Peter Schiff calls the recession to the letter, as reported by Fortune.

This is too funny. Listen to these guys mocking him, it's unbelievable. This is how bubbles happen, everyone piling into the same theory which they believe is correct for the simple fact that everyone is doing it.

1/30/2009

Saved by the Bell

The week was a giant bore. The best thing about it is, it's over. Five day ATR for crude is 340 tics which is very low. I guess you have to factor in that this is a 41 dollar contract now, not a 140 dollar one.

I'm happy with the inherent risk management in the "blue bars" as adding range to the trend equation has kept me flat for most of the week.

Flat was the correct position.

We shall see what next week brings.

Two swings at the CL today for a net result of -8 tics.

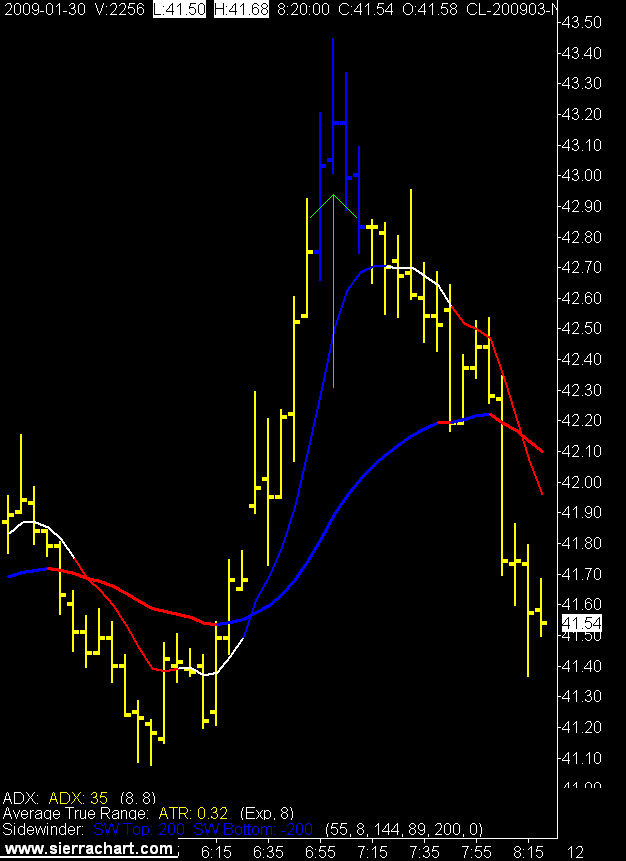

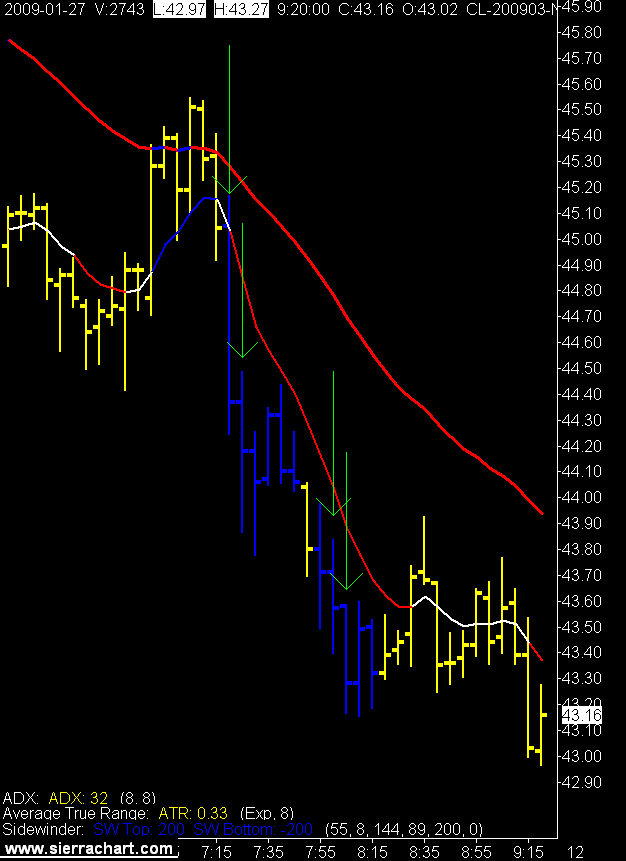

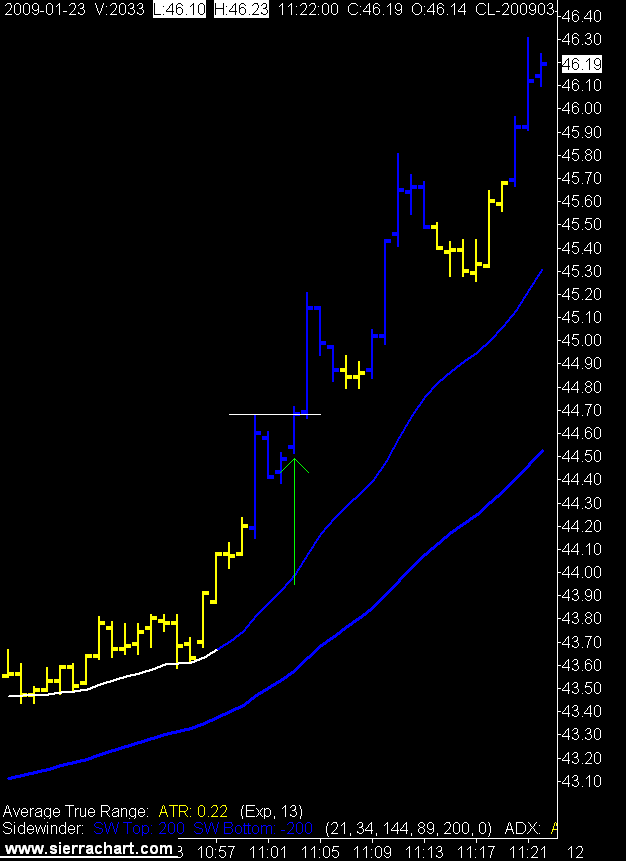

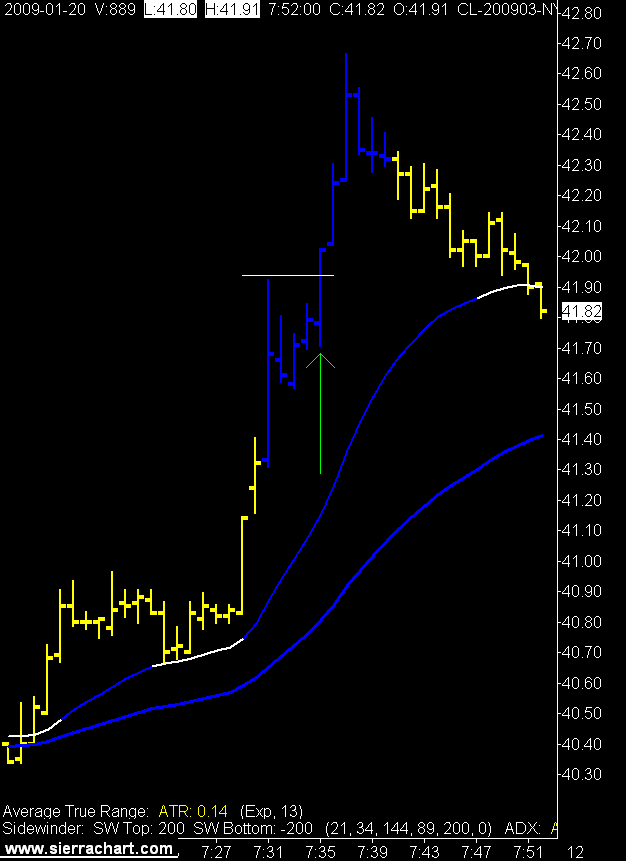

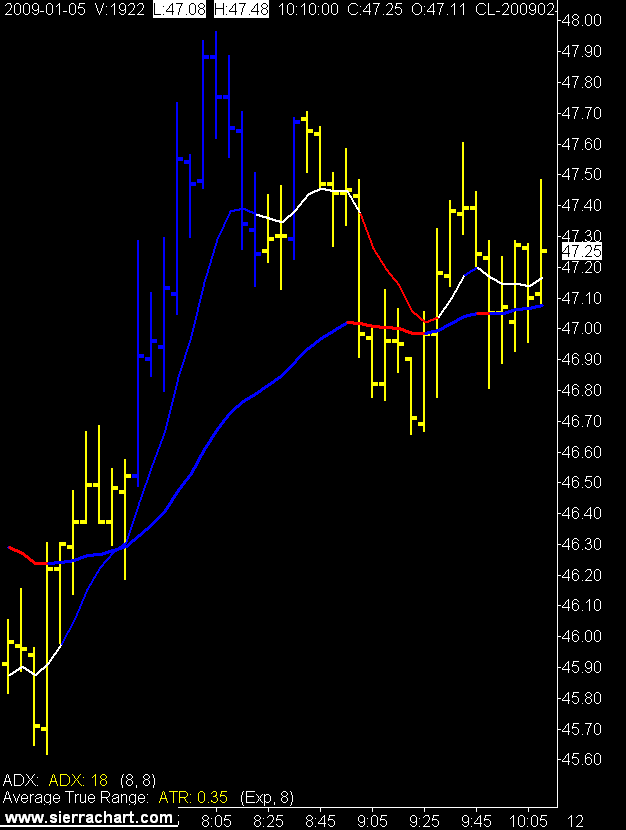

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

I'm happy with the inherent risk management in the "blue bars" as adding range to the trend equation has kept me flat for most of the week.

Flat was the correct position.

We shall see what next week brings.

Two swings at the CL today for a net result of -8 tics.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

1/29/2009

Guess What

When I wasn't learning how to knit today I saw this little nugget. The French have found the cure for the world's economic crisis.

Have your entire country go on strike.

Oh my that's good, I haven't laughed like that for a long time.

1/28/2009

redrum

A day with no trades. No signals, no trades. You plan, you prepare, you wait, and nothing.

Nothing.

No trades.

It could cause a man to, well, go a little nutty.

Nothing.

No trades.

It could cause a man to, well, go a little nutty.

1/27/2009

Harmony

The man and machine were one today. The machine identified high probability time periods and the man made sound entry decisions.

We lost money, but we were one.

Actually did trade well, took the first set up as it appeared, and then another swing as the trend stayed in place. Missed one target by 3 tics which would have made the day green.

That's trading.

I did not revenge trade, I did not pass up opportunities, I did my job.

Some days you do it all right and you lose.

On another note it turns out the EIT (Exceptional Irish Trader) is also a EIP (Exceptional Irish Painter) take a look at his gallery.

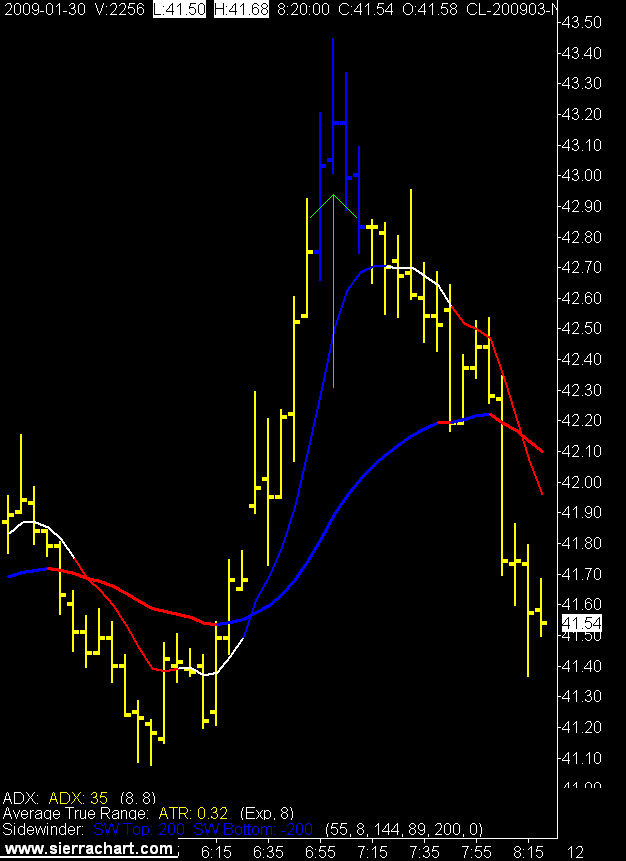

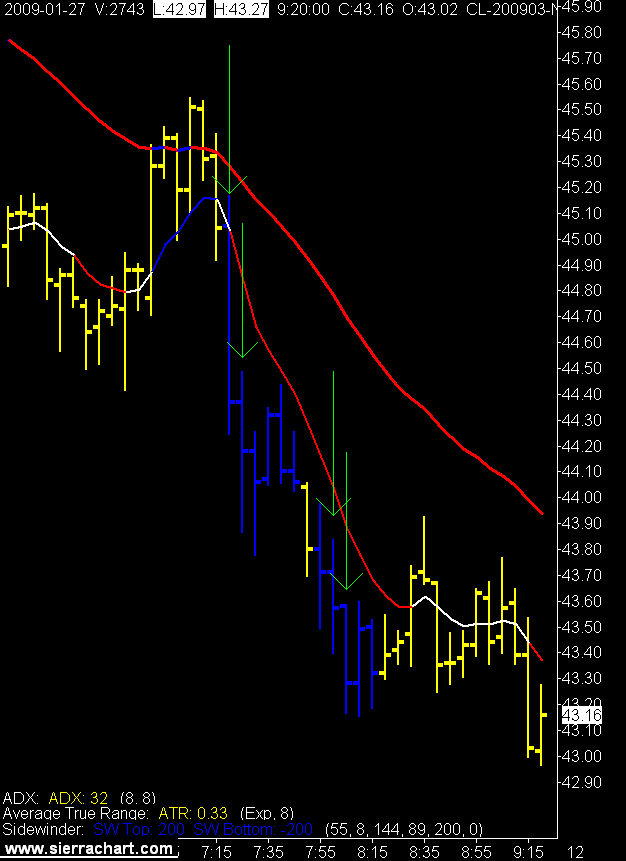

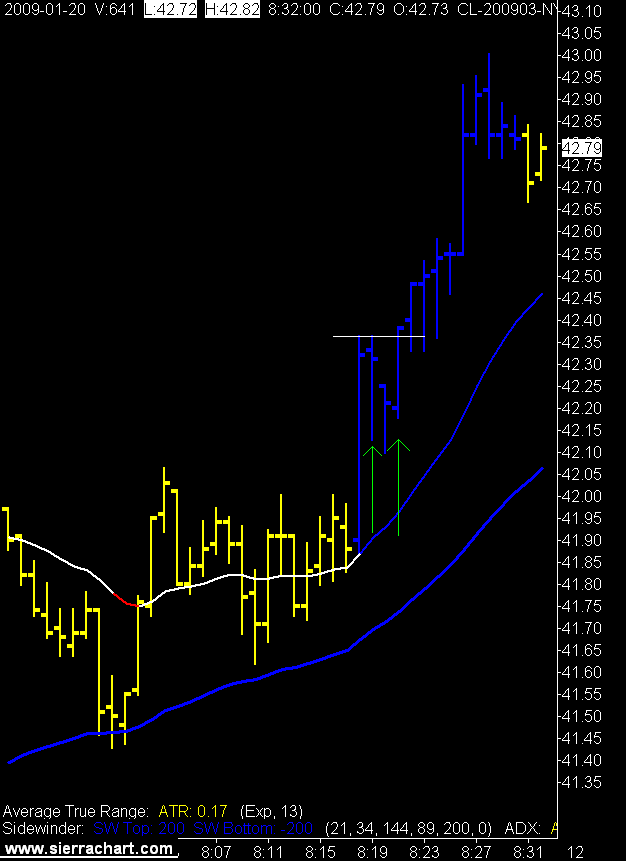

5 Minute Crude Oil Chart

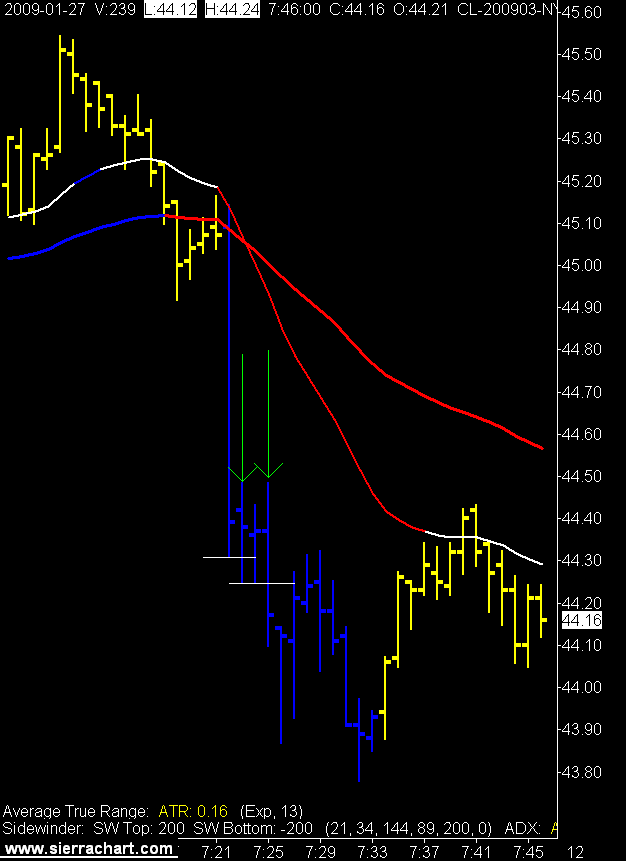

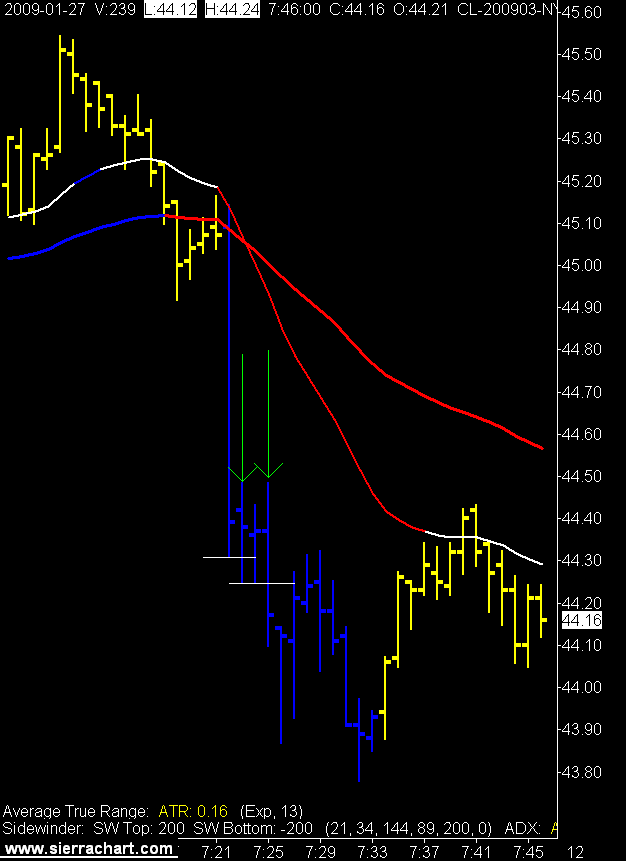

1 Minute Crude Oil Charts

We lost money, but we were one.

Actually did trade well, took the first set up as it appeared, and then another swing as the trend stayed in place. Missed one target by 3 tics which would have made the day green.

That's trading.

I did not revenge trade, I did not pass up opportunities, I did my job.

Some days you do it all right and you lose.

On another note it turns out the EIT (Exceptional Irish Trader) is also a EIP (Exceptional Irish Painter) take a look at his gallery.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

1/26/2009

Machine Beats Man, Again

The machine had 2 trades, 1 full target and 1 full stop, gross RR 3.00. The man had 3 trades, 1 full target and 2 full stops, gross RR 1.64.

The first 2 trades were the same for the man and the machine, the third trade was a pure experiential, intuitional, humanoid, run for the roses. Yes I do realize one of those words is brand new to the world.

I won't bore you with charts as they will just depress you with their randomness. Instead I'll bore you with the exact times (MST) and stats from the day.

Trade 1: Long, Entry 8:06:09 $47.44, Exit 8:07:03 $47.32, MAE 12, MFE 9, Gross (12)

Trade 2: Long, Entry 8:08:38 $47.56, Exit 8:09:27 $47.92, MAE 3, MFE 36, Gross 36

Trade 3: Short, Entry 12:14:40 $45.89, Exit 12:14:54 $45.99, MAE 10, MFE 3, Gross (10)

If resistance really is futile why do I continue to resist?

The first 2 trades were the same for the man and the machine, the third trade was a pure experiential, intuitional, humanoid, run for the roses. Yes I do realize one of those words is brand new to the world.

I won't bore you with charts as they will just depress you with their randomness. Instead I'll bore you with the exact times (MST) and stats from the day.

Trade 1: Long, Entry 8:06:09 $47.44, Exit 8:07:03 $47.32, MAE 12, MFE 9, Gross (12)

Trade 2: Long, Entry 8:08:38 $47.56, Exit 8:09:27 $47.92, MAE 3, MFE 36, Gross 36

Trade 3: Short, Entry 12:14:40 $45.89, Exit 12:14:54 $45.99, MAE 10, MFE 3, Gross (10)

If resistance really is futile why do I continue to resist?

1/25/2009

A World Without Consequences?

Leverage:

"In finance, leverage is borrowing money to supplement existing funds for investment in such a way that the potential positive or negative outcome is magnified and/or enhanced. It generally refers to using borrowed funds, or debt, so as to attempt to increase the returns to equity. Deleveraging is the action of reducing borrowings." Wikipeida

Why is the world shedding millions of jobs?

It's all about leverage, and as we are now seeing, deleveraging. The world is deleveraging. Deleveraging is a nice way of saying we are up to our eyeballs in debt and now we're screwed.

Getting into to debt takes very little time. Getting out of debt takes a very long time. If the world's economy was set up to service the demands of a leveraged society than we are going to need much less capacity to service the needs of a deleveraged society.

How did we get into this mess?

Did the world just want to increase its return on equity?

This leverage became the norm rather than the abnormal. No more $20 used couches, used cars, and ratty apartments for couples just starting out. No, we wanted everything new and now. Equity? We don't need no stinkin equity. No money down, no payments for 12 months, it's just that easy,

This went way beyond a return on equity.

We as a society have lost a respect, or fear, or knowledge, or something, about the dangers of leverage. People who should have known better also forgot, or never knew in the first place.

There is no industry that understands leverage better than the commodity futures business. All participants are well versed in the dangers of leverage. Leverage is what makes futures trading so lucrative and so dangerous. If you don't understand this you won't be in the business for long.

Maybe the banking industry could have learned something from their commodity brokerage peers, or in some cases subsidiaries. The commodity futures trading industry has been living with huge amounts of leverage for decades and as far as I know without too many problems.

Oh sure traders go broke all the time, lol, little traders and some very big traders but the industry, the backbone so to speak remains intact. That's what the banks could have learned from the commodity brokers. The banks took on the traders (home owners / speculators) risk. They took that risk and lost.

My commodity broker would never do that.

They monitor my position constantly, they monitor the volatility in the market, they change the amount of leverage available whenever they see fit, and they will sell my position out from under me if they see any possible risk to themselves.

They don't care if I make money, their only concern is that they don't lose money on my leverage. There is nothing wrong with that. They have to operate that way.

So what could the banks have learned from the commodity brokers?

They can't just up and sell your house if they feel threatened can they?

No.

They could have monitored their position though. Their position is held in trust by you the mortgagee living in their house. They need you to keep making those payments. They could monitor your bank account for any signs of decreased revenue, they could have monitored the market place to better determine value, they could have used sector caps (position sizing) to mitigate risk, they could have placed location caps on their portfolios, they could have done many things.

Why didn't they?

They felt secure, they had a mortgage, not a "risky" crude oil position on the books. They had insurance. Or so they thought, it turned out they only had a worthless "swap".

Risk management is a frame of mind, commodity brokers live with it every day, and traders live or die with it every day. It's a frame of mind that thinks along the lines of, capital is scarce, treat it as such. :)

Banks thought they understood this. They did not.

I think consumers, businesses, and banks all get it now.

Does your government?

Governments around the world believe that they can leverage themselves by the trillions to increase demand for products in order to keep the world employed.

They certainly have the ability to borrow, the question is what will they do next year, and the year after that. The world's consumers cannot deleverage in 1 or 2 years, it may take 5, 10, or 20 years.

Will governments just keep borrowing?

When will governments have to start deleveraging?

What will that do to the economy?

Is this a world without consequences?

I think not, we just keep delaying them.

Maybe we should just take our medicine now instead of passing it on to our kids.

"In finance, leverage is borrowing money to supplement existing funds for investment in such a way that the potential positive or negative outcome is magnified and/or enhanced. It generally refers to using borrowed funds, or debt, so as to attempt to increase the returns to equity. Deleveraging is the action of reducing borrowings." Wikipeida

Why is the world shedding millions of jobs?

It's all about leverage, and as we are now seeing, deleveraging. The world is deleveraging. Deleveraging is a nice way of saying we are up to our eyeballs in debt and now we're screwed.

Getting into to debt takes very little time. Getting out of debt takes a very long time. If the world's economy was set up to service the demands of a leveraged society than we are going to need much less capacity to service the needs of a deleveraged society.

How did we get into this mess?

Did the world just want to increase its return on equity?

This leverage became the norm rather than the abnormal. No more $20 used couches, used cars, and ratty apartments for couples just starting out. No, we wanted everything new and now. Equity? We don't need no stinkin equity. No money down, no payments for 12 months, it's just that easy,

This went way beyond a return on equity.

We as a society have lost a respect, or fear, or knowledge, or something, about the dangers of leverage. People who should have known better also forgot, or never knew in the first place.

There is no industry that understands leverage better than the commodity futures business. All participants are well versed in the dangers of leverage. Leverage is what makes futures trading so lucrative and so dangerous. If you don't understand this you won't be in the business for long.

Maybe the banking industry could have learned something from their commodity brokerage peers, or in some cases subsidiaries. The commodity futures trading industry has been living with huge amounts of leverage for decades and as far as I know without too many problems.

Oh sure traders go broke all the time, lol, little traders and some very big traders but the industry, the backbone so to speak remains intact. That's what the banks could have learned from the commodity brokers. The banks took on the traders (home owners / speculators) risk. They took that risk and lost.

My commodity broker would never do that.

They monitor my position constantly, they monitor the volatility in the market, they change the amount of leverage available whenever they see fit, and they will sell my position out from under me if they see any possible risk to themselves.

They don't care if I make money, their only concern is that they don't lose money on my leverage. There is nothing wrong with that. They have to operate that way.

So what could the banks have learned from the commodity brokers?

They can't just up and sell your house if they feel threatened can they?

No.

They could have monitored their position though. Their position is held in trust by you the mortgagee living in their house. They need you to keep making those payments. They could monitor your bank account for any signs of decreased revenue, they could have monitored the market place to better determine value, they could have used sector caps (position sizing) to mitigate risk, they could have placed location caps on their portfolios, they could have done many things.

Why didn't they?

They felt secure, they had a mortgage, not a "risky" crude oil position on the books. They had insurance. Or so they thought, it turned out they only had a worthless "swap".

Risk management is a frame of mind, commodity brokers live with it every day, and traders live or die with it every day. It's a frame of mind that thinks along the lines of, capital is scarce, treat it as such. :)

Banks thought they understood this. They did not.

I think consumers, businesses, and banks all get it now.

Does your government?

Governments around the world believe that they can leverage themselves by the trillions to increase demand for products in order to keep the world employed.

They certainly have the ability to borrow, the question is what will they do next year, and the year after that. The world's consumers cannot deleverage in 1 or 2 years, it may take 5, 10, or 20 years.

Will governments just keep borrowing?

When will governments have to start deleveraging?

What will that do to the economy?

Is this a world without consequences?

I think not, we just keep delaying them.

Maybe we should just take our medicine now instead of passing it on to our kids.

1/24/2009

1/23/2009

I am Not a Human

I am a trader.

An emotionless, humourless, colourless, heartless, trader.

I sit and I wait. I wait for the machine to tell me it's time to trade.

Then I press a button.

The machine places the order, the stop, and the target.

The machine moves the stop to break even.

I sit and watch, expressionless, eyes glazed over.

I accept the outcome of the machine's work.

I have no joy or sorrow with that outcome.

I am a trader.

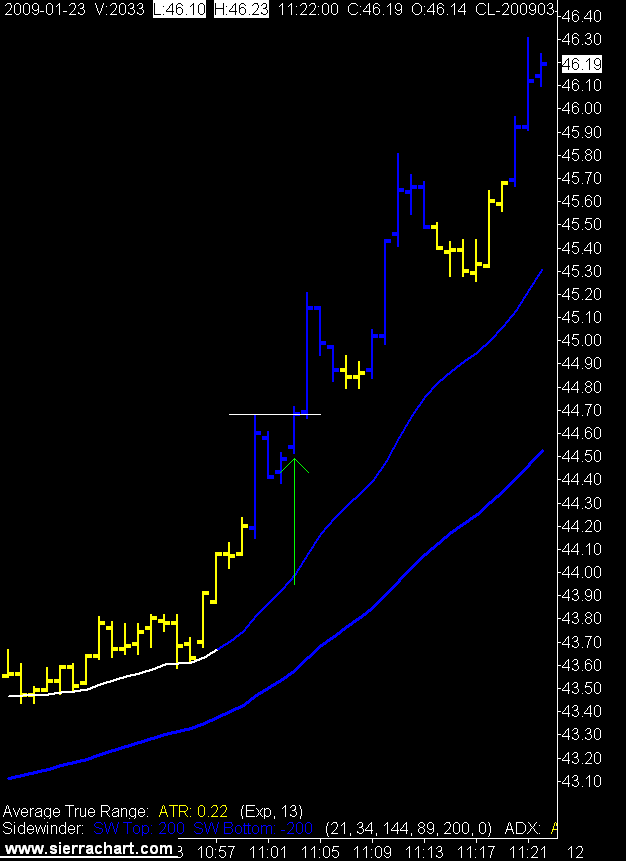

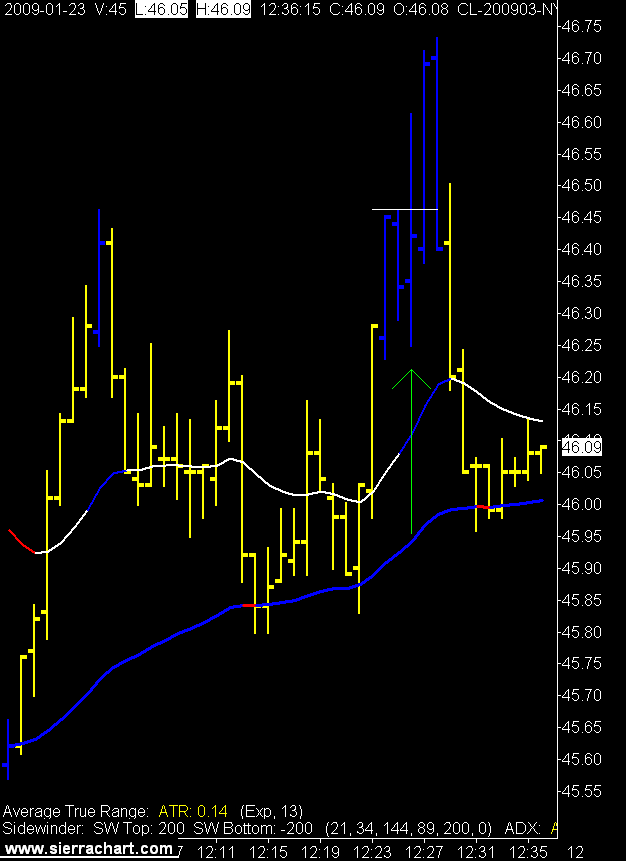

5 Minute Crude Oil Chart

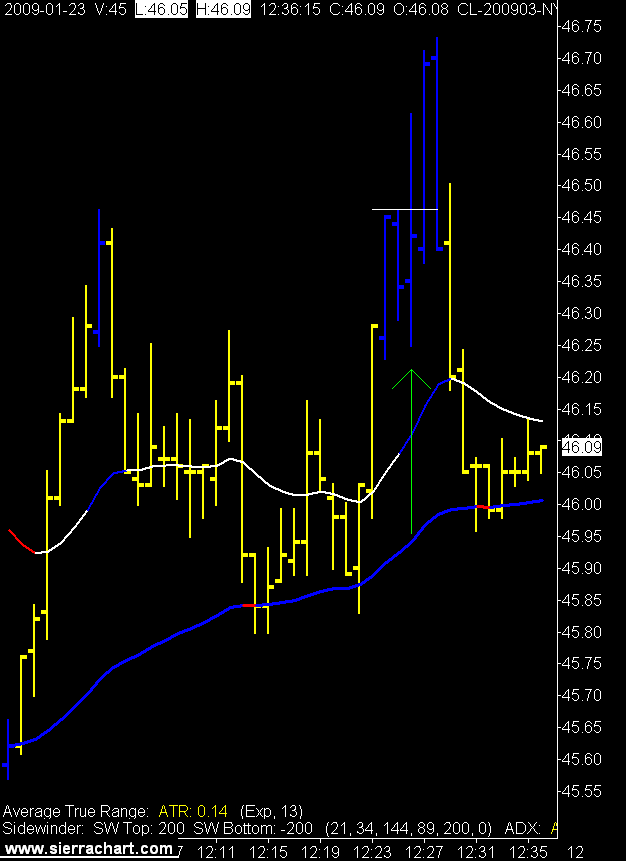

1 Minute Crude Oil Charts

1 Minute Crude Oil Charts

Trade number one result: Target achieved and accepted.

Trade number two result: Break Even achieved and accepted.

An emotionless, humourless, colourless, heartless, trader.

I sit and I wait. I wait for the machine to tell me it's time to trade.

Then I press a button.

The machine places the order, the stop, and the target.

The machine moves the stop to break even.

I sit and watch, expressionless, eyes glazed over.

I accept the outcome of the machine's work.

I have no joy or sorrow with that outcome.

I am a trader.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

1 Minute Crude Oil Charts

Trade number one result: Target achieved and accepted.

Trade number two result: Break Even achieved and accepted.

1/22/2009

I am a Human

I am not a machine; I have a heart, a brain, and a soul.

I should use them.

In trading we learn that the biggest obstacle to success is our self. All our human frailties are exposed in this business.

Or are they?

Maybe most traders just don't last long enough to become successful.

Maybe.

There has been some research that suggests it takes 10 years to really become proficient at something. Maybe proficient isn't strong enough, an expert is what you need to become in your chosen field.

Doctors and lawyers are considered to be the "golden" professionals, how many years of training do they endure. What kind of hours do they put in each day as they train? What kind of mentors do they have while they train?

How many hours, days, and years have you put into your chosen field?

The barriers to entry in the trading profession are not very high, the experts in the field want everyone to come in and test their mettle. The more the merrier for them.

Are you ready for them?

Am I?

Two trades today and as you may have guessed not too successful, not that unsuccessful either, just another day in the business.

The first trade was after the crude oil inventory report and it is usually a good idea to give that report a little space before trying to trade. Usually.

So I waited for the 5 minute blue bar to complete before entering on the 1 minute and took a break even - 1. If I had gone at the end of the first 1 minute bar......

1 Minute Crude Oil Chart

The second trade set up with one 5 minute blue bar in the bank and then the next one lost colour. So although I could see a natural spot to place the limit order I didn’t have blue so I didn’t go. I knew that it would turn blue if the trade took off, but I pulled the order and waited.

The second trade set up with one 5 minute blue bar in the bank and then the next one lost colour. So although I could see a natural spot to place the limit order I didn’t have blue so I didn’t go. I knew that it would turn blue if the trade took off, but I pulled the order and waited.

The bar I did enter on was blue when the order filled and then lost colour when the bar closed. Full stop.

1 Minute Crude Oil Chart

Now I know all you traders out there will tell me that these are 2 trades, 2 trades, you don't go off and get all nutty over 2 trades.

Now I know all you traders out there will tell me that these are 2 trades, 2 trades, you don't go off and get all nutty over 2 trades.

I know.

But, all my humanness said place the orders here, instead I waited for my magic, ok its not magic. I waited for my mechanical indicators to confirm.

I knew what to do and didn’t do it. This isn't just a look back at the static chart to play shoulda coulda woulda, these were the thoughts going through my head at the time. On the second trade the limit order was in and I pulled it.

The mechanical indicators tell me when the probability of success has gone up. They don't place orders for me. I had blue, or at least on and off blue bars when I wanted to place the orders. Yet I waited, like a machine, a machine without a brain, heart, or soul.

Is that my training at work, or is this just whining at the end of a negative day?

I should use them.

In trading we learn that the biggest obstacle to success is our self. All our human frailties are exposed in this business.

Or are they?

Maybe most traders just don't last long enough to become successful.

Maybe.

There has been some research that suggests it takes 10 years to really become proficient at something. Maybe proficient isn't strong enough, an expert is what you need to become in your chosen field.

Doctors and lawyers are considered to be the "golden" professionals, how many years of training do they endure. What kind of hours do they put in each day as they train? What kind of mentors do they have while they train?

How many hours, days, and years have you put into your chosen field?

The barriers to entry in the trading profession are not very high, the experts in the field want everyone to come in and test their mettle. The more the merrier for them.

Are you ready for them?

Am I?

Two trades today and as you may have guessed not too successful, not that unsuccessful either, just another day in the business.

The first trade was after the crude oil inventory report and it is usually a good idea to give that report a little space before trying to trade. Usually.

So I waited for the 5 minute blue bar to complete before entering on the 1 minute and took a break even - 1. If I had gone at the end of the first 1 minute bar......

1 Minute Crude Oil Chart

The second trade set up with one 5 minute blue bar in the bank and then the next one lost colour. So although I could see a natural spot to place the limit order I didn’t have blue so I didn’t go. I knew that it would turn blue if the trade took off, but I pulled the order and waited.

The second trade set up with one 5 minute blue bar in the bank and then the next one lost colour. So although I could see a natural spot to place the limit order I didn’t have blue so I didn’t go. I knew that it would turn blue if the trade took off, but I pulled the order and waited.The bar I did enter on was blue when the order filled and then lost colour when the bar closed. Full stop.

1 Minute Crude Oil Chart

Now I know all you traders out there will tell me that these are 2 trades, 2 trades, you don't go off and get all nutty over 2 trades.

Now I know all you traders out there will tell me that these are 2 trades, 2 trades, you don't go off and get all nutty over 2 trades. I know.

But, all my humanness said place the orders here, instead I waited for my magic, ok its not magic. I waited for my mechanical indicators to confirm.

I knew what to do and didn’t do it. This isn't just a look back at the static chart to play shoulda coulda woulda, these were the thoughts going through my head at the time. On the second trade the limit order was in and I pulled it.

The mechanical indicators tell me when the probability of success has gone up. They don't place orders for me. I had blue, or at least on and off blue bars when I wanted to place the orders. Yet I waited, like a machine, a machine without a brain, heart, or soul.

Is that my training at work, or is this just whining at the end of a negative day?

1/20/2009

Shiny and New

A new crude oil month, a new President, onward and upward my friends.

I'll leave the new President alone for now (so LT doesn't get mad at me) and concentrate on the new crude month.

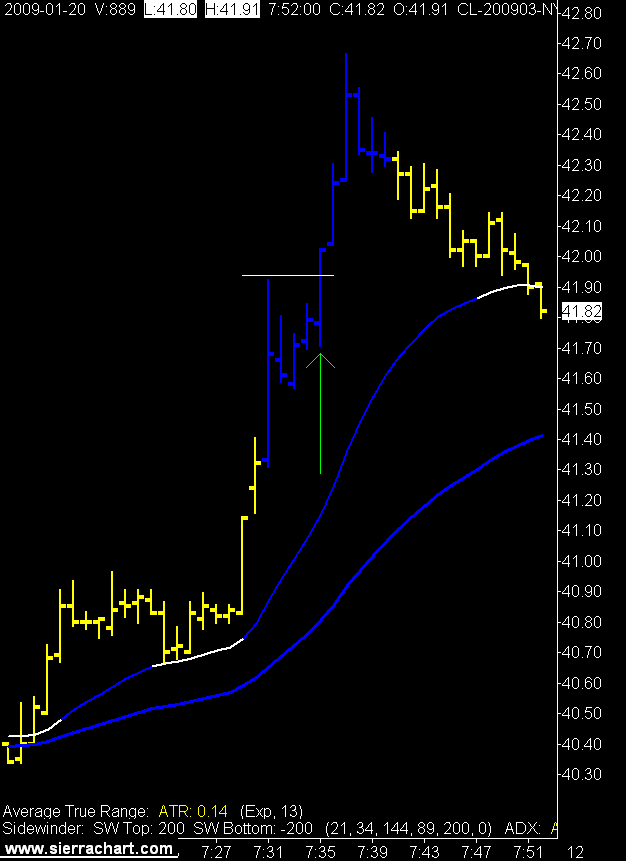

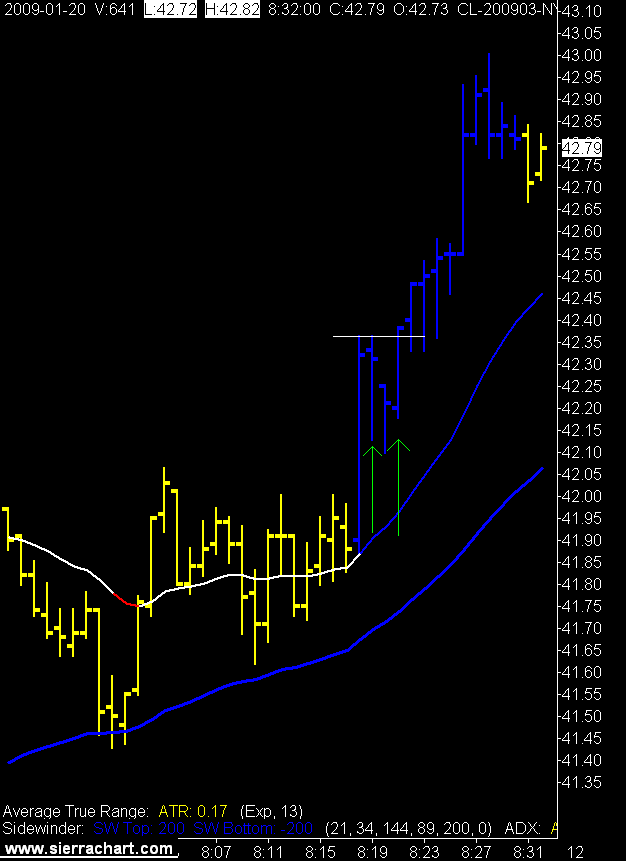

A very strong up move in the morning brought forth a plethora of 5 minute blue bars. I took the first trade, bagged my target, and congratulated myself for the very self evident genius at work.

Then came the second trade.

Twas not my fault, I swear.

Limit long at 42.38, price on the chart does not go over .36, I get filled at .37, price then plummets through my stop and I bail for a 25 tic loser.

Nice.

The signal was still intact, and technically my entry price was not hit so I went again at 42.38 and got a BE + 1. Well this is crude oil, so the fill was BE - 1.

Sheesh.

These things happen, I want a product that moves, and I got one. Day was net positive so I guess it could have been worse.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

I'll leave the new President alone for now (so LT doesn't get mad at me) and concentrate on the new crude month.

A very strong up move in the morning brought forth a plethora of 5 minute blue bars. I took the first trade, bagged my target, and congratulated myself for the very self evident genius at work.

Then came the second trade.

Twas not my fault, I swear.

Limit long at 42.38, price on the chart does not go over .36, I get filled at .37, price then plummets through my stop and I bail for a 25 tic loser.

Nice.

The signal was still intact, and technically my entry price was not hit so I went again at 42.38 and got a BE + 1. Well this is crude oil, so the fill was BE - 1.

Sheesh.

These things happen, I want a product that moves, and I got one. Day was net positive so I guess it could have been worse.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

1/15/2009

1/14/2009

Two Signals, Three Trades

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

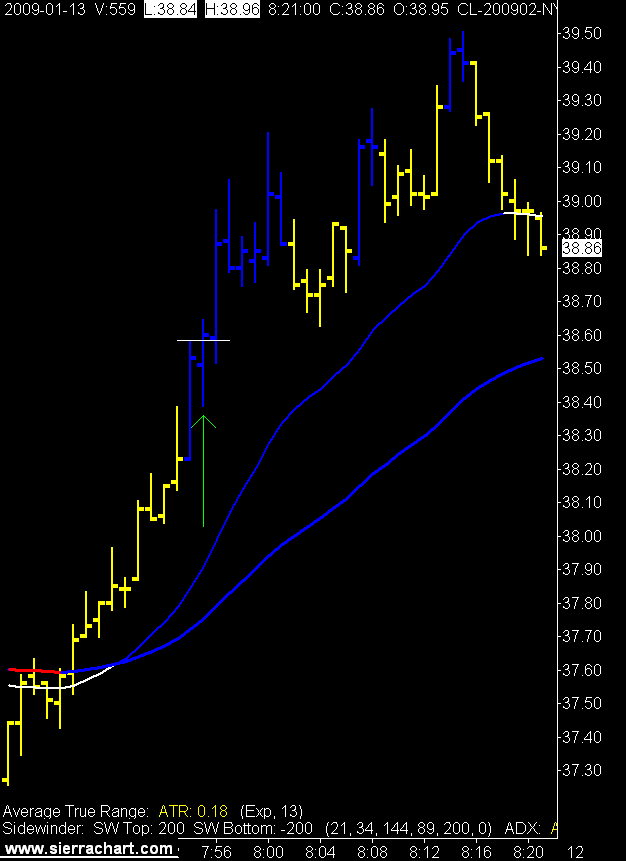

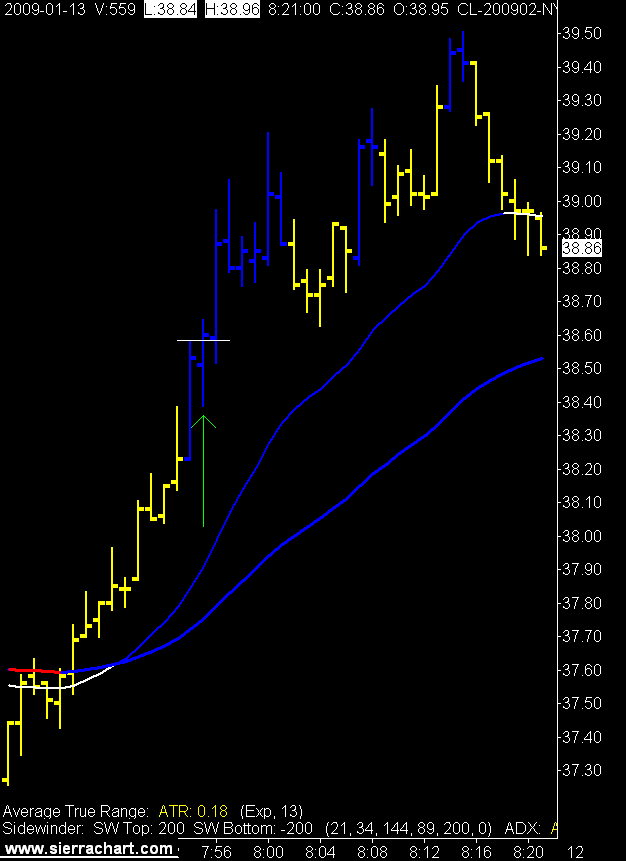

1/13/2009

How Low Will Oil Go?

I don't know why I ask this question. I guess I ask because it's the question most people ask me. My answer is always the same, I have no idea.

All I can say is the trend is still down. It will remain down until it is up.

Daily Crude Oil Chart

This is a very strange business, spent 6 hours looking at charts, made one trade, held the position for about a minute, and that was it for the day.

This is a very strange business, spent 6 hours looking at charts, made one trade, held the position for about a minute, and that was it for the day.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

All I can say is the trend is still down. It will remain down until it is up.

Daily Crude Oil Chart

This is a very strange business, spent 6 hours looking at charts, made one trade, held the position for about a minute, and that was it for the day.

This is a very strange business, spent 6 hours looking at charts, made one trade, held the position for about a minute, and that was it for the day.5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

1/12/2009

AHAAA!

Almost fell out of my chair with that aha. My loyal readers, not you one time wannabes, will join with me in my aha.

Why aha?

I have been saying for months the response to our current economic issues from virtually all governments is straight out of the book.

What book?

Atlas Shrugged

Many thanks to ugly for finding this story.

Read the story, then read the book.

Oh yes, I almost forgot. No signals and no trades.

I'm thinking of taking up knitting, stamp collecting, needlepoint, shuffleboard, watching paint dry, anything other than watching these markets.

Why aha?

I have been saying for months the response to our current economic issues from virtually all governments is straight out of the book.

What book?

Atlas Shrugged

Many thanks to ugly for finding this story.

Read the story, then read the book.

Oh yes, I almost forgot. No signals and no trades.

I'm thinking of taking up knitting, stamp collecting, needlepoint, shuffleboard, watching paint dry, anything other than watching these markets.

1/09/2009

A Trade

One lonely trade. Tis better than nothing.

I was teaching the EIT again today, teaching him about the markets, economics, and life in general. He's like a sponge, so young, so eager to learn.

EIT I said, it’s not your trading system that makes you money, it's trading the right market conditions. If the market conditions are not right, don't trade, or trade a different market.

He looked up at me with those I'm so glad you’re my mentor eyes and said, yes Mr. Solfest.

My capacity for the welfare of my fellow man amazes even me sometimes.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

8 Tic Renko Crude Oil Chart

I was teaching the EIT again today, teaching him about the markets, economics, and life in general. He's like a sponge, so young, so eager to learn.

EIT I said, it’s not your trading system that makes you money, it's trading the right market conditions. If the market conditions are not right, don't trade, or trade a different market.

He looked up at me with those I'm so glad you’re my mentor eyes and said, yes Mr. Solfest.

My capacity for the welfare of my fellow man amazes even me sometimes.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

8 Tic Renko Crude Oil Chart

1/08/2009

It's Not Good to be the Bank

No signals, no trades.

This is an interesting series done on a small manufacturing company that is facing severe financial issues. As an old business banker I find myself yearning (yearning? that's kinda weird) to see their financial statements. So many things at play here that affect so many people. I remember the stress of dealing with situations like this. You know there are employees, you feel the emotions of the owners, anger, sadness, denial.

I don't miss that.

The issue is debt. When Jen talks about growing too fast she hits it right on the head. Most small business owners don't get this. They think more sales and more growth are the keys to success. Sustainable growth is the key. Meaning that your equity has to grow with your increased sales. Debt can increase to help fund the growth but it cannot fund all the growth. If you keep pushing the debt levels before your retained earnings have time to grow you will eventually find yourself in the situation they are in now.

It's all about financial ratios, ratios that are very simple to calculate and understand if you take a little time to do it. They must be I did them. :)

Most small business owners won't, at least they won't until it's too late.

J.W. Hulme's problems have nothing to do with the current "credit crisis", these individual credit crisis happen all the time, and have been going on for decades.

I think the lack of financial literacy the world faces is the greatest mistake our educational systems have ever made.

When we all ate what we grew financial literacy was not much of an issue. As mankind became more "sophisticated" our understanding of finance has stayed in the agrarian age. Actually you could argue it has gotten worse since then. We have so many more ways to screw up financially.

Why is financial planning of some sort not taught as a core subject in high school? It is certainly more relevant than most of the current curriculum. Suze Orman and Oprah are trying, but if you know anything about the subject watching them try and teach very simple concepts to adults is like watching a 40 year old trying to learn how to read, or add 2 + 2.

It's painful.

It just shouldn't be this way.

Maybe Obama will fix it. He is going to cure all. Right?

Wait, he's going to borrow trillions without any thought of the consequences.

Have I mentioned debt is bad?

This is an interesting series done on a small manufacturing company that is facing severe financial issues. As an old business banker I find myself yearning (yearning? that's kinda weird) to see their financial statements. So many things at play here that affect so many people. I remember the stress of dealing with situations like this. You know there are employees, you feel the emotions of the owners, anger, sadness, denial.

I don't miss that.

The issue is debt. When Jen talks about growing too fast she hits it right on the head. Most small business owners don't get this. They think more sales and more growth are the keys to success. Sustainable growth is the key. Meaning that your equity has to grow with your increased sales. Debt can increase to help fund the growth but it cannot fund all the growth. If you keep pushing the debt levels before your retained earnings have time to grow you will eventually find yourself in the situation they are in now.

It's all about financial ratios, ratios that are very simple to calculate and understand if you take a little time to do it. They must be I did them. :)

Most small business owners won't, at least they won't until it's too late.

J.W. Hulme's problems have nothing to do with the current "credit crisis", these individual credit crisis happen all the time, and have been going on for decades.

I think the lack of financial literacy the world faces is the greatest mistake our educational systems have ever made.

When we all ate what we grew financial literacy was not much of an issue. As mankind became more "sophisticated" our understanding of finance has stayed in the agrarian age. Actually you could argue it has gotten worse since then. We have so many more ways to screw up financially.

Why is financial planning of some sort not taught as a core subject in high school? It is certainly more relevant than most of the current curriculum. Suze Orman and Oprah are trying, but if you know anything about the subject watching them try and teach very simple concepts to adults is like watching a 40 year old trying to learn how to read, or add 2 + 2.

It's painful.

It just shouldn't be this way.

Maybe Obama will fix it. He is going to cure all. Right?

Wait, he's going to borrow trillions without any thought of the consequences.

Have I mentioned debt is bad?

1/07/2009

It's Good to be the Bank

Insert Wild Cackling Laughter.

Just when I calmed down from Pranil and Anonymous telling me I'm a trading idiot the EIT sends me this.

We're all doomed.

Just when I calmed down from Pranil and Anonymous telling me I'm a trading idiot the EIT sends me this.

We're all doomed.

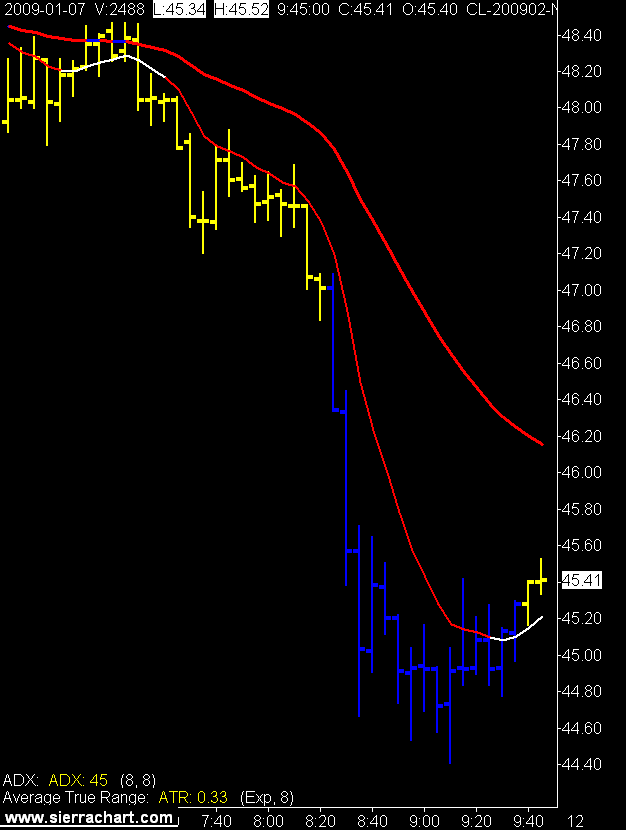

Crude Oil Plummets

Plummets, tanks, plunges, dives, tumbles, crashes, etc. As a trader looking for volatility this should be a great day to trade. Oil in the news, good volume, it's all there.

Not for me.

It was a get short stay short day and I don't trade that way. Hard to believe looking at the 15 minute chart that I couldn't have pulled something out that.

Oh well.

15 Minute Crude Oil Chart

Tried 4 trades after the inventory report and one at the end of the session. Came up with 3 losers, 1 be, and 1 winner for small net gain. Very small.

5 Minute Crude Oil Chart

Not for me.

It was a get short stay short day and I don't trade that way. Hard to believe looking at the 15 minute chart that I couldn't have pulled something out that.

Oh well.

15 Minute Crude Oil Chart

Tried 4 trades after the inventory report and one at the end of the session. Came up with 3 losers, 1 be, and 1 winner for small net gain. Very small.

5 Minute Crude Oil Chart

1/06/2009

No Trades

No signals on the YM today and one on CL which I missed as I was out bleeding. Or giving blood as it is more commonly known. Not for other people, no, just some blood to, ah, look at, I guess.

So no fascinating charts with witty dialogue today. How about some funny video instead.

So no fascinating charts with witty dialogue today. How about some funny video instead.

1/05/2009

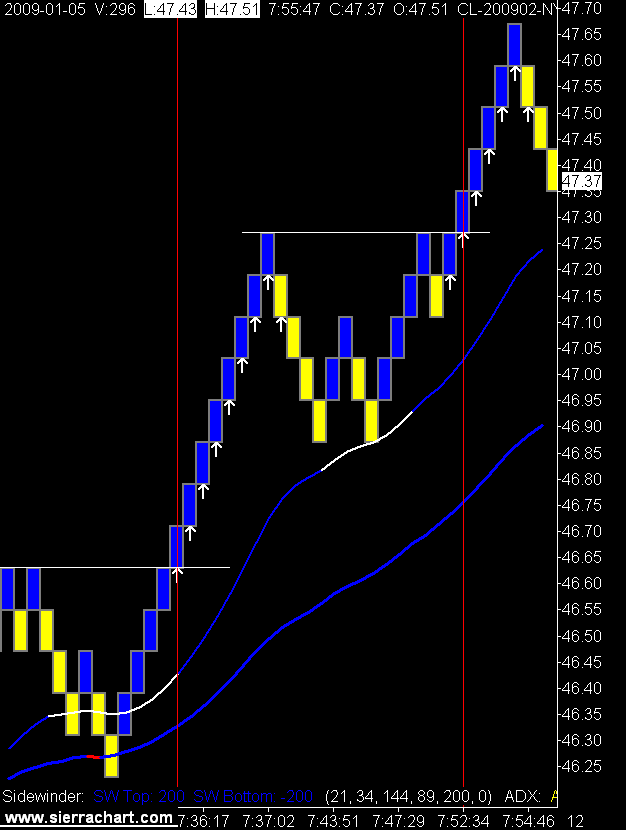

Renko Redundant?

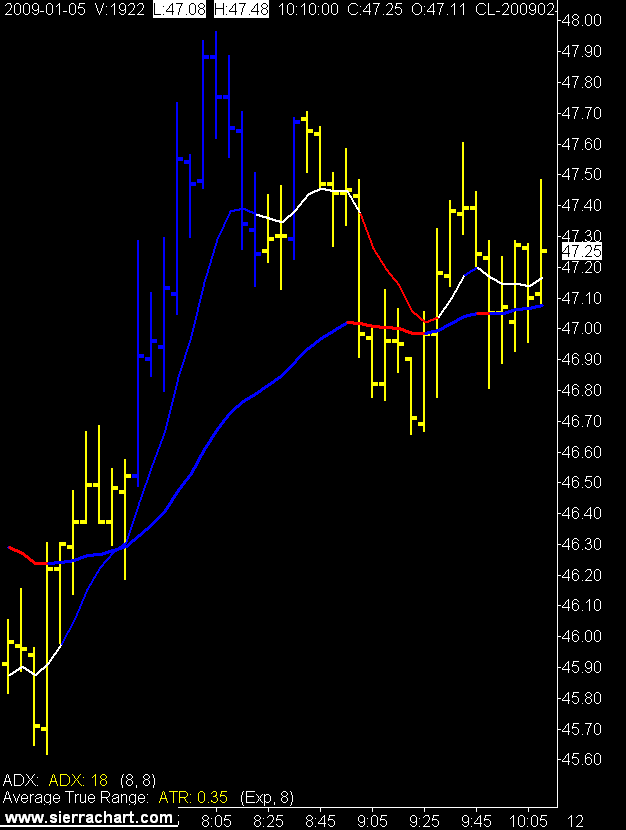

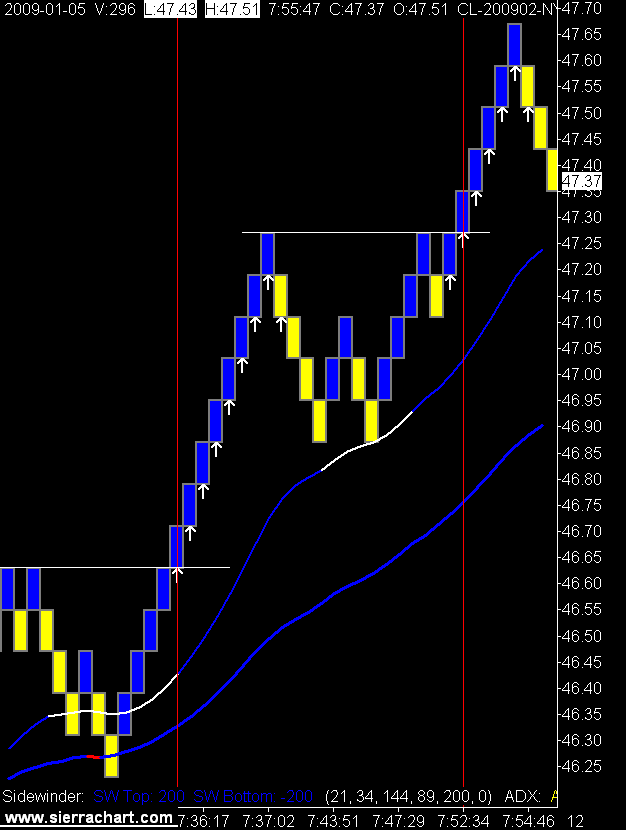

Traded crude oil today.

Didn't look at the YM until the end of the day and there were no signals.

The 5 day average true range on the YM is 220 tics and the CL's is 503 tics.

So, I don't think it takes a trading genius to figure out that it's a whole lot easier to snag a few tics out of the CL's day as opposed to the YM's day.

Crude had 2 nice trades in the morning that I caught and one at the end of the session that I did not.

I find I am not looking at the renko chart as much as I used to. I am concentrating

(concentrating may be overstating it says the man who loves rain) more on the minute charts instead. Once a market really gets moving the renko will show an entry quicker than waiting for a minute bar to close. Maybe then they will still have some value for me.

Right now the markets are not moving quickly.

Could also be that the renko chart only has magic white arrows, which when compared to the magic blue bars are rather passé.

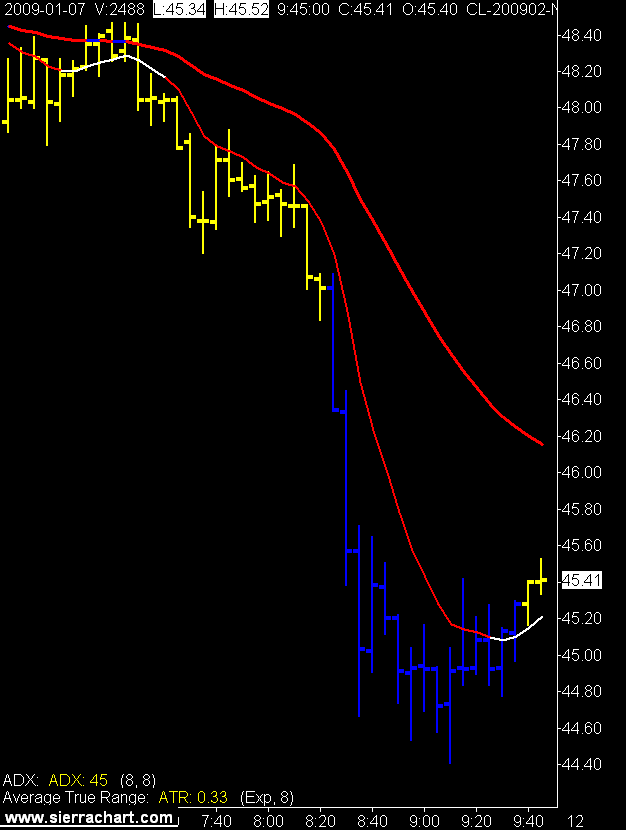

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

8 Tic Renko Crude Oil Chart

Didn't look at the YM until the end of the day and there were no signals.

The 5 day average true range on the YM is 220 tics and the CL's is 503 tics.

So, I don't think it takes a trading genius to figure out that it's a whole lot easier to snag a few tics out of the CL's day as opposed to the YM's day.

Crude had 2 nice trades in the morning that I caught and one at the end of the session that I did not.

I find I am not looking at the renko chart as much as I used to. I am concentrating

(concentrating may be overstating it says the man who loves rain) more on the minute charts instead. Once a market really gets moving the renko will show an entry quicker than waiting for a minute bar to close. Maybe then they will still have some value for me.

Right now the markets are not moving quickly.

Could also be that the renko chart only has magic white arrows, which when compared to the magic blue bars are rather passé.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

8 Tic Renko Crude Oil Chart

Oops

There is always a battle raging in a bank with the sales side vs. the risk management side and when one of those entities gains an upper hand bad things happen.

Back in the olden days when I was a banker we would actually go look at a property before we put a mortgage on it. I always asked the question would I (I being the bank) ever want to own this property? As the banker it was your reputation and credibility within the organization at risk, along with your bank's capital.

Maybe humans still have a place in the whole credit risk process.

Back in the olden days when I was a banker we would actually go look at a property before we put a mortgage on it. I always asked the question would I (I being the bank) ever want to own this property? As the banker it was your reputation and credibility within the organization at risk, along with your bank's capital.

Maybe humans still have a place in the whole credit risk process.

1/02/2009

New Year Crude Oil

There are some who pontificated that it was the price of crude oil (energy) that caused the current global recession. If so you would think that the subsequent collapse of crude oil prices would help move the economy back into the black.

What does this little crude oil rally mean for the economic outlook?

Is oil looking forward?

If so it ran to $147 with a blindfold on.

Is the current oil price just a reflection of a lower American dollar?

I have more questions than answers.

For whatever reason crude has come back to life over the past few days and has shown some decent intra day range. Decent compared to the YM's range that is. I am currently simming crude oil with the magic blue bars and caught a few nice trades today.

The YM had no signals and no trades.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

What does this little crude oil rally mean for the economic outlook?

Is oil looking forward?

If so it ran to $147 with a blindfold on.

Is the current oil price just a reflection of a lower American dollar?

I have more questions than answers.

For whatever reason crude has come back to life over the past few days and has shown some decent intra day range. Decent compared to the YM's range that is. I am currently simming crude oil with the magic blue bars and caught a few nice trades today.

The YM had no signals and no trades.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

Subscribe to:

Posts (Atom)