what I gathered from the history of Goldman Sachs and Sidney Weinberg, is that education can never stop. Starting with a BA is a great idea, but if you end there you may wind up as the assistant janitor that never moves beyond the mop.

Education happens every where. It's there in every job you take, every team you're on, with every person you meet, and with every book you read.

Take it all.

I said in my last post I worked in a cattle feedlot after high school. I made it sound like this was a tough job, and it was, but I also learned a great deal there. I eventually bought my own farm and I went back to that feedlot for several winters to work while working my own farm at the same time. I also took that "education" and parlayed it into a job at the University of Alberta's Dept of Animal Science. There I found I knew more about feeding cattle then the PhDs at the university.

Plus I got paid while getting educated, they had to buy theirs.

All in all there are many ways of getting educated and if yours is a little out of the norm don't worry about it.

Sidney Weinberg never did.

Somehow that got me thinking about their old janitor.

In 1907 Sidney Weinberg, a grade 7 drop out, started work at Goldman Sachs as an assistant janitor.

After a stint in the Navy during WW I he came back to Goldman and started working as a trader.

In 1927 he became a partner and in 1930 became the head of the firm where he remained until his death in 1969.

During WW II and the Korean War Sidney was also the President of the United States choice for Vice Chairman of the War Production Board.

I wonder what would happen to Sidney if he and his partial grade 7 education started work as an assistant janitor for Goldman Sachs in 2010?

Would he even get the job as the assistant janitor?

You know by now I'm still thinking about my last post on education. Thinking as my daughter enters high school and now has to make choices as far as education goes.

The boys in the tr....g room were asking me how I became a banker if I'm not good at math. Note to boys, read the entire post not just the failure part. Sheesh.

Banking is not about math, banking is about people. A true banker is someone who can decline a loan for a client and still keep that client as a happy customer.

I doubt there are many quants who can do that.

Being able to do the math is not necessary as the machines do it for you. Being able to understand why the machines are spitting out the result is important. You need to know.... (my favourite word).. WHY. Since I wanted to know why I learned the math behind the answers.

As I said I only learn what is relevant to me.

Is this reductionist science as LW stated? I guess so, but I only reduce the mechanical stuff to what is necessary. As far as the history, people, and culture of the business I'm in, I go all out to learn everything. I have read the history of money, gold, oil, banking, bankers, traders, and the corporate histories of the two banks I worked for.

Does that sound like a reductionist?

Sounds more like a nut case.

I find it relevant, so I'm all in, I devour every thing I can get my hands on. I even read about my clients industries if I was not that familiar with them.

I guess the point I am making, and what I gathered from the history of Goldman Sachs and Sidney Weinberg, is that education can never stop. Starting with a BA is a great idea, but if you end there you may wind up as the assistant janitor that never moves beyond the mop.

Education happens every where. It's there in every job you take, every team you're on, with every person you meet, and with every book you read.

Take it all.

I said in my last post I worked in a cattle feedlot after high school. I made it sound like this was a tough job, and it was, but I also learned a great deal there. I eventually bought my own farm and I went back to that feedlot for several winters to work while working my own farm at the same time. I also took that "education" and parlayed it into a job at the University of Alberta's Dept of Animal Science. There I found I knew more about feeding cattle then the PhDs at the university.

Plus I got paid while getting educated, they had to buy theirs.

All in all there are many ways of getting educated and if yours is a little out of the norm don't worry about it.

Sidney Weinberg never did.

4/14/2010

Why

I just spent a little time helping my daughter with her grade 9 math. This and the Ken Robinson video I watched a few days ago got me thinking back to my school days.

More specifically why I failed math.

I came across the answer a few years ago when I did one of those on line personality tests. Kind of like the Meyers Briggs one, I forget the name of it. It had one paragraph that just absolutely nailed me. I can summarize it in one word, why.

If I don't see, know, or understand why I am being asked to do something I won't do it.

Period.

So now as I looked at my daughter's math homework she got the full brunt of her Dad's mental block.

It was a simple little equation, or polynomial, or something.

It had a letter in it so I asked her are we solving for X?

Answer, no.

Ok, why is X in there.

Answer, I dunno it just is.

Question, why are we doing this, what is the purpose?

Answer, I dunno, Dad go get Mom.

Yes princess.

My wife is the exact opposite of me. She will learn anything, or at least memorize it, and her only concern is getting the highest mark possible.

My only concern is why are we doing this, and I could care less about the mark. 30 years later I still can't do something for no apparent reason, and apparently the reason, we just have to, still doesn't resonate with me.

Now watch the Ken Robinson video.

I did graduate from high school with a diploma. I knew deep down that I wasn't stupid, but I did feel a little stupid after my 12 year stint, and I certainly was a failure as far as the education system was concerned.

After high school I got a job in a cattle feedlot. I made $6.50 an hour and worked 10 hours a day, 12 days on, 2 days off. In the winter you go to work in the dark and come home in the dark.

After a year of that I began to re think this whole education thing.

So I went to the local college and sat down with a councillor. She said I could take high school over again at the college and do it in a year. I said ok. She also stated that based on my high school marks I must take a reading course.

She didn't think I could read.

Now when I said I graduated from high school I mean I found out what the minimum requirements were to graduate and I achieved them. :)

I took all the stupid courses (I think they call them something else), not the matric courses that you needed to go on to university.

My big problem in school was math, I found after failing the first high school math course that I couldn't pass it without doing any of the work. I could pass all the other courses with out doing anything, but not math.

So I took it again and did enough to pass the grade 10 math, and then did enough to get the credits in the grade 11 math, and that was it, that was all you needed to get the diploma.

So now a year later here I am in college, doing all the matric high school courses, math, biology, chemistry, physics, English, and of course "reading".

After 6 years (junior and senior high) of basically failing math I wasn't too confident I could do this.

I still remember my marks from the first four math tests, 92%, 89%, 92%, and 89%.

What happened?

One I tried, two this was my idea, three I was paying for it, and four I was in physics and chemistry at the same time and actually found a use for this new math I was learning. You actually used it in these courses to do something, especially physics.

So I proved to myself that I wasn't stupid and I could do math if I wanted to. I wasn't gifted at it, but I could do it.

This begs the question whose fault was it that I failed math in high school and basically wasted those 3 years?

Ken Robinson suggests the education system was at fault. I would suggest it was my fault. I'm not sure in a mass produced system of public school we can find the individual triggers in every single student that will motivate them to do the work.

So I have to ask myself why didn't I do it? I'm not lazy, I work very hard. But again only on the things I see value or a reason in. This has been a pretty good trait for me as an adult but probably not so good in a teenage boy. As teenage boys by definition are idiots.

Could a teacher have found the right trigger for me? Probably, but it would have taken a very special teacher to reach into my weird psyche and pull out the reason for me to do this work. I think it is too much to ask in a public school system.

My wife (who is a teacher) and I now see this with our children. Children who have inherited some of their Father's "traits". We have meetings with their teachers and we talk about some "individual" programs we can use to help them. But in the end they seem to get stuck back in the herd and left to suffer there.

So it's our job to help them find their passion in life, find it, nurture it, and help them run with it as far as they can go.

More specifically why I failed math.

I came across the answer a few years ago when I did one of those on line personality tests. Kind of like the Meyers Briggs one, I forget the name of it. It had one paragraph that just absolutely nailed me. I can summarize it in one word, why.

If I don't see, know, or understand why I am being asked to do something I won't do it.

Period.

So now as I looked at my daughter's math homework she got the full brunt of her Dad's mental block.

It was a simple little equation, or polynomial, or something.

It had a letter in it so I asked her are we solving for X?

Answer, no.

Ok, why is X in there.

Answer, I dunno it just is.

Question, why are we doing this, what is the purpose?

Answer, I dunno, Dad go get Mom.

Yes princess.

My wife is the exact opposite of me. She will learn anything, or at least memorize it, and her only concern is getting the highest mark possible.

My only concern is why are we doing this, and I could care less about the mark. 30 years later I still can't do something for no apparent reason, and apparently the reason, we just have to, still doesn't resonate with me.

Now watch the Ken Robinson video.

I did graduate from high school with a diploma. I knew deep down that I wasn't stupid, but I did feel a little stupid after my 12 year stint, and I certainly was a failure as far as the education system was concerned.

After high school I got a job in a cattle feedlot. I made $6.50 an hour and worked 10 hours a day, 12 days on, 2 days off. In the winter you go to work in the dark and come home in the dark.

After a year of that I began to re think this whole education thing.

So I went to the local college and sat down with a councillor. She said I could take high school over again at the college and do it in a year. I said ok. She also stated that based on my high school marks I must take a reading course.

She didn't think I could read.

Now when I said I graduated from high school I mean I found out what the minimum requirements were to graduate and I achieved them. :)

I took all the stupid courses (I think they call them something else), not the matric courses that you needed to go on to university.

My big problem in school was math, I found after failing the first high school math course that I couldn't pass it without doing any of the work. I could pass all the other courses with out doing anything, but not math.

So I took it again and did enough to pass the grade 10 math, and then did enough to get the credits in the grade 11 math, and that was it, that was all you needed to get the diploma.

So now a year later here I am in college, doing all the matric high school courses, math, biology, chemistry, physics, English, and of course "reading".

After 6 years (junior and senior high) of basically failing math I wasn't too confident I could do this.

I still remember my marks from the first four math tests, 92%, 89%, 92%, and 89%.

What happened?

One I tried, two this was my idea, three I was paying for it, and four I was in physics and chemistry at the same time and actually found a use for this new math I was learning. You actually used it in these courses to do something, especially physics.

So I proved to myself that I wasn't stupid and I could do math if I wanted to. I wasn't gifted at it, but I could do it.

This begs the question whose fault was it that I failed math in high school and basically wasted those 3 years?

Ken Robinson suggests the education system was at fault. I would suggest it was my fault. I'm not sure in a mass produced system of public school we can find the individual triggers in every single student that will motivate them to do the work.

So I have to ask myself why didn't I do it? I'm not lazy, I work very hard. But again only on the things I see value or a reason in. This has been a pretty good trait for me as an adult but probably not so good in a teenage boy. As teenage boys by definition are idiots.

Could a teacher have found the right trigger for me? Probably, but it would have taken a very special teacher to reach into my weird psyche and pull out the reason for me to do this work. I think it is too much to ask in a public school system.

My wife (who is a teacher) and I now see this with our children. Children who have inherited some of their Father's "traits". We have meetings with their teachers and we talk about some "individual" programs we can use to help them. But in the end they seem to get stuck back in the herd and left to suffer there.

So it's our job to help them find their passion in life, find it, nurture it, and help them run with it as far as they can go.

4/12/2010

I'm Back

That was a short the end.

Yes.

Why are you back?

I keep finding things I want to share, maybe I will even write something I want to share.

Maybe.

What I'm not going to do is talk about trading. I have said all I have to say there.

So I will need to re name the blog, find a new theme, and go from there.

But for now, I'm back.

Yes.

Why are you back?

I keep finding things I want to share, maybe I will even write something I want to share.

Maybe.

What I'm not going to do is talk about trading. I have said all I have to say there.

So I will need to re name the blog, find a new theme, and go from there.

But for now, I'm back.

3/24/2010

The End

I do believe the blog has run its course. It is 2 years old today and after 458 posts I think it's time to stop.

The blog started because I wanted to see how a blog worked. What I didn't know at the time was how much I would enjoy it, how much I would learn, or how many smart, interesting, weird, and funny people I would meet.

That said the ink well has gone dry and there is no point in continuing.

My trading has found a path that I will continue on, and while my business looks good right now I remain cognisant that markets change and so must I.

I want to thank all who contributed to the blog and you can be sure that I will continue my daily perusal of your musings.

I wish all of you the very best in your trading and your life.

Solfest

3/22/2010

Emotion

Emotion: A mental state that arises spontaneously rather than through conscious effort and is often accompanied by physiological changes.

I have been thinking more on this wonderful human thing we call emotion and how it affects our lives as traders. We traders have been taught, or somehow just believe, that we need to control our emotions in order to be successful.

This begs the rather large question, can emotions be controlled?

I would suggest that they cannot. The "Free Dictionary" definition above also suggests this, of course it's free, so you know.

What people learn to control is their reaction to the emotions they are feeling. Or at least we try to control our reaction to these emotions.

Another good question is why can some people do this better than others?

Genetics or is it a learned behavior?

Or both?

As a kid I played sports and I learned that your physical ability goes down if you become angry, if you can control your actions under stress you will do better than those who can’t.

As an adult I watch and coach my kids in sports. I see kids who have trouble controlling their actions in the emotion of the game. Worse than that I see adults who are completely out of control watching their kids. They say and do things that you would not believe could come out of their mouths as our 11 years olds compete.

Emotion is a powerful thing. Those who cannot control their actions during emotional times will have a difficult life no matter what they do. However if they're a trader, well you know the answer.

When it comes to trading I have all emotions known to man, I get as angry, frustrated, and dejected as anyone. Maybe more, I don't have a benchmark to judge this on.

So if we cannot control our emotions but we can control our reaction to these emotions the question becomes how can we do this better.

The pop psychology answer is to talk it out. Do the thing that men love to do, verbally "express our feelings".

Yuck.

I think it may be the only way. If you have done your trading homework you know all the rational reasons to only trade the plan, to keep trading the plan, to only judge your execution of the plan, to not focus on immediate results, or lack of results.

We intellectually know all of this yet when we have a losing trade we have an emotional reaction. We can't help it. We don't want to lose, we want to win.

So the conversation with yourself has to happen, out loud. Talk through the rational for the trade, talk through the trading plan, why you took the trade, tell yourself out loud it was a good trade, you did the right thing, you have an expectancy and it's not 100% winners.

Emotional humans also have the ability to be rational. I used to say the most important psychological battle for a trader was to reverse our fear and greed complex.

I now believe the most important trading battle is between our rational being and our emotional being. The key to success in this battle is not suppressing our emotions, because we can't, the key is using our rational brain to explain our emotions and to control and change our reaction to these emotions.

Think back to my previous post, the three Mondays with three identical financial results. The same financial result yet we all know that we will have three very different emotional reactions to these three days.

Monday #1 we felt angry, Monday #2 we felt frustrated, and Monday #3 we felt pretty good.

Rationally we know that the result at the end of each day was the same, zero. We know this but we still feel different at the end of each day because we got to zero differently each day.

Trading is simple, yet most fail.

Think about that. Why do most fail? We are all emotional beings, those who cannot control their actions to these emotions will fail. That means most of us.

Now think about this some more. Think about it during the next trading day. Talk to yourself, out loud.

Have a good discussion.

Oh by the way, today, I get to eat ice cream. :)

3/20/2010

One Result, Three Outcomes

Just for fun let us consider 3 different trading days, days that we have all lived through if we are in this business of trading. These days could happen any time in no particular order. So let's just call them all Mondays, Mondays that start off 3 different and random weeks in the year.

Monday #1) We start off our day with a winning trade, let's say net $300. We followed our system, we took the signal, and we were rewarded with a winning trade. The next signal comes along and we enter again, result, losing trade net -$100. Signal again, loser again net -$100. Signal again, loser again net -$100.

Day ends with the net result of, ZERO.

Monday #2) We sit in front of our computer for the entire day, we see no signals and we do nothing all day.

Day ends with the net result of, ZERO.

Monday #3) We start off the day with a valid signal and a losing trade, net -$100. Next signal, net -$100. Next signal, net -$100. Next signal, aha, a winner for $300.

Day ends with the net result of, ZERO.

Now you may say, Solfest those results and outcomes are all the same, all ZERO. True the results are all ZERO but the outcome I'm talking about is what happens the Tuesday after one of those random Mondays.

Let's start with Monday #1, our first trade was a winner, we have started the week demonstrating the genius we know we are. We then proceed to see all that genius disappear throughout the rest of the day. We end the day feeling defeated and angry.

Now comes Tuesday, first trade is again a winner, ya baby, the next signal comes along and.... we don't want to push the button, we remember Monday, we don't want to lose those profits again, we don't want to lose this feeling of genius again. We don't push the button. In fact we don't push the button again all day, we have our little genius in the bank and we're not letting go. What happens that day? You know, it's a given, all the signals work and you would have made thousands not hundreds.

Ok now Monday #2, we have sat for an entire day, that's right one whole day, and done nothing, nothing. It's terrible, we are a trader we should trade. People ask what you did today, answer, I did nothing.

Now comes Tuesday, again no signals, no signals, no signals, almost a signal, ah close enough, I've seen this work before, let's go, nothing ventured nothing gained. Result, loser.

Is there a worse result then a non signal loser? Yes, a non signal winner. That leads to more non signal trades as I am now smarter than the market, smarter than my system, I am a genius discretionary trader. I have read about these people, they can feel the market.

Right?

Wrong, the result ultimately is a string of losers with no rational thought behind any of the trades.

Lastly, Monday #3. We followed our plan and we were rewarded. We took our losers and we stayed focused and "traded our way out of this mess". Surely this means I have arrived as a trader.

Now Tuesday. First trade loser, second trade, loser, third trade, loser, fourth trade, loser, fifth trade, loser, BLOODY STUPID MOTHER OF ALL &!&@%$&!%. Solfest smashes new 24 inch monitor with coffee cup and quits trading for a month, or changes the trading plan for a month because it obviously doesn’t work, or does any number of other juvenile things.

Of course the next month would have been the most profitable month his system has ever seen.

So, our 3 Mondays all had the same result, ZERO, but our 3 Tuesdays all take different turns based on the different ways we got to ZERO on the previous Monday.

Sound familiar?

What do we do?

Hire LW to trade our plan for us? Yes he has had his emotion chip removed so that would work. However I asked him and he said no as his gardening keeps him very busy.

So now what?

I have often thought that I could hire a 12 year old, train him to follow the blue bars, pay him minimum wage to sit there for the 5.5 hours, offer him a $20 bonus for every valid signal he takes, and deduct $20 from his pay for every non valid trade he takes.

I think the 12 year old's trading results might be better than mine. (gasp)

So maybe what we need to do is frame our trading success or failure outside monetary results. Not a new idea I know. The question is how? I have tried to grade the day based on how well I followed the system. But soon I stopped the grading and just looked at the money.

Maybe it has to be tangible, remember humans are stupid. We like shiny things, but they cost alot of money. Hmmmm, what else do humans like?

Sex and food.

That's it, no sex on days with non valid entries. (Freudian slip)

Ah but that would be punishing your innocent spouse, hehe, only a man would say that.

Ok then, food.

Every day I follow all signals perfectly I go out and buy myself an ice cream treat of some kind. That starts the anticipation chip in our brain, we want the ice cream at the end of the trading day. The kicker is we must deny ourselves the ice cream if we fail to follow the plan.

So that’s my new reward system. Like a dog, do a trick, get a treat.

Its "stupid" enough it just might work.

Monday #1) We start off our day with a winning trade, let's say net $300. We followed our system, we took the signal, and we were rewarded with a winning trade. The next signal comes along and we enter again, result, losing trade net -$100. Signal again, loser again net -$100. Signal again, loser again net -$100.

Day ends with the net result of, ZERO.

Monday #2) We sit in front of our computer for the entire day, we see no signals and we do nothing all day.

Day ends with the net result of, ZERO.

Monday #3) We start off the day with a valid signal and a losing trade, net -$100. Next signal, net -$100. Next signal, net -$100. Next signal, aha, a winner for $300.

Day ends with the net result of, ZERO.

Now you may say, Solfest those results and outcomes are all the same, all ZERO. True the results are all ZERO but the outcome I'm talking about is what happens the Tuesday after one of those random Mondays.

Let's start with Monday #1, our first trade was a winner, we have started the week demonstrating the genius we know we are. We then proceed to see all that genius disappear throughout the rest of the day. We end the day feeling defeated and angry.

Now comes Tuesday, first trade is again a winner, ya baby, the next signal comes along and.... we don't want to push the button, we remember Monday, we don't want to lose those profits again, we don't want to lose this feeling of genius again. We don't push the button. In fact we don't push the button again all day, we have our little genius in the bank and we're not letting go. What happens that day? You know, it's a given, all the signals work and you would have made thousands not hundreds.

Ok now Monday #2, we have sat for an entire day, that's right one whole day, and done nothing, nothing. It's terrible, we are a trader we should trade. People ask what you did today, answer, I did nothing.

Now comes Tuesday, again no signals, no signals, no signals, almost a signal, ah close enough, I've seen this work before, let's go, nothing ventured nothing gained. Result, loser.

Is there a worse result then a non signal loser? Yes, a non signal winner. That leads to more non signal trades as I am now smarter than the market, smarter than my system, I am a genius discretionary trader. I have read about these people, they can feel the market.

Right?

Wrong, the result ultimately is a string of losers with no rational thought behind any of the trades.

Lastly, Monday #3. We followed our plan and we were rewarded. We took our losers and we stayed focused and "traded our way out of this mess". Surely this means I have arrived as a trader.

Now Tuesday. First trade loser, second trade, loser, third trade, loser, fourth trade, loser, fifth trade, loser, BLOODY STUPID MOTHER OF ALL &!&@%$&!%. Solfest smashes new 24 inch monitor with coffee cup and quits trading for a month, or changes the trading plan for a month because it obviously doesn’t work, or does any number of other juvenile things.

Of course the next month would have been the most profitable month his system has ever seen.

So, our 3 Mondays all had the same result, ZERO, but our 3 Tuesdays all take different turns based on the different ways we got to ZERO on the previous Monday.

Sound familiar?

What do we do?

Hire LW to trade our plan for us? Yes he has had his emotion chip removed so that would work. However I asked him and he said no as his gardening keeps him very busy.

So now what?

I have often thought that I could hire a 12 year old, train him to follow the blue bars, pay him minimum wage to sit there for the 5.5 hours, offer him a $20 bonus for every valid signal he takes, and deduct $20 from his pay for every non valid trade he takes.

I think the 12 year old's trading results might be better than mine. (gasp)

So maybe what we need to do is frame our trading success or failure outside monetary results. Not a new idea I know. The question is how? I have tried to grade the day based on how well I followed the system. But soon I stopped the grading and just looked at the money.

Maybe it has to be tangible, remember humans are stupid. We like shiny things, but they cost alot of money. Hmmmm, what else do humans like?

Sex and food.

That's it, no sex on days with non valid entries. (Freudian slip)

Ah but that would be punishing your innocent spouse, hehe, only a man would say that.

Ok then, food.

Every day I follow all signals perfectly I go out and buy myself an ice cream treat of some kind. That starts the anticipation chip in our brain, we want the ice cream at the end of the trading day. The kicker is we must deny ourselves the ice cream if we fail to follow the plan.

So that’s my new reward system. Like a dog, do a trick, get a treat.

Its "stupid" enough it just might work.

3/19/2010

I Believe

I didn't take the fourth signal although it would have worked too. A nice way to end a slow week.

Crude Oil

Crude Oil

3/17/2010

'The Big Short'

Michael Lewis (Liars Poker) has written another book on Wall Street. If it's half as good as Liars Poker it will be worth the read.

Here is a link to his interview with Charlie Rose.

Here is a link to his interview with Charlie Rose.

3/16/2010

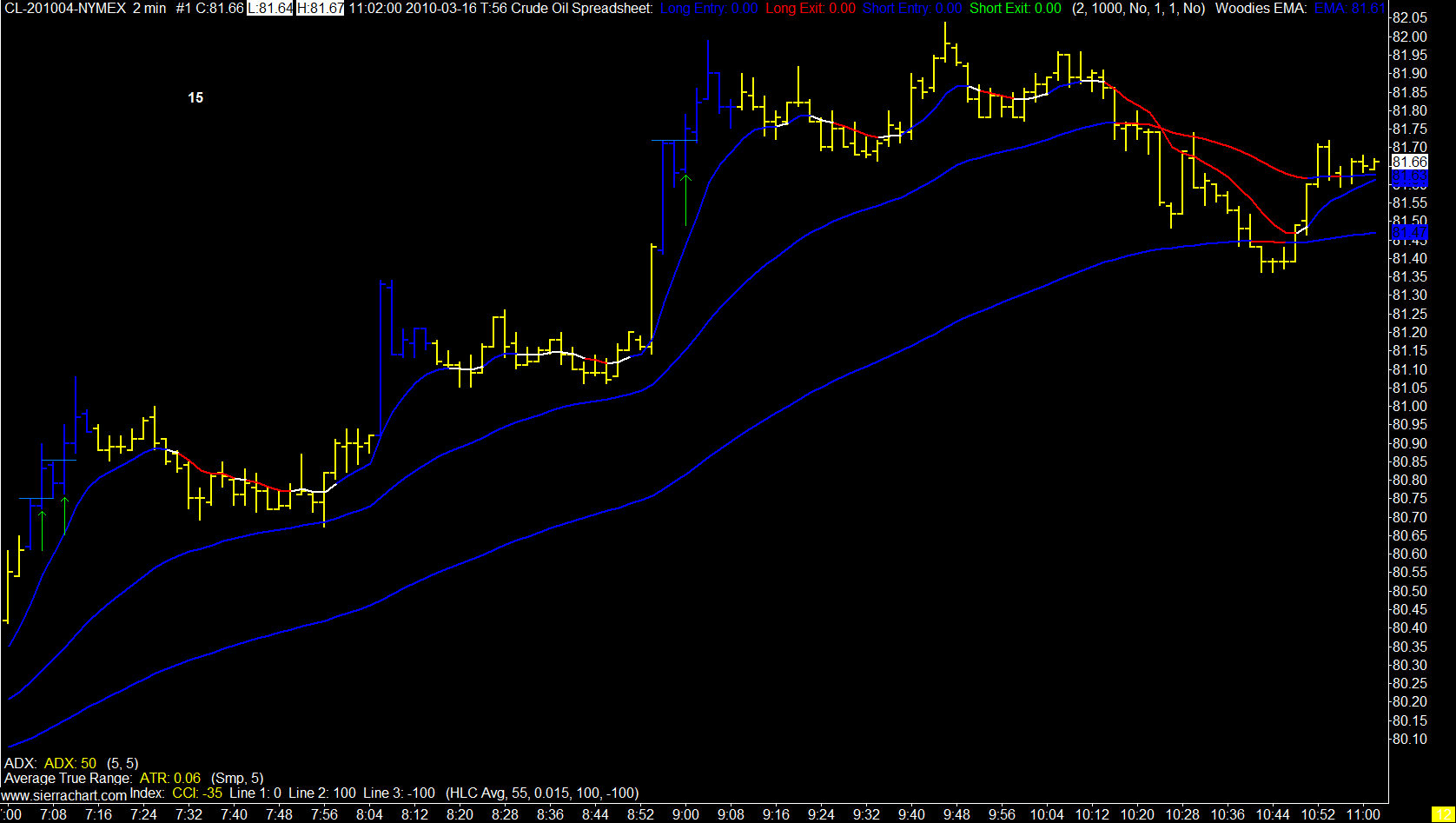

Mouse Trading

Market was slow but with a direction. My signals take a little while to trigger in this kind of market, leaving most of the cheese for the smarter mice.

The smaller targets saved the day as I caught 2 and took a break even on the other. I guess this could be considered scalping, depending what your definition of scalping is.

Whatever works.

Crude Oil

The smaller targets saved the day as I caught 2 and took a break even on the other. I guess this could be considered scalping, depending what your definition of scalping is.

Whatever works.

Crude Oil

3/12/2010

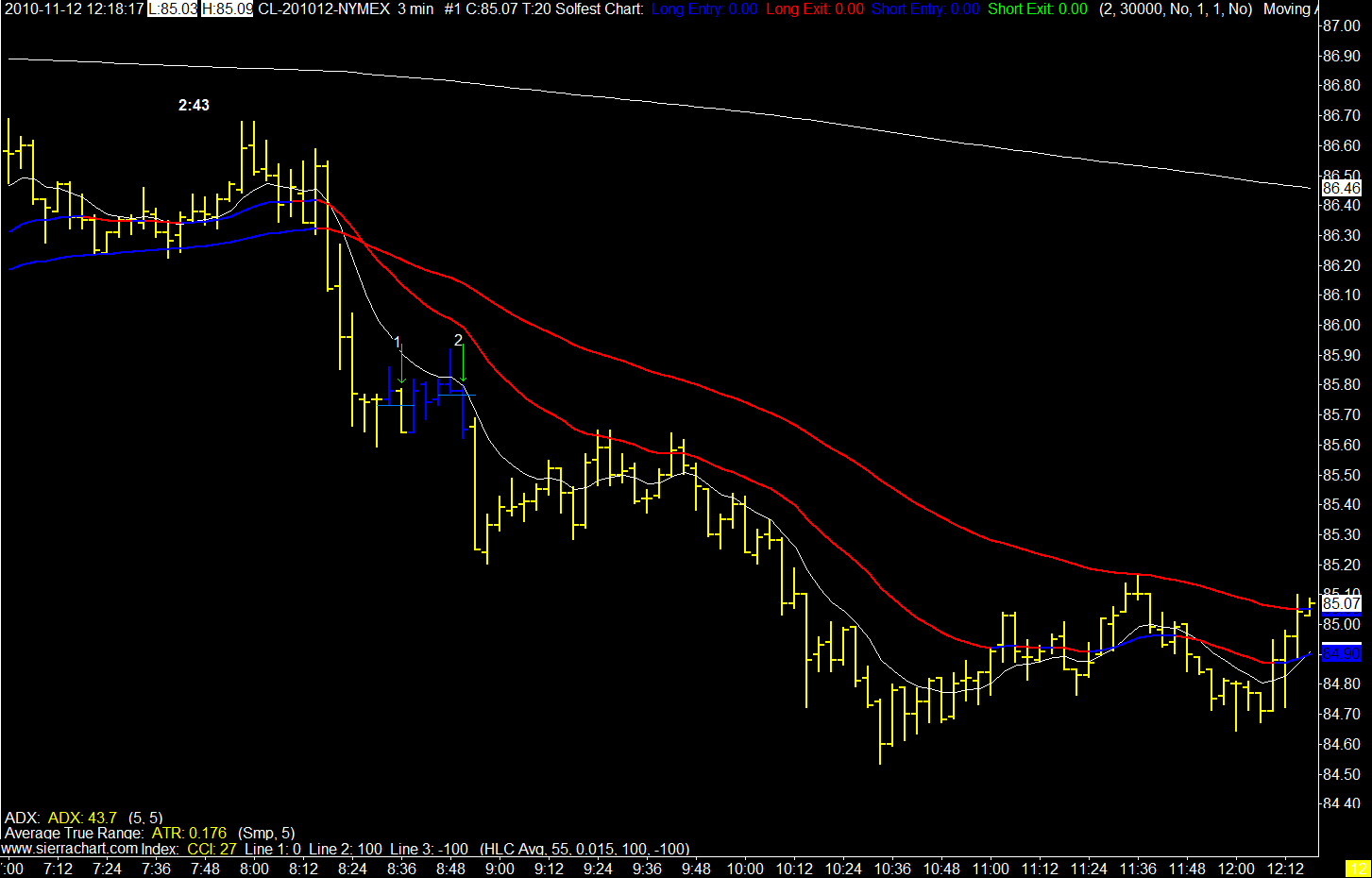

Who Needs Wednesdays

Something spooked crude, don't know what but a very dull day became rather exciting for a while.

The stop and target levels all worked within a tick of not working, if that makes any sense.

You just never know.

Crude Oil Chart

The stop and target levels all worked within a tick of not working, if that makes any sense.

You just never know.

Crude Oil Chart

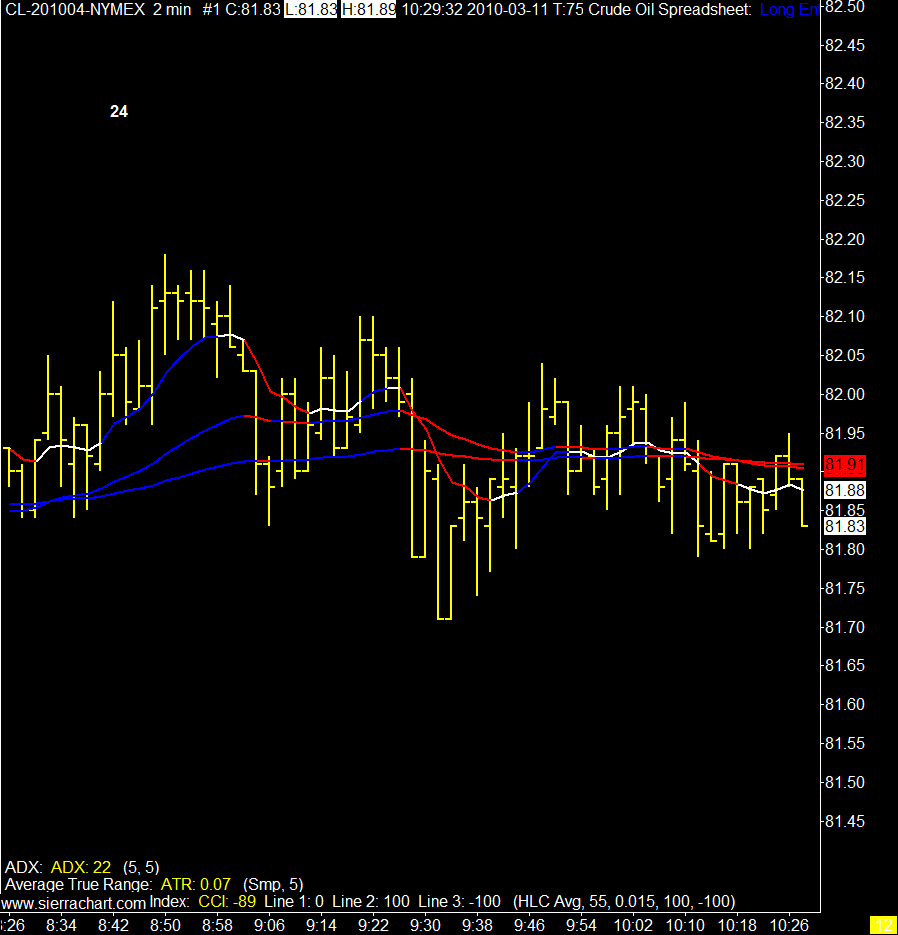

3/11/2010

3/10/2010

Wednesday

Man with real job: So what do you do for a living?

Solfest: I work Wednesdays.

Man with real job: That's it?

Solfest: Yes.

Man with real job: So what do you do the rest of the week?

Solfest: I look forward to Wednesday.

Crude Oil Chart

Solfest: I work Wednesdays.

Man with real job: That's it?

Solfest: Yes.

Man with real job: So what do you do the rest of the week?

Solfest: I look forward to Wednesday.

Crude Oil Chart

3/05/2010

'How We Decide'

Suddenly I feel like a monkey sucking apple juice.

Click on watch full program after the video starts.

Click on watch full program after the video starts.

3/02/2010

The Bush Legacy

President Obama's plan to fix all this? He's going to double the U.S. debt in 8 years.

The U.S. national debt clock. In a word, wow.

Watch, learn, say something.

How can any rational human being ask their government to spend more money than they take in?

How can any rational human being vote for a politician who promises to cut taxes while they increase spending?

How?

The U.S. national debt clock. In a word, wow.

Watch, learn, say something.

How can any rational human being ask their government to spend more money than they take in?

How can any rational human being vote for a politician who promises to cut taxes while they increase spending?

How?

3/01/2010

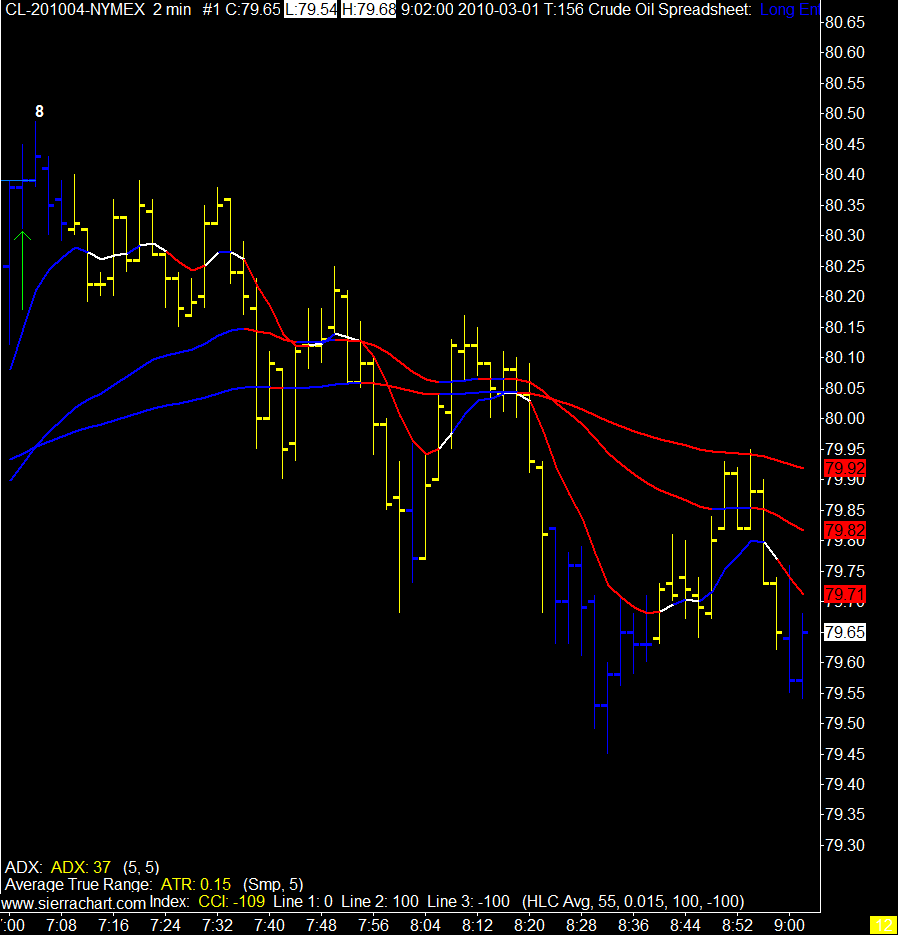

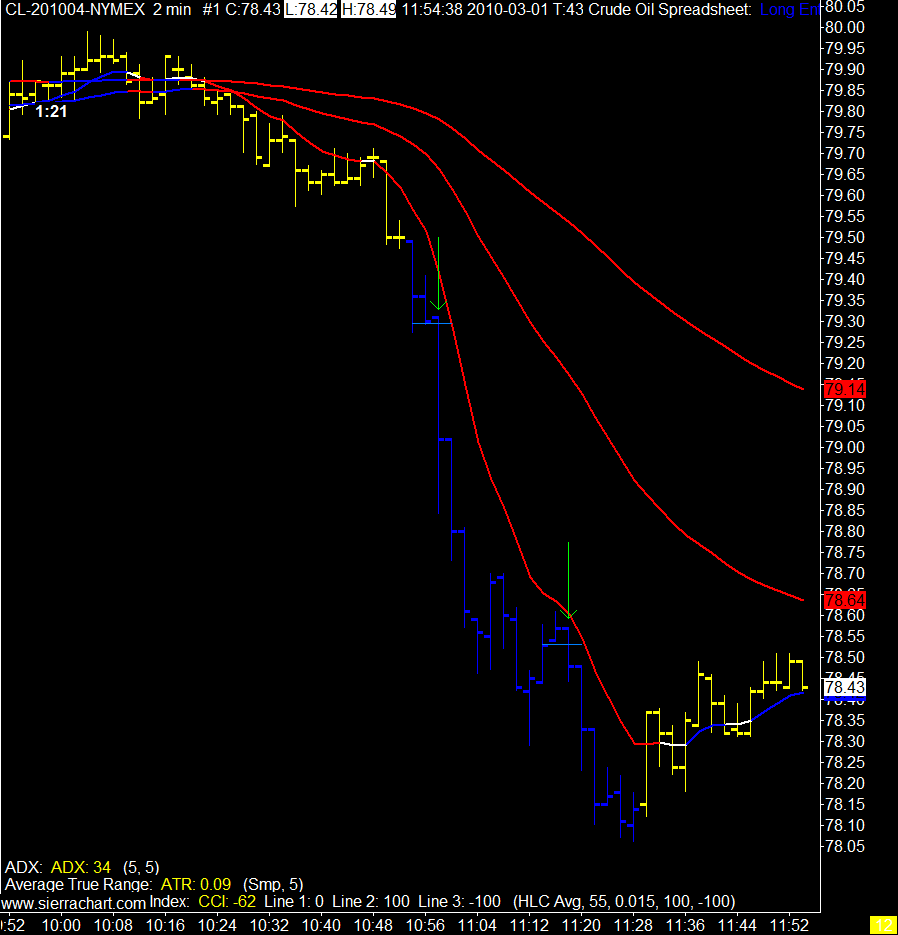

A Stop, Pass, Pass, Target, and a Chicken Dance

Perhaps I can only follow a plan for so long in a day before my rebellious nature exerts itself.

Took the stop on the first trade, passed on the next 2 signals due to longer time frame charts not in congruence, got my target on the second trade, and then chickened out of the third trade.

Question is who am I rebelling against?

Crude Oil Chart

Took the stop on the first trade, passed on the next 2 signals due to longer time frame charts not in congruence, got my target on the second trade, and then chickened out of the third trade.

Question is who am I rebelling against?

Crude Oil Chart

2/25/2010

2/24/2010

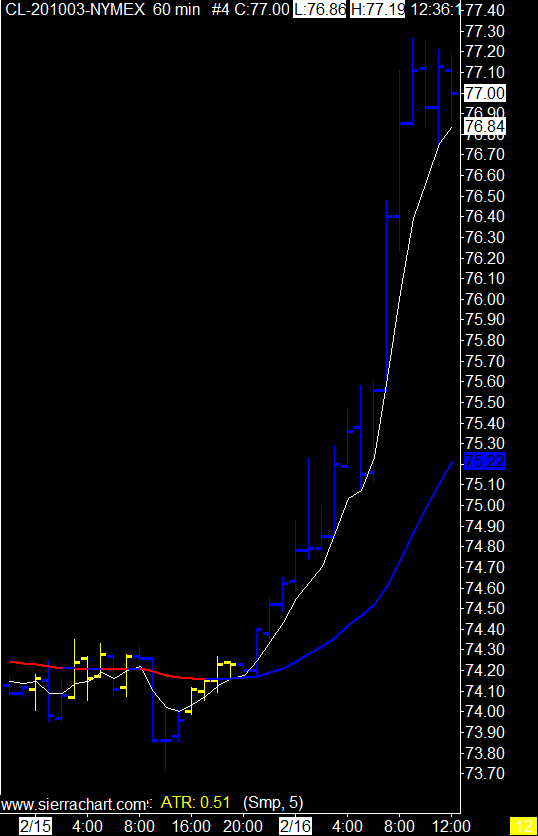

Green is Gold

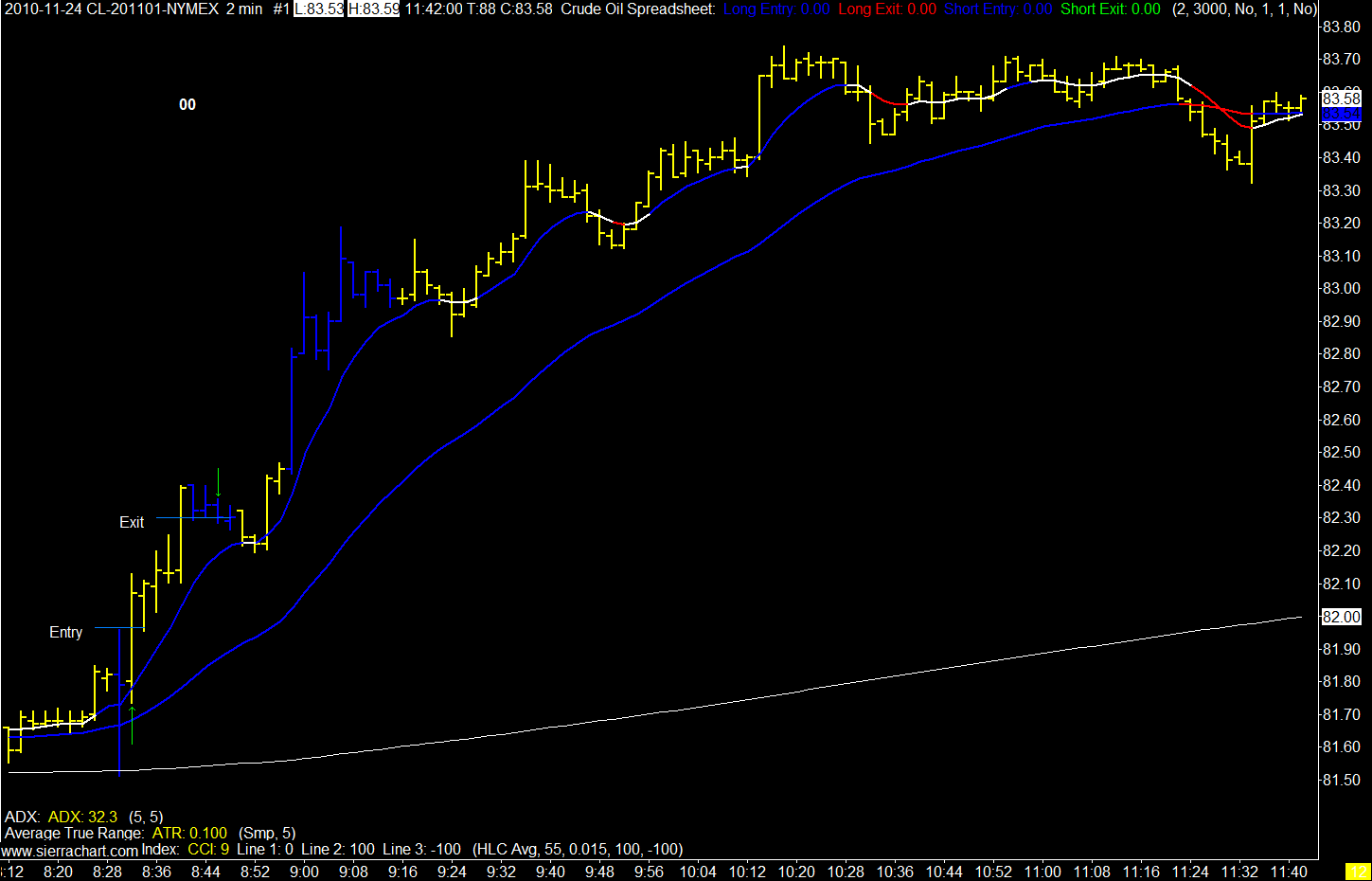

2 Minute Crude Oil

Let the first long go without me as I was waiting for the longer time frame charts to confirm. Stop wasn't big enough to stay in the first trade but caught the second for target.

That appears to be it for today.

Let the first long go without me as I was waiting for the longer time frame charts to confirm. Stop wasn't big enough to stay in the first trade but caught the second for target.

That appears to be it for today.

2/23/2010

Ho Hum II

Can anyone name one single improvement in the new blogger format?

I can name a few disimprovements. (I love it when I make up new words) Such as I can't embed 2 charts on one post, no spell check anymore, preview screen is now too small.

Humbug!

2 Minute Crude Oil Chart

I can name a few disimprovements. (I love it when I make up new words) Such as I can't embed 2 charts on one post, no spell check anymore, preview screen is now too small.

Humbug!

2 Minute Crude Oil Chart

What a World

Thanks to KC Trader for bringing this site to my attention. There are probably a few more gems here but The Warning is the first one I watched.

It's a great piece with many facets.

The first being that government consists of paid morons, the second that you cannot allow the foxes to set the rules in the hen house, and the third, we don't seem to learn from our mistakes.

Also interesting to note they drag out the ghost of Ayn Rand once again to "prove" all her theories are wrong. What Rand's critics always fail to make note of is she would never approve of any government intervention for a failed company. In a capitalist system they must, MUST, go bankrupt.

If LTCM had been allowed to go under maybe we would have learned something then that would have changed the course of the future we have just lived through.

Or not.

If we as a society deem that an institution truly is "too big to fail" then they cannot be allowed to exist as private companies.

They must be nationalized.

I don't believe they are too big to fail, but it seems everyone else does. After we bail them out and yell at them for a while everyone goes back to sleep until the next bomb goes off.

I'm all for regulating the marketplace and derivatives should only be allowed to trade on an open market, but after that, let the chips fall where they may.

It's a great piece with many facets.

The first being that government consists of paid morons, the second that you cannot allow the foxes to set the rules in the hen house, and the third, we don't seem to learn from our mistakes.

Also interesting to note they drag out the ghost of Ayn Rand once again to "prove" all her theories are wrong. What Rand's critics always fail to make note of is she would never approve of any government intervention for a failed company. In a capitalist system they must, MUST, go bankrupt.

If LTCM had been allowed to go under maybe we would have learned something then that would have changed the course of the future we have just lived through.

Or not.

If we as a society deem that an institution truly is "too big to fail" then they cannot be allowed to exist as private companies.

They must be nationalized.

I don't believe they are too big to fail, but it seems everyone else does. After we bail them out and yell at them for a while everyone goes back to sleep until the next bomb goes off.

I'm all for regulating the marketplace and derivatives should only be allowed to trade on an open market, but after that, let the chips fall where they may.

2/22/2010

'Too Big to Fail'

I have been looking for the best book on the whole credit crisis / end of the world story for a while now. There are plenty to choose from. This one seems to have been given the most praise and coverage from those who may have some knowledge on the subject. I'm about half way through it and it is very well done.

Andrew Ross Sorkin on Charlie Rose.

Andrew Ross Sorkin on Charlie Rose.

2/18/2010

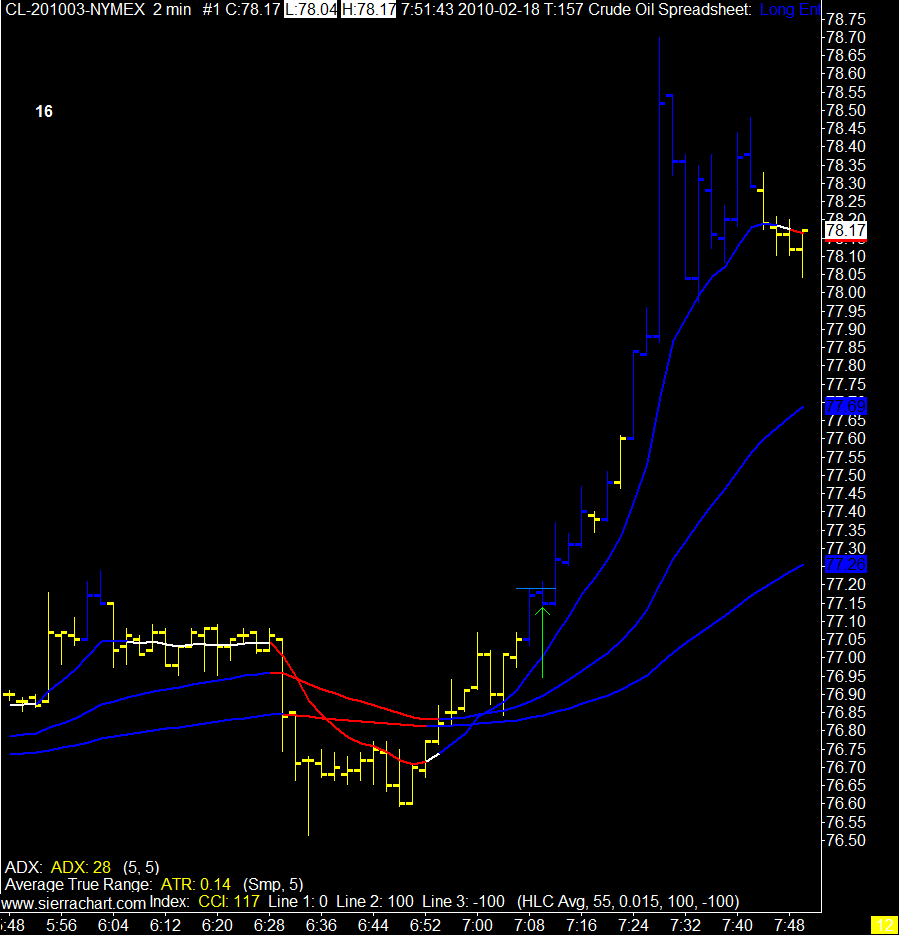

Boy Wonder

Nothing like a 150 tick move to get your day going. Of course when you are a genius boy wonder trader you expect days like this. You anticipate, you are ready to pounce and collect your bounty.

Or.

You take your 21 tick target and curl up in the fetal position sucking your thumb.

2 Minute Crude Oil chart

Or.

You take your 21 tick target and curl up in the fetal position sucking your thumb.

2 Minute Crude Oil chart

2/17/2010

How Long Can You Tread Water?

I've developed a strange fascination with ships lately. It all started with a Discovery Channel series called Mighty Ships which I watched via the internet all in one sitting. The scale of these ships and the tasks they take on are indeed mighty.

That got me browsing through you tube looking at tankers and some rough sea footage.

Insert comparison to trading analogy here:

Right.

Imagine yourself as the captain on one of these ships, the danger to you, your crew, passengers, and cargo is immense. How do you react?

Do you run screaming we're all going to die and hide in a life boat?

Or, stay at the helm and do everything in your power to ride this out.

Trading can be a lot like the North Sea in the winter. This begs the question, what kind of captain are you?

Now the rough sea trading analogy runs a little offside here as maybe the best result for your trading would be to abandon ship.

Why?

A good captain always goes down with the ship.

I guess the good news is they got it back to port.

That got me browsing through you tube looking at tankers and some rough sea footage.

Insert comparison to trading analogy here:

Right.

Imagine yourself as the captain on one of these ships, the danger to you, your crew, passengers, and cargo is immense. How do you react?

Do you run screaming we're all going to die and hide in a life boat?

Or, stay at the helm and do everything in your power to ride this out.

Trading can be a lot like the North Sea in the winter. This begs the question, what kind of captain are you?

Now the rough sea trading analogy runs a little offside here as maybe the best result for your trading would be to abandon ship.

Why?

A good captain always goes down with the ship.

I guess the good news is they got it back to port.

2/16/2010

Jim Collins

An interview discussing his book, Good to Great.

A link to an interview discussing his new book, How The Mighty Fall.

A link to an interview discussing his new book, How The Mighty Fall.

2/11/2010

Risk

This is a wonderful essay on risk, if you're not a trader find some time to watch it. Of course if you are a trader you have nothing but time. :)

I can't get the full program to embed so once the video starts click on watch full program.

I can't get the full program to embed so once the video starts click on watch full program.

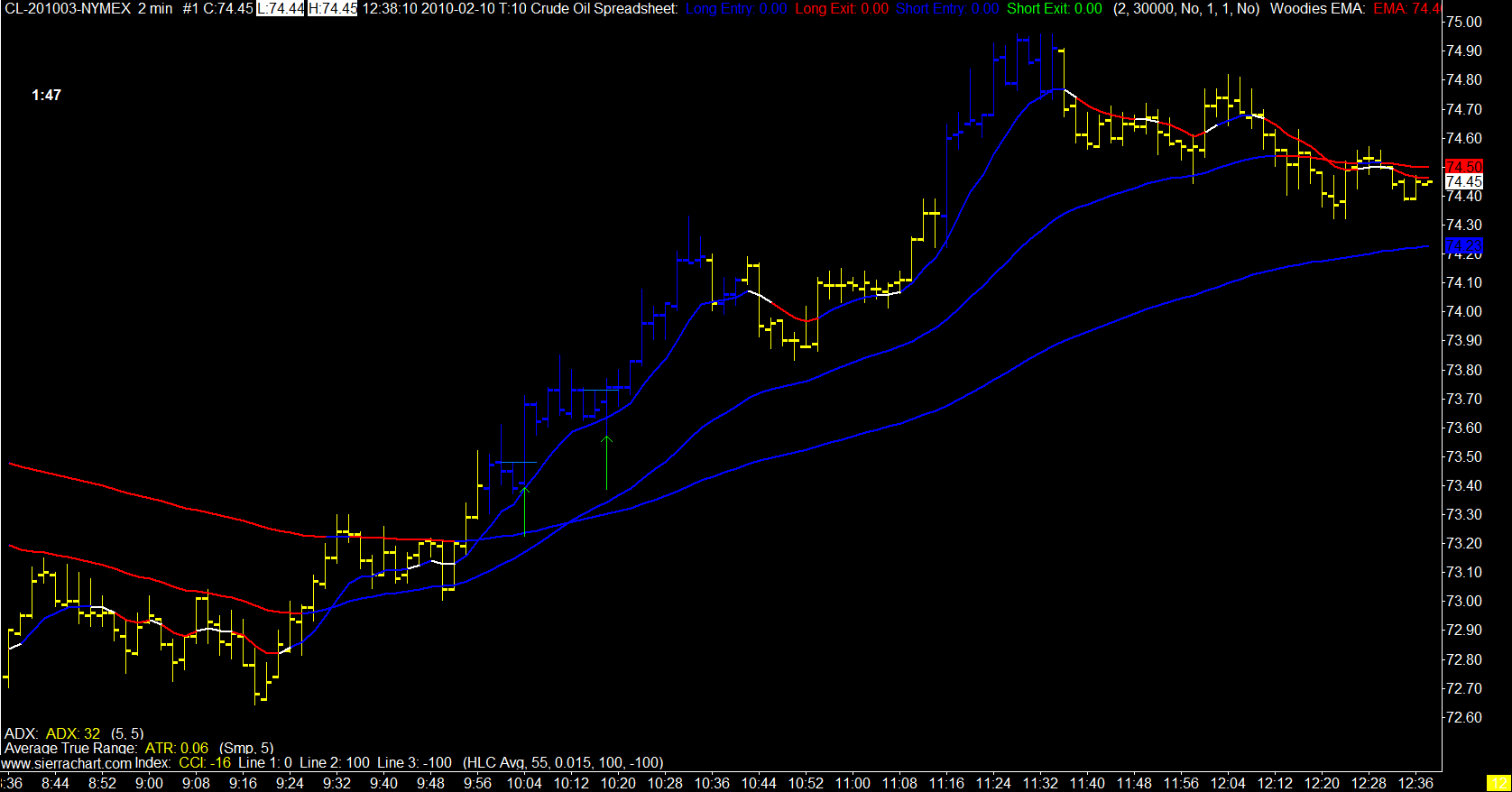

2/10/2010

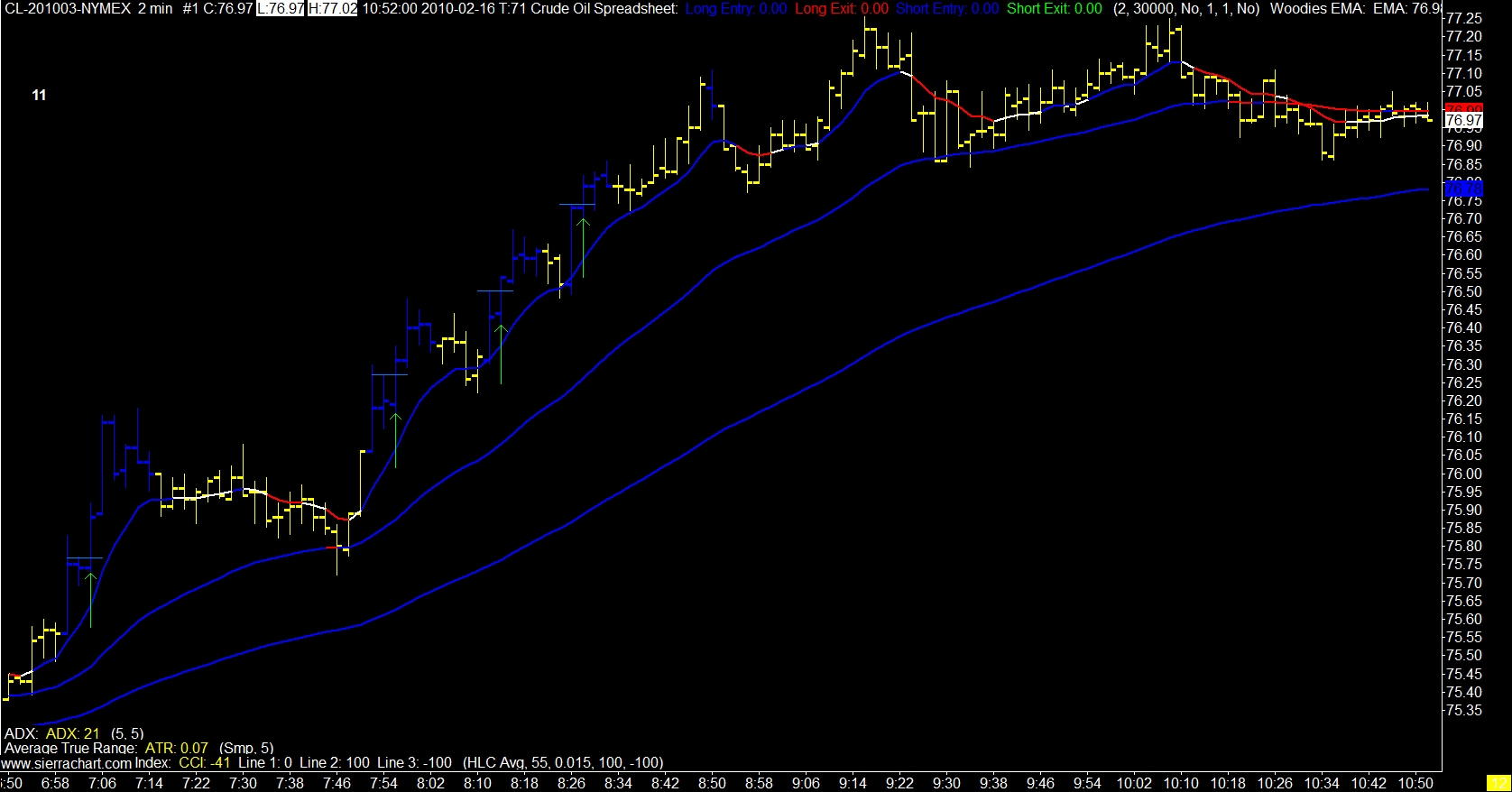

Crude Oil

Crude is moving again, finding some range and direction and staying there for a while. I have removed the "curbs" from the blue bars and am trading more aggressively in the direction of the major trend.

How does this day trader define major trend?

60 minute, 10 minute, 15 minute, something along those lines. Take the 2 minute signals in that direction and ignore the rest. Will miss some good trades as I did this morning but such is life.

2 Minute Crude Oil Chart

The best part is the chart looks much prettier with more blue bars.

I missed the last move as I had to step out for a while.

How does this day trader define major trend?

60 minute, 10 minute, 15 minute, something along those lines. Take the 2 minute signals in that direction and ignore the rest. Will miss some good trades as I did this morning but such is life.

2 Minute Crude Oil Chart

The best part is the chart looks much prettier with more blue bars.

I missed the last move as I had to step out for a while.

2/09/2010

2/06/2010

'The Ascent of Money'

I found this interview interesting and have added the book to my wish list. I couldn't add it to the shopping cart as the last order is still in transit. I figure if I wait a while it won't look like I have a problem.

As in hi my name is Solfest and I can't stop buying books.

Subscribe to:

Posts (Atom)