Before I answer that statement let's have a look at why people want to be traders.

1) They can't sleep.

2) They just got fired.

3) They have never been hired.

4) They want to make lots of money.

5) They know a guy and he.......

6) They don't like their boss.

7) They don’t want to be "corporate".

8) They want to work when they feel like it.

9) They can do this work from the beach.

10) Women love traders.

Now let's have a look at what I think it takes to be a successful trader, or more precisely to become a successful trader.

1) A complete understanding and acceptance of risk management.

That's it?

Ok let me flesh that out a bit. I used to work as a lender in a bank. Banks have a department called risk management. The people that wind up there usually did not do so well in the sales (lending) side of the business. I wonder if they still call it sales? Never mind that's another topic.

Where were we? Oh yes risk managers, risk managers are generally men who are old, bald, ugly, have no friends, and don't do all that well in social situations. They are most comfortable in their 17th floor cubicle where they do not see any human life form other than their comrades.

What does this have to do with trading?

Nothing I just like making fun of risk managers.

No no no bear with me here. So I as the lender in the bank meet a client, the client tells me a very long story about why they need money for this great business idea they have. I fall for it hook line and sinker and spend the next 2 days writing up a credit request that I send to risk management.

Now the fun begins.

One of my "partners" in risk calls me up to "discuss" this proposal, they start out nicely enough as they have been taught to do after the Johnson incident. Then they forget all that partner crap and really start laying into me. Insufficient net worth, no current ratio, no experience, tough industry, won't withstand a cyclical downturn, debt service ratio too weak, why would I send this piece of crap down here and waste their time, how long have you been in this business you stupid moron.

All righty then.

Is there a point to all this?

There is, I have to stop crying first. Ok, I'm better now.

Let's get back to trading.

So I'm all set up, charts, broker, front end, Mark Douglas in hand, and now I see a "trade", WHAM I pull the trigger, SLAM hits my stop in 3 seconds, WHAM go again, I am a day trader and I am fast baby, SLAM hits my stop in 7 seconds, and on and on we go.

Now let’s add risk management. Remember all those annoying questions? How much capital do I have equals my position size. How many losing trades am I allowed to take? How many winning trades before I stop? What is that based on? What are my stops? When do I stop trading, daily stops, weekly stops, monthly stops, and on and on we go.

This is the reason why you should not be a trader. You are the risk management department. In banking the lender cannot be the risk manager or bad things happen. In our business the trader is the risk manager, and, bad things happen.

YOU MUST PRESERVE CAPITAL.In my opinion that is the first and last thing all traders must think about. Not charts, not set ups, not what will I do with all my profit.

Capital preservation. It's not sexy, it's not fun, it's not exciting, and it has rules, rules that must be followed or you’re fired. In other words it's everything that you hated about your other job.

If you want a fun, exciting, and sexy job try on line poker.

If you want to be a trader/risk manager shave your head bald, insult all your friends until they leave, stop bathing, wear polyester, and sniff constantly.

There, you're ready to go.

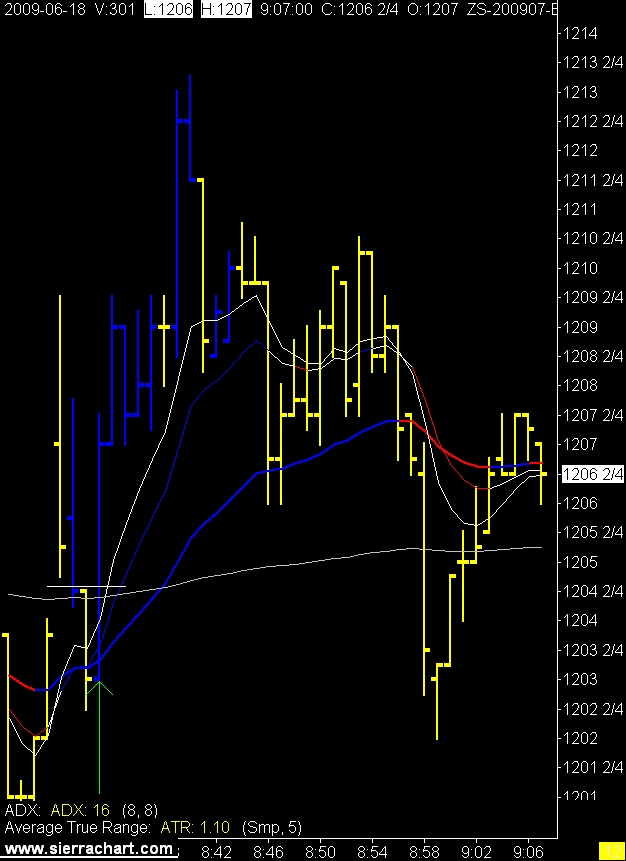

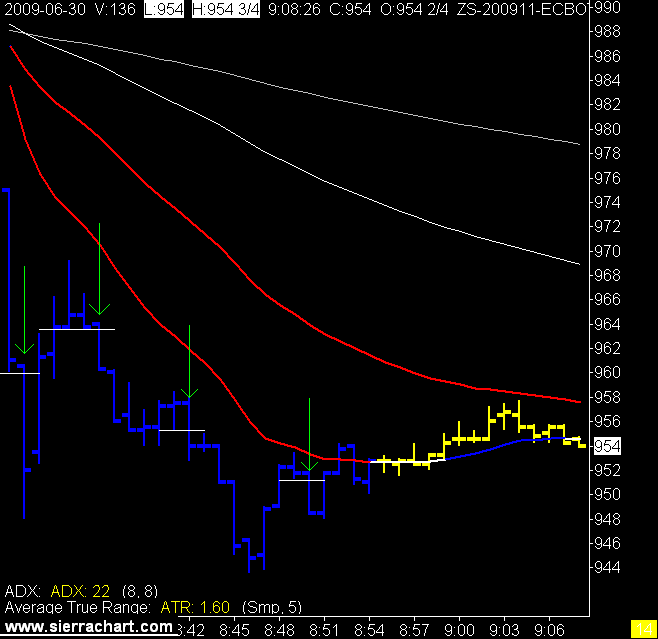

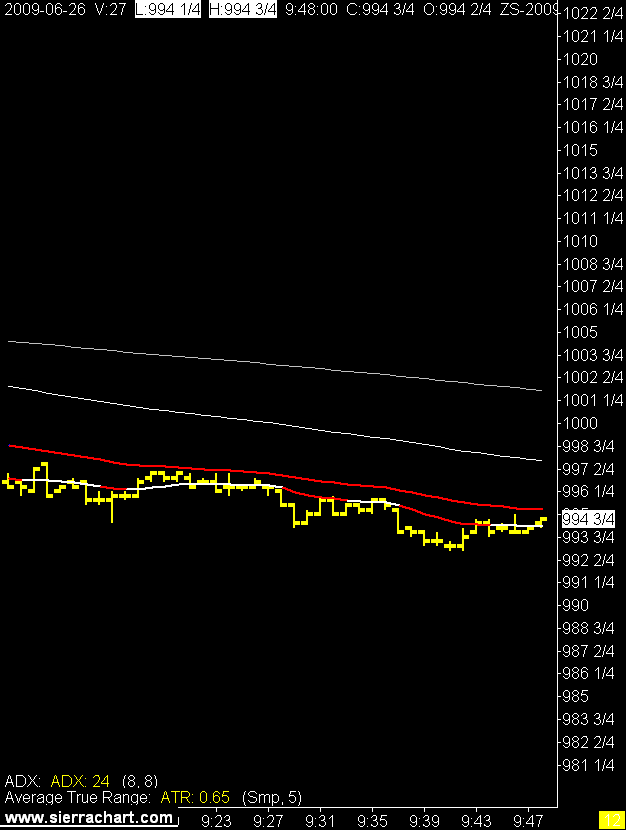

Soybeans

Soybeans

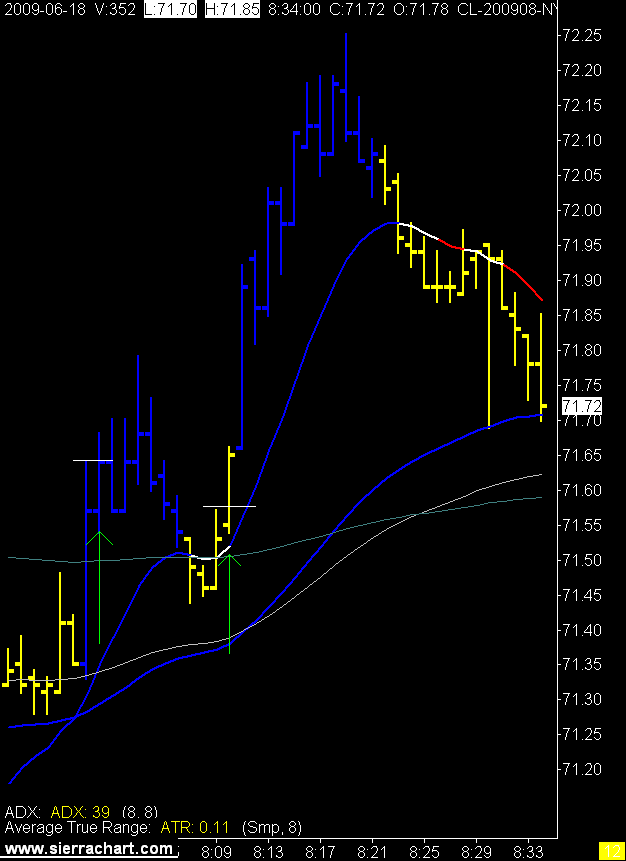

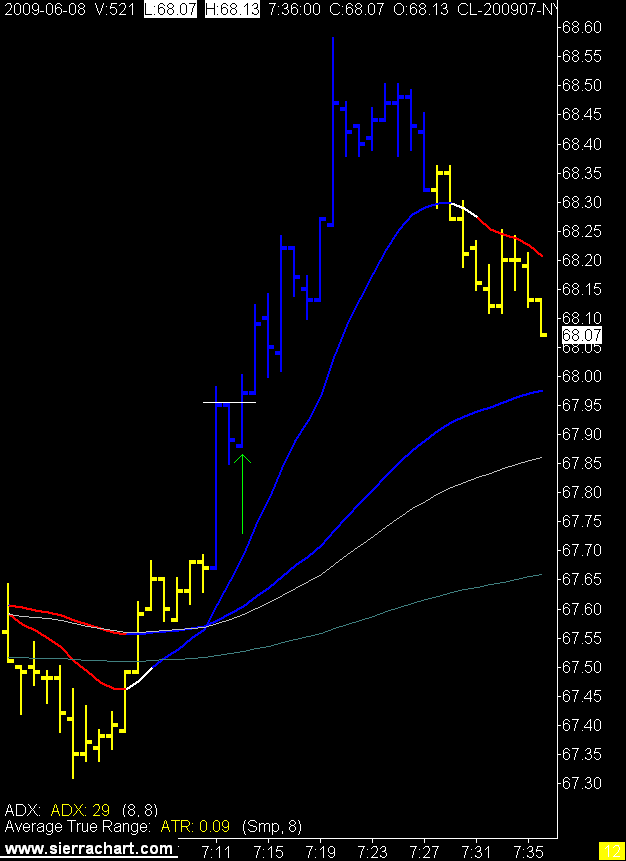

1 Minute Crude Oil Chart

1 Minute Crude Oil Chart

Photograph by: Walter Tychnowicz, Edmonton Journal, file

Photograph by: Walter Tychnowicz, Edmonton Journal, file