WARNING: This post is very long and has no pictures. If this alarms you skip down to the next post which has few words and shiny pictures of charts.

Pandu the FX trader from Australia asked me this on an

old post.

"I want to know what do you mean by 'The hard stop value is set as a % of the range bar we are trading.'. What is the meaning of 'Range Bar'? Also, what parameters do you use for the ADX you use?"

So that along with all the google searches for

renko bar trading I get on this blog I thought I should take a moment and discuss why I quit using

range bars and or renko bars.

In a word, time.

We all have access to the same data, we all live in the same space and time continuum. I heard that on Star Trek I think.

I don't move the market. I want to be looking at what most everyone else is looking at. Why? Because I'm going to ride along with whomever, collectively or all by themselves, does move the market.

So we're all looking at price move and we are all breaking down that price action with different methods. We have volume, time, and tick data and all of it tracks the same price but presents the trader bar closes in different ways. I want to look at the chart picture with the method, time, that I think most other traders are using. Note I said think, not know.

Of course everyone who uses one of those categories thinks it is the best. Until they change, just like I have. :)

Back to Pandu's question. The range bar measures a set range of price movements and when that range is met the bar prints.

A renko bar does the same except the range has to be all in one direction for the bar to print. So with a 10 tick renko bar the range has to be all up or all down for it to print. A 10 tick range bar could open at 70.25 and have 5 ticks up to 70.30 and 5 ticks down to 70.20 and the bar would print. A 10 tick renko bar would have to have 10 ticks up to 70.35 or 10 ticks down to 70.15 before it would print.

There are other little nuances to them both depending on your chart service but I'm not going into that here.

Got it? I hope so it exhausted me explaining it.

So the benefits to both are when price moves quickly the bars start printing. We need the bars to print in order for our indicators to, well, indicate. It may be a shock for some but all our indicators are lagging. Sorry. They need the price bars to move in order for them to do their "magic".

This all sounds good and works for many people, like the man who loves rain (Rainwater) and really wants to be included in Jules private blog but is too shy to ask. (Rainwater uses range bars not renko bars)

Actually it sounds so good it's making me wonder why I gave them up?

Renko, I gave up because there can be too much intra bar movement and it is too hard to find your way in with renko alone. I started using time charts with renko and then eventually just dumped the renko. Renko charts are great for keeping you in a trade and could be used for a technical exit, but then I started trading for a target rather than a technical exit so renko went bye bye.

Range bars are probably of more use but I found they gave me too many false starts and I need to control my pushy the button fingers.

I control them with time.

Time, I have to wait. I use 1 and 2 minute bars so I don't wait for long but

for me, let me say again,

for me, I find that time works the best.

Am I late sometimes? Yes. I give that up in order to stay out of some false moves.

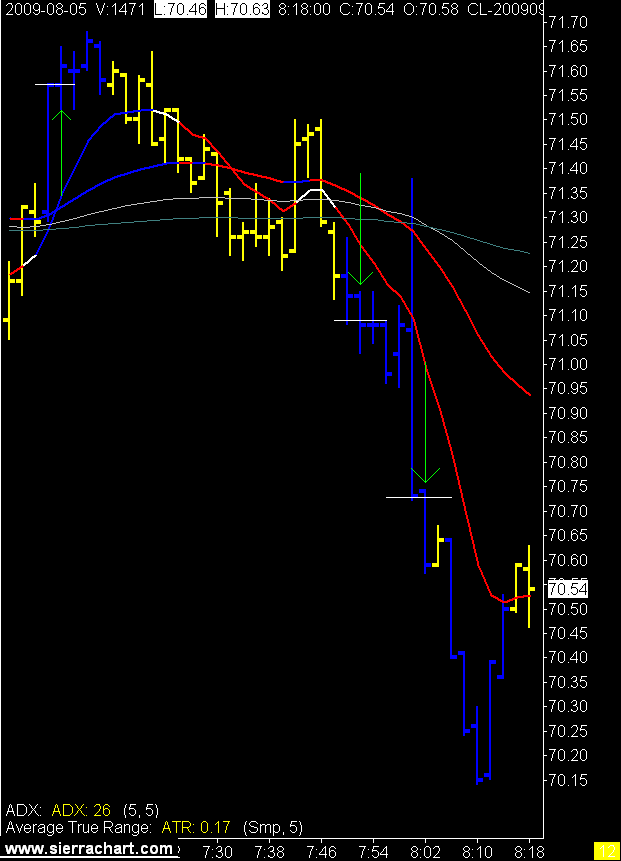

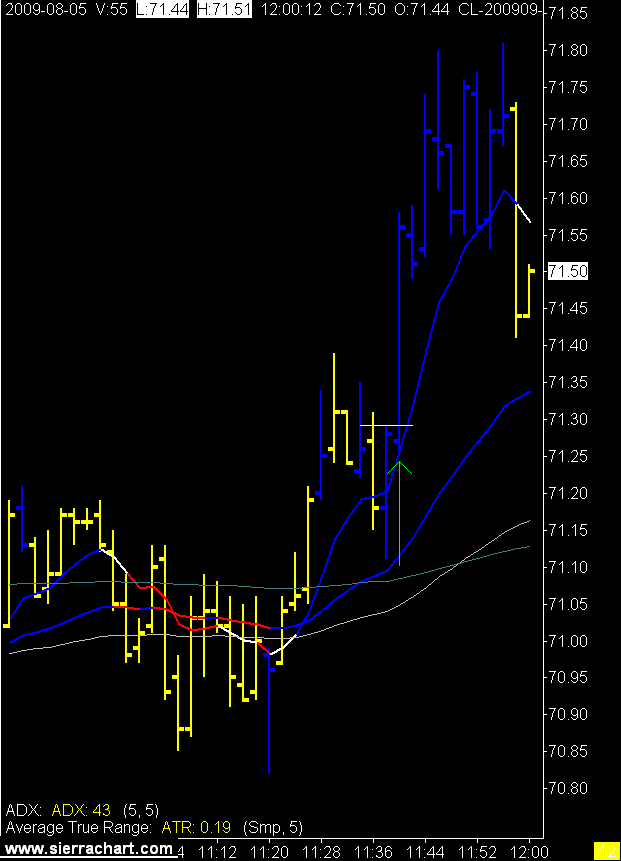

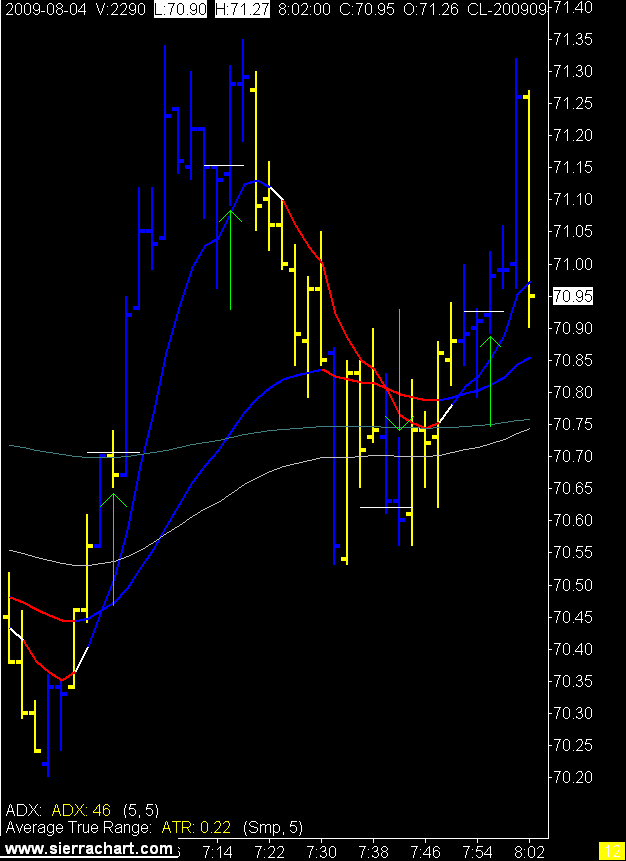

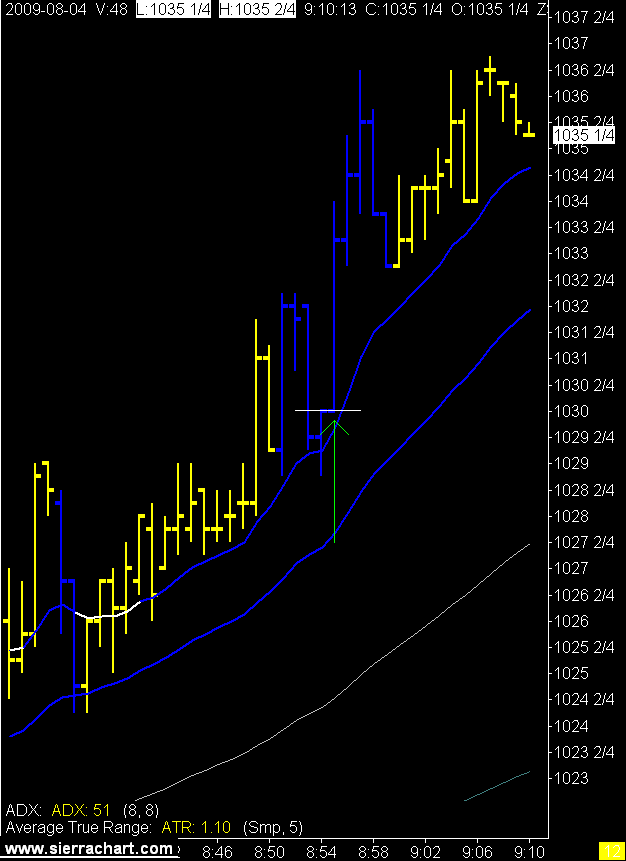

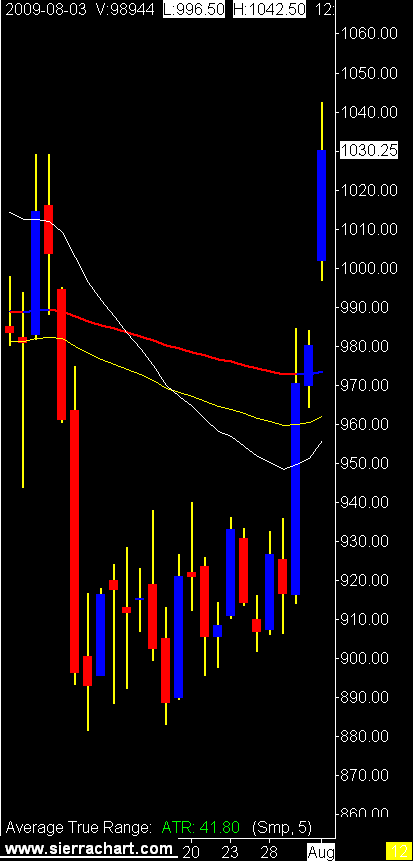

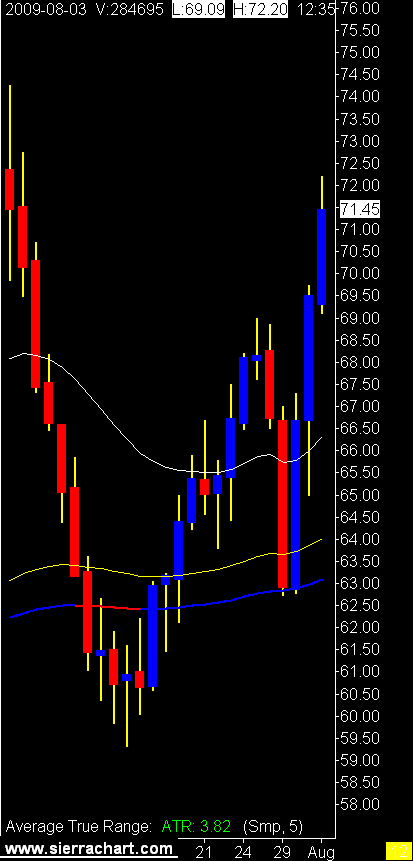

So there it is, my trading still looks at range via the ATR, I need to see some movement in one direction via the ADX, I need price on the right side of the EMA's, I look for a higher high or lower low and away we go.

The longer multiple EMAs are there to simulate what a longer term chart would be showing in terms of trend and direction. Like a 5 and 15 minute chart or so.

This is a very long post with no pictures which may be alarming to some. I better place a warning at the top of this post.

Oh yes the rest of Pandu's questions. My stop on the range or renko bar was a % of the bar I was using. So for a 20 tick range bar I may use 75% of that as a stop, 15 ticks. With the ADX and ATR I am looking for a minimum threshold to be met before I start looking for signals. That's all.

P.S. Those renko bar charts were sure pretty.

Home

On another note China may have found the cure for all the investment fraud we have seen in North America lately.

On another note China may have found the cure for all the investment fraud we have seen in North America lately.