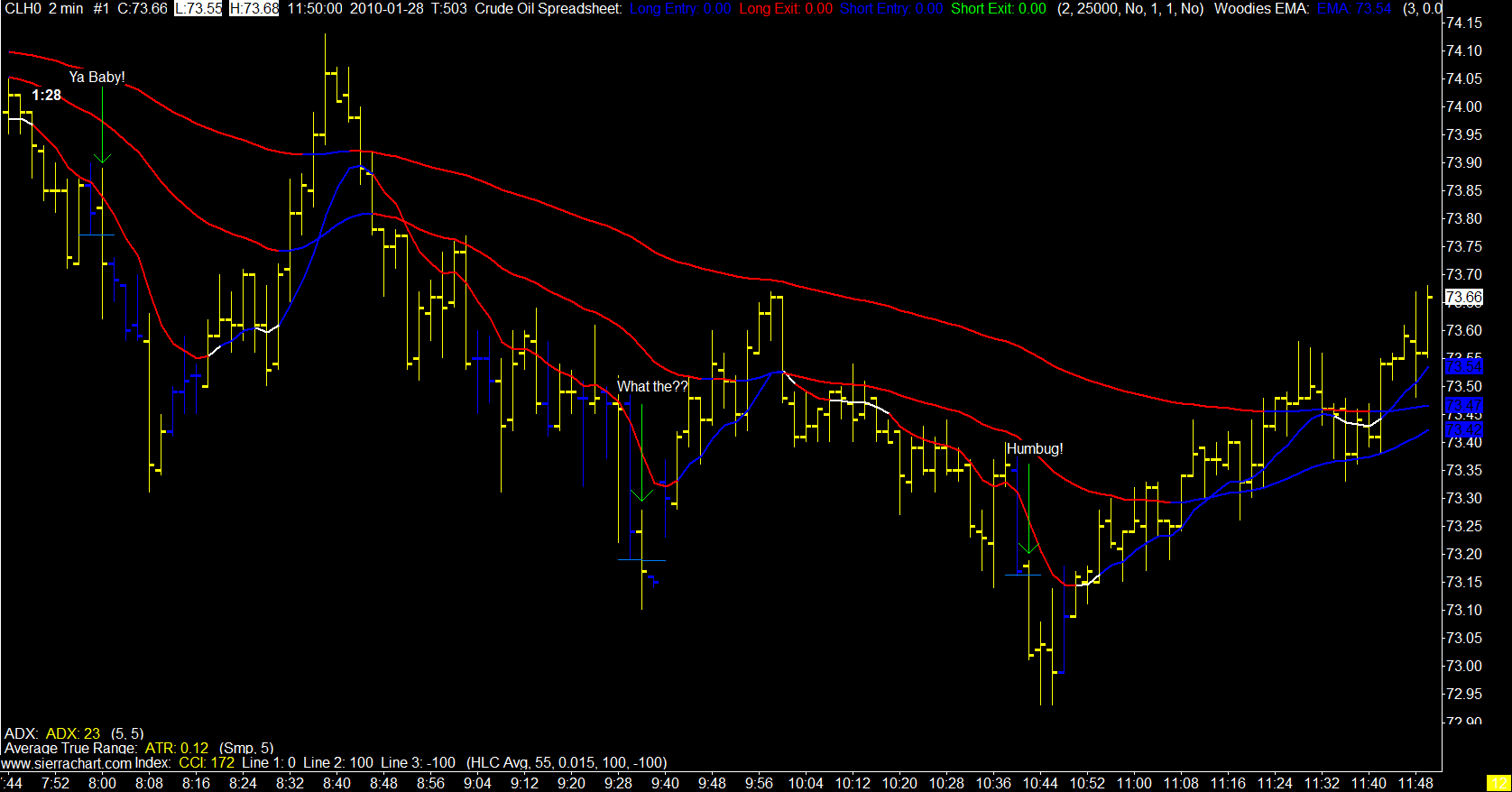

Today?

We had a ya baby, a why is my chart not moving, and a near miss.

2 Minute Crude Oil Chart

Ya baby speaks for itself, lost data while in the second trade so I sat there wondering why my stop was hit while price had not moved, and the third was a near miss of target with the trailing stop taken out for break even.

All in all just another day in the pit.

1/28/2010

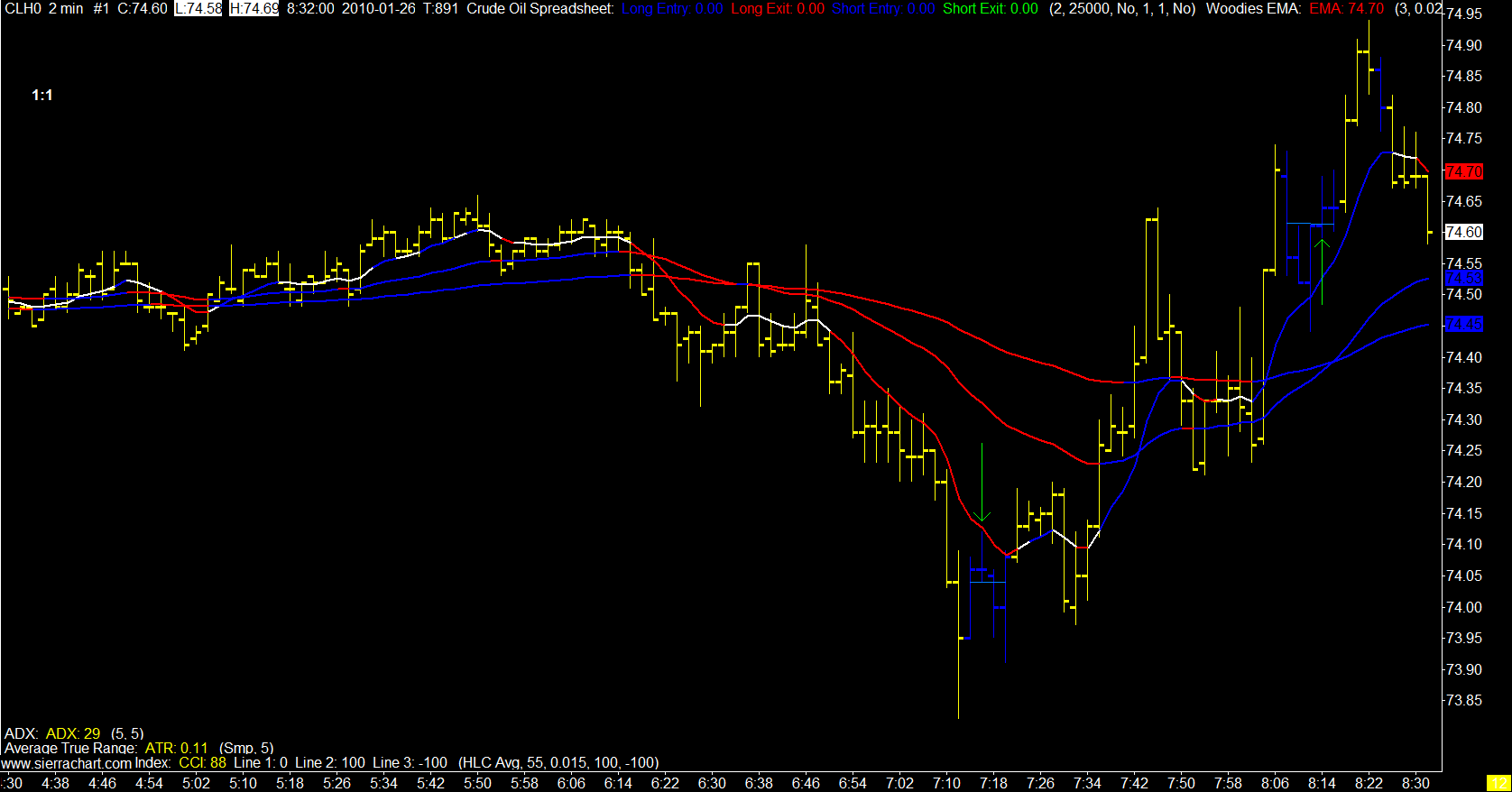

1/26/2010

Range is Scarce

I don't really have anything wonderful to post today however since I think we would all like to stop looking at that poor woman's face I thought I would post a couple of charts.

Five day ATR is still barely over 2.00 and the results of that still show on the 2 minute chart. The moves are few and weak. Caught a partial stop (-9) and a target (+29) today.

Give me range or give me death.

Too much?

Ya.

I tried please before and that didn't work.

2 Minute Crude Oil Charts

Five day ATR is still barely over 2.00 and the results of that still show on the 2 minute chart. The moves are few and weak. Caught a partial stop (-9) and a target (+29) today.

Give me range or give me death.

Too much?

Ya.

I tried please before and that didn't work.

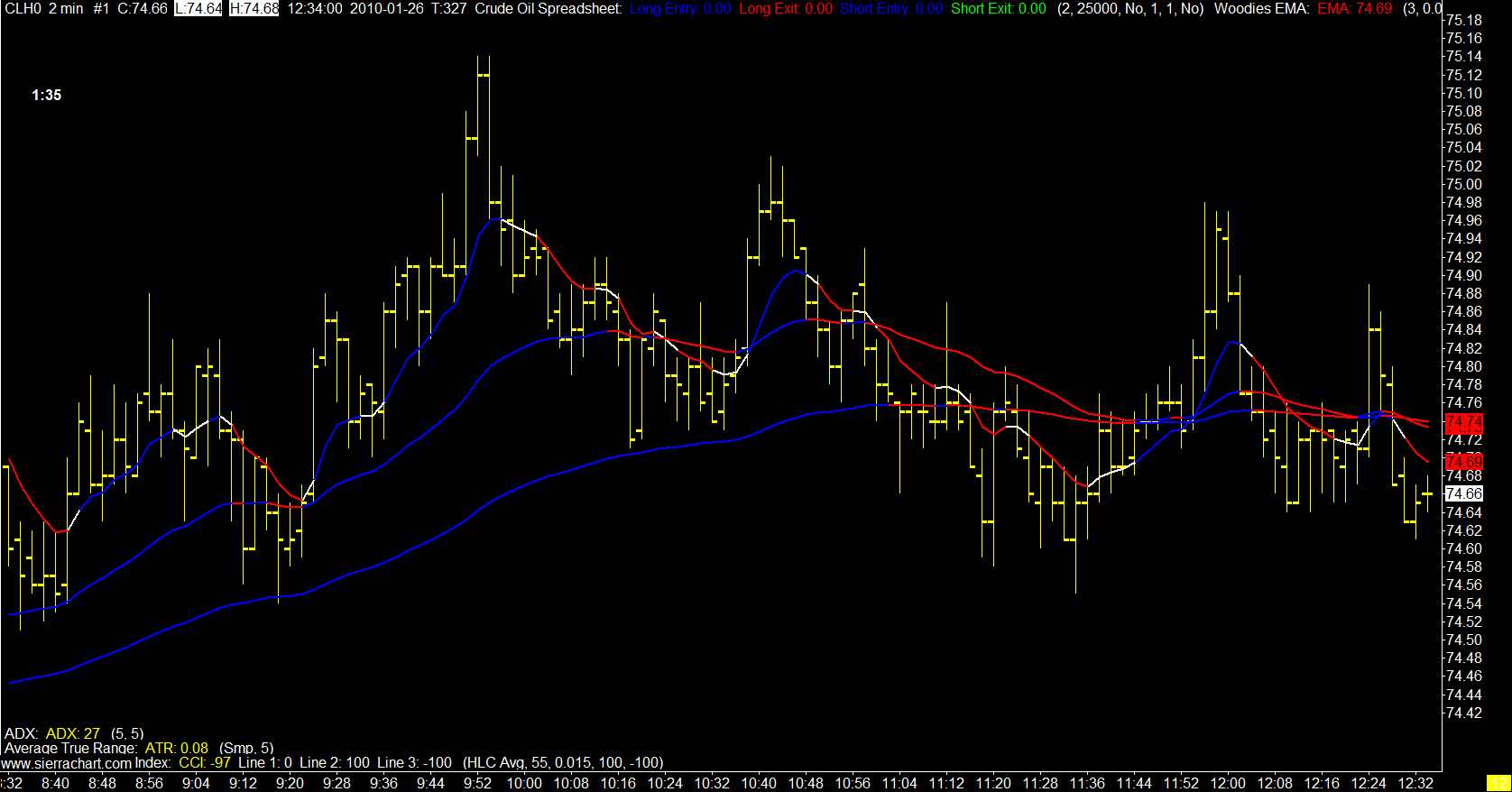

2 Minute Crude Oil Charts

1/21/2010

The New America

Dear Americans:

There seems to be a slight decline in your status as the most powerful nation on earth. We your adoring neighbors to the north respect all you have accomplished in your 200+ years but have noticed you are starting to look a little long in the tooth.

We note that you appear to have noticed this yourselves as you have made several cosmetic intrusions in an attempt to hide the evidence of your declining state.

You have gone out and got yourself a new President and we all were very excited and happy with your choice. However over his first year in office we have noticed a few things which does cause us some alarm.

Your new President is now taxing banks, dictating compensation, firing CEOs, dictating lending practices, and now wants to ban proprietary trading at banks. President Obama has correctly taken the pulse of his America and decided that everyone now hates banks. This gives him free reign to do and take whatever he wants from them.

Do the banks deserve this treatment? Of course they made their deal with devil (the government, not President Obama) and now he is coming to collect.

Your humble scribe is then forced to wonder if everyone hates them why didn’t they just let them go bankrupt.

There seems to be a new America emerging, a new American capitalism. A capitalism that no longer is willing to accept the risk in the good old risk reward equation. In fact you appear to be no longer willing to accept the reward in that equation either. Well that is, of course, if those rewards are not coming to you personally.

Banks, insurers, car manufacturers are now all free to do really stupid things for years and years and no longer have to worry about the consequences. If you are deemed to big to fail you will be saved no matter how stupid you are.

Of course after your resurrection the government will now dictate all the terms of your new existence.

It seems odd to me that you appear to be willing to throw away a system that made you the most powerful country on earth simply because of a recession?

The common theme running through mainstream, or should I say Main Street, USA is that capitalism has failed them. Is this not the most glaring case of recency bias you can think of?

You are trying to kill the very engine that made you who you are. All because markets went down for a while? In case you have not noticed or sold everything in March of 2009 the market has almost made it all back. When things get bad we have to remember that we are trading the 100 year DOW chart not the 3 year DOW chart. Making decisions based on the 3 year chart is insane.

Americans want to blame someone. So you have blamed the banks, not just some of the banks but all of them.

Let's think about this, if you bought a house in 2007 for $500,000 and took out a $500,000 mortgage to pay for it, and then you went broke, you are an idiot.

Idiots are supposed to go broke. That's capitalism. If you are a bank CEO and bought billions of CDO's with borrowed money and then the market collapsed you are an idiot. Idiots are supposed to go broke.

But no, we now live in a world without consequences. It's not your fault, you can't be the idiot. It's the bank fault, it's the mortgage brokers fault, it has to someone else's fault.

Well guess what. IT’S YOUR FAULT!

If the banks and auto manufacturers that were broke were allowed to go through the bankruptcy process they would be better off than they are now. The system would be better off. We would all be better off because the idiots have been eliminated and the geniuses have been made stronger as they now have less competition.

Capitalism is a hard beast. It has to be. It just doesn’t work unless there are consequences to stupid actions. We have all seen that communism doesn’t work as an economic system, i.e. Cuba and North Korea; socialism can work as it does in the Scandinavian countries but you have to pay for it with 60% taxes and the like.

Americans now seem to want a socialist state except for the part where they have to pay for it. Hence the 1.4 trillion dollar deficit.

So now the knives are out. The government needs money and they are going to go after banks to get it. The government knows the people will be with them on this one. You can all blame the banks, take their money, and continue on in your world without consequences.

We should all remember that at some point even plastic surgery can’t hide the truth.

There seems to be a slight decline in your status as the most powerful nation on earth. We your adoring neighbors to the north respect all you have accomplished in your 200+ years but have noticed you are starting to look a little long in the tooth.

We note that you appear to have noticed this yourselves as you have made several cosmetic intrusions in an attempt to hide the evidence of your declining state.

You have gone out and got yourself a new President and we all were very excited and happy with your choice. However over his first year in office we have noticed a few things which does cause us some alarm.

Your new President is now taxing banks, dictating compensation, firing CEOs, dictating lending practices, and now wants to ban proprietary trading at banks. President Obama has correctly taken the pulse of his America and decided that everyone now hates banks. This gives him free reign to do and take whatever he wants from them.

Do the banks deserve this treatment? Of course they made their deal with devil (the government, not President Obama) and now he is coming to collect.

Your humble scribe is then forced to wonder if everyone hates them why didn’t they just let them go bankrupt.

There seems to be a new America emerging, a new American capitalism. A capitalism that no longer is willing to accept the risk in the good old risk reward equation. In fact you appear to be no longer willing to accept the reward in that equation either. Well that is, of course, if those rewards are not coming to you personally.

Banks, insurers, car manufacturers are now all free to do really stupid things for years and years and no longer have to worry about the consequences. If you are deemed to big to fail you will be saved no matter how stupid you are.

Of course after your resurrection the government will now dictate all the terms of your new existence.

It seems odd to me that you appear to be willing to throw away a system that made you the most powerful country on earth simply because of a recession?

The common theme running through mainstream, or should I say Main Street, USA is that capitalism has failed them. Is this not the most glaring case of recency bias you can think of?

You are trying to kill the very engine that made you who you are. All because markets went down for a while? In case you have not noticed or sold everything in March of 2009 the market has almost made it all back. When things get bad we have to remember that we are trading the 100 year DOW chart not the 3 year DOW chart. Making decisions based on the 3 year chart is insane.

Americans want to blame someone. So you have blamed the banks, not just some of the banks but all of them.

Let's think about this, if you bought a house in 2007 for $500,000 and took out a $500,000 mortgage to pay for it, and then you went broke, you are an idiot.

Idiots are supposed to go broke. That's capitalism. If you are a bank CEO and bought billions of CDO's with borrowed money and then the market collapsed you are an idiot. Idiots are supposed to go broke.

But no, we now live in a world without consequences. It's not your fault, you can't be the idiot. It's the bank fault, it's the mortgage brokers fault, it has to someone else's fault.

Well guess what. IT’S YOUR FAULT!

If the banks and auto manufacturers that were broke were allowed to go through the bankruptcy process they would be better off than they are now. The system would be better off. We would all be better off because the idiots have been eliminated and the geniuses have been made stronger as they now have less competition.

Capitalism is a hard beast. It has to be. It just doesn’t work unless there are consequences to stupid actions. We have all seen that communism doesn’t work as an economic system, i.e. Cuba and North Korea; socialism can work as it does in the Scandinavian countries but you have to pay for it with 60% taxes and the like.

Americans now seem to want a socialist state except for the part where they have to pay for it. Hence the 1.4 trillion dollar deficit.

So now the knives are out. The government needs money and they are going to go after banks to get it. The government knows the people will be with them on this one. You can all blame the banks, take their money, and continue on in your world without consequences.

We should all remember that at some point even plastic surgery can’t hide the truth.

1/19/2010

'Long & Wrong'

Long & Wrong? That sounds familiar. Hmmmm.

So I ignored my own advice and took one trade today. Twas the only signal bar that had a subsequent entry bar in the day. Barely made target which currently is at my absolute minimum to trade.

If the trade had failed I would have posted how dumb I was for not staying out of this market. Since it worked I can say.....

No I can't, it was still a dumb trade. We need more range. We need LW to start moving his massively leveraged liquidity into the crude oil pit.

Something, anything, just make it move.

Please.

2 Minute Crude Oil Chart

So I ignored my own advice and took one trade today. Twas the only signal bar that had a subsequent entry bar in the day. Barely made target which currently is at my absolute minimum to trade.

If the trade had failed I would have posted how dumb I was for not staying out of this market. Since it worked I can say.....

No I can't, it was still a dumb trade. We need more range. We need LW to start moving his massively leveraged liquidity into the crude oil pit.

Something, anything, just make it move.

Please.

2 Minute Crude Oil Chart

1/15/2010

Warning

The crude oil market is currently operating without range. So that means trading, at least for my system, in this market is a good way to blow up.

I haven't read my business plan for a while; I do believe it mentions something about not blowing up.

How do you not blow up?

You don't trade.

You do nothing.

The hardest thing in the world for most people to do, including me, is to do nothing.

The right thing to do is quite often the hard thing to do.

I haven't read my business plan for a while; I do believe it mentions something about not blowing up.

How do you not blow up?

You don't trade.

You do nothing.

The hardest thing in the world for most people to do, including me, is to do nothing.

The right thing to do is quite often the hard thing to do.

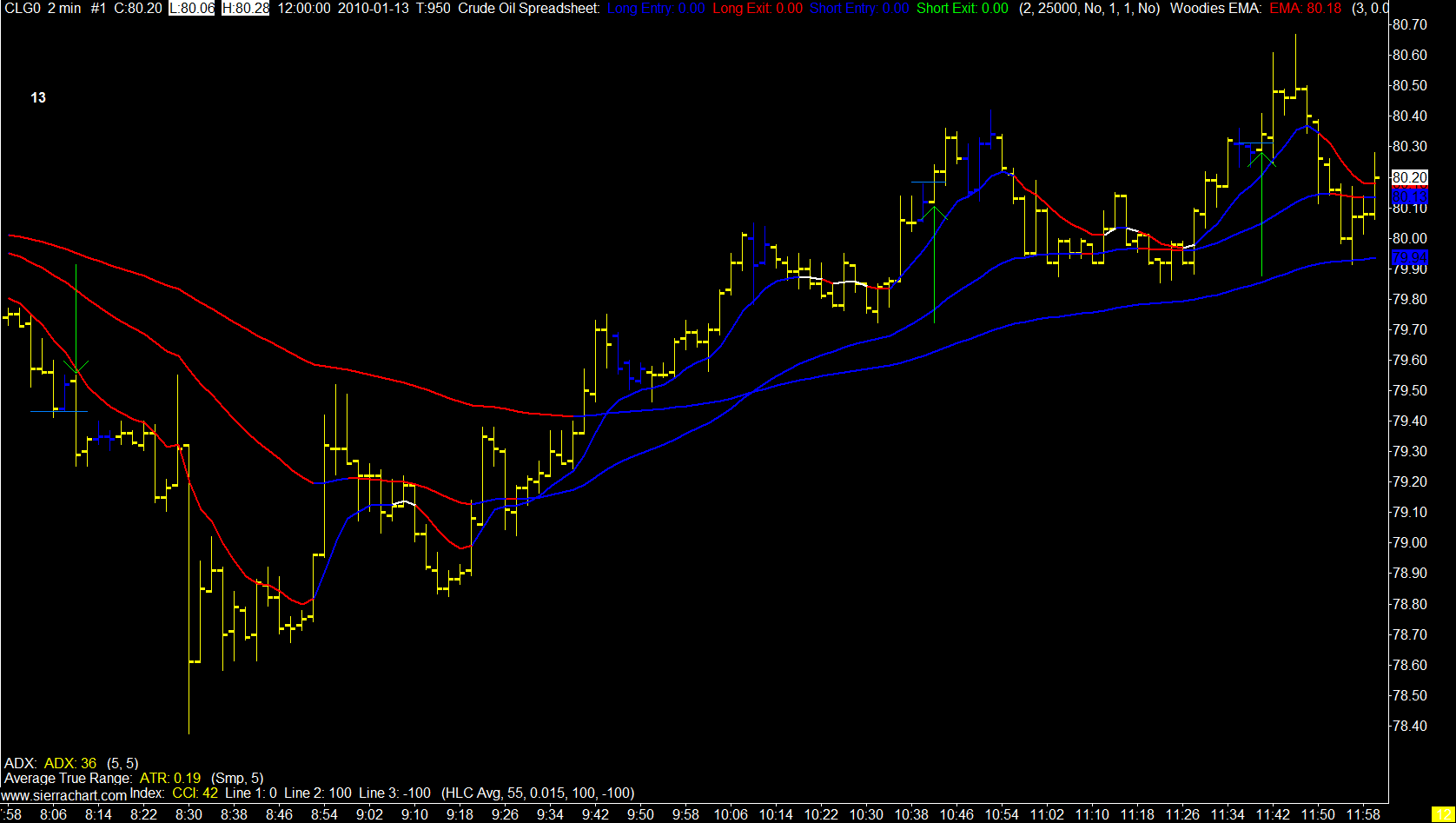

1/13/2010

Wednesday

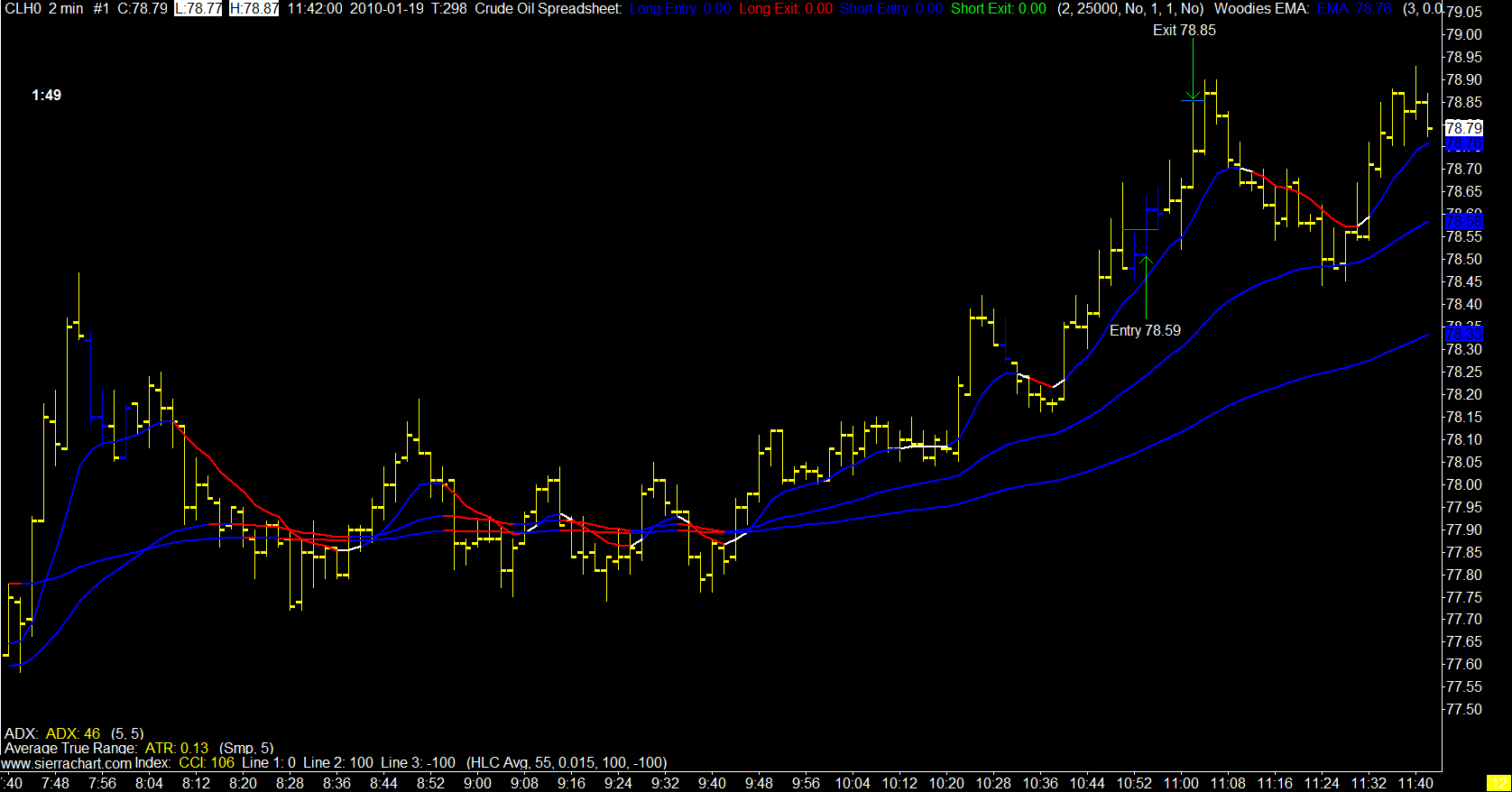

2 Minute Crude Oil Chart

Three trades today with the barrel count providing a catalyst. First trade caught my trailing stop for a net tick, second trade I bailed just before target as we were having a tough time getting through the HOD to get to target, and the third trade hit target.

There have been a few changes to the magic blue bars. You may notice there are not as many of them as before. That is due to some coding that drops the signal as price moves a certain distance away from the 8 EMA, and or the 3 EMAs spread gets to wide.

So if I get a signal bar and enter I want to see the blue bars disappear as that means price is moving my way fast.

I am also using a factor of the 5 day ATR for my target now.

Seems to make sense.

That 5 day ATR is still very low and any trading in this market is muted at best. Anybody who is relatively new to the crude oil pit should know that this is not the "normal" price action we usually see.

Hopefully we see the volatility pick up soon.

Three trades today with the barrel count providing a catalyst. First trade caught my trailing stop for a net tick, second trade I bailed just before target as we were having a tough time getting through the HOD to get to target, and the third trade hit target.

There have been a few changes to the magic blue bars. You may notice there are not as many of them as before. That is due to some coding that drops the signal as price moves a certain distance away from the 8 EMA, and or the 3 EMAs spread gets to wide.

So if I get a signal bar and enter I want to see the blue bars disappear as that means price is moving my way fast.

I am also using a factor of the 5 day ATR for my target now.

Seems to make sense.

That 5 day ATR is still very low and any trading in this market is muted at best. Anybody who is relatively new to the crude oil pit should know that this is not the "normal" price action we usually see.

Hopefully we see the volatility pick up soon.

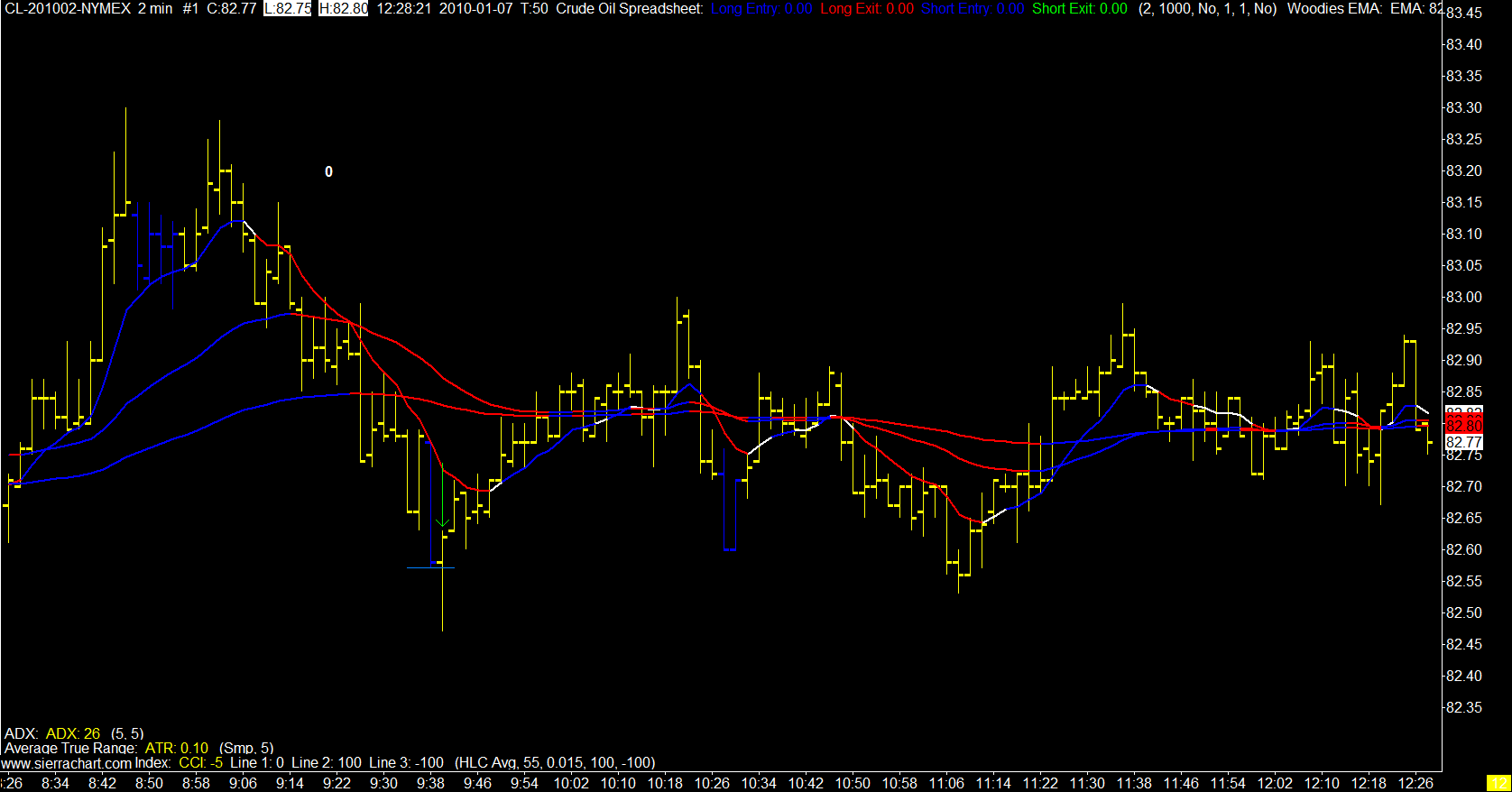

1/07/2010

Talking Heads

The talking heads are annoying me.

With the start of a new year you dare not tune into CNBC, Bloomberg, BNN, or any business news with out bearing the full brunt of some "brilliant" prognostication.

Everyone is asked what's going to happen in 2010. Where's the S & P, the DOW, crude oil, natural gas, gold, pork bellies, etc going in the new year.

The astonishing thing is they all have an answer. The interviewer loves this part, the part where they get an answer. It makes them feel powerful. The interviewer I mean, not the prognosticator. Most of the prognosticators have been around the block once or twice.

They all know that their prediction is a load of crap.

They also know that they have to deliver this load when asked.

Why?

Because they are all salesmen. They need us to buy what they're selling.

We don't want to buy if the answer, to what's the DOW going to do in 2010, is I dunno.

We don't like, I dunno.

But it's the truth.

Some people can't handle the truth.

With the start of a new year you dare not tune into CNBC, Bloomberg, BNN, or any business news with out bearing the full brunt of some "brilliant" prognostication.

Everyone is asked what's going to happen in 2010. Where's the S & P, the DOW, crude oil, natural gas, gold, pork bellies, etc going in the new year.

The astonishing thing is they all have an answer. The interviewer loves this part, the part where they get an answer. It makes them feel powerful. The interviewer I mean, not the prognosticator. Most of the prognosticators have been around the block once or twice.

They all know that their prediction is a load of crap.

They also know that they have to deliver this load when asked.

Why?

Because they are all salesmen. They need us to buy what they're selling.

We don't want to buy if the answer, to what's the DOW going to do in 2010, is I dunno.

We don't like, I dunno.

But it's the truth.

Some people can't handle the truth.

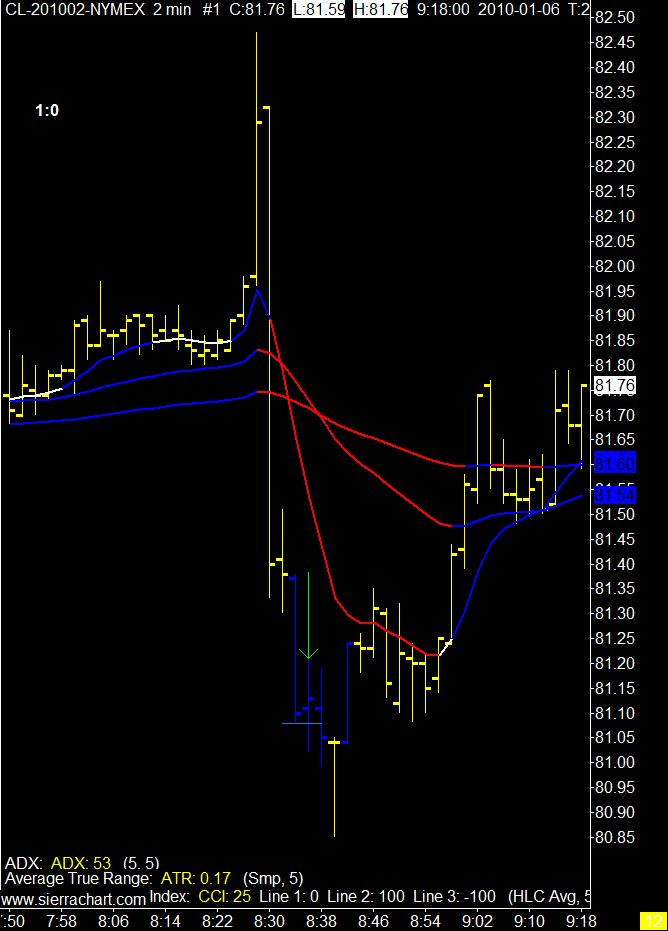

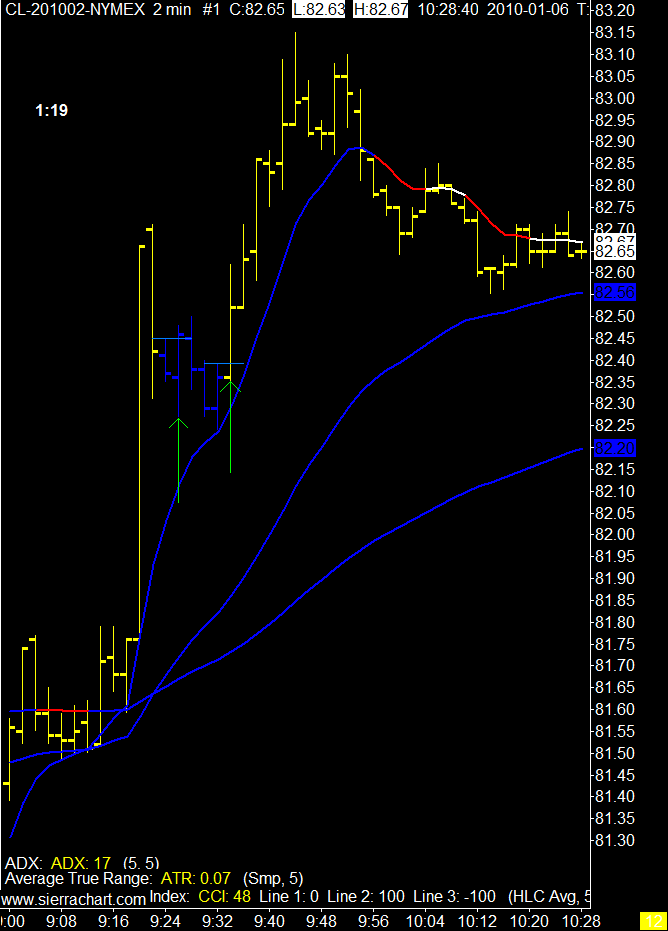

1/06/2010

Sign of Life

The barrel count woke up the crude oil market today and I took a couple of trades. Hopefully we see the daily ATR increase.

2 Minute Crude Oil Chart

2 Minute Crude Oil Chart

Subscribe to:

Comments (Atom)