3/24/2010

The End

I do believe the blog has run its course. It is 2 years old today and after 458 posts I think it's time to stop.

The blog started because I wanted to see how a blog worked. What I didn't know at the time was how much I would enjoy it, how much I would learn, or how many smart, interesting, weird, and funny people I would meet.

That said the ink well has gone dry and there is no point in continuing.

My trading has found a path that I will continue on, and while my business looks good right now I remain cognisant that markets change and so must I.

I want to thank all who contributed to the blog and you can be sure that I will continue my daily perusal of your musings.

I wish all of you the very best in your trading and your life.

Solfest

3/22/2010

Emotion

Emotion: A mental state that arises spontaneously rather than through conscious effort and is often accompanied by physiological changes.

I have been thinking more on this wonderful human thing we call emotion and how it affects our lives as traders. We traders have been taught, or somehow just believe, that we need to control our emotions in order to be successful.

This begs the rather large question, can emotions be controlled?

I would suggest that they cannot. The "Free Dictionary" definition above also suggests this, of course it's free, so you know.

What people learn to control is their reaction to the emotions they are feeling. Or at least we try to control our reaction to these emotions.

Another good question is why can some people do this better than others?

Genetics or is it a learned behavior?

Or both?

As a kid I played sports and I learned that your physical ability goes down if you become angry, if you can control your actions under stress you will do better than those who can’t.

As an adult I watch and coach my kids in sports. I see kids who have trouble controlling their actions in the emotion of the game. Worse than that I see adults who are completely out of control watching their kids. They say and do things that you would not believe could come out of their mouths as our 11 years olds compete.

Emotion is a powerful thing. Those who cannot control their actions during emotional times will have a difficult life no matter what they do. However if they're a trader, well you know the answer.

When it comes to trading I have all emotions known to man, I get as angry, frustrated, and dejected as anyone. Maybe more, I don't have a benchmark to judge this on.

So if we cannot control our emotions but we can control our reaction to these emotions the question becomes how can we do this better.

The pop psychology answer is to talk it out. Do the thing that men love to do, verbally "express our feelings".

Yuck.

I think it may be the only way. If you have done your trading homework you know all the rational reasons to only trade the plan, to keep trading the plan, to only judge your execution of the plan, to not focus on immediate results, or lack of results.

We intellectually know all of this yet when we have a losing trade we have an emotional reaction. We can't help it. We don't want to lose, we want to win.

So the conversation with yourself has to happen, out loud. Talk through the rational for the trade, talk through the trading plan, why you took the trade, tell yourself out loud it was a good trade, you did the right thing, you have an expectancy and it's not 100% winners.

Emotional humans also have the ability to be rational. I used to say the most important psychological battle for a trader was to reverse our fear and greed complex.

I now believe the most important trading battle is between our rational being and our emotional being. The key to success in this battle is not suppressing our emotions, because we can't, the key is using our rational brain to explain our emotions and to control and change our reaction to these emotions.

Think back to my previous post, the three Mondays with three identical financial results. The same financial result yet we all know that we will have three very different emotional reactions to these three days.

Monday #1 we felt angry, Monday #2 we felt frustrated, and Monday #3 we felt pretty good.

Rationally we know that the result at the end of each day was the same, zero. We know this but we still feel different at the end of each day because we got to zero differently each day.

Trading is simple, yet most fail.

Think about that. Why do most fail? We are all emotional beings, those who cannot control their actions to these emotions will fail. That means most of us.

Now think about this some more. Think about it during the next trading day. Talk to yourself, out loud.

Have a good discussion.

Oh by the way, today, I get to eat ice cream. :)

3/20/2010

One Result, Three Outcomes

Just for fun let us consider 3 different trading days, days that we have all lived through if we are in this business of trading. These days could happen any time in no particular order. So let's just call them all Mondays, Mondays that start off 3 different and random weeks in the year.

Monday #1) We start off our day with a winning trade, let's say net $300. We followed our system, we took the signal, and we were rewarded with a winning trade. The next signal comes along and we enter again, result, losing trade net -$100. Signal again, loser again net -$100. Signal again, loser again net -$100.

Day ends with the net result of, ZERO.

Monday #2) We sit in front of our computer for the entire day, we see no signals and we do nothing all day.

Day ends with the net result of, ZERO.

Monday #3) We start off the day with a valid signal and a losing trade, net -$100. Next signal, net -$100. Next signal, net -$100. Next signal, aha, a winner for $300.

Day ends with the net result of, ZERO.

Now you may say, Solfest those results and outcomes are all the same, all ZERO. True the results are all ZERO but the outcome I'm talking about is what happens the Tuesday after one of those random Mondays.

Let's start with Monday #1, our first trade was a winner, we have started the week demonstrating the genius we know we are. We then proceed to see all that genius disappear throughout the rest of the day. We end the day feeling defeated and angry.

Now comes Tuesday, first trade is again a winner, ya baby, the next signal comes along and.... we don't want to push the button, we remember Monday, we don't want to lose those profits again, we don't want to lose this feeling of genius again. We don't push the button. In fact we don't push the button again all day, we have our little genius in the bank and we're not letting go. What happens that day? You know, it's a given, all the signals work and you would have made thousands not hundreds.

Ok now Monday #2, we have sat for an entire day, that's right one whole day, and done nothing, nothing. It's terrible, we are a trader we should trade. People ask what you did today, answer, I did nothing.

Now comes Tuesday, again no signals, no signals, no signals, almost a signal, ah close enough, I've seen this work before, let's go, nothing ventured nothing gained. Result, loser.

Is there a worse result then a non signal loser? Yes, a non signal winner. That leads to more non signal trades as I am now smarter than the market, smarter than my system, I am a genius discretionary trader. I have read about these people, they can feel the market.

Right?

Wrong, the result ultimately is a string of losers with no rational thought behind any of the trades.

Lastly, Monday #3. We followed our plan and we were rewarded. We took our losers and we stayed focused and "traded our way out of this mess". Surely this means I have arrived as a trader.

Now Tuesday. First trade loser, second trade, loser, third trade, loser, fourth trade, loser, fifth trade, loser, BLOODY STUPID MOTHER OF ALL &!&@%$&!%. Solfest smashes new 24 inch monitor with coffee cup and quits trading for a month, or changes the trading plan for a month because it obviously doesn’t work, or does any number of other juvenile things.

Of course the next month would have been the most profitable month his system has ever seen.

So, our 3 Mondays all had the same result, ZERO, but our 3 Tuesdays all take different turns based on the different ways we got to ZERO on the previous Monday.

Sound familiar?

What do we do?

Hire LW to trade our plan for us? Yes he has had his emotion chip removed so that would work. However I asked him and he said no as his gardening keeps him very busy.

So now what?

I have often thought that I could hire a 12 year old, train him to follow the blue bars, pay him minimum wage to sit there for the 5.5 hours, offer him a $20 bonus for every valid signal he takes, and deduct $20 from his pay for every non valid trade he takes.

I think the 12 year old's trading results might be better than mine. (gasp)

So maybe what we need to do is frame our trading success or failure outside monetary results. Not a new idea I know. The question is how? I have tried to grade the day based on how well I followed the system. But soon I stopped the grading and just looked at the money.

Maybe it has to be tangible, remember humans are stupid. We like shiny things, but they cost alot of money. Hmmmm, what else do humans like?

Sex and food.

That's it, no sex on days with non valid entries. (Freudian slip)

Ah but that would be punishing your innocent spouse, hehe, only a man would say that.

Ok then, food.

Every day I follow all signals perfectly I go out and buy myself an ice cream treat of some kind. That starts the anticipation chip in our brain, we want the ice cream at the end of the trading day. The kicker is we must deny ourselves the ice cream if we fail to follow the plan.

So that’s my new reward system. Like a dog, do a trick, get a treat.

Its "stupid" enough it just might work.

Monday #1) We start off our day with a winning trade, let's say net $300. We followed our system, we took the signal, and we were rewarded with a winning trade. The next signal comes along and we enter again, result, losing trade net -$100. Signal again, loser again net -$100. Signal again, loser again net -$100.

Day ends with the net result of, ZERO.

Monday #2) We sit in front of our computer for the entire day, we see no signals and we do nothing all day.

Day ends with the net result of, ZERO.

Monday #3) We start off the day with a valid signal and a losing trade, net -$100. Next signal, net -$100. Next signal, net -$100. Next signal, aha, a winner for $300.

Day ends with the net result of, ZERO.

Now you may say, Solfest those results and outcomes are all the same, all ZERO. True the results are all ZERO but the outcome I'm talking about is what happens the Tuesday after one of those random Mondays.

Let's start with Monday #1, our first trade was a winner, we have started the week demonstrating the genius we know we are. We then proceed to see all that genius disappear throughout the rest of the day. We end the day feeling defeated and angry.

Now comes Tuesday, first trade is again a winner, ya baby, the next signal comes along and.... we don't want to push the button, we remember Monday, we don't want to lose those profits again, we don't want to lose this feeling of genius again. We don't push the button. In fact we don't push the button again all day, we have our little genius in the bank and we're not letting go. What happens that day? You know, it's a given, all the signals work and you would have made thousands not hundreds.

Ok now Monday #2, we have sat for an entire day, that's right one whole day, and done nothing, nothing. It's terrible, we are a trader we should trade. People ask what you did today, answer, I did nothing.

Now comes Tuesday, again no signals, no signals, no signals, almost a signal, ah close enough, I've seen this work before, let's go, nothing ventured nothing gained. Result, loser.

Is there a worse result then a non signal loser? Yes, a non signal winner. That leads to more non signal trades as I am now smarter than the market, smarter than my system, I am a genius discretionary trader. I have read about these people, they can feel the market.

Right?

Wrong, the result ultimately is a string of losers with no rational thought behind any of the trades.

Lastly, Monday #3. We followed our plan and we were rewarded. We took our losers and we stayed focused and "traded our way out of this mess". Surely this means I have arrived as a trader.

Now Tuesday. First trade loser, second trade, loser, third trade, loser, fourth trade, loser, fifth trade, loser, BLOODY STUPID MOTHER OF ALL &!&@%$&!%. Solfest smashes new 24 inch monitor with coffee cup and quits trading for a month, or changes the trading plan for a month because it obviously doesn’t work, or does any number of other juvenile things.

Of course the next month would have been the most profitable month his system has ever seen.

So, our 3 Mondays all had the same result, ZERO, but our 3 Tuesdays all take different turns based on the different ways we got to ZERO on the previous Monday.

Sound familiar?

What do we do?

Hire LW to trade our plan for us? Yes he has had his emotion chip removed so that would work. However I asked him and he said no as his gardening keeps him very busy.

So now what?

I have often thought that I could hire a 12 year old, train him to follow the blue bars, pay him minimum wage to sit there for the 5.5 hours, offer him a $20 bonus for every valid signal he takes, and deduct $20 from his pay for every non valid trade he takes.

I think the 12 year old's trading results might be better than mine. (gasp)

So maybe what we need to do is frame our trading success or failure outside monetary results. Not a new idea I know. The question is how? I have tried to grade the day based on how well I followed the system. But soon I stopped the grading and just looked at the money.

Maybe it has to be tangible, remember humans are stupid. We like shiny things, but they cost alot of money. Hmmmm, what else do humans like?

Sex and food.

That's it, no sex on days with non valid entries. (Freudian slip)

Ah but that would be punishing your innocent spouse, hehe, only a man would say that.

Ok then, food.

Every day I follow all signals perfectly I go out and buy myself an ice cream treat of some kind. That starts the anticipation chip in our brain, we want the ice cream at the end of the trading day. The kicker is we must deny ourselves the ice cream if we fail to follow the plan.

So that’s my new reward system. Like a dog, do a trick, get a treat.

Its "stupid" enough it just might work.

3/19/2010

I Believe

I didn't take the fourth signal although it would have worked too. A nice way to end a slow week.

Crude Oil

Crude Oil

3/17/2010

'The Big Short'

Michael Lewis (Liars Poker) has written another book on Wall Street. If it's half as good as Liars Poker it will be worth the read.

Here is a link to his interview with Charlie Rose.

Here is a link to his interview with Charlie Rose.

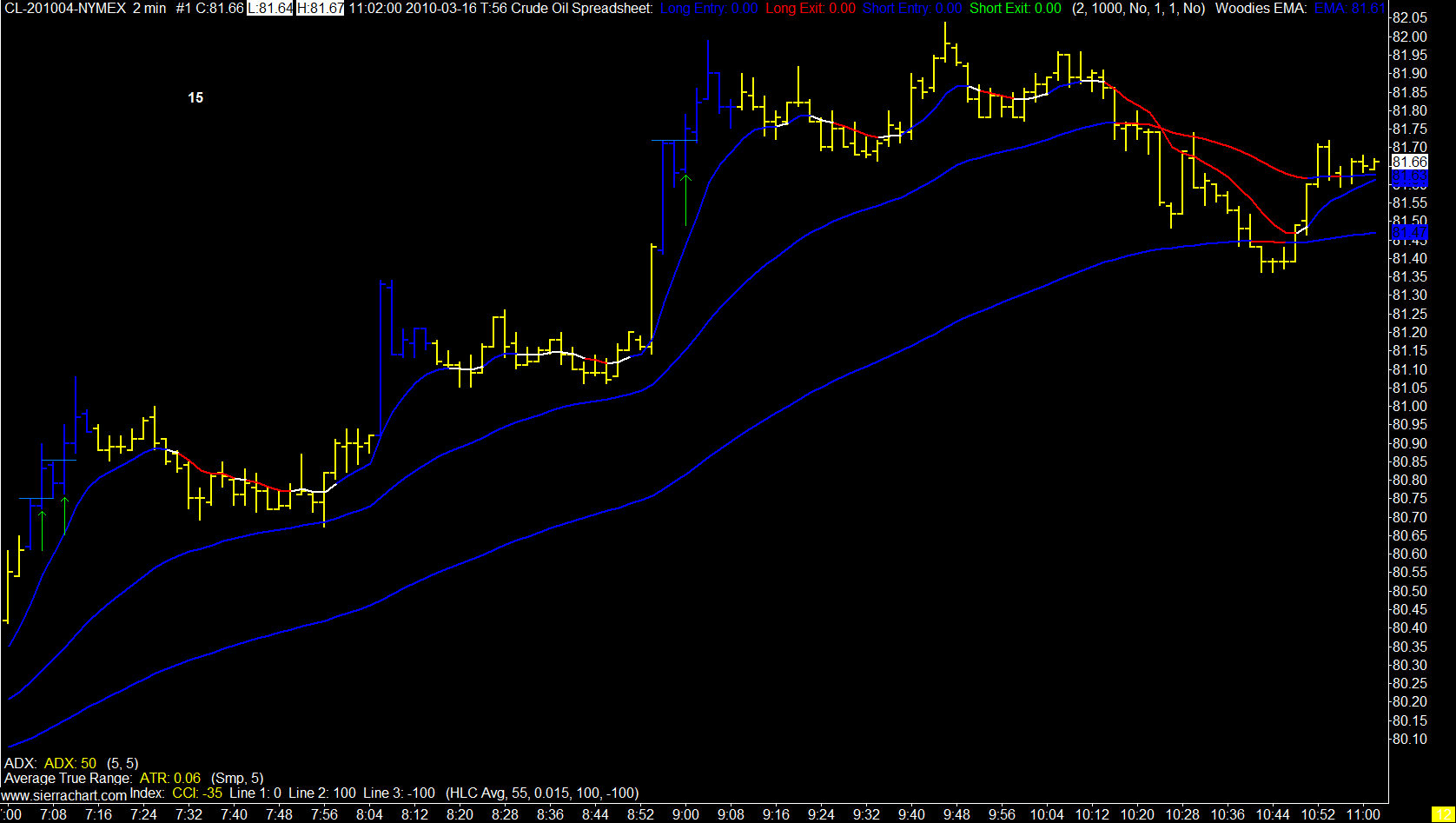

3/16/2010

Mouse Trading

Market was slow but with a direction. My signals take a little while to trigger in this kind of market, leaving most of the cheese for the smarter mice.

The smaller targets saved the day as I caught 2 and took a break even on the other. I guess this could be considered scalping, depending what your definition of scalping is.

Whatever works.

Crude Oil

The smaller targets saved the day as I caught 2 and took a break even on the other. I guess this could be considered scalping, depending what your definition of scalping is.

Whatever works.

Crude Oil

3/12/2010

Who Needs Wednesdays

Something spooked crude, don't know what but a very dull day became rather exciting for a while.

The stop and target levels all worked within a tick of not working, if that makes any sense.

You just never know.

Crude Oil Chart

The stop and target levels all worked within a tick of not working, if that makes any sense.

You just never know.

Crude Oil Chart

3/11/2010

3/10/2010

Wednesday

Man with real job: So what do you do for a living?

Solfest: I work Wednesdays.

Man with real job: That's it?

Solfest: Yes.

Man with real job: So what do you do the rest of the week?

Solfest: I look forward to Wednesday.

Crude Oil Chart

Solfest: I work Wednesdays.

Man with real job: That's it?

Solfest: Yes.

Man with real job: So what do you do the rest of the week?

Solfest: I look forward to Wednesday.

Crude Oil Chart

3/05/2010

'How We Decide'

Suddenly I feel like a monkey sucking apple juice.

Click on watch full program after the video starts.

Click on watch full program after the video starts.

3/02/2010

The Bush Legacy

President Obama's plan to fix all this? He's going to double the U.S. debt in 8 years.

The U.S. national debt clock. In a word, wow.

Watch, learn, say something.

How can any rational human being ask their government to spend more money than they take in?

How can any rational human being vote for a politician who promises to cut taxes while they increase spending?

How?

The U.S. national debt clock. In a word, wow.

Watch, learn, say something.

How can any rational human being ask their government to spend more money than they take in?

How can any rational human being vote for a politician who promises to cut taxes while they increase spending?

How?

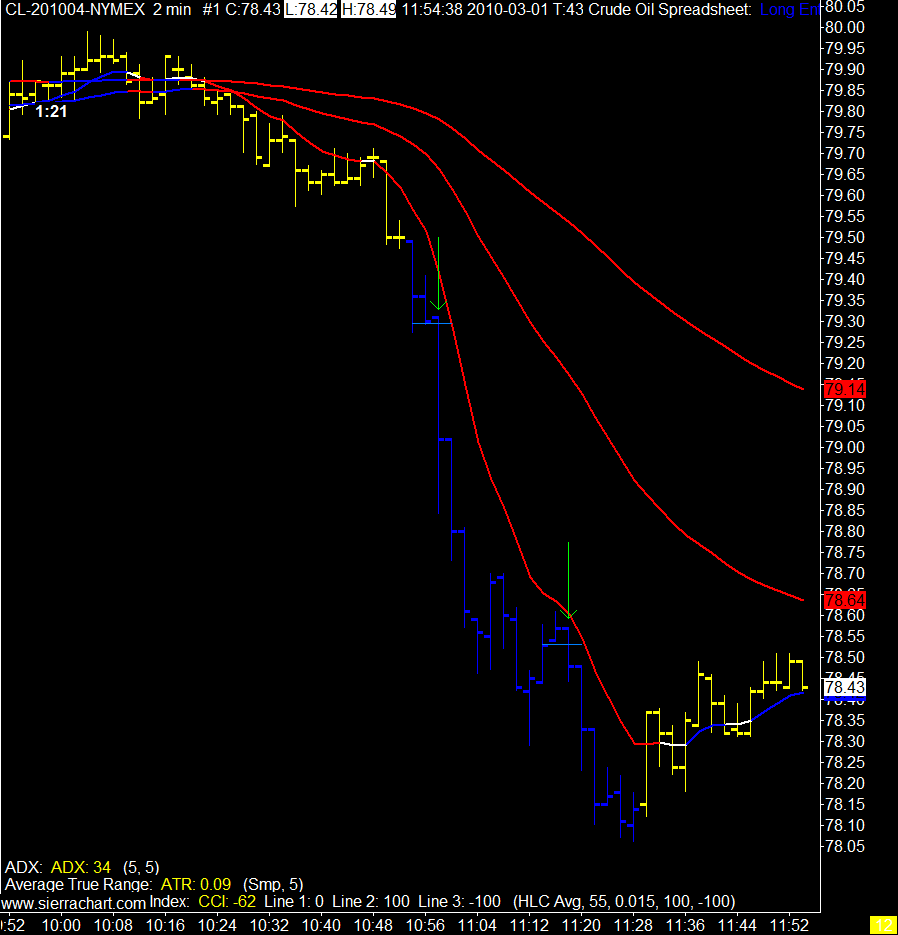

3/01/2010

A Stop, Pass, Pass, Target, and a Chicken Dance

Perhaps I can only follow a plan for so long in a day before my rebellious nature exerts itself.

Took the stop on the first trade, passed on the next 2 signals due to longer time frame charts not in congruence, got my target on the second trade, and then chickened out of the third trade.

Question is who am I rebelling against?

Crude Oil Chart

Took the stop on the first trade, passed on the next 2 signals due to longer time frame charts not in congruence, got my target on the second trade, and then chickened out of the third trade.

Question is who am I rebelling against?

Crude Oil Chart

Subscribe to:

Posts (Atom)