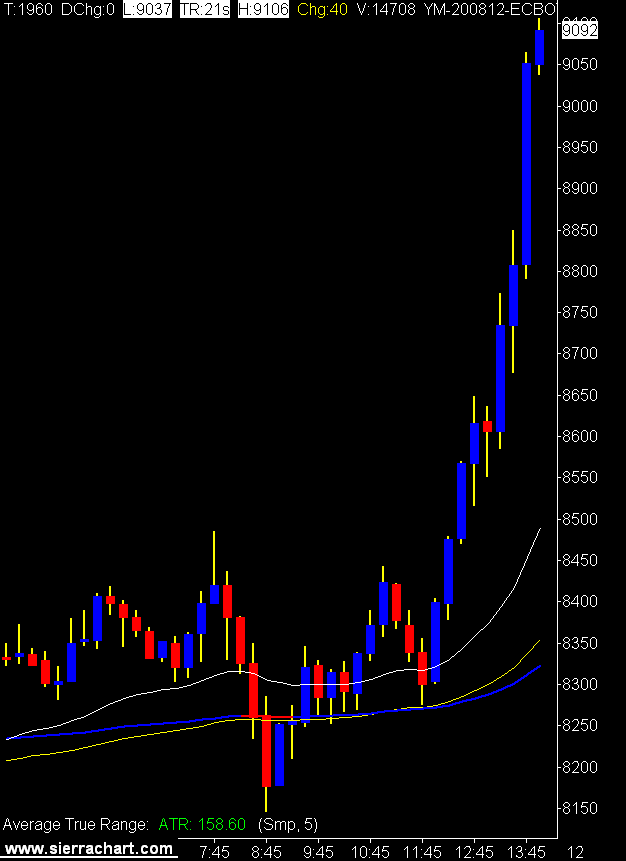

The good news is we didn't make new lows on the daily DOW. So, that's the good news, ya, the good news.

Daily DOW (YM) Futures Chart

The overnight session went limit down so the market was just a tad nervous today. I found it a tough market to trade and should have stepped aside in the morning. The late afternoon session provided some nice trades and got me back in the black for the day.

You could make a nice living only trading the last hour of the day in the past month or so. So why don't I do that? I might miss a trade. My mind set, sad but true.

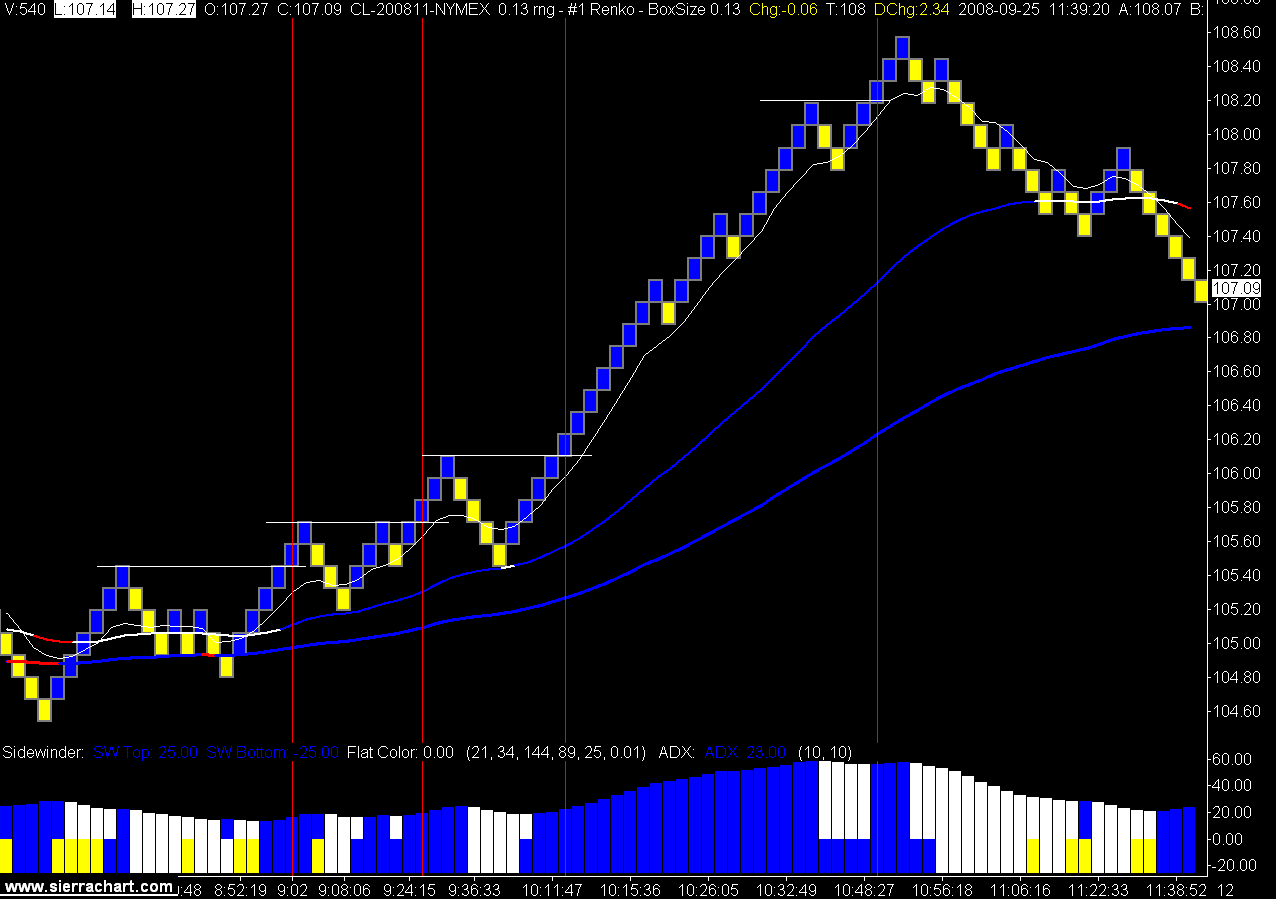

Depending on your definition of scalping I am either trend trading with a fixed target, or scalping. Doesn't really matter what you call it as long as it works.

I am using a 7 tick stop and a 25 tick target on the YM. I used to consider that a "trade" not a "scalp" but when I look at the number of trades at the end of the day I would now consider it scalping.

It's just scalping with a nice risk reward ratio.

I do want to cut down on the number of trades as the win rate is not where I would like it and I think I can filter some more. I have about 50 live trades to look at so I will take the weekend and see if I can identify the losing trade profile.

This is trend trading only so the obvious place to look is how you identify that a trend is place. Longer time frame chart, etc.

It is promising that you can trade rather badly and still wind up making a little money in the last 2 days.

Capital is scarce, treat it as such.