It is officially the one year anniversary of Capital is Scarce, formerly known as Trading Crude Oil. It's been an interesting year with some unbelievable market events. We have seen $147 dollar crude oil and the subsequent collapse, the credit crisis, the bear market, and all that government intervention in the economy. Don't get me started on that.

All of that plus a little trading has provided some good blogging material, although I'm not sure which was more entertaining the news or the trading.

I'm now questioning where I go from here with the blog? More of the same? It seems most of the interest in the blog comes from people who want me to tell them how to trade. I'm not going to do that because you cannot trade someone else's plan.

Is there any point in my continuing to blog? I feel as though I've said all I have to say in my 313 posts over the last 12 months.

If this is my last post I should have some brilliant trading wisdom to leave you with. The missing link you have all been looking for, that magic indicator, the holy grail. However since I don't just watch this video over and over.

There are two things I've seen in my trading over this past year that really stand out for me, money management and consistency. One I'm good at, the other I'm not.

Technical analysis is not the key to success. The key is figuring out what size of stop you need to capture X number of price points if the trade goes your way. I think this simple concept is the most important and the most difficult to find. How can I take the smallest amount of risk to capture the largest amount of reward? Finding that number is a must to have any success in this business.

Risk reward, expectancy, R multiples, however you categorize it, you have to trade a pattern with a positive expectancy. That doesn't necessarily mean more winners than losers, it means bigger winners than losers. That is money management for traders.

Knowing all that why do I still struggle with consistency? Humans suffer from a condition known as recency bias. We place more meaning on the most recent events, no matter if they are good or bad. This causes traders to think they have it made after a good week, actually a good day will do it, and causes traders to abandon the plan after a bad week, or day.

The only way to know if you have a trade with a statistical edge is to trade it without fault for a period of time. Then believe in it.

This is a hard business, if it was easy everyone would do it. What makes it so hard? The machines do the math for us so it's not that. The human brain does not appear to be naturally wired for trading success. The fight or flight impulse is wrong for trading, we have to reverse our natural fear and greed complex. This is very hard to do, it's like someone who loves sugar and hates salt trying to change those taste buds to do the reverse. We must be aware of our emotions at all times and work to keep them in a place that allows us to succeed in this business.

I will say good bye for now and continue to mull over if it's good bye forever. Thank you to all who participated over this last year. If you are new here have a look through the archives, you may find something of interest, or not.

Blessed is the man who finds wisdom, the man who gains understanding, for she is more profitable than silver and yields better returns than gold. She is more precious than rubies; nothing you desire can compare with her. Long life is in her right hand; in her left hand are riches and honor. Her ways are pleasant ways, and all her paths are peace. She is a tree of life to those who embrace her; those who lay hold of her will be blessed. Proverbs 3: 13 - 18

3/24/2009

3/23/2009

Coin Flipping

There's an old adage in trading that says with proper money management you could make money by flipping a coin to choose your direction in the market.

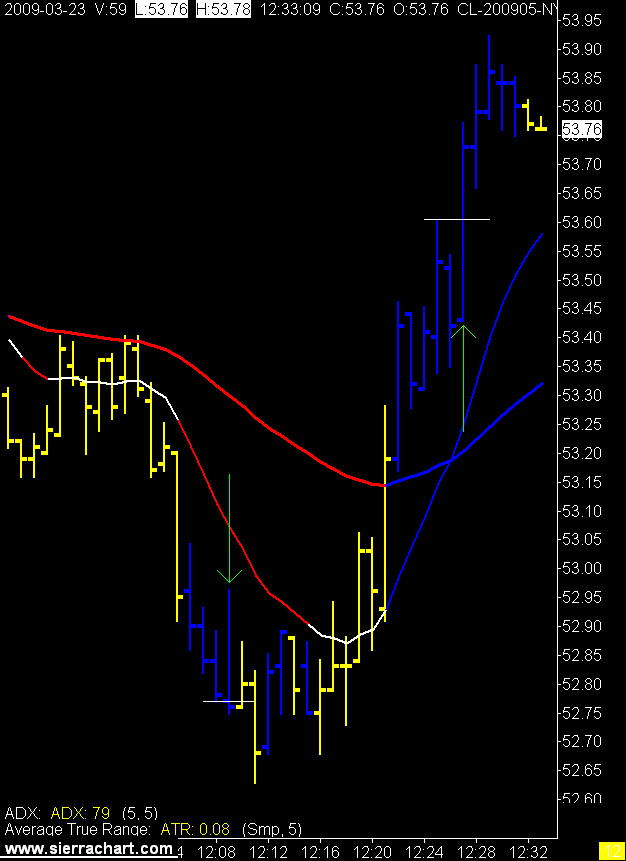

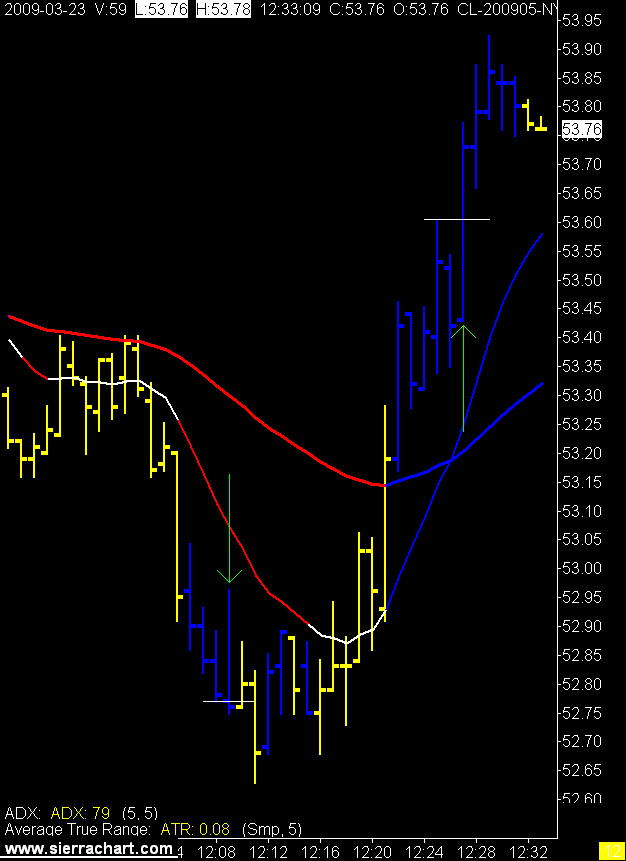

Saw the gamut of trading results today with a target hit, a full stop hit, and trailing profit stop hit. I traded well; I took what the market gave and let the money management rules work for me.

All in all a nice day, with the equity markets moving up and huge Canadian oil patch merger. My stocks with the limit stop orders are still in play and their prices moving further away from the stops.

That's today, who knows what tomorrow shall bring.

1 Minute Crude Oil Charts

Added a link to the EIT's trading room in the right hand column of the blog. Mirc is not exactly user friendly so if you can figure out how to get there you have passed half the test to join.

The other half of the test starts after you are in the room. If you are not a jerk and have nothing for sale you are welcome to stay.

Once you download the mirc platform find the othernet random server and then search for #TigersCommunity.

Saw the gamut of trading results today with a target hit, a full stop hit, and trailing profit stop hit. I traded well; I took what the market gave and let the money management rules work for me.

All in all a nice day, with the equity markets moving up and huge Canadian oil patch merger. My stocks with the limit stop orders are still in play and their prices moving further away from the stops.

That's today, who knows what tomorrow shall bring.

1 Minute Crude Oil Charts

Added a link to the EIT's trading room in the right hand column of the blog. Mirc is not exactly user friendly so if you can figure out how to get there you have passed half the test to join.

The other half of the test starts after you are in the room. If you are not a jerk and have nothing for sale you are welcome to stay.

Once you download the mirc platform find the othernet random server and then search for #TigersCommunity.

Canadian Oil Patch Mega Merger

Suncor and Petro Canada announced this morning that they have agreed to an all stock merger with Suncor taking over the management of the newly merged company. This would make the merged company the largest oil company in Canada.

Suncor is the oldest participant in the Fort McMurray oil sands arena and widely considered the pioneer in oil sands extraction technology. Suncor was the first company to finally succeed in getting oil out of the sand in Fort McMurray. Many companies had tried and failed over the years before Suncor found success. Suncor's decision to treat the oil sands as a mining operation with shovels and trucks was the key to successfully harvesting the enormous oil resources in the Alberta oil sands.

Suncor is the oldest participant in the Fort McMurray oil sands arena and widely considered the pioneer in oil sands extraction technology. Suncor was the first company to finally succeed in getting oil out of the sand in Fort McMurray. Many companies had tried and failed over the years before Suncor found success. Suncor's decision to treat the oil sands as a mining operation with shovels and trucks was the key to successfully harvesting the enormous oil resources in the Alberta oil sands.

Petro Canada has a more checkered past in the Canadian oil patch. They were started by the federal government as a way for the Canadian government to take part, or take over, the Canadian oil business. This was a disaster of monumental proportions and the company finally had to be handed back over to the private sector with the Canadian government selling their shares in 2004. This was another very clear account of a government completely failing in their attempt to run a company.

Petro Canada has a more checkered past in the Canadian oil patch. They were started by the federal government as a way for the Canadian government to take part, or take over, the Canadian oil business. This was a disaster of monumental proportions and the company finally had to be handed back over to the private sector with the Canadian government selling their shares in 2004. This was another very clear account of a government completely failing in their attempt to run a company.

While I have no issue with foreign equity coming into Canada it is nice to see an all Canadian merger forming a company with global scale.

Suncor is the oldest participant in the Fort McMurray oil sands arena and widely considered the pioneer in oil sands extraction technology. Suncor was the first company to finally succeed in getting oil out of the sand in Fort McMurray. Many companies had tried and failed over the years before Suncor found success. Suncor's decision to treat the oil sands as a mining operation with shovels and trucks was the key to successfully harvesting the enormous oil resources in the Alberta oil sands.

Suncor is the oldest participant in the Fort McMurray oil sands arena and widely considered the pioneer in oil sands extraction technology. Suncor was the first company to finally succeed in getting oil out of the sand in Fort McMurray. Many companies had tried and failed over the years before Suncor found success. Suncor's decision to treat the oil sands as a mining operation with shovels and trucks was the key to successfully harvesting the enormous oil resources in the Alberta oil sands. Petro Canada has a more checkered past in the Canadian oil patch. They were started by the federal government as a way for the Canadian government to take part, or take over, the Canadian oil business. This was a disaster of monumental proportions and the company finally had to be handed back over to the private sector with the Canadian government selling their shares in 2004. This was another very clear account of a government completely failing in their attempt to run a company.

Petro Canada has a more checkered past in the Canadian oil patch. They were started by the federal government as a way for the Canadian government to take part, or take over, the Canadian oil business. This was a disaster of monumental proportions and the company finally had to be handed back over to the private sector with the Canadian government selling their shares in 2004. This was another very clear account of a government completely failing in their attempt to run a company.While I have no issue with foreign equity coming into Canada it is nice to see an all Canadian merger forming a company with global scale.

3/19/2009

Good Solfest, Bad Solfest

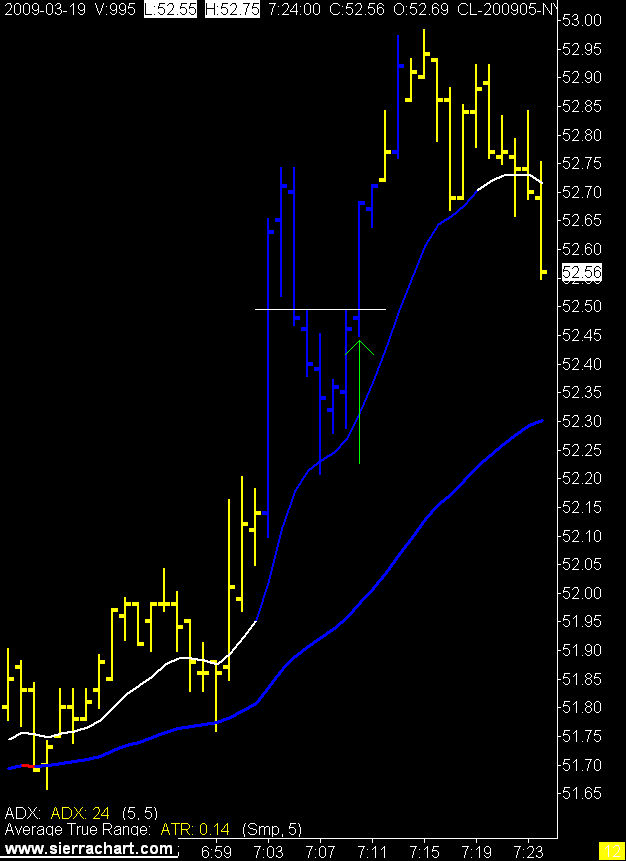

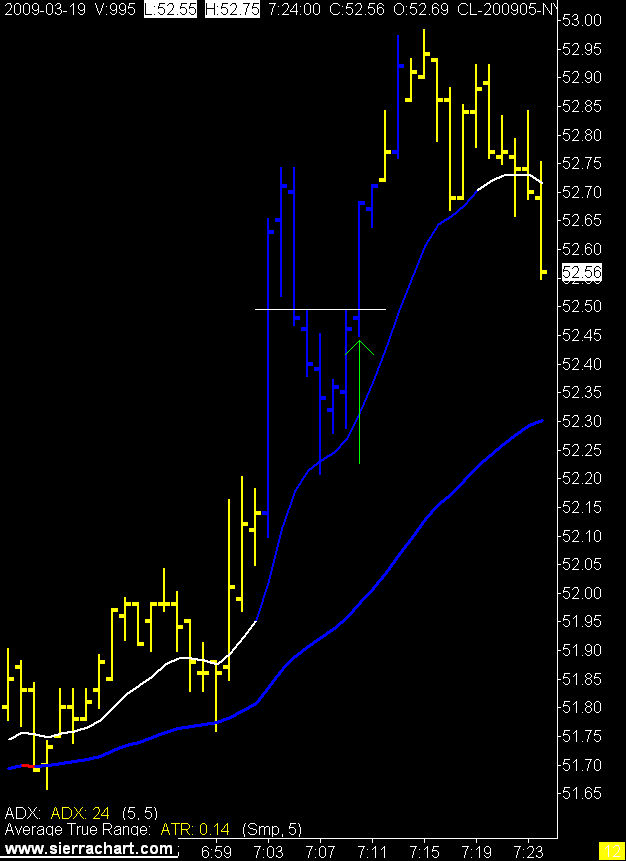

Good Solfest waited for his trade set up on both charts, the 3 minute and the 1 minute. Good Solfest was rewarded for his patience by having his trade hit his predetermined target.

Bad Solfest is too embarrassed to even show you the chart where he took his trade. Bad Solfest saw his set up on one chart and jumped in without waiting for confirmation from the other chart. Bad Solfest's trade moved a few tics his way and then turned around and smacked him in the head.

The only thing Good Solfest and Bad Solfest have in common is their money management. This ensures that Bad Solfest cannot ruin the day completely.

For this Good Solfest is grateful.

1 Minute Crude Oil Chart

Bad Solfest is too embarrassed to even show you the chart where he took his trade. Bad Solfest saw his set up on one chart and jumped in without waiting for confirmation from the other chart. Bad Solfest's trade moved a few tics his way and then turned around and smacked him in the head.

The only thing Good Solfest and Bad Solfest have in common is their money management. This ensures that Bad Solfest cannot ruin the day completely.

For this Good Solfest is grateful.

1 Minute Crude Oil Chart

3/18/2009

Oil Inventory

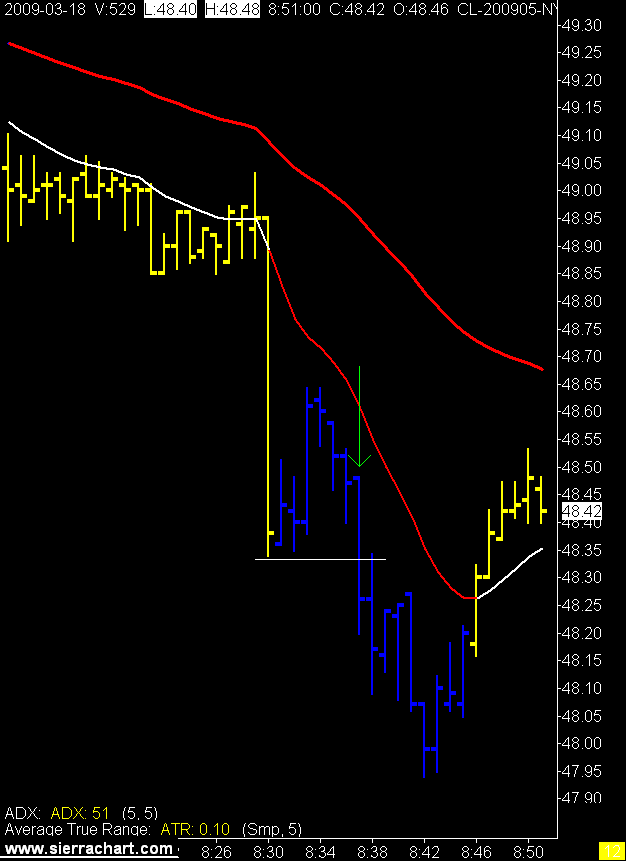

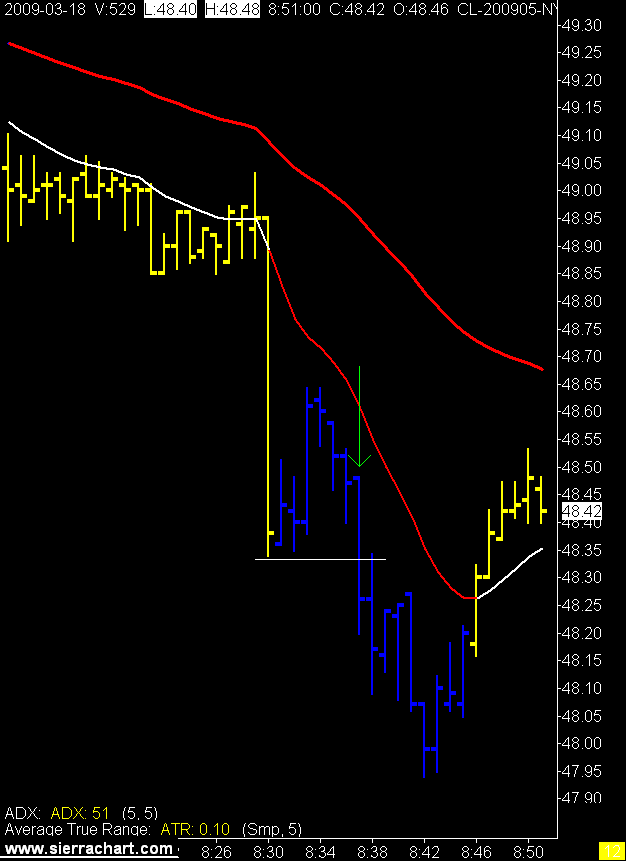

I don't know if it would shock anyone that I don't listen to or watch the weekly oil inventory report when it is first released. I know when it's coming and I do not trade in front of it, but I don't need to know what it says when it's released.

I just follow the chart.

Hit target with this trade after the report and didn't have anything else line up for the rest of the day.

I watched the YM when the Fed announcement came out and it seemed to like whatever the Fed had to say. Has the DOW put in the bottom on this bear market?

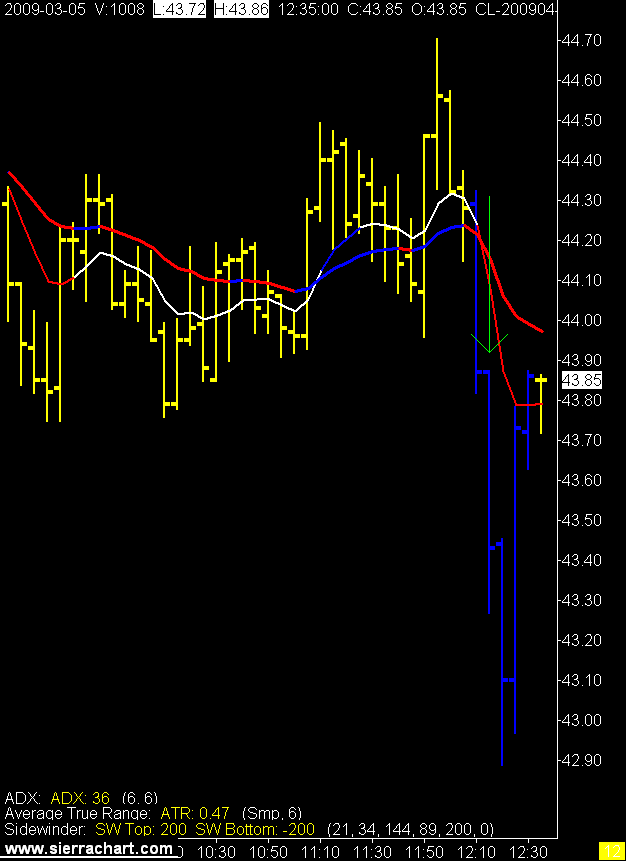

1 Minute Crude Oil Chart

I just follow the chart.

Hit target with this trade after the report and didn't have anything else line up for the rest of the day.

I watched the YM when the Fed announcement came out and it seemed to like whatever the Fed had to say. Has the DOW put in the bottom on this bear market?

1 Minute Crude Oil Chart

3/16/2009

One of Those Days

In my perusal of trading blogs today I see a familiar theme. Most of which I won't repeat here as this is a G rated blog. My results were the same.

IB went strange on me right out the gate, a sign perhaps, I should have shut it down right there. As soon as I entered the first order the April contract disappeared off my IB screen. Everything froze up and when it came back to life I was stopped out. Needless to say I had a conversation with IB, and of course the market took off while I was talking. When I got back to the trade I took the next signal and got smacked again.

The smartest thing I did all day was quit trading right there and then.

In case you're wondering on the first chart below yes I do see where I should have entered. Like I said it was one of those days.

1 Minute Crude Oil Charts

Not sure if you remember I purchased some stock back on March 3, 2009. I have placed sell on stop limit orders on all 3 stocks at the break even point. I'm up 9%, 5%, and 2% on the 3 stocks I purchased.

Certainly could get stopped on the intra day whip on that +2% one. We shall see.

I have never used stops on my stock portfolio as my investing has always been done on 100% fundamental analysis. My thought patterns on investing have always been if it was a good buy at $10.00 its a great buy at $8.00.

After this stock market meltdown, I've decided I don't want to own "new" stocks that are going the wrong way. So with this little rally under these three the break even stop limit order is in. The worst thing that can happen is I get my cash back.

I can live with that.

IB went strange on me right out the gate, a sign perhaps, I should have shut it down right there. As soon as I entered the first order the April contract disappeared off my IB screen. Everything froze up and when it came back to life I was stopped out. Needless to say I had a conversation with IB, and of course the market took off while I was talking. When I got back to the trade I took the next signal and got smacked again.

The smartest thing I did all day was quit trading right there and then.

In case you're wondering on the first chart below yes I do see where I should have entered. Like I said it was one of those days.

1 Minute Crude Oil Charts

Not sure if you remember I purchased some stock back on March 3, 2009. I have placed sell on stop limit orders on all 3 stocks at the break even point. I'm up 9%, 5%, and 2% on the 3 stocks I purchased.

Certainly could get stopped on the intra day whip on that +2% one. We shall see.

I have never used stops on my stock portfolio as my investing has always been done on 100% fundamental analysis. My thought patterns on investing have always been if it was a good buy at $10.00 its a great buy at $8.00.

After this stock market meltdown, I've decided I don't want to own "new" stocks that are going the wrong way. So with this little rally under these three the break even stop limit order is in. The worst thing that can happen is I get my cash back.

I can live with that.

Labels:

crude oil trade,

sell on stop order,

stop loss order

3/13/2009

I Don't Want to Say...

But I told you so. The first shot across the bow from the Chinese.

Interpretation: You're my puppy now.

"China's Leader Says He Is Worried over U.S. Treasuries"

Diego Azubel/European Pressphoto Agency

Diego Azubel/European Pressphoto Agency

BEIJING — "The Chinese prime minister, Wen Jiabao, expressed unusually blunt concern on Friday about the safety of China’s $1 trillion investment in American government debt, the world’s largest such holding, and urged the Obama administration to provide assurances that the securities would maintain their value in the face of a global financial crisis." Michael Wines and Keith Bradsher, NY Times

Click on the read more icon for the full NY Times story.

read more | digg story

Interpretation: You're my puppy now.

"China's Leader Says He Is Worried over U.S. Treasuries"

Diego Azubel/European Pressphoto Agency

Diego Azubel/European Pressphoto Agency BEIJING — "The Chinese prime minister, Wen Jiabao, expressed unusually blunt concern on Friday about the safety of China’s $1 trillion investment in American government debt, the world’s largest such holding, and urged the Obama administration to provide assurances that the securities would maintain their value in the face of a global financial crisis." Michael Wines and Keith Bradsher, NY Times

Click on the read more icon for the full NY Times story.

read more | digg story

Blue Sky

Solfest has just recently recognized the fragility of life and seen the error of his scarcity mantra.

Or, Solfest is sick and tired of Rain (RR) complaining about his "negative" blog title.

So with my new found abundant life in hand I present the Solfest transformation.

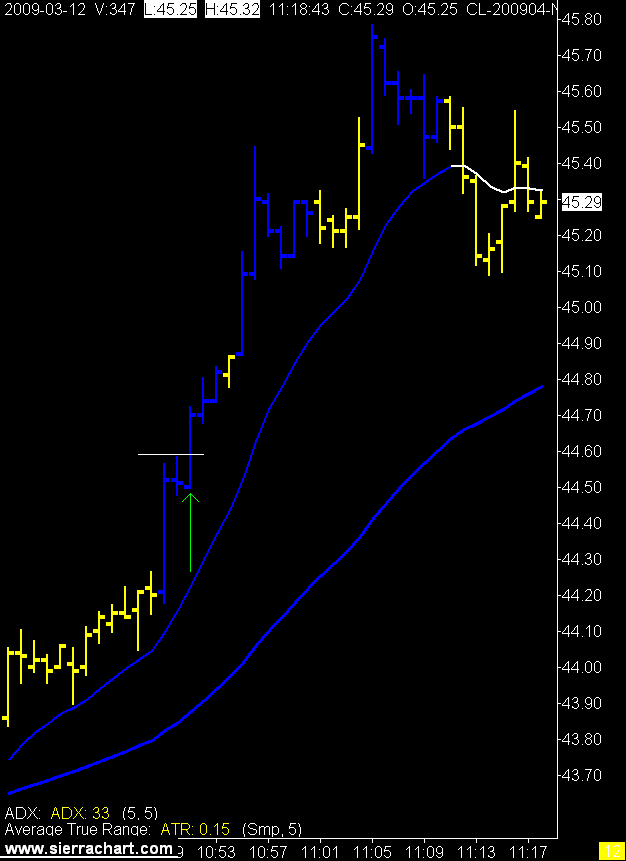

Caught 25 tics with this trade and pretty much shut it down for the day. I was too busy celebrating my abundance to trade anymore.

1 Minute Crude Oil Chart

Or, Solfest is sick and tired of Rain (RR) complaining about his "negative" blog title.

So with my new found abundant life in hand I present the Solfest transformation.

Caught 25 tics with this trade and pretty much shut it down for the day. I was too busy celebrating my abundance to trade anymore.

1 Minute Crude Oil Chart

3/12/2009

A Sad Day

A helicopter carrying 18 oil workers to an off shore rig went down off the coast of Newfoundland today. So far they have only found one survivor. This tragedy reminded me of the Ocean Ranger, an off shore rig that sank on Feb 14, 1982 with 84 crew on board. There were no survivors.

Drilling for oil is a dangerous enough job on land, when you add the Atlantic Ocean in the winter time it gets even worse.

My wife and I met a lady from Newfoundland last summer who's Father died on the Ocean Ranger. Kind of brings it home.

Trading doesn't really matter.

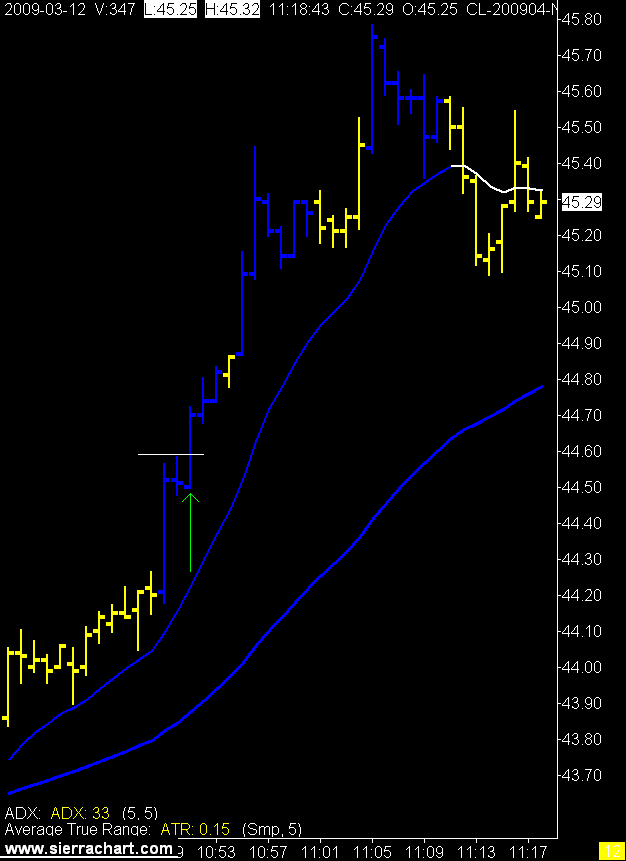

1 Minute Crude Oil Chart

Drilling for oil is a dangerous enough job on land, when you add the Atlantic Ocean in the winter time it gets even worse.

My wife and I met a lady from Newfoundland last summer who's Father died on the Ocean Ranger. Kind of brings it home.

Trading doesn't really matter.

1 Minute Crude Oil Chart

3/11/2009

Curve Fitting

When you start messing with your trading system there is always a danger that you will catch the horrible disease known as constantinkeritis.

This is a nasty affliction which you should recognize if you are making 3:00 AM MACD adjustments and mumbling to yourself throughout the day.

The only known cure is the blue screen of death on your computer that causes you to toss it in the garbage and buy a new one. This clean slate provides the opportunity to begin life anew.

Three trades today, one on a time frame that shall remain nameless for now. Caught a partial stop, partial target, and full target.

The second trade shown here did not have blue on the entry bar, but did on the longer time frame chart. I thought the 1 minute bar would turn blue if the trade went my way. It didn't, but the trade worked anyway.

1 Minute Crude Oil Charts

This is a nasty affliction which you should recognize if you are making 3:00 AM MACD adjustments and mumbling to yourself throughout the day.

The only known cure is the blue screen of death on your computer that causes you to toss it in the garbage and buy a new one. This clean slate provides the opportunity to begin life anew.

Three trades today, one on a time frame that shall remain nameless for now. Caught a partial stop, partial target, and full target.

The second trade shown here did not have blue on the entry bar, but did on the longer time frame chart. I thought the 1 minute bar would turn blue if the trade went my way. It didn't, but the trade worked anyway.

1 Minute Crude Oil Charts

3/10/2009

A Tale of Two Charts

The Bull.

15 Minute Mini DOW Chart

The Bear.

Daily Mini DOW Chart

Unless the DOW is going to zero it has to stop going down sometime.

Maybe this is that time?

Or not.

15 Minute Mini DOW Chart

The Bear.

Daily Mini DOW Chart

Unless the DOW is going to zero it has to stop going down sometime.

Maybe this is that time?

Or not.

3/09/2009

"Daddy's Benk"

My kids were young when I started with the bank, whenever we drove by a branch my daughter would recognize the logo and state "Daddy's benk". Not sure why I thought of that now, I guess because she's growing up and I'm feeling old. :)

Hopefully "Daddy's benks" don't go broke because as 60 Minutes reports, the depositors are protected, but the shareholders get wiped out.

More great journalism from 60 Minutes.

Watch CBS Videos Online

They raise an interesting question about limiting the size of banks going forward. If you're too big to fail then maybe you shouldn't continue to exist in your current form.

I'm of the opinion, probably a minority position, that no company is too big to fail. We just need to let them fail. Let the consolidation continue.

I guess we will never know what would have happened if the government had stayed out of the way.

As long as we're watching 60 Minutes we might as well get the Bernie Madoff story from them as well. It's sad that you have to diversify your portfolio managers to protect from yourself from fraud. Investors now have systemic and fraud risk, to go along with the old company, market, and inflation risks we have always lived with.

There's probably a few more "risks" I'm forgetting.

Watch CBS Videos Online

Hopefully "Daddy's benks" don't go broke because as 60 Minutes reports, the depositors are protected, but the shareholders get wiped out.

More great journalism from 60 Minutes.

Watch CBS Videos Online

They raise an interesting question about limiting the size of banks going forward. If you're too big to fail then maybe you shouldn't continue to exist in your current form.

I'm of the opinion, probably a minority position, that no company is too big to fail. We just need to let them fail. Let the consolidation continue.

I guess we will never know what would have happened if the government had stayed out of the way.

As long as we're watching 60 Minutes we might as well get the Bernie Madoff story from them as well. It's sad that you have to diversify your portfolio managers to protect from yourself from fraud. Investors now have systemic and fraud risk, to go along with the old company, market, and inflation risks we have always lived with.

There's probably a few more "risks" I'm forgetting.

Watch CBS Videos Online

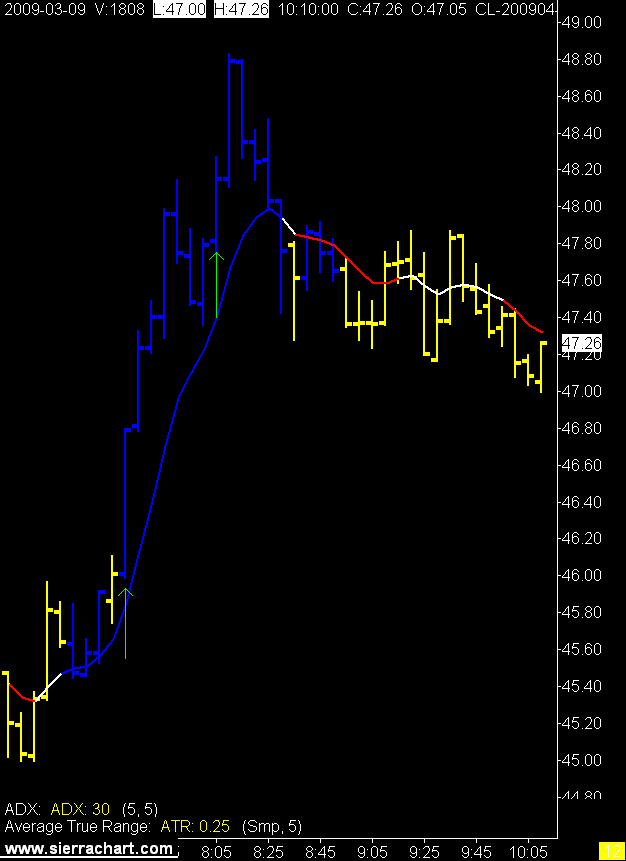

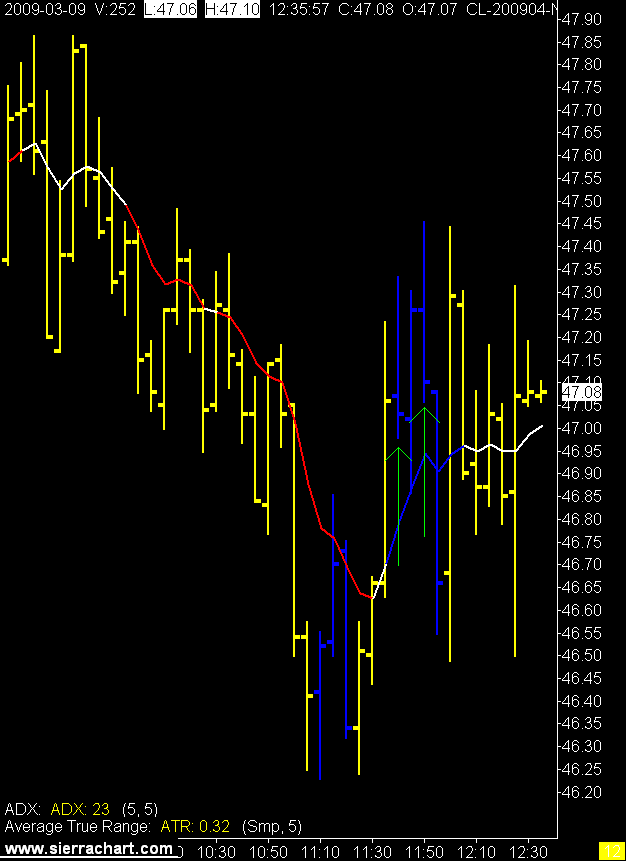

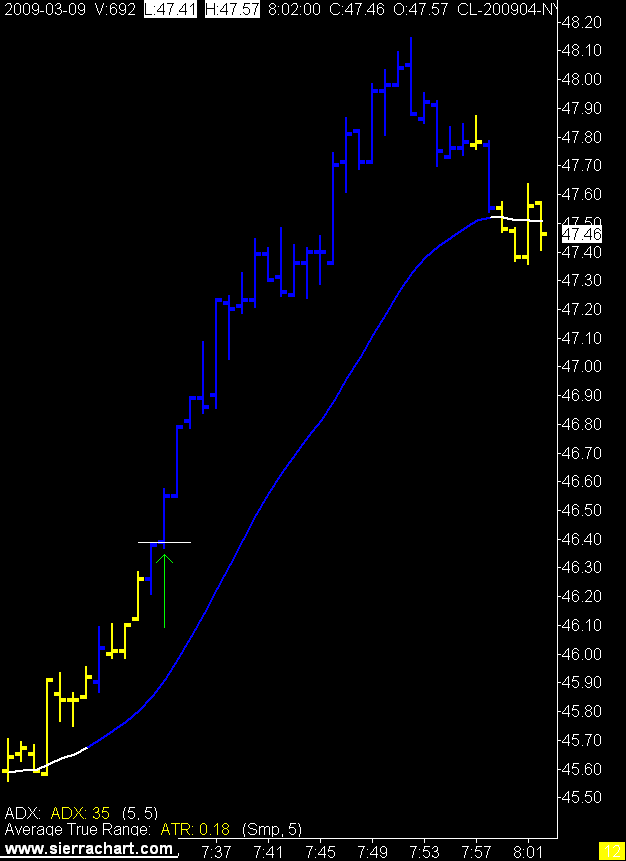

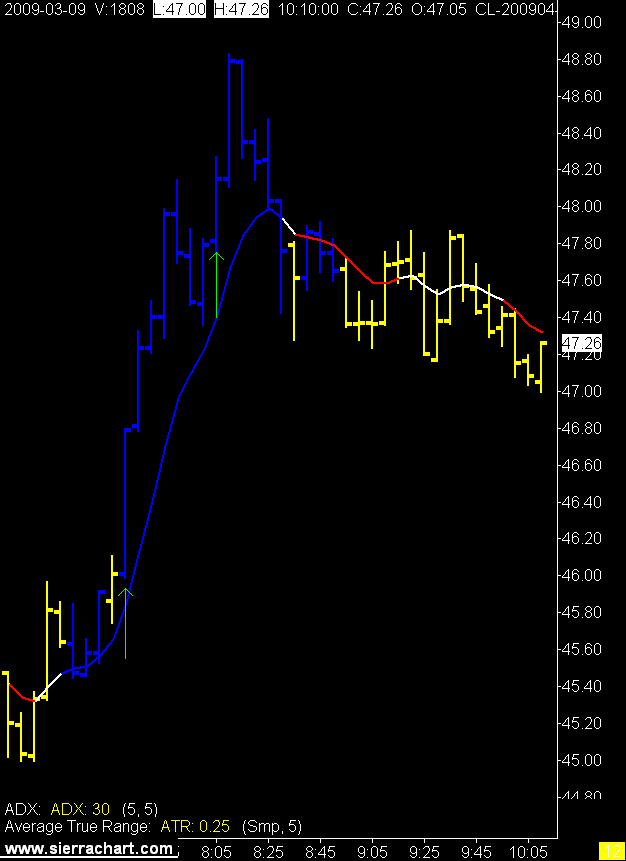

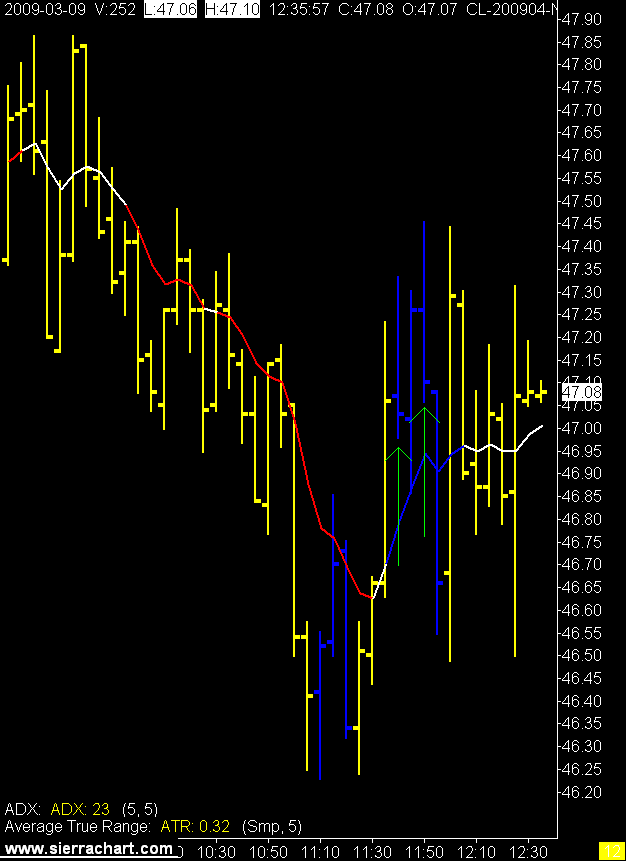

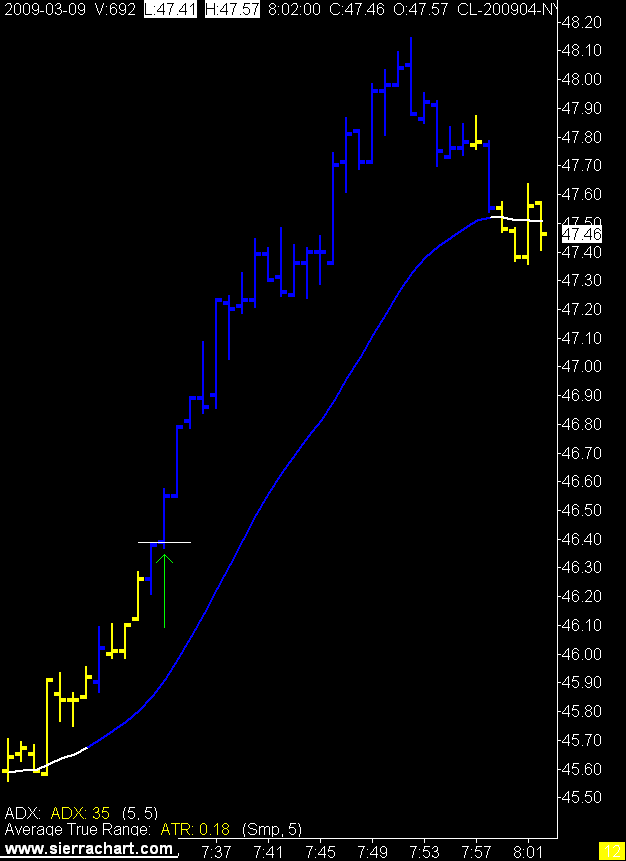

Blue is Abundant

The abundance of blue was not due to any changes I made in the blue bars. The price action this morning makes everyone a trading genius. It went up, and up, and up. Then a retrace to support, a bounce, and up some more.

Nice and easy.

Caught 2 full targets in that action. Trading for a target in a market like that looks rather foolish, but you would have to let me know in advance when those market conditions are coming. We have not seen a consistent run like that in a long time.

Sounds like OPEC is sticking to their quotas and ruminating on cutting more production.

The afternoon session saw the signals fire, trades entered, and there they died. Two full stops there.

All in all a good day.

I'm not going to comment on the changes to the blue bars as I'm not sure anyone cares :) and the changes may not be done.

5 Minute Crude Oil Charts

1 Minute Crude Oil Charts

Solfest added a new blog to the blog roll. Solfest is very happy about it. Solfest suggests you check it out.

Nice and easy.

Caught 2 full targets in that action. Trading for a target in a market like that looks rather foolish, but you would have to let me know in advance when those market conditions are coming. We have not seen a consistent run like that in a long time.

Sounds like OPEC is sticking to their quotas and ruminating on cutting more production.

The afternoon session saw the signals fire, trades entered, and there they died. Two full stops there.

All in all a good day.

I'm not going to comment on the changes to the blue bars as I'm not sure anyone cares :) and the changes may not be done.

5 Minute Crude Oil Charts

1 Minute Crude Oil Charts

Solfest added a new blog to the blog roll. Solfest is very happy about it. Solfest suggests you check it out.

3/08/2009

Atlas Shrugged, Again

I am starting to see more commentary on the amount of government intervention in the economy, and the cost of that intervention, in the news lately.

A few people are waking up to the fact that the government attempts to save us from a depression could move us into something much worse.

For me the question that no one wants to ask is, what happens if the world stops buying U.S. treasuries?

Is the United States government the only entity on earth that can borrow money forever?

For every other entity on earth that scenario winds up badly.

Stephen Moore wrote an article a while ago comparing current government actions with those described in Rand's book, which I posted here. It's worth another look along with some video from the author describing the reaction to his article.

A few people are waking up to the fact that the government attempts to save us from a depression could move us into something much worse.

For me the question that no one wants to ask is, what happens if the world stops buying U.S. treasuries?

Is the United States government the only entity on earth that can borrow money forever?

For every other entity on earth that scenario winds up badly.

Stephen Moore wrote an article a while ago comparing current government actions with those described in Rand's book, which I posted here. It's worth another look along with some video from the author describing the reaction to his article.

Labels:

Atlas Shrugged,

Ayn Rand,

From Fiction to Fact,

Stephen Moore

3/06/2009

Canada envy, amid a global meltdown

"Canada's banks are finally getting some respect. Derided for years as meek and mild while banks around the world expanded wildly, suddenly the reputation of Canada's big lenders as prudent and sometimes downright boring has become an asset instead of a liability.

U.S. President Barack Obama has heaped praise on the management of this country's financial system. Ireland is considering overhauling its system to look more like Canada's. Financial papers around the world are running headlines such as “Canada banks prove envy of the world.”

Whether measured by market value, balance sheet strength or profitability, Canada's banks are rising to the top. Since the credit crunch began in the summer of 2007, the Big Five banks have booked a total of $18.9-billion in profits.

In roughly the same period, the five biggest U.S. banks have lost more than $37-billion (U.S.). One, Wachovia Corp., was forced to sell out to avoid failing. Another, Citigroup Inc., long the world's largest bank, may have to be nationalized and this week became a penny stock. The picture is similar in Britain." Tara Perkins and Boyd Erman, Globe and Mail

I worked for and still own Royal Bank and Toronto Dominion. I thought we pushed the envelope on lending a bit far some times. I guess that just shows how conservative a lender I was.

Click on the read more icon for the full Globe and Mail story.

read more | digg story

U.S. President Barack Obama has heaped praise on the management of this country's financial system. Ireland is considering overhauling its system to look more like Canada's. Financial papers around the world are running headlines such as “Canada banks prove envy of the world.”

Whether measured by market value, balance sheet strength or profitability, Canada's banks are rising to the top. Since the credit crunch began in the summer of 2007, the Big Five banks have booked a total of $18.9-billion in profits.

In roughly the same period, the five biggest U.S. banks have lost more than $37-billion (U.S.). One, Wachovia Corp., was forced to sell out to avoid failing. Another, Citigroup Inc., long the world's largest bank, may have to be nationalized and this week became a penny stock. The picture is similar in Britain." Tara Perkins and Boyd Erman, Globe and Mail

I worked for and still own Royal Bank and Toronto Dominion. I thought we pushed the envelope on lending a bit far some times. I guess that just shows how conservative a lender I was.

Click on the read more icon for the full Globe and Mail story.

read more | digg story

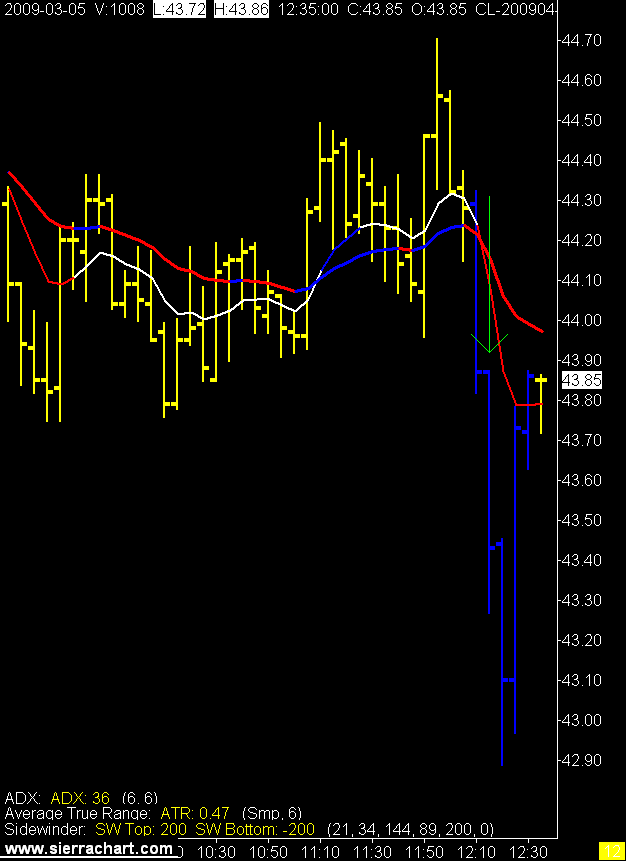

A Couple of Trades

Thursday's trade had a full target and a full stop. Would have got target if I had entered again on the break of that 2nd 1 minute entry bar.

I don't take the third swing as I have found that it is usually getting too far away from mean (EMAs) and doesn't have the risk reward I want.

But yes the third swing would have worked here.

5 Minute Crude Oil

1 Minute Crude Oil

Didn't trade Friday as I was doing a little tinkering with the blue bars. Not sure if I learned anything and we will continue to work on it this weekend.

I'm happy with the results of my trades, there just are not enough of them. So the idea is to find a few more without adding too many strike outs.

We shall see.

Have a nice weekend all, here's another addition to the what do Canadians do for fun file.

I don't take the third swing as I have found that it is usually getting too far away from mean (EMAs) and doesn't have the risk reward I want.

But yes the third swing would have worked here.

5 Minute Crude Oil

1 Minute Crude Oil

Didn't trade Friday as I was doing a little tinkering with the blue bars. Not sure if I learned anything and we will continue to work on it this weekend.

I'm happy with the results of my trades, there just are not enough of them. So the idea is to find a few more without adding too many strike outs.

We shall see.

Have a nice weekend all, here's another addition to the what do Canadians do for fun file.

3/04/2009

Confessions of an Economic Hit Man

Debt as a weapon, hmmmm.

No idea if any of this is true, but it certainly makes for a good story.

Confessions of an Economic Hit Man

No idea if any of this is true, but it certainly makes for a good story.

Confessions of an Economic Hit Man

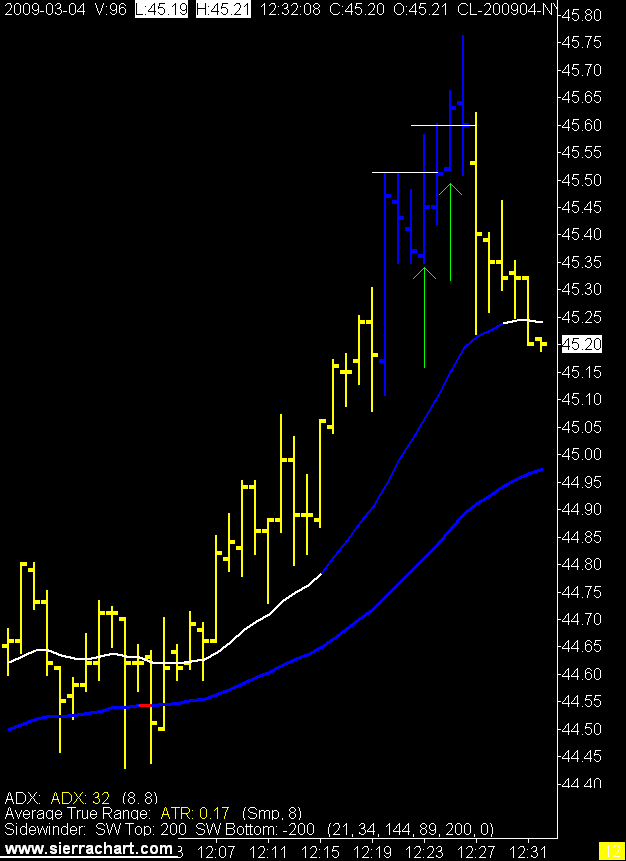

Stupid Blue Bars

3/03/2009

I Was Interested

So I hope you are too. Not sure who created these videos but they do a nice job of explaining a few things. Or at least providing an opinion.

The Japan commentary is from the same gentleman that brought us the oil contango video.

The Japan commentary is from the same gentleman that brought us the oil contango video.

Don't Blink

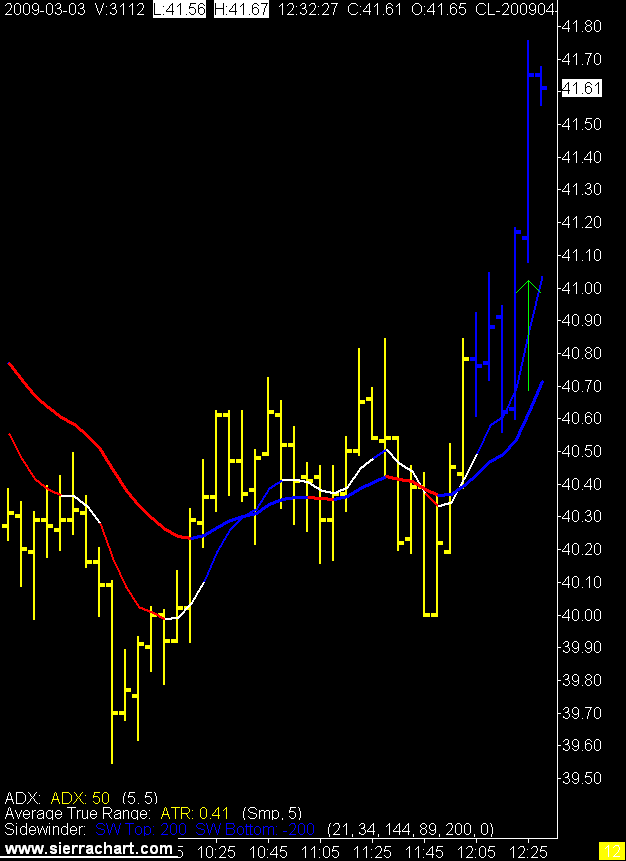

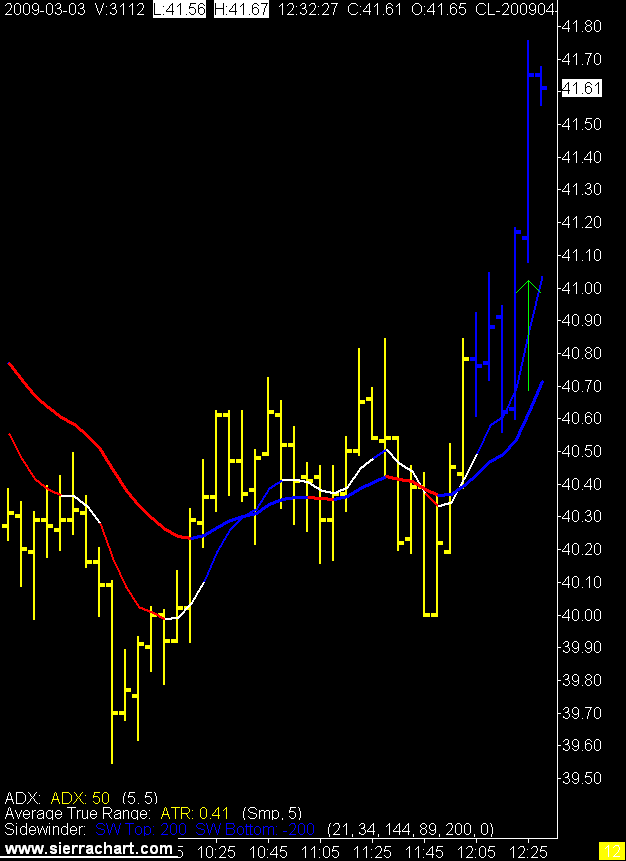

To continue with my counting of the seconds theme today I watched charts for 19,645 seconds, traded for 46 seconds, and then congratulated myself for the remaining 109 seconds in the session.

I got full target on the trade as the peak of the move was 1 tic above my target.

Is that skill or dumb luck?

It's been a slow couple of days, let's call it skill.

I also deployed the retirement cash into stock so yes this is officially the bottom.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

I got full target on the trade as the peak of the move was 1 tic above my target.

Is that skill or dumb luck?

It's been a slow couple of days, let's call it skill.

I also deployed the retirement cash into stock so yes this is officially the bottom.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

3/02/2009

We're all Going to Die

In times like this it's important not to panic. To remain calm, a Captain Chesley Sullenberger kind of calm.

A simple "brace for impact" kind of calm.

With that in mind I offer the following kind, humorous, warm, and fuzzy little video.

Which is differnt from the original video I had chosen today. This one did not play well in the "room".

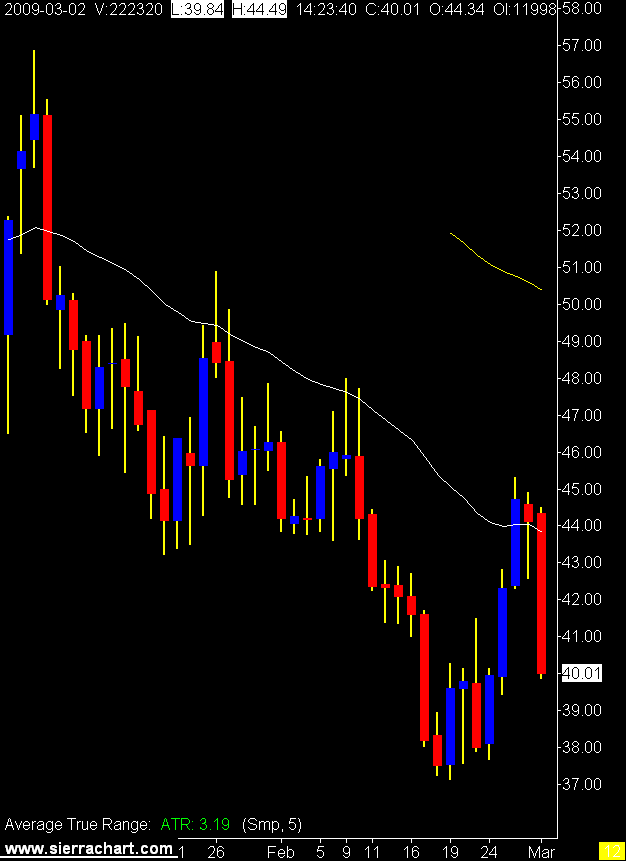

Daily DOW Futures Chart

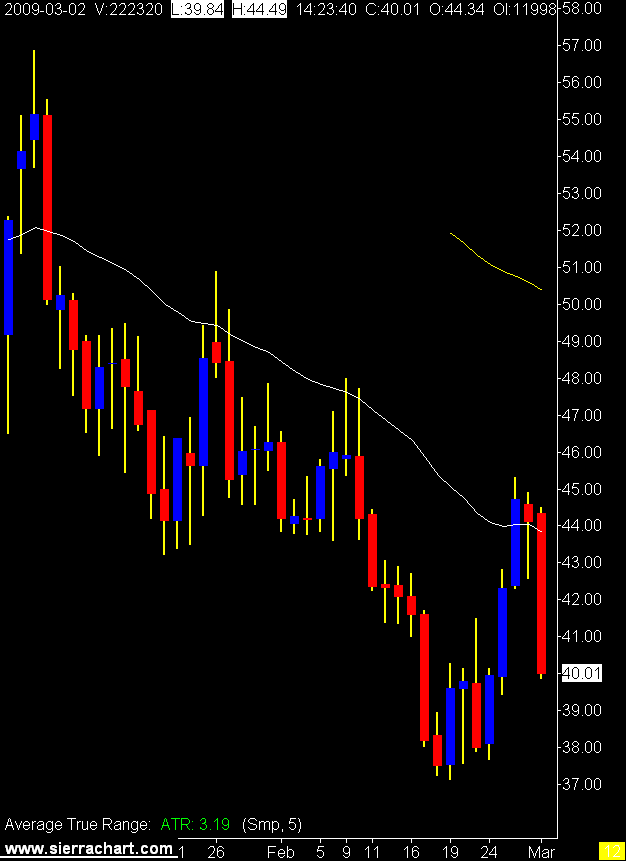

Daily Crude Oil Chart

So with the DOW collapsing again I am looking to deploy some retirement cash. The last time I did this was Oct 2008.

Then we had Nov 2008. Ouch.

I held through and sold a few weeks ago for a small profit.

This time I'm looking at Canadian Real Estate Investment Trust and Cominar for an income producing long term hold.

We shall see.

A simple "brace for impact" kind of calm.

With that in mind I offer the following kind, humorous, warm, and fuzzy little video.

Which is differnt from the original video I had chosen today. This one did not play well in the "room".

Daily DOW Futures Chart

Daily Crude Oil Chart

So with the DOW collapsing again I am looking to deploy some retirement cash. The last time I did this was Oct 2008.

Then we had Nov 2008. Ouch.

I held through and sold a few weeks ago for a small profit.

This time I'm looking at Canadian Real Estate Investment Trust and Cominar for an income producing long term hold.

We shall see.

Subscribe to:

Posts (Atom)