The majority of this blog's readers are not from Canada, so for those of you who only think of Canada in terms of polar bears and hockey players this will all be news to you.

Those of us who live in Canada are apparently facing another federal election on the heels of the last one held October 14, 2008. Yes, less than 2 months ago.

We have a minority federal government in Canada, which means the ruling Conservative party needs the support of at least one of the opposition parties in order to pass anything in the House of Commons.

The Conservative party brought forth an economic update to the country in which they detailed some things they may do in an official budget. Things to stimulate the economy while trying to maintain our long history of fiscal surpluses. Yes, we have not run a deficit in many years.

One cost cutting measure was to eliminate a subsidy provided to all federal parties based on the number of votes that party received in the last election. Since the Conservatives received the most votes they would lose the most money.

However the Conservatives have the most money on hand from their very successful and very constant fund raising. The Conservatives can live without the subsidy; the other parties cannot in their current form.

So, the opposition parties are now in talks to form a coalition government. Meaning if they all vote together they have more seats in the House of Commons than the Conservatives.

This has never been done in Canadian Political history. We would then have a ruling government made up of Liberals (just as the name implies), New Democrats (socialists), and the Bloc Quebecois. The Bloc is a fascinating bit of Canadian politics, we actually have, and pay for, a "federal" party that only runs candidates in Quebec, and who's sole mandate is to separate Quebec from the rest of Canada.

That's right we pay for a party that wishes to destroy the country. We the Canadian tax payer pay the Bloc's members of parliament salaries, benefits, and pensions. The party is also subsidized by the Canadian tax payer like all the other parties.

So while the world is facing its greatest financial crisis since the great depression Canada would be run by three different political parties, liberals, socialists, and separatists.

The best part is the whole idea was not conceived by the current opposition party leadership, but by their leaders of the past who are no longer members of the House of Commons. Former liberal Prime Minister Jean Chretien and former NDP leader Ed Broadbent have been reported as the masters of this idea.

The other political alternatives are, we have another federal election, or the opposition parties vote with the Conservatives and let them rule as we the people elected them to do 6 weeks ago.

So if you were, or are, a Canadian citizen which alternative would you prefer.

Imagine the carnage of a coalition government of liberals, socialists, and separatists running this country.

Imagine you were a Liberal or New Democrat politician and 6 weeks after the last election you showed up on my doorstep asking for my vote again. Asking because the Conservatives took away your tax payer subsidy. Asking, because of the tax payer’s subsidy, you had not bothered to do any proper fund raising. Asking because even if you did try fund raising no one would give you any money.

If I were our Prime Minister I would draw the line in the sand and dare the opposition to try any of the alternatives other than voting with the government to pass whatever budget they ultimately do bring to the House of Commons.

Some would say he already has.

Now we wait to see if anyone blinks.

11/29/2008

11/28/2008

Someone Made Money

Great story from the Globe and Mail on Fairfax Financial.

"Only a handful of financial companies worldwide are in better shape now than before this crisis started. Fairfax Financial is one of them. CEO Prem Watsa managed to make $2 billion and thumb his nose at his opponents at the same time." Derek DeCloet, Globe and Mail.

"Only a handful of financial companies worldwide are in better shape now than before this crisis started. Fairfax Financial is one of them. CEO Prem Watsa managed to make $2 billion and thumb his nose at his opponents at the same time." Derek DeCloet, Globe and Mail.

11/27/2008

Dragons Den

I love this show. Budding entrepreneurs pitch their products to a group of investors. As a former business banker it reminds me of the many pitches I heard. I wish I could have been as honest as the "dragons".

The show started on the BBC and the Canadian version has been running for 3 years now. All of the episodes are available online at CBC Dragons Den.

Here's a sample.

The show started on the BBC and the Canadian version has been running for 3 years now. All of the episodes are available online at CBC Dragons Den.

Here's a sample.

11/26/2008

Is There Hope?

No, there isn't.

Happy Thanksgiving.

Ok maybe, but not just yet.

We have so far to go before there is hope it's hard to even see it. I know we have Barack Obama's, yes we can, working for us. But, 21 days ago the DOW futures were over 9600. We haven't even got back to there yet.

We have a long way to go and I want to get there as fast as anyone, I'm 100% invested, and it's all long equities.

We have had a little 4 day rally, it's meaningless.

Sorry.

I hope, there's that word, that we have seen the bottom, I hope my negative post today looks foolish in the future, I hope Barack Obama and his team turn it all around.

I hope.

But I don't believe.

This house of cards cannot be rebuilt with debt. The house needs to crumble, and those who survive have to build a new one. With all governments adding more cards to the current house it only postpones the inevitable.

The house is going to fall down.

So why do I stay long in equities?

I think mine are survivors, they are paying me handsomely while I wait, and I can't miss any of the up move if there ever is one.

Besides that if you don't have hope, what do you have?

Cash. LOL

Labels:

Barack Obama,

DOW futures,

dow futures chart,

economy,

yes we can

11/25/2008

I Want Nuclear!

Jack Dee Live at the Apollo: Cold Calling

Oh, and the markets?

Who cares.

They went up, down, and sideways.

Just keep President Elect Obama at the microphone, Ben Bernanke at the printing press, and Hank Paulson handing out the dough and we'll all be ok.

Yes I'm in a bad mood, I've got a "man cold".

One more thing, make sure you watch this "ugly" post.

Oh, and the markets?

Who cares.

They went up, down, and sideways.

Just keep President Elect Obama at the microphone, Ben Bernanke at the printing press, and Hank Paulson handing out the dough and we'll all be ok.

Yes I'm in a bad mood, I've got a "man cold".

One more thing, make sure you watch this "ugly" post.

Labels:

apollo theatre,

Barack Obama,

Ben Bernanke,

cold calling,

Hank Paulson,

jack dee,

man cold

11/21/2008

It Was Close

Daily DOW Futures

Yesterday we entered the land of no return.

Yesterday we entered the land of no return.

Today I jumped, but at the last second turned and grabbed the window sill around 1:00PM MST. I hung there by my finger tips and only with my super manly brute strength was I able to pull my self back in.

We closed back in the land of milk and honey. Well, maybe the land of watered down soup and crackers. Apparently we were saved by (other than my super manly brute strength) Barack Obama's cabinet selections. Good on ya man, come back and save us some more on Monday.

If you trade take a look at the last hour of these 15 minute charts, that is the only time you need to trade.

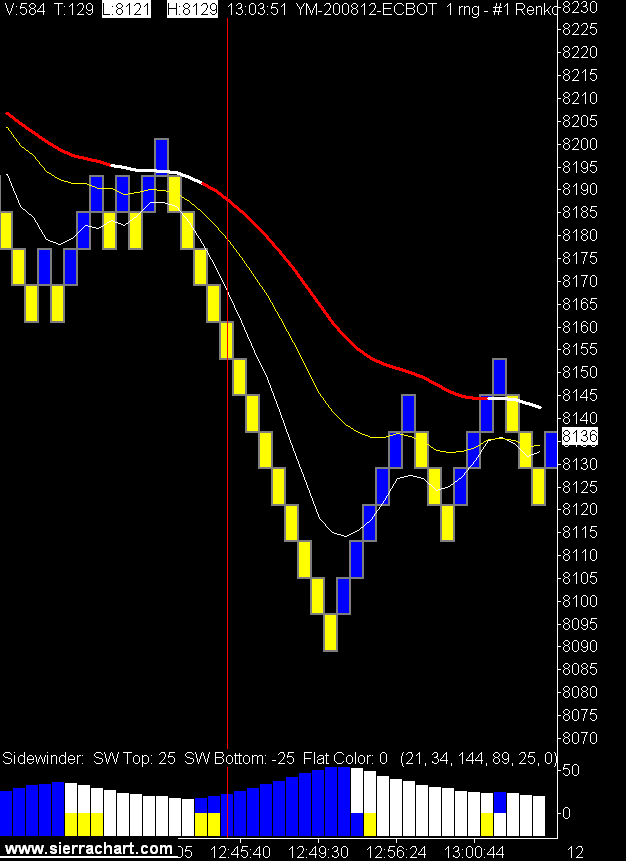

15 Minute DOW Futures

Yesterday we entered the land of no return.

Yesterday we entered the land of no return.Today I jumped, but at the last second turned and grabbed the window sill around 1:00PM MST. I hung there by my finger tips and only with my super manly brute strength was I able to pull my self back in.

We closed back in the land of milk and honey. Well, maybe the land of watered down soup and crackers. Apparently we were saved by (other than my super manly brute strength) Barack Obama's cabinet selections. Good on ya man, come back and save us some more on Monday.

If you trade take a look at the last hour of these 15 minute charts, that is the only time you need to trade.

15 Minute DOW Futures

11/20/2008

We all need a good laugh

Your stocks portfolio has been decimated, you're up to your eyeballs in debt, and you've just been laid off.

You need a good laugh, and a good look at 600 million dollars in gold.

Try some Canadian humour.

I can't believe they let him in there.

You need a good laugh, and a good look at 600 million dollars in gold.

Try some Canadian humour.

I can't believe they let him in there.

Good Bye Cruel World

The sky is falling.

The end is near.

Ma, git the youngins, beef jerky, guns, and head for the bomb shelter.

YM Daily Chart

15 Minute YM Chart

Where do we go from here? The charts say down. How far?

Where do we go from here? The charts say down. How far?

I have no idea.

I'm glad I can trade this to the downside, although I should have hedged the retirement accounts. I sat here and watched and did not do anything to protect the long positions. I would not have sold, but could have used options or a bear ETF to hedge.

Not smart.

Is it too late to hedge now?

The end is near.

Ma, git the youngins, beef jerky, guns, and head for the bomb shelter.

YM Daily Chart

15 Minute YM Chart

Where do we go from here? The charts say down. How far?

Where do we go from here? The charts say down. How far?I have no idea.

I'm glad I can trade this to the downside, although I should have hedged the retirement accounts. I sat here and watched and did not do anything to protect the long positions. I would not have sold, but could have used options or a bear ETF to hedge.

Not smart.

Is it too late to hedge now?

Labels:

15 minute YM chart,

daily ym chart,

mini dow trading

11/19/2008

Not Looking Good

11/18/2008

Living the Dream

Just one more consolidation loan and we will all be ok. Or if you own a company make sure it is "too big to fail" and the government will lend you money forever. Of course the government doesn't actually have the money to lend you, they have to borrow it first.

Right.

Right.

Up, Down, Up

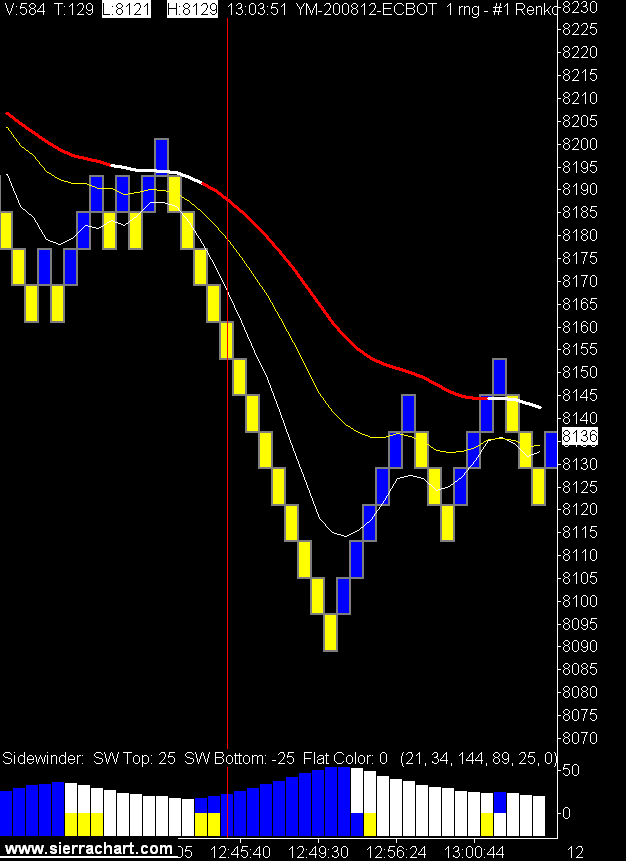

Mini DOW 15 Minute Chart

A nice trading day today and I did a much better job of picking the trends to trade. It looked like we were going to go down and test 8000 on the dow futures but a late day rally turned it into a new intra day high.

A nice trading day today and I did a much better job of picking the trends to trade. It looked like we were going to go down and test 8000 on the dow futures but a late day rally turned it into a new intra day high.

You could make a nice living trading only the last hour of the day.

Mini DOW Renko Charts

A nice trading day today and I did a much better job of picking the trends to trade. It looked like we were going to go down and test 8000 on the dow futures but a late day rally turned it into a new intra day high.

A nice trading day today and I did a much better job of picking the trends to trade. It looked like we were going to go down and test 8000 on the dow futures but a late day rally turned it into a new intra day high. You could make a nice living trading only the last hour of the day.

Mini DOW Renko Charts

11/17/2008

Hindsight

The 15 minute chart look at the day shows two nice trends divided by a whole lot of congestion on the EMAs. The moves today were difficult for me to determine which were real and which were not.

The 15 minute chart look at the day shows two nice trends divided by a whole lot of congestion on the EMAs. The moves today were difficult for me to determine which were real and which were not.I can see it now.

Labels:

15 minute DOW chart,

15 minute YM chart,

DOW futures

11/16/2008

Winter is Coming

I was perusing my photos on flickr and realizing how beautiful this country is. We have yet to see our first real snow this year and I am already looking forward to spring. Actually I could pass on spring and go right to summer.

Maybe this winter I need to take some pictures and appreciate the beauty of winter.

11/15/2008

Iceland - A Land Without Money

Hallgrímskirkja cathedral looms up out of the mists and gloom of downtown Reykjavík

"Think of Ireland. Rotate it 90 degrees clockwise, make it a third bigger and hang it like a pendant from the Arctic Circle. Crack open the earth’s crust below to release limitless supplies of geothermal steam, then fill its territorial waters, all 200 miles of them, with an abundance of cod." Robert Jackson, Financial Times, Photographs by Bjarki Reyr

I grew up in a Canadian community populated by Icelandic settlers so this story caught my eye. An amazing and sad tale.

Click on the read more icon for the full Financial Times story.

read more | digg story

"Think of Ireland. Rotate it 90 degrees clockwise, make it a third bigger and hang it like a pendant from the Arctic Circle. Crack open the earth’s crust below to release limitless supplies of geothermal steam, then fill its territorial waters, all 200 miles of them, with an abundance of cod." Robert Jackson, Financial Times, Photographs by Bjarki Reyr

I grew up in a Canadian community populated by Icelandic settlers so this story caught my eye. An amazing and sad tale.

Click on the read more icon for the full Financial Times story.

read more | digg story

Crude oil prices: Love or beggar thy neighbor?

A drilling rig in the Gulf of Mexico - AFP/Getty Images

A drilling rig in the Gulf of Mexico - AFP/Getty Images"So, crude oil prices are unlikely to hit $200 per barrel any time soon. But what will oil prices be over the next several years? From my perspective, prices will likely average around US$40 or around US$80 per barrel, depending upon the political and economic fall out from the global financial crisis." Vincent Lauerman, Financial Post

Click on the read more icon for the full Financial Post story.

read more | digg story

11/14/2008

A Tale of Two Trends

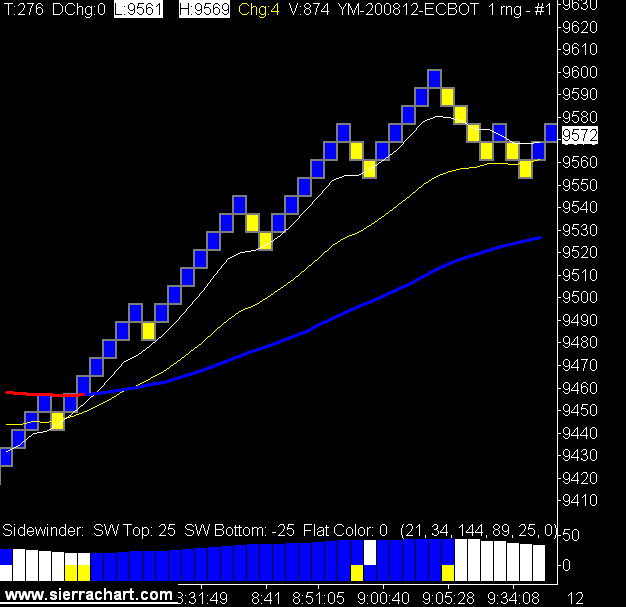

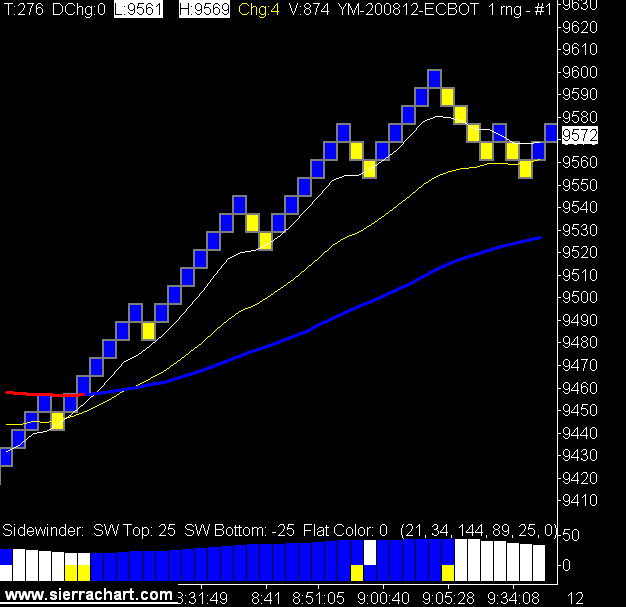

A wise old trader tells all who will listen the key to success in trading is knowing when not to trade. That would suggest another key is knowing when to trade. For me when to trade is when there is a trend with some range. All other time in the market should have you flat.

Today there was not alot of time where you needed to be flat. The day only got better as it went along with 2 huge moves in the afternoon session. The down move was faster than the up move. You can see them nicely on the three minute chart.

How you get in and out of these trends really doesn't matter, the key is to identify when a trend is in place and trade it. Just as the key is to identify when there is no trend in place and stay flat.

How you get in and out of these trends really doesn't matter, the key is to identify when a trend is in place and trade it. Just as the key is to identify when there is no trend in place and stay flat.

Identifying trend is easier said than done as many moves start out looking good only to reverse quickly. I have not mastered this yet but do find multiple time frames and the average true range a good way to identify a trend to trade.

Today there was not alot of time where you needed to be flat. The day only got better as it went along with 2 huge moves in the afternoon session. The down move was faster than the up move. You can see them nicely on the three minute chart.

How you get in and out of these trends really doesn't matter, the key is to identify when a trend is in place and trade it. Just as the key is to identify when there is no trend in place and stay flat.

How you get in and out of these trends really doesn't matter, the key is to identify when a trend is in place and trade it. Just as the key is to identify when there is no trend in place and stay flat.Identifying trend is easier said than done as many moves start out looking good only to reverse quickly. I have not mastered this yet but do find multiple time frames and the average true range a good way to identify a trend to trade.

11/13/2008

DOW Uncrushed

LOL

Yesterday I basically called the end of the world as we know it, and today; a reprieve, a reprieve!

It certainly was a great day for trading.

The daily chart has an interesting pattern on it now, a triple bottom perhaps? The second and third legs don't quite touch the first one, but hey the DOW went up so let's think positive.

Could we have seen the bottom?

Naw.

Yesterday I basically called the end of the world as we know it, and today; a reprieve, a reprieve!

It certainly was a great day for trading.

The daily chart has an interesting pattern on it now, a triple bottom perhaps? The second and third legs don't quite touch the first one, but hey the DOW went up so let's think positive.

Could we have seen the bottom?

Naw.

11/12/2008

DOW Crushed Again

The daily DOW is running hard for the October 10th low, and if we breach that, well let's just say it won't be good.

Watching Secretary Paulson and all the central bankers of the world pulling levers like mad men is at best humorous, and at worst pathetic.

The market is going down.

Trying to bureaucratise the market to save humanity does not seem to be working. The parallels to this activity and Atlas Shrugged are amazing. Read the book.

The governments all claim this activity is required to save us from a depression. What if a depression would be a good thing compared to what may happen as a result of this government intervention?

The so called capitalists are not acting any better than the government, as I don't hear too many telling government to get out of the market. Markets work if left to work. That doesn't mean they can't go down and it doesn't mean companies won't go bankrupt.

The strong are supposed to eat the weak.

If we don't cull the bottom end of industry it weakens the entire system as the the strong now have to compete with the government subsidized weaklings. With governments deciding who survives, instead of the market, it puts the whole economic system on a very dangerous path.

A path leading to a place that could make a depression look rosy.

11/08/2008

Perspective

Here is a 3 page market commentary from Jim O'Shaughnessy for your perusal. Click on the post title for the link.

In another lifetime a bank I worked for brought Mr O'Shaughnessy's value and growth investment styles to the Canadian market place in the form of mutual funds. Being an eager young banker I read Mr. O'Shaughnessy's first book, What Works on Wall Street, and was impressed enough to place some money in his funds. That was back in 1997, and the fund has outperformed the TSX composite index nicely.

O'Shaughnessy's approach removes human emotion from the investment process, and we as traders know that is the key to success.

In another lifetime a bank I worked for brought Mr O'Shaughnessy's value and growth investment styles to the Canadian market place in the form of mutual funds. Being an eager young banker I read Mr. O'Shaughnessy's first book, What Works on Wall Street, and was impressed enough to place some money in his funds. That was back in 1997, and the fund has outperformed the TSX composite index nicely.

O'Shaughnessy's approach removes human emotion from the investment process, and we as traders know that is the key to success.

11/07/2008

Oil sands players to lobby Obama

Jim Bourg/Reuters

Jim Bourg/ReutersPresident-elect Barack Obama's energy program is expected to focus on renewable energy, transitioning away from fossil fuels.

CALGARY - "Canada's oil sands community is gearing up for a big push in Washington to influence U. S. president-elect Barack Obama's energy agenda." Claudia Cattaneo, Financial Post (click on the read more icon for the full Financial Post story)

I know why I am not a politician or a diplomat as my reaction to this issue is take it or leave it. Here is our "friendly" oil, you my American "friends" can buy all you want. Or if our oil is too "dirty" for you go back to the Middle East and buy their "clean" oil.

The Chinese only see oil. No dirty, friendly, or non friendly oil.

Just oil.

Total American Imports of Petroleum (Top 15 Countries) Source USA Govt Dept of Energy

(Thousand Barrels per Day) YTD 2008

CANADA 2,427

SAUDI ARABIA 1,560

MEXICO 1,31

VENEZUELA 1,210

NIGERIA 1,067

IRAQ 675

ALGERIA 525

ANGOLA 523

RUSSIA 487

VIRGIN ISLANDS 326

ECUADOR 216

COLOMBIA 210

UNITED KINGDOM 218

BRAZIL 244

KUWAIT 207

As I said take it, or leave it.

read more | digg story

Labels:

alberta oil sands,

Barack Obama,

dirty oil,

fort mcmurray

11/06/2008

More From John Galt

I mean Tom Barrack, CEO of Colony Capital.

Click on the post title for the video link.

This is the first Tom Barrack interview.

http://tradingcrude.blogspot.com/2008/10/i-found-john-galt.html

Click on the post title for the video link.

This is the first Tom Barrack interview.

http://tradingcrude.blogspot.com/2008/10/i-found-john-galt.html

DOW Rolls Over

We have taken a hard turn off the 34 EMA on the daily chart. Now do we retest the lows?

Daily DOW Futures Chart

Market ground down all day, it was a hard day to trade as the entries seemed to always be pushing through new daily lows. These tend to retrace just enough to hit stops and break evens. 62 winning tics / 58 losing tics today.

15 Minute YM Chart

Daily DOW Futures Chart

Market ground down all day, it was a hard day to trade as the entries seemed to always be pushing through new daily lows. These tend to retrace just enough to hit stops and break evens. 62 winning tics / 58 losing tics today.

15 Minute YM Chart

11/05/2008

The People Have Spoken

I am happy for my American neighbors and their new President elect. It was nice to see the excitement that Obama has brought to the American people. The voter turnout sounds like it was huge, and that is a wonderful thing for a democracy. The fact that a racial barrier was absolutely destroyed is also a wonderful thing.

I asked myself who I would have voted for, my Canadian political bent is conservative, but after the last 8 years of Republican rule in the U.S. you feel as though someone needs to take a bullet for where America currently is.

Unfortunately John McCain gets that bullet.

I admire McCain for his candor and sense of right and wrong. When the crazy haired lady made some ridiculous statements about Obama in a town hall meeting McCain could have just let it pass and move on, neither condemning or condoning the statement. That may have been the right move politically, but McCain could not do that. He shut her down and complimented his rival, Mr. Obama, on what a great family man he is.

That is John McCain.

My only concern with Obama are his views on business. He seems to view business as the enemy. I assume this is only political rhetoric to get elected, but those are his words.

That leads me to question does he truly understand how an economy works, does he think that governments create wealth?

Only businesses create wealth, only businesses create jobs, and only businesses generate tax revenue.

All government attempts at creating jobs are simply a redistribution of money that the private sector has all ready created. Without the engine of private commerce there is no government as there is no money for government.

Now Mr. Obama was given the perfect storm in which to bash "big" business, a bunch of idiot investment bankers bankrupt their company's. Then the Republican government decided they were too big to fail. If that's the case then they shouldn't be allowed to exist in their current form. If they are too big to fail then they should be nationalized.

As others have stated you cannot have privatized profits and socialized losses.

As I have stated they should have gone under. Period.

You will notice that since the government started pumping in billions and taking ownership stakes in the banks the consolidation of banks has stopped. The strong are no longer eating the weak as the government has decided that all the banks, both stupid and smart, should continue to exist.

That is a mistake.

I digress.

Who would I have voted for?

Mr. Obama.

The Republicans were on guard during this mess and have to pay for it, and pay they did with the presidency, senate, and congress. So my American friends you will have Democrats running your country.

I wish them and you, all the best.

P.S.

Someone please send Mr. Obama a copy of Atlas Shrugged.

I asked myself who I would have voted for, my Canadian political bent is conservative, but after the last 8 years of Republican rule in the U.S. you feel as though someone needs to take a bullet for where America currently is.

Unfortunately John McCain gets that bullet.

I admire McCain for his candor and sense of right and wrong. When the crazy haired lady made some ridiculous statements about Obama in a town hall meeting McCain could have just let it pass and move on, neither condemning or condoning the statement. That may have been the right move politically, but McCain could not do that. He shut her down and complimented his rival, Mr. Obama, on what a great family man he is.

That is John McCain.

My only concern with Obama are his views on business. He seems to view business as the enemy. I assume this is only political rhetoric to get elected, but those are his words.

That leads me to question does he truly understand how an economy works, does he think that governments create wealth?

Only businesses create wealth, only businesses create jobs, and only businesses generate tax revenue.

All government attempts at creating jobs are simply a redistribution of money that the private sector has all ready created. Without the engine of private commerce there is no government as there is no money for government.

Now Mr. Obama was given the perfect storm in which to bash "big" business, a bunch of idiot investment bankers bankrupt their company's. Then the Republican government decided they were too big to fail. If that's the case then they shouldn't be allowed to exist in their current form. If they are too big to fail then they should be nationalized.

As others have stated you cannot have privatized profits and socialized losses.

As I have stated they should have gone under. Period.

You will notice that since the government started pumping in billions and taking ownership stakes in the banks the consolidation of banks has stopped. The strong are no longer eating the weak as the government has decided that all the banks, both stupid and smart, should continue to exist.

That is a mistake.

I digress.

Who would I have voted for?

Mr. Obama.

The Republicans were on guard during this mess and have to pay for it, and pay they did with the presidency, senate, and congress. So my American friends you will have Democrats running your country.

I wish them and you, all the best.

P.S.

Someone please send Mr. Obama a copy of Atlas Shrugged.

Labels:

Atlas Shrugged,

Ayn Rand,

Barack Obama,

John McCain,

U.S. election

11/04/2008

What to Trade, What to Trade

I love crude oil, flowing, trending, crude oil, mmmm, crude oil.

Wake up!!

Sorry.

The YM wasn't too bad today either. We will look again at the end of the week and decide what to trade. The best plan may be to trade crude oil until the pit session closes and then trade the last hour and a half of the DOW session.

Wake up!!

Sorry.

The YM wasn't too bad today either. We will look again at the end of the week and decide what to trade. The best plan may be to trade crude oil until the pit session closes and then trade the last hour and a half of the DOW session.

11/03/2008

Thank You Ugly

In case you didn't see this on my new favourite blog, http://www.uglychart.com/

Speaking of ugly, took 2 break evens, 2 fulls stops and quit. Market was flat and only idiots trade flat markets.

That would be me.

It's only one day, and the DOW has been a great trading vehicle, but if this market stays like this for the week I will be moving back over to the crude oil pit.

Might just be a lull before the U.S. election.

See more funny videos at Funny or Die

Speaking of ugly, took 2 break evens, 2 fulls stops and quit. Market was flat and only idiots trade flat markets.

That would be me.

It's only one day, and the DOW has been a great trading vehicle, but if this market stays like this for the week I will be moving back over to the crude oil pit.

Might just be a lull before the U.S. election.

11/01/2008

Where oil and water mix

Photo by Dave Einsel for National Post

Photo by Dave Einsel for National PostPort Arthur Economic Development Corporation CEO Floyd Batiste doesn't see any problem with Alberta oil. In fact, he thinks it would mean more jobs and prosperity for his town.

PORT ARTHUR, Tex. "By the middle of the next decade, this weathered city in America's deep south abutting the Gulf of Mexico, will receive a flood of oil from Fort McMurray's oil sands plants. About one million barrels a day of Alberta oil will flow into the world's biggest refining market." Claudia Cattaneo, Financial Post

Click on the read more icon for the full Financial Post story.

read more | digg story

Capital Was Abundant

David M. Walker is CEO of the Peter G. Peterson Foundation and served ten years as Comptroller General of the U.S., heading the Government Accountability Office.

Click on the post title for David Walker's Fortune article.

Subscribe to:

Posts (Atom)