2 Minute Crude Oil

2/25/2010

2/24/2010

Green is Gold

2 Minute Crude Oil

Let the first long go without me as I was waiting for the longer time frame charts to confirm. Stop wasn't big enough to stay in the first trade but caught the second for target.

That appears to be it for today.

Let the first long go without me as I was waiting for the longer time frame charts to confirm. Stop wasn't big enough to stay in the first trade but caught the second for target.

That appears to be it for today.

2/23/2010

Ho Hum II

Can anyone name one single improvement in the new blogger format?

I can name a few disimprovements. (I love it when I make up new words) Such as I can't embed 2 charts on one post, no spell check anymore, preview screen is now too small.

Humbug!

2 Minute Crude Oil Chart

I can name a few disimprovements. (I love it when I make up new words) Such as I can't embed 2 charts on one post, no spell check anymore, preview screen is now too small.

Humbug!

2 Minute Crude Oil Chart

What a World

Thanks to KC Trader for bringing this site to my attention. There are probably a few more gems here but The Warning is the first one I watched.

It's a great piece with many facets.

The first being that government consists of paid morons, the second that you cannot allow the foxes to set the rules in the hen house, and the third, we don't seem to learn from our mistakes.

Also interesting to note they drag out the ghost of Ayn Rand once again to "prove" all her theories are wrong. What Rand's critics always fail to make note of is she would never approve of any government intervention for a failed company. In a capitalist system they must, MUST, go bankrupt.

If LTCM had been allowed to go under maybe we would have learned something then that would have changed the course of the future we have just lived through.

Or not.

If we as a society deem that an institution truly is "too big to fail" then they cannot be allowed to exist as private companies.

They must be nationalized.

I don't believe they are too big to fail, but it seems everyone else does. After we bail them out and yell at them for a while everyone goes back to sleep until the next bomb goes off.

I'm all for regulating the marketplace and derivatives should only be allowed to trade on an open market, but after that, let the chips fall where they may.

It's a great piece with many facets.

The first being that government consists of paid morons, the second that you cannot allow the foxes to set the rules in the hen house, and the third, we don't seem to learn from our mistakes.

Also interesting to note they drag out the ghost of Ayn Rand once again to "prove" all her theories are wrong. What Rand's critics always fail to make note of is she would never approve of any government intervention for a failed company. In a capitalist system they must, MUST, go bankrupt.

If LTCM had been allowed to go under maybe we would have learned something then that would have changed the course of the future we have just lived through.

Or not.

If we as a society deem that an institution truly is "too big to fail" then they cannot be allowed to exist as private companies.

They must be nationalized.

I don't believe they are too big to fail, but it seems everyone else does. After we bail them out and yell at them for a while everyone goes back to sleep until the next bomb goes off.

I'm all for regulating the marketplace and derivatives should only be allowed to trade on an open market, but after that, let the chips fall where they may.

2/22/2010

'Too Big to Fail'

I have been looking for the best book on the whole credit crisis / end of the world story for a while now. There are plenty to choose from. This one seems to have been given the most praise and coverage from those who may have some knowledge on the subject. I'm about half way through it and it is very well done.

Andrew Ross Sorkin on Charlie Rose.

Andrew Ross Sorkin on Charlie Rose.

2/18/2010

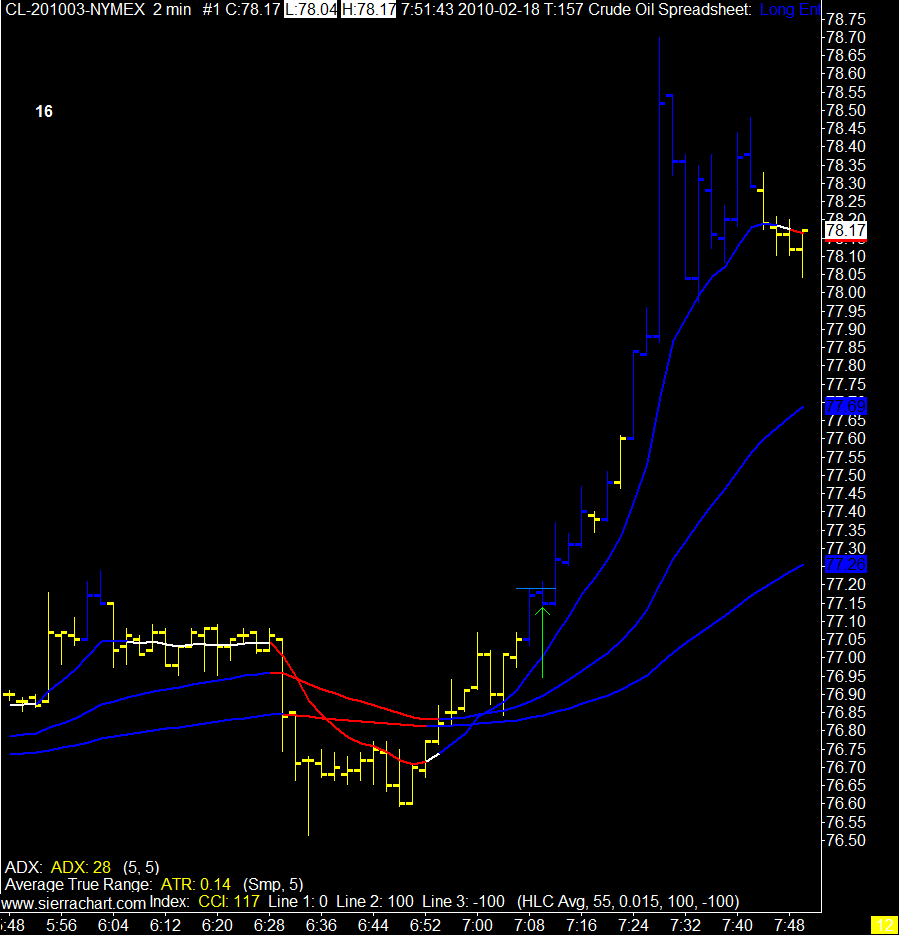

Boy Wonder

Nothing like a 150 tick move to get your day going. Of course when you are a genius boy wonder trader you expect days like this. You anticipate, you are ready to pounce and collect your bounty.

Or.

You take your 21 tick target and curl up in the fetal position sucking your thumb.

2 Minute Crude Oil chart

Or.

You take your 21 tick target and curl up in the fetal position sucking your thumb.

2 Minute Crude Oil chart

2/17/2010

How Long Can You Tread Water?

I've developed a strange fascination with ships lately. It all started with a Discovery Channel series called Mighty Ships which I watched via the internet all in one sitting. The scale of these ships and the tasks they take on are indeed mighty.

That got me browsing through you tube looking at tankers and some rough sea footage.

Insert comparison to trading analogy here:

Right.

Imagine yourself as the captain on one of these ships, the danger to you, your crew, passengers, and cargo is immense. How do you react?

Do you run screaming we're all going to die and hide in a life boat?

Or, stay at the helm and do everything in your power to ride this out.

Trading can be a lot like the North Sea in the winter. This begs the question, what kind of captain are you?

Now the rough sea trading analogy runs a little offside here as maybe the best result for your trading would be to abandon ship.

Why?

A good captain always goes down with the ship.

I guess the good news is they got it back to port.

That got me browsing through you tube looking at tankers and some rough sea footage.

Insert comparison to trading analogy here:

Right.

Imagine yourself as the captain on one of these ships, the danger to you, your crew, passengers, and cargo is immense. How do you react?

Do you run screaming we're all going to die and hide in a life boat?

Or, stay at the helm and do everything in your power to ride this out.

Trading can be a lot like the North Sea in the winter. This begs the question, what kind of captain are you?

Now the rough sea trading analogy runs a little offside here as maybe the best result for your trading would be to abandon ship.

Why?

A good captain always goes down with the ship.

I guess the good news is they got it back to port.

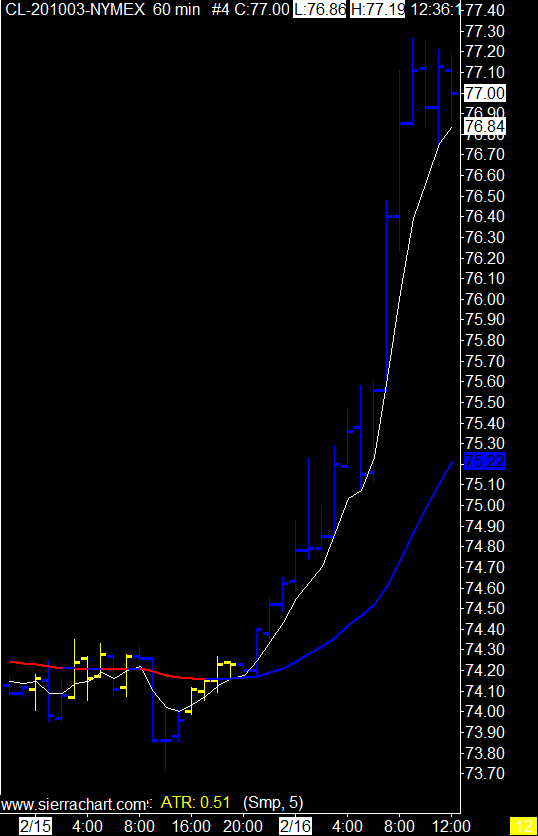

2/16/2010

Jim Collins

An interview discussing his book, Good to Great.

A link to an interview discussing his new book, How The Mighty Fall.

A link to an interview discussing his new book, How The Mighty Fall.

2/11/2010

Risk

This is a wonderful essay on risk, if you're not a trader find some time to watch it. Of course if you are a trader you have nothing but time. :)

I can't get the full program to embed so once the video starts click on watch full program.

I can't get the full program to embed so once the video starts click on watch full program.

2/10/2010

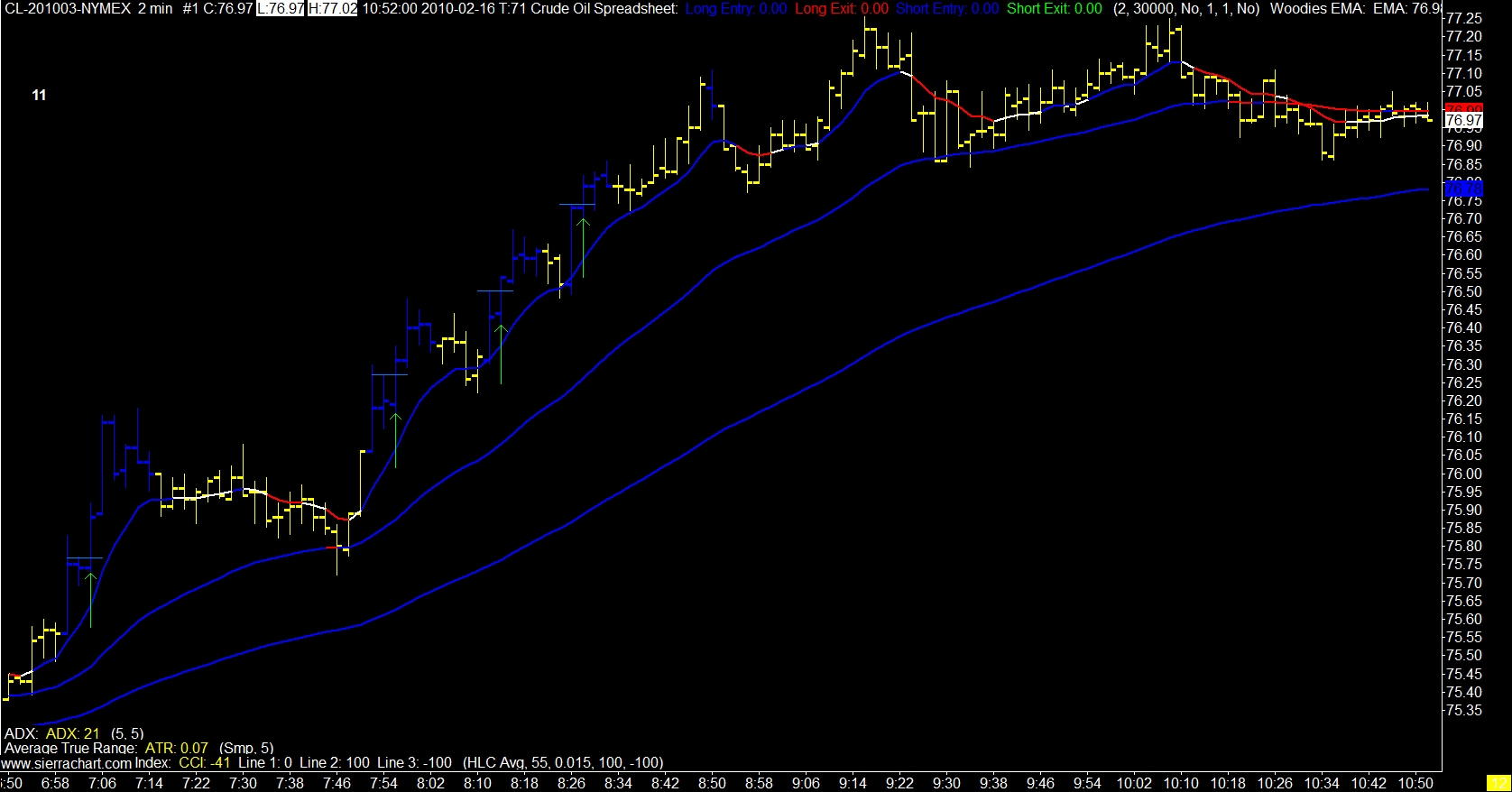

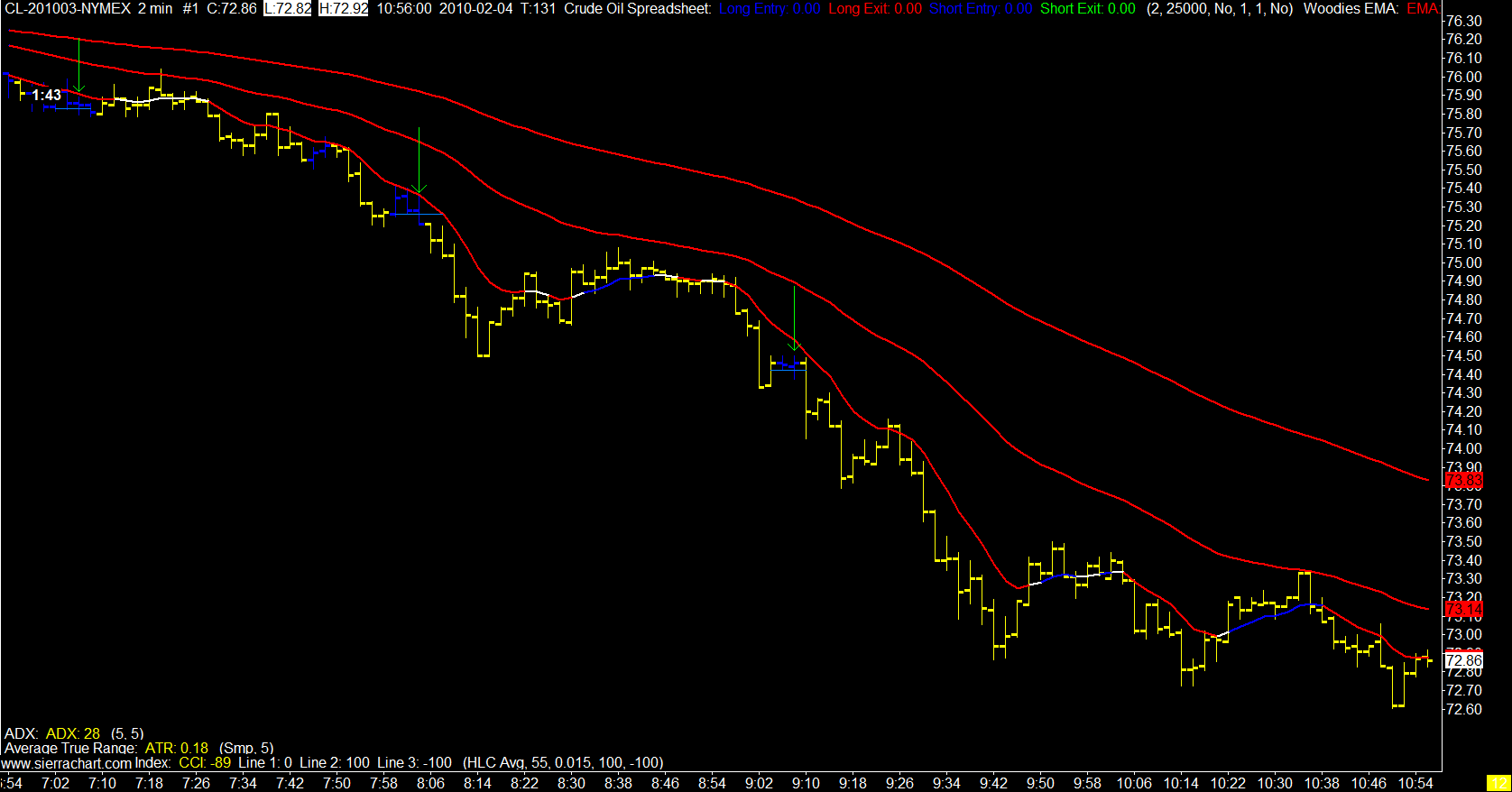

Crude Oil

Crude is moving again, finding some range and direction and staying there for a while. I have removed the "curbs" from the blue bars and am trading more aggressively in the direction of the major trend.

How does this day trader define major trend?

60 minute, 10 minute, 15 minute, something along those lines. Take the 2 minute signals in that direction and ignore the rest. Will miss some good trades as I did this morning but such is life.

2 Minute Crude Oil Chart

The best part is the chart looks much prettier with more blue bars.

I missed the last move as I had to step out for a while.

How does this day trader define major trend?

60 minute, 10 minute, 15 minute, something along those lines. Take the 2 minute signals in that direction and ignore the rest. Will miss some good trades as I did this morning but such is life.

2 Minute Crude Oil Chart

The best part is the chart looks much prettier with more blue bars.

I missed the last move as I had to step out for a while.

2/09/2010

2/06/2010

'The Ascent of Money'

I found this interview interesting and have added the book to my wish list. I couldn't add it to the shopping cart as the last order is still in transit. I figure if I wait a while it won't look like I have a problem.

As in hi my name is Solfest and I can't stop buying books.

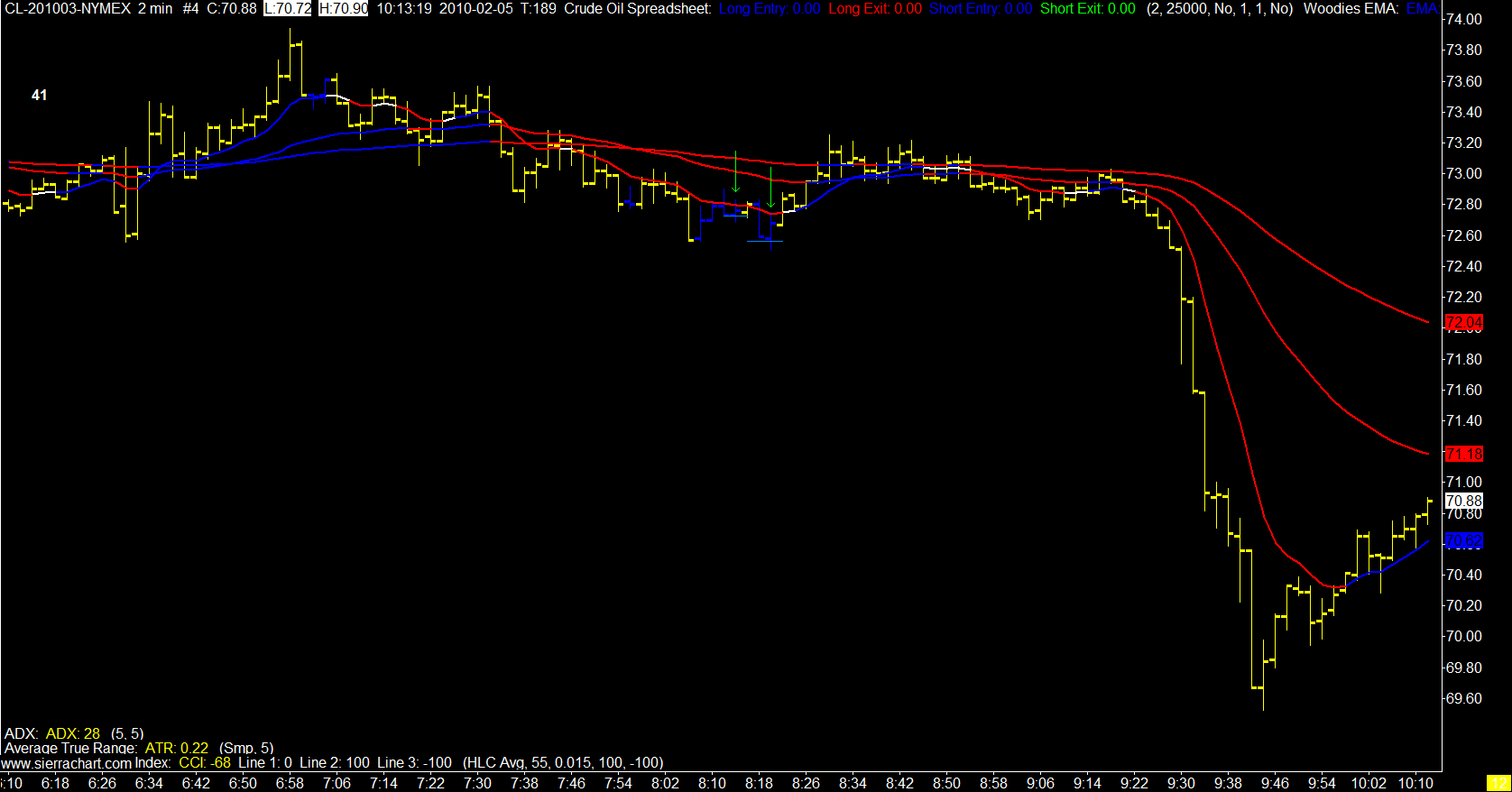

2/05/2010

The Ship Sailed Without Me

We were steaming along quietly and then all of a sudden the sea got a Little rough.

2 Minute Crude oil Chart

Humbug!

2/04/2010

2/02/2010

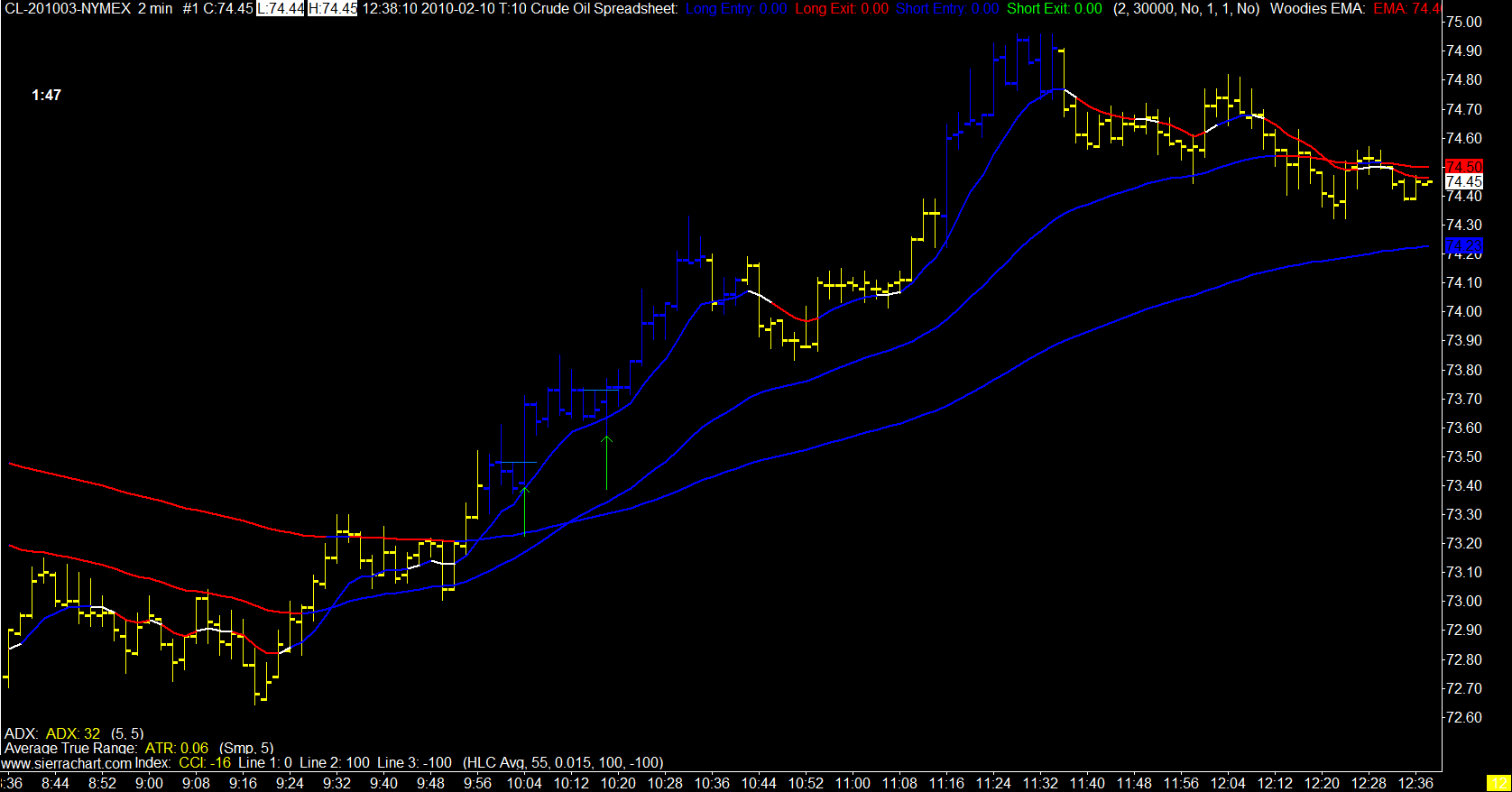

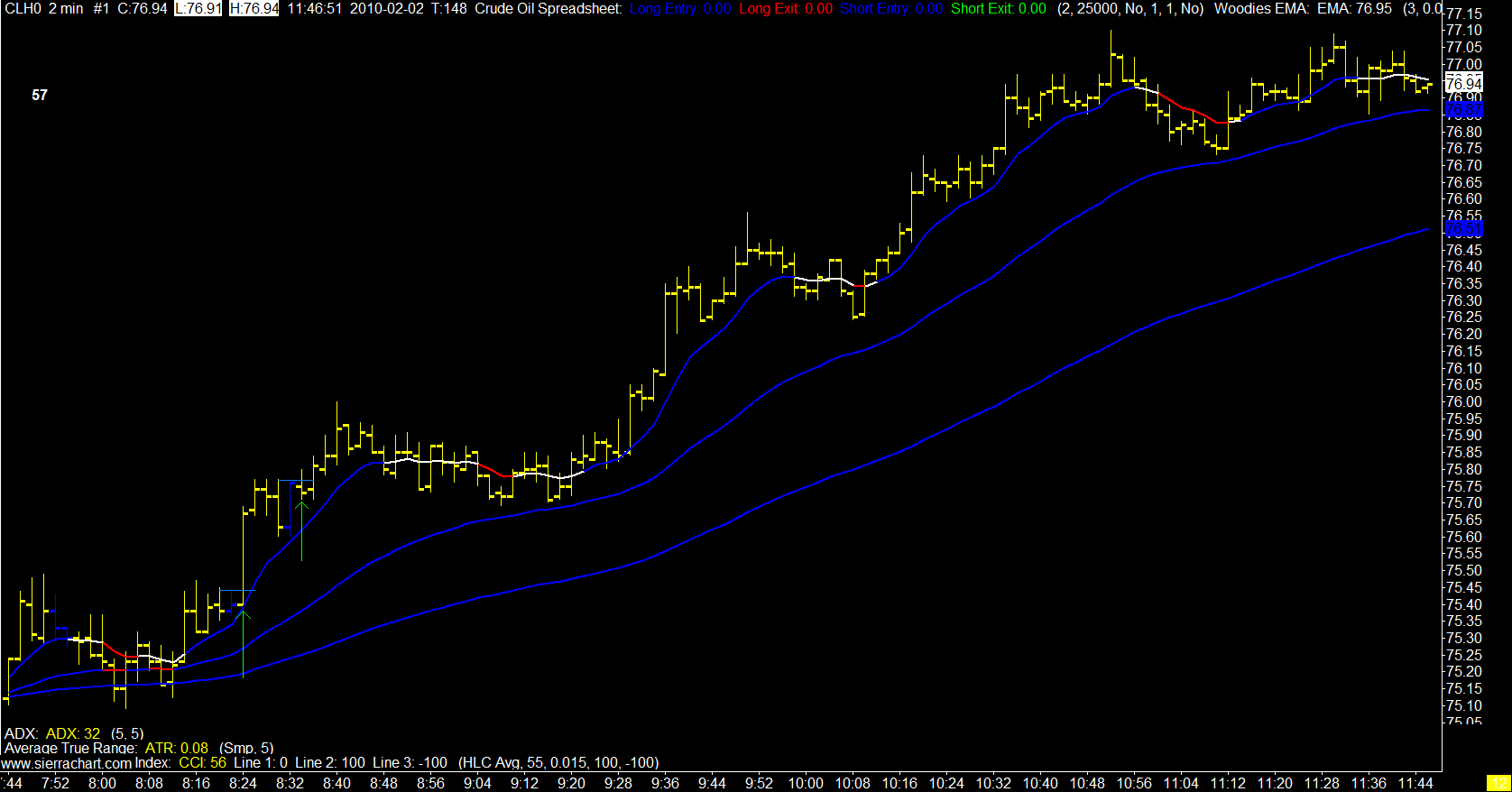

The Porridge is Just Right

Crude came to life today, don't know why and don't care why.

Ok I do care but since I don't know why I just said I didn't care.

I think I may have stumbled onto a nice system for setting targets. If not "nice" then at least one that is rational. Don't have the stats to back that up but I do have a few years of staring at this thing and have earned a bit of a feel for it.

I hope.

Anyway I am using a percentage the 5 day ATR and then setting the actual target number to the first fib number under that percentage.

Could all be a massive case of recency bias but seems to be working nicely for now.

I only got 2 signals in this massive move up today as the signals stopped due to the EMA spread.

Both hit target and that always makes the "just watching" part of the day a little more relaxing.

2 Minute Crude Oil Chart

Obviously with the right side of the chart filled out I left a lot of porridge on the table today. (and the day's not over) That's ok, the right side of the chart was blank when I exited. I traded my plan my way and it all worked out.

Nice day.

Ok I do care but since I don't know why I just said I didn't care.

I think I may have stumbled onto a nice system for setting targets. If not "nice" then at least one that is rational. Don't have the stats to back that up but I do have a few years of staring at this thing and have earned a bit of a feel for it.

I hope.

Anyway I am using a percentage the 5 day ATR and then setting the actual target number to the first fib number under that percentage.

Could all be a massive case of recency bias but seems to be working nicely for now.

I only got 2 signals in this massive move up today as the signals stopped due to the EMA spread.

Both hit target and that always makes the "just watching" part of the day a little more relaxing.

2 Minute Crude Oil Chart

Obviously with the right side of the chart filled out I left a lot of porridge on the table today. (and the day's not over) That's ok, the right side of the chart was blank when I exited. I traded my plan my way and it all worked out.

Nice day.

Subscribe to:

Posts (Atom)