Showing posts with label crude oil chart. Show all posts

Showing posts with label crude oil chart. Show all posts

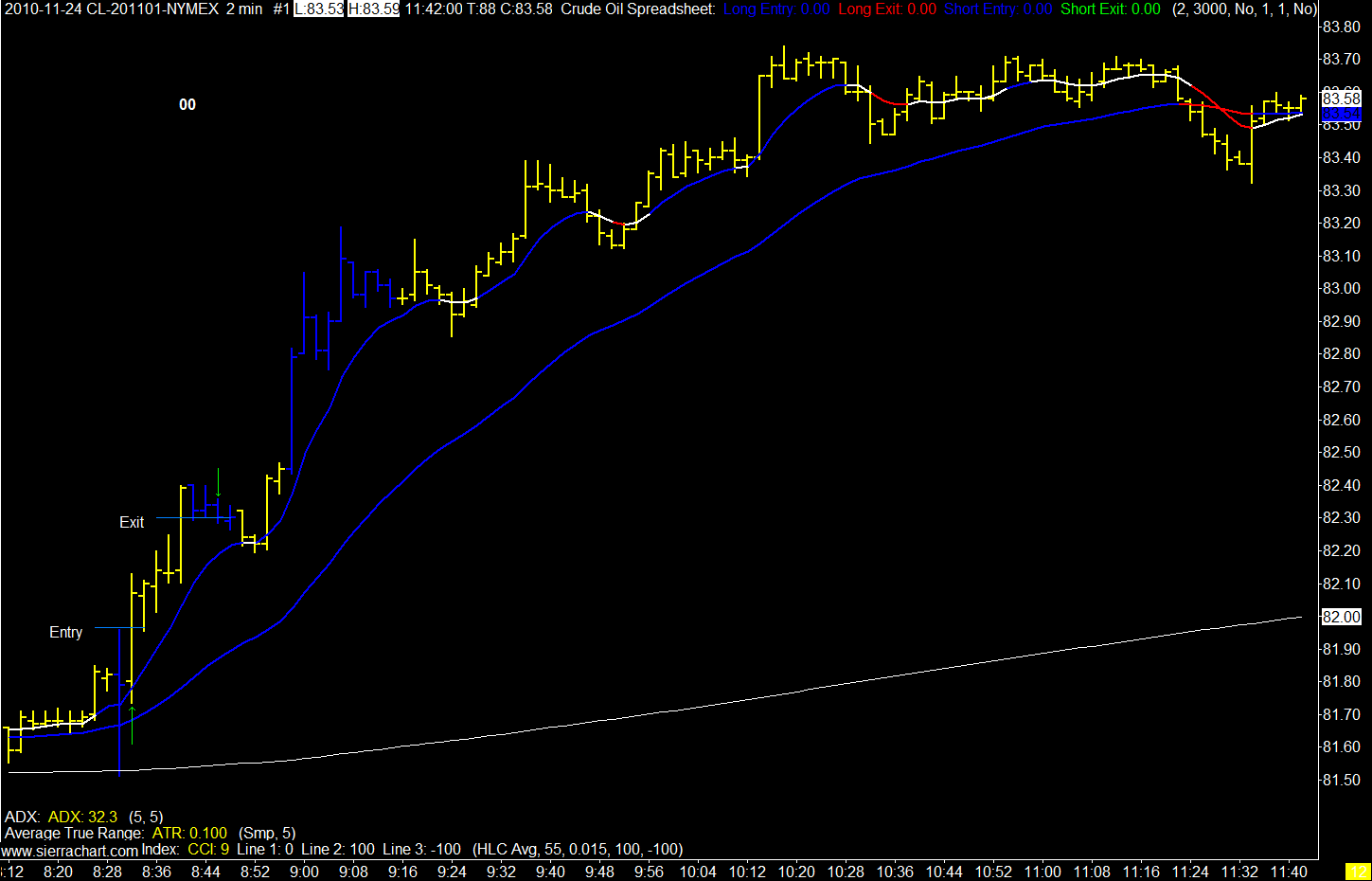

11/24/2010

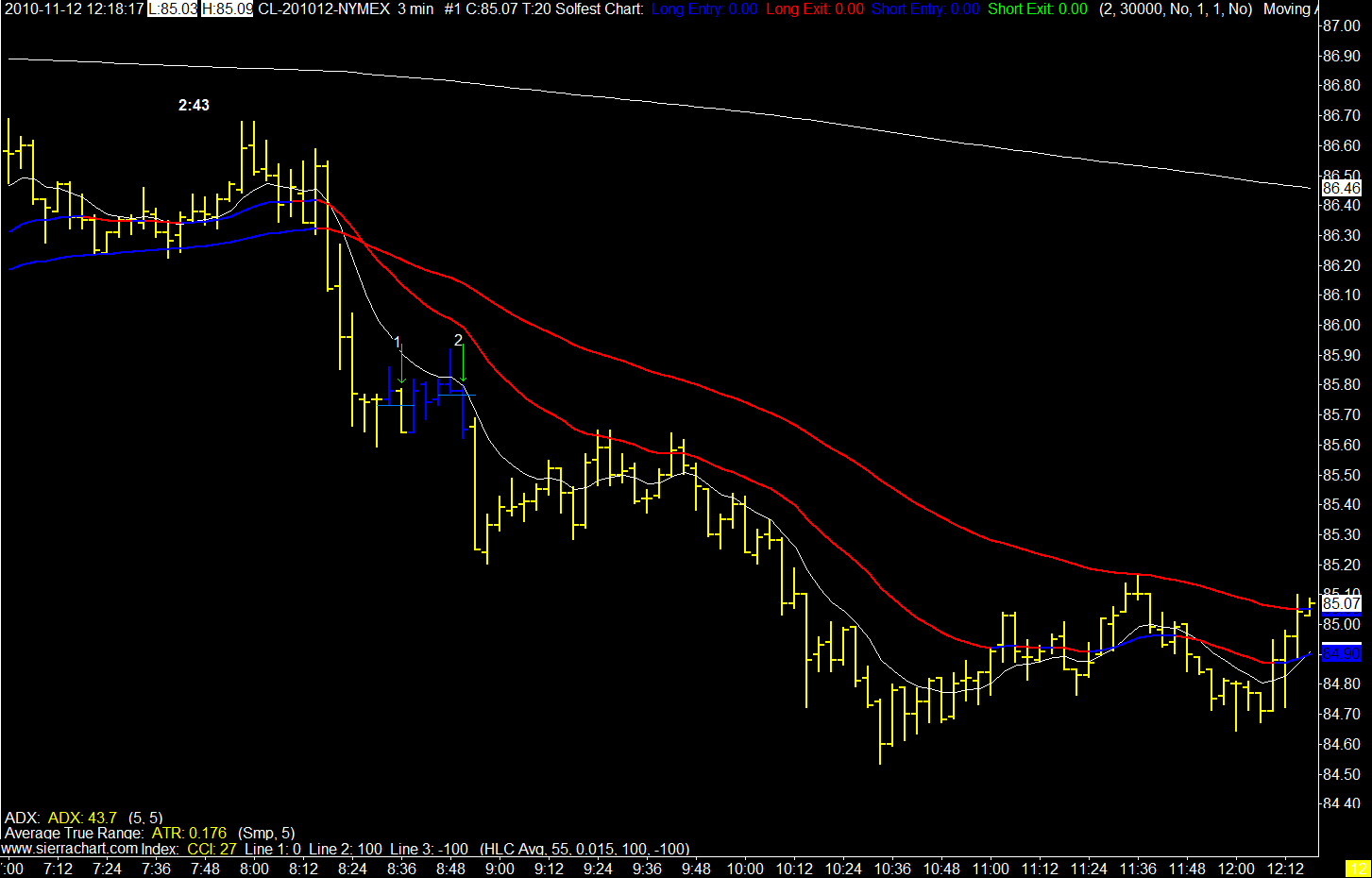

11/12/2010

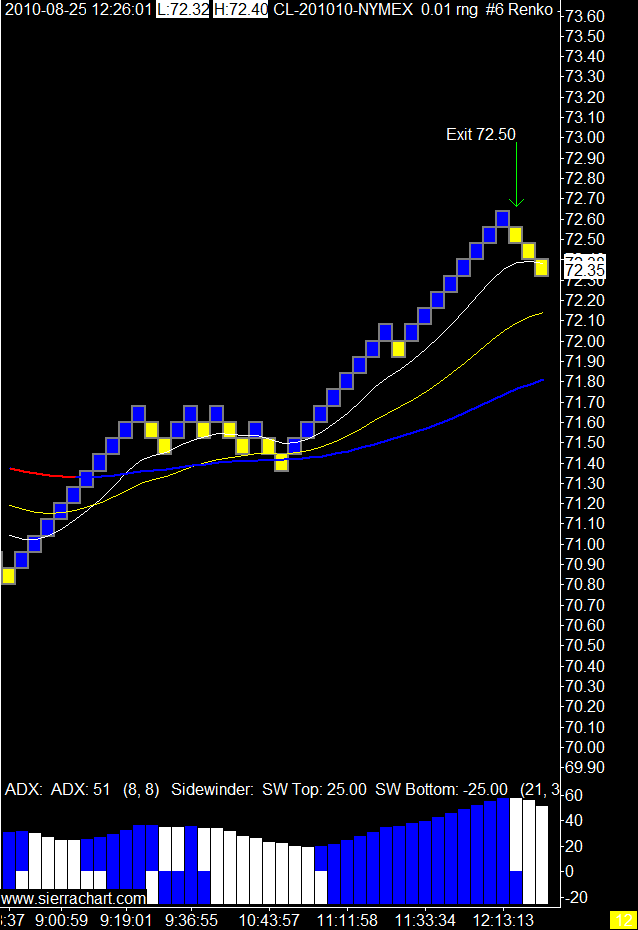

What is this?

I think it's a intraday trend.

I thought they were extinct.

In celebration of this new found trend like object I suggest we all listen to SRV at a volume level that disturbs the neighbors.

I thought they were extinct.

In celebration of this new found trend like object I suggest we all listen to SRV at a volume level that disturbs the neighbors.

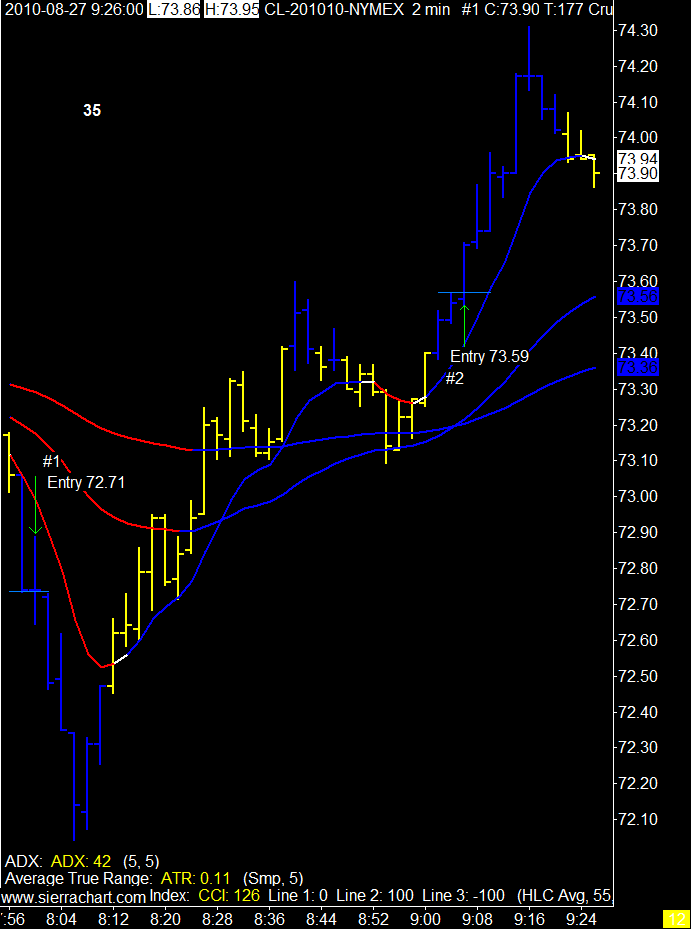

8/27/2010

The Boy Who Cried Wolf

The week is done. A week of trading with all the fear, greed, regret, happiness, sorrow, and every other emotion you can think of.

The weeks are all pretty much like that.

How we handle the changes in our emotional environment determines our success or failure.

The market has nothing to do with our success or failure.

P.S.

This is not a good bye post, because I don't do good bye posts anymore. I have had a few of those and then always came back to the blog. So if it was a good bye post you would have no reason to believe me.

Right.

The weeks are all pretty much like that.

How we handle the changes in our emotional environment determines our success or failure.

The market has nothing to do with our success or failure.

P.S.

This is not a good bye post, because I don't do good bye posts anymore. I have had a few of those and then always came back to the blog. So if it was a good bye post you would have no reason to believe me.

Right.

8/26/2010

8/25/2010

An Odd Business

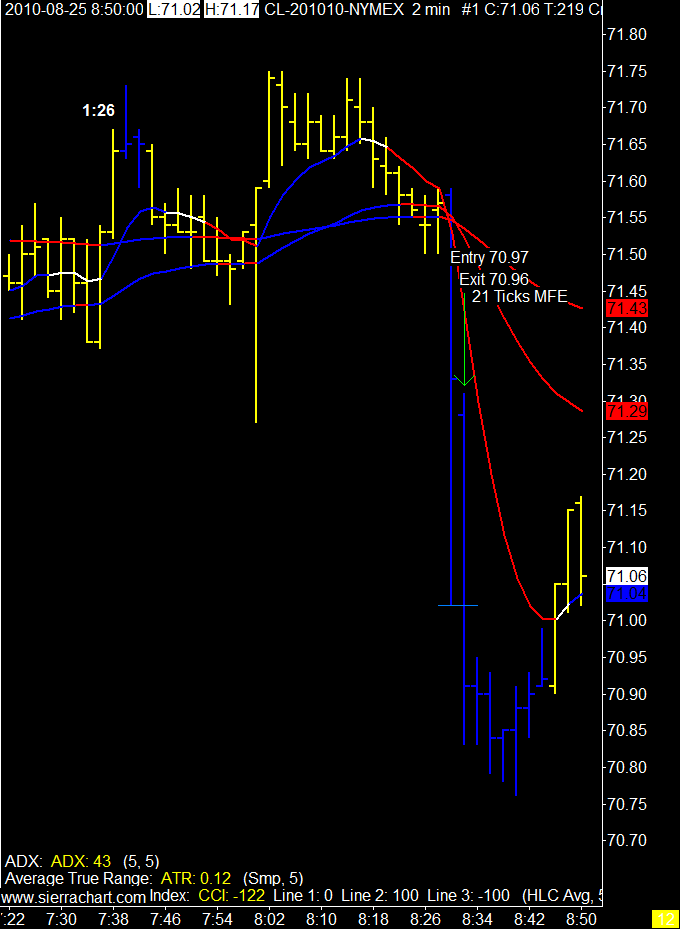

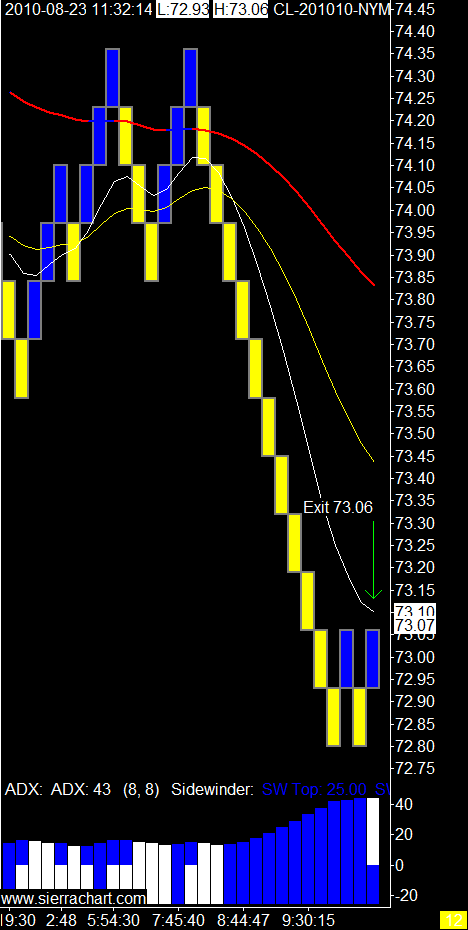

Barrel count didn't work out and I thought the day was done.

Good thing I was "prepared to be wrong" as the day worked out well.

Good thing I was "prepared to be wrong" as the day worked out well.

8/23/2010

2/10/2010

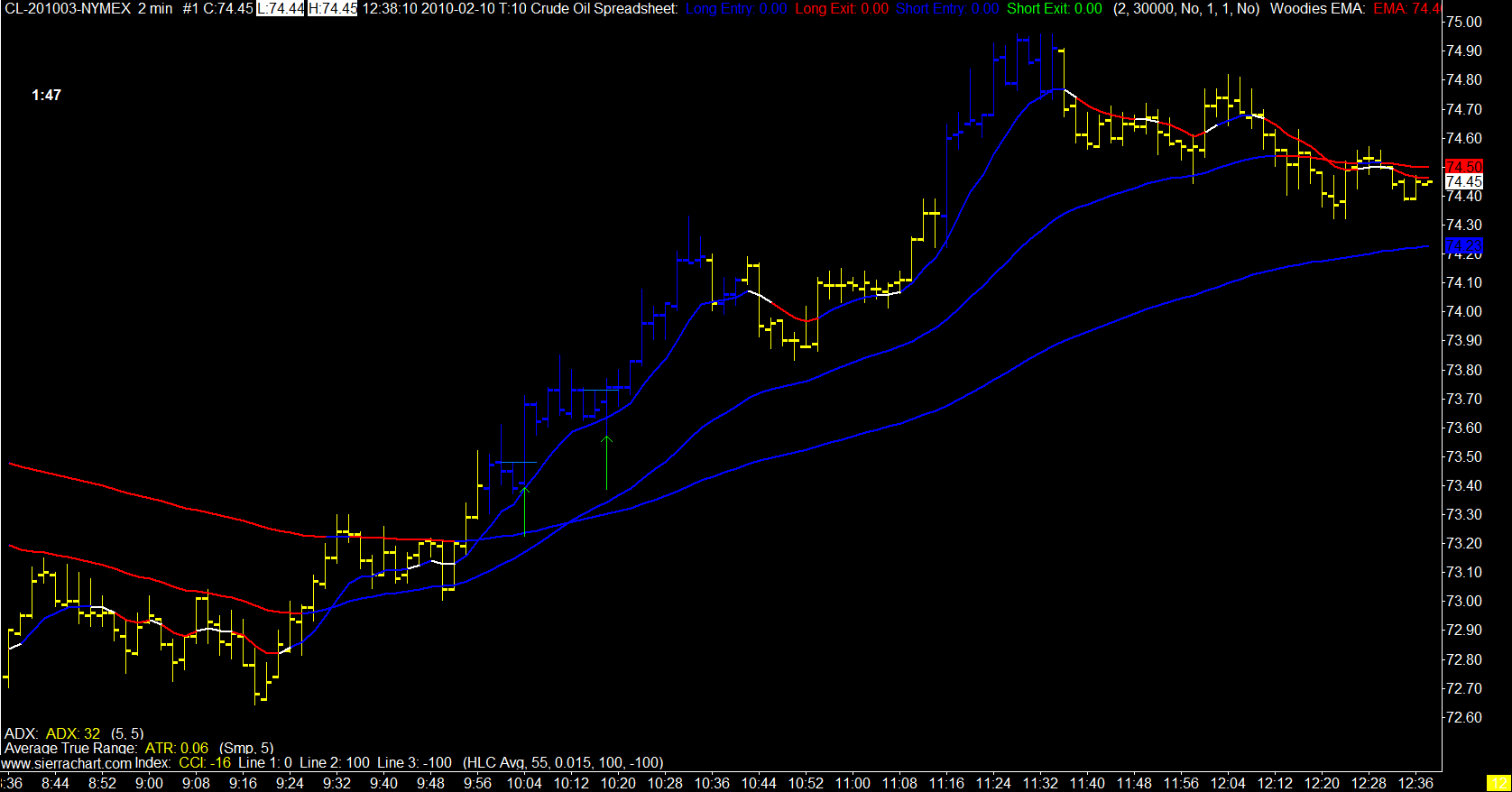

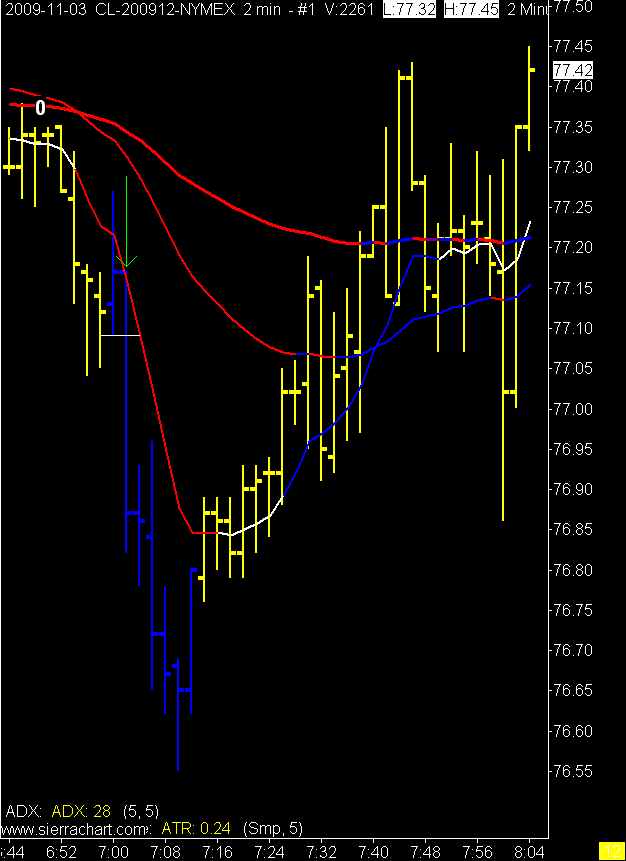

Crude Oil

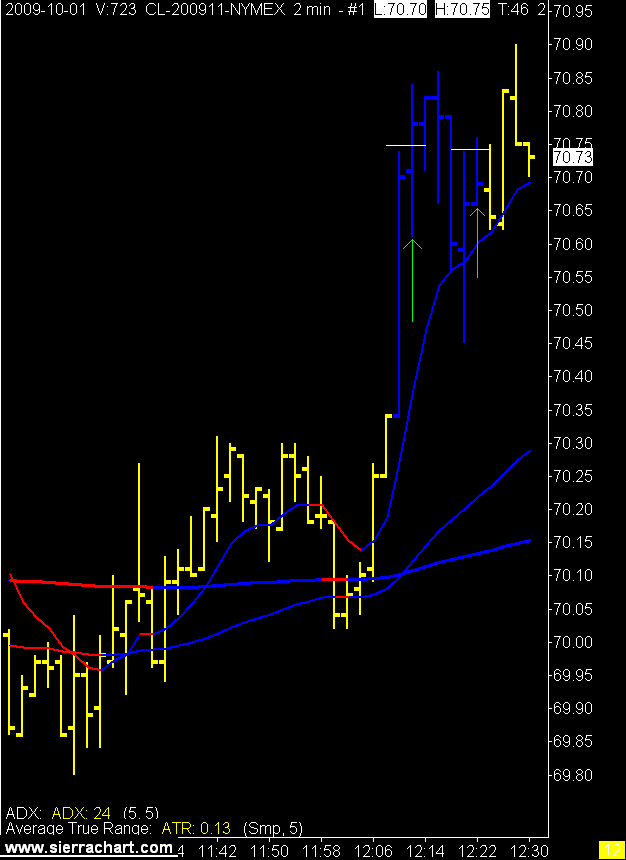

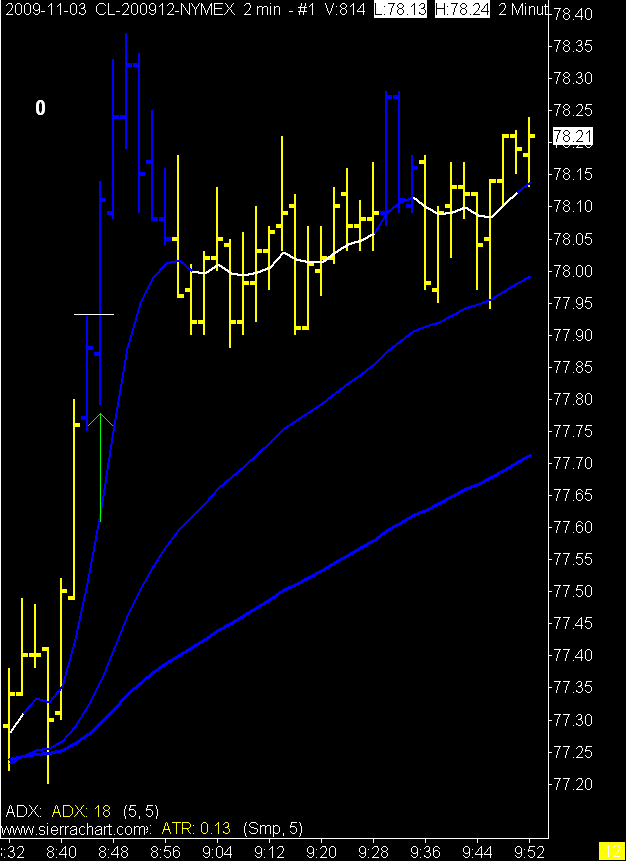

Crude is moving again, finding some range and direction and staying there for a while. I have removed the "curbs" from the blue bars and am trading more aggressively in the direction of the major trend.

How does this day trader define major trend?

60 minute, 10 minute, 15 minute, something along those lines. Take the 2 minute signals in that direction and ignore the rest. Will miss some good trades as I did this morning but such is life.

2 Minute Crude Oil Chart

The best part is the chart looks much prettier with more blue bars.

I missed the last move as I had to step out for a while.

How does this day trader define major trend?

60 minute, 10 minute, 15 minute, something along those lines. Take the 2 minute signals in that direction and ignore the rest. Will miss some good trades as I did this morning but such is life.

2 Minute Crude Oil Chart

The best part is the chart looks much prettier with more blue bars.

I missed the last move as I had to step out for a while.

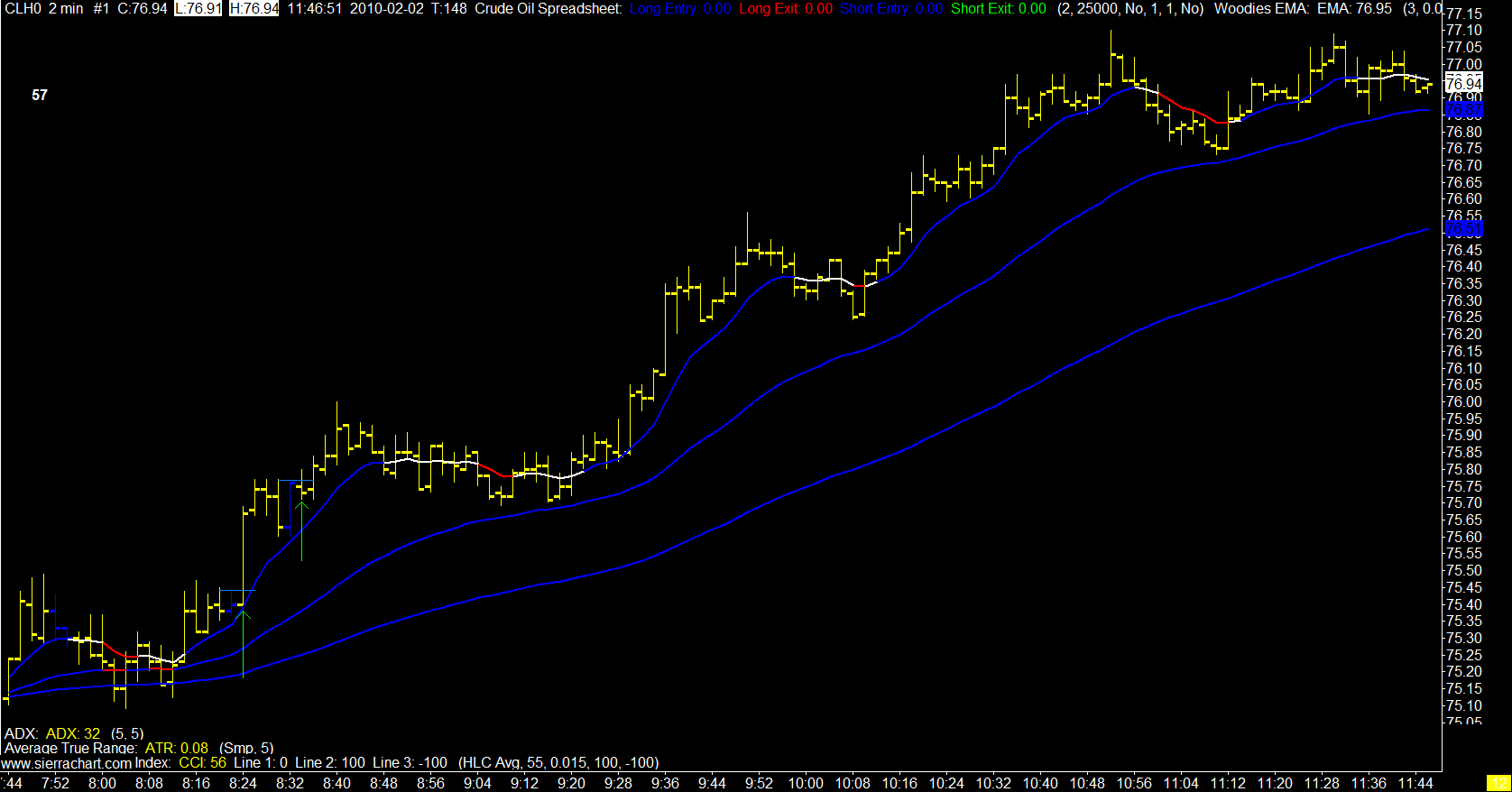

2/02/2010

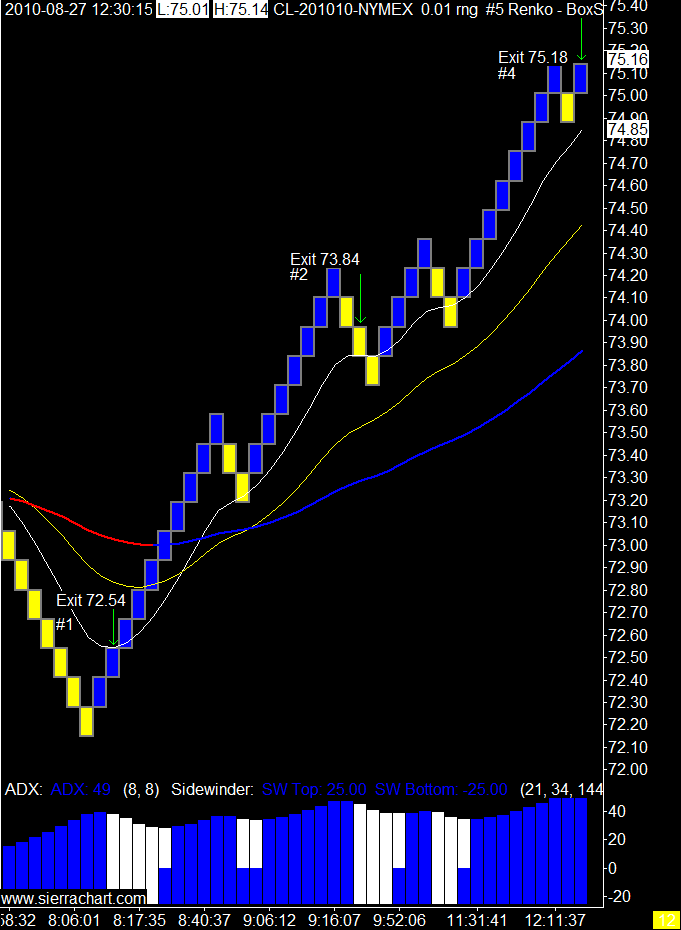

The Porridge is Just Right

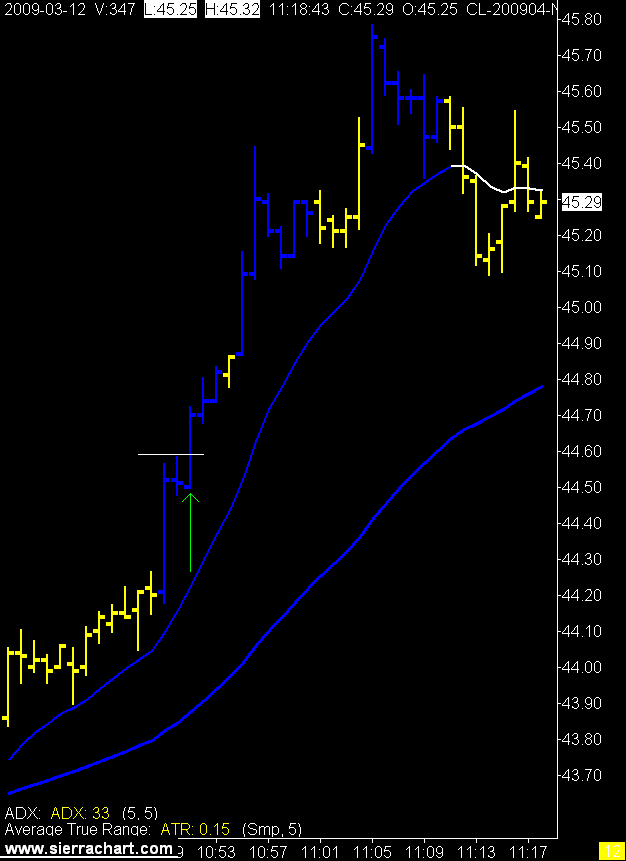

Crude came to life today, don't know why and don't care why.

Ok I do care but since I don't know why I just said I didn't care.

I think I may have stumbled onto a nice system for setting targets. If not "nice" then at least one that is rational. Don't have the stats to back that up but I do have a few years of staring at this thing and have earned a bit of a feel for it.

I hope.

Anyway I am using a percentage the 5 day ATR and then setting the actual target number to the first fib number under that percentage.

Could all be a massive case of recency bias but seems to be working nicely for now.

I only got 2 signals in this massive move up today as the signals stopped due to the EMA spread.

Both hit target and that always makes the "just watching" part of the day a little more relaxing.

2 Minute Crude Oil Chart

Obviously with the right side of the chart filled out I left a lot of porridge on the table today. (and the day's not over) That's ok, the right side of the chart was blank when I exited. I traded my plan my way and it all worked out.

Nice day.

Ok I do care but since I don't know why I just said I didn't care.

I think I may have stumbled onto a nice system for setting targets. If not "nice" then at least one that is rational. Don't have the stats to back that up but I do have a few years of staring at this thing and have earned a bit of a feel for it.

I hope.

Anyway I am using a percentage the 5 day ATR and then setting the actual target number to the first fib number under that percentage.

Could all be a massive case of recency bias but seems to be working nicely for now.

I only got 2 signals in this massive move up today as the signals stopped due to the EMA spread.

Both hit target and that always makes the "just watching" part of the day a little more relaxing.

2 Minute Crude Oil Chart

Obviously with the right side of the chart filled out I left a lot of porridge on the table today. (and the day's not over) That's ok, the right side of the chart was blank when I exited. I traded my plan my way and it all worked out.

Nice day.

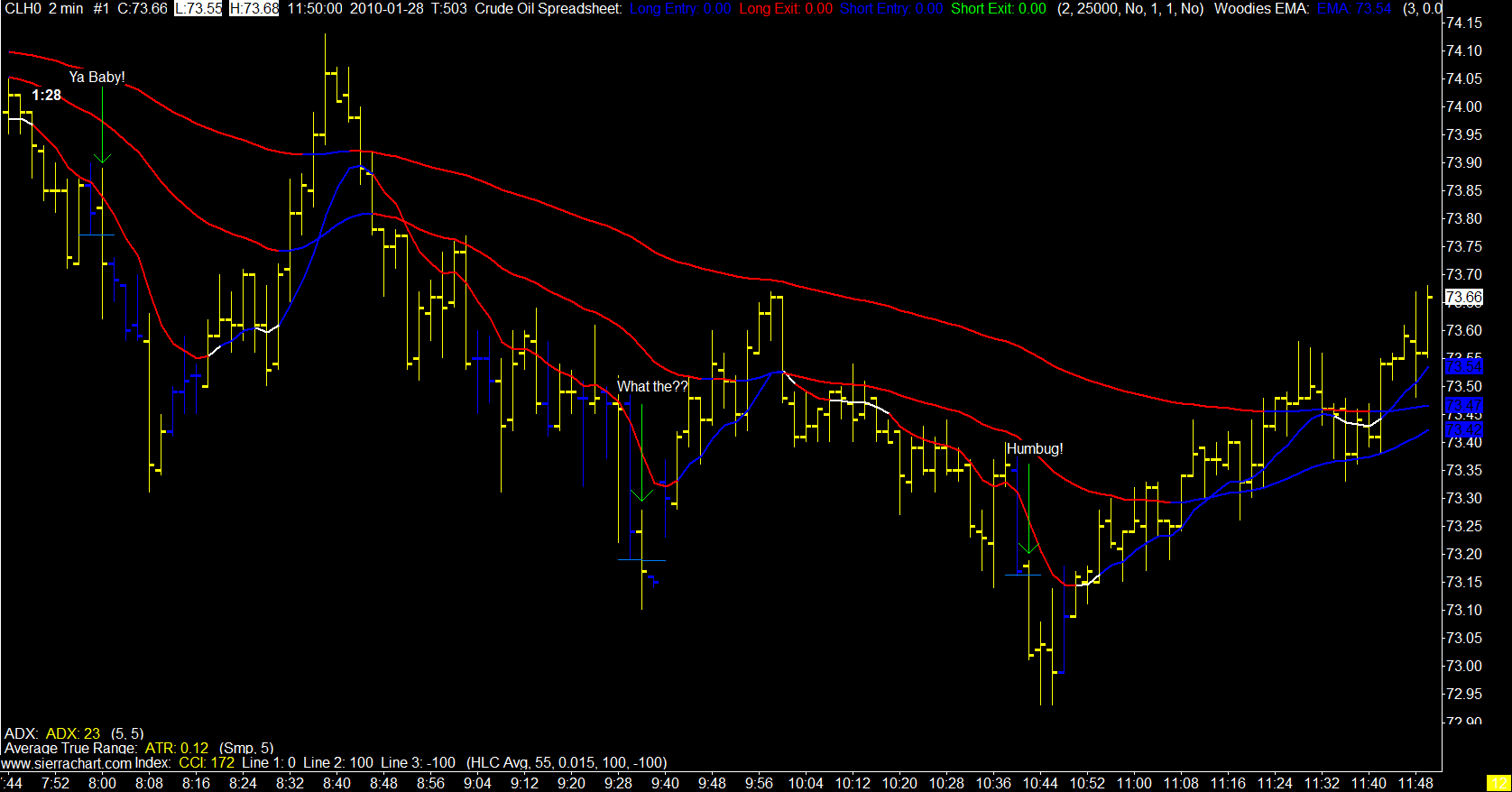

1/28/2010

Yesterday was Fun

Today?

We had a ya baby, a why is my chart not moving, and a near miss.

2 Minute Crude Oil Chart

Ya baby speaks for itself, lost data while in the second trade so I sat there wondering why my stop was hit while price had not moved, and the third was a near miss of target with the trailing stop taken out for break even.

All in all just another day in the pit.

We had a ya baby, a why is my chart not moving, and a near miss.

2 Minute Crude Oil Chart

Ya baby speaks for itself, lost data while in the second trade so I sat there wondering why my stop was hit while price had not moved, and the third was a near miss of target with the trailing stop taken out for break even.

All in all just another day in the pit.

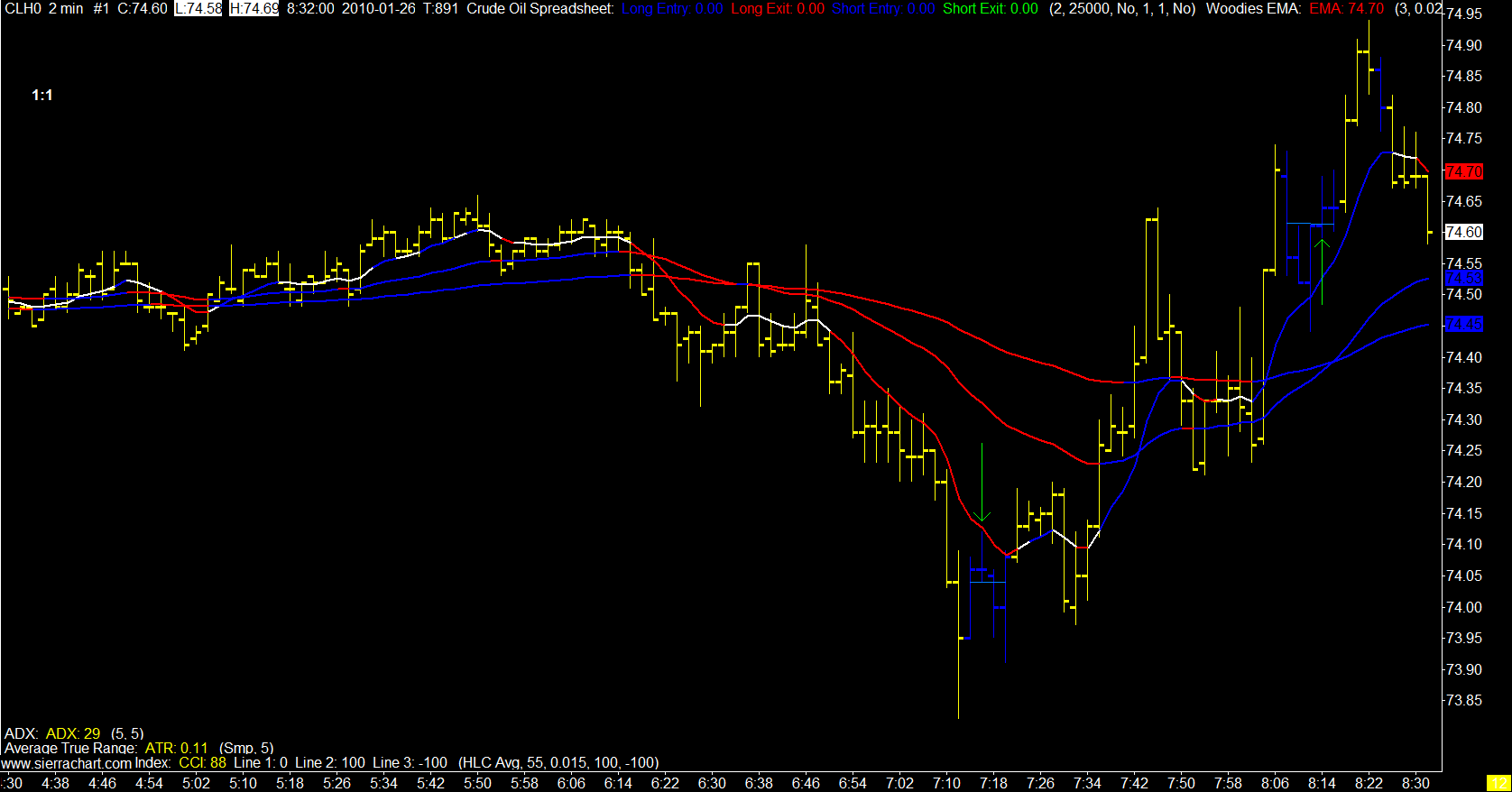

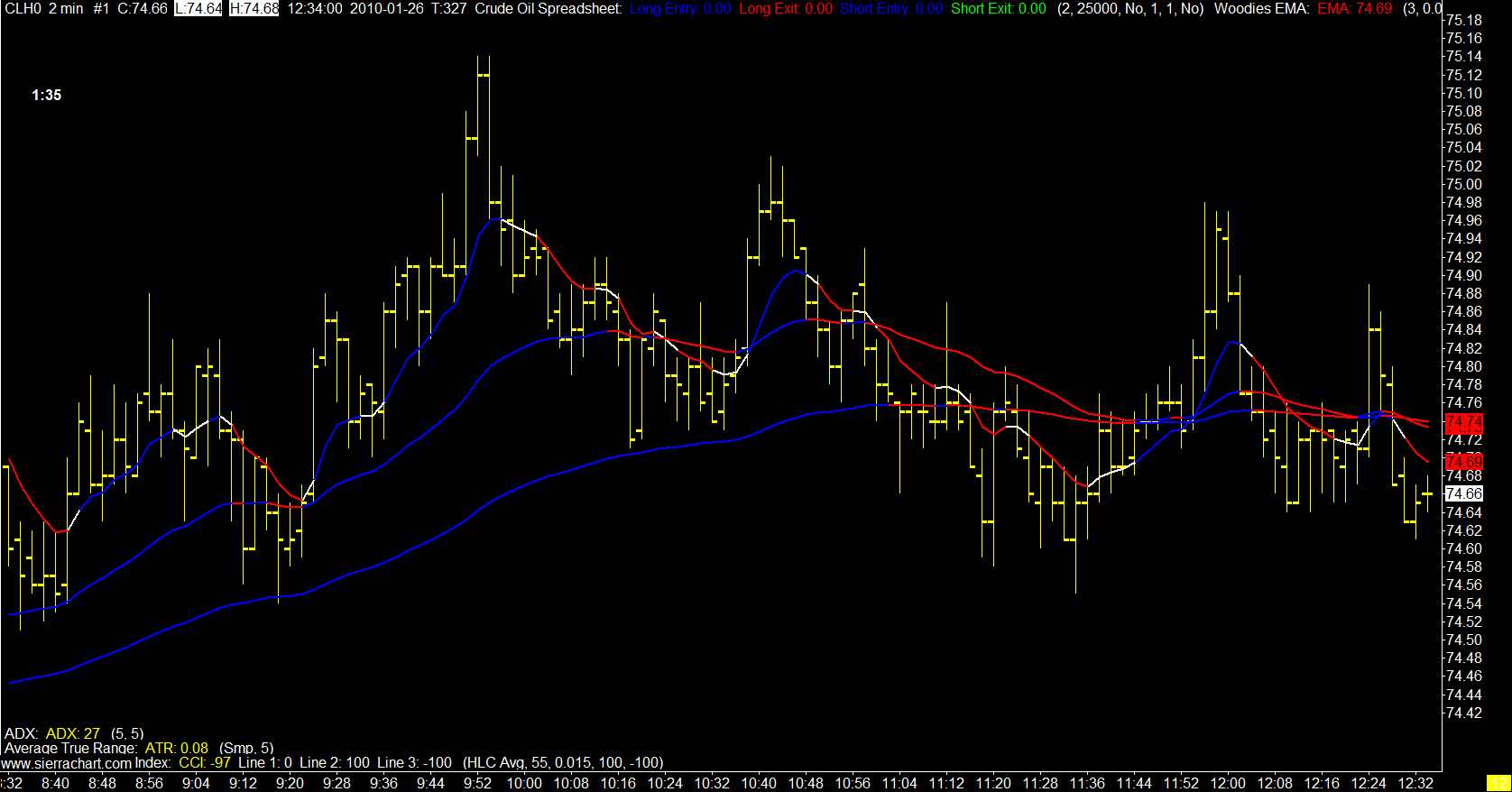

1/26/2010

Range is Scarce

I don't really have anything wonderful to post today however since I think we would all like to stop looking at that poor woman's face I thought I would post a couple of charts.

Five day ATR is still barely over 2.00 and the results of that still show on the 2 minute chart. The moves are few and weak. Caught a partial stop (-9) and a target (+29) today.

Give me range or give me death.

Too much?

Ya.

I tried please before and that didn't work.

2 Minute Crude Oil Charts

Five day ATR is still barely over 2.00 and the results of that still show on the 2 minute chart. The moves are few and weak. Caught a partial stop (-9) and a target (+29) today.

Give me range or give me death.

Too much?

Ya.

I tried please before and that didn't work.

2 Minute Crude Oil Charts

1/19/2010

'Long & Wrong'

Long & Wrong? That sounds familiar. Hmmmm.

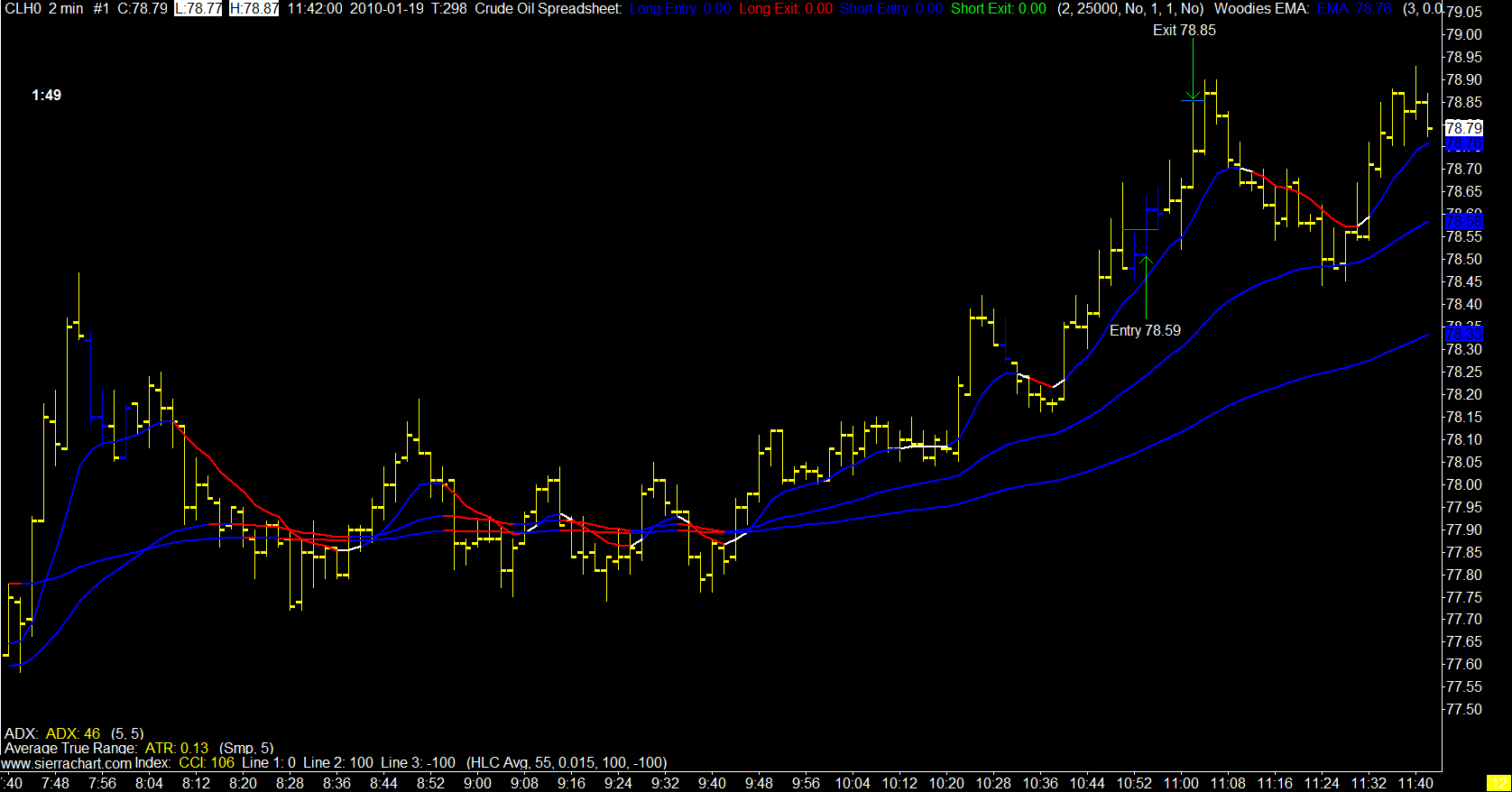

So I ignored my own advice and took one trade today. Twas the only signal bar that had a subsequent entry bar in the day. Barely made target which currently is at my absolute minimum to trade.

If the trade had failed I would have posted how dumb I was for not staying out of this market. Since it worked I can say.....

No I can't, it was still a dumb trade. We need more range. We need LW to start moving his massively leveraged liquidity into the crude oil pit.

Something, anything, just make it move.

Please.

2 Minute Crude Oil Chart

So I ignored my own advice and took one trade today. Twas the only signal bar that had a subsequent entry bar in the day. Barely made target which currently is at my absolute minimum to trade.

If the trade had failed I would have posted how dumb I was for not staying out of this market. Since it worked I can say.....

No I can't, it was still a dumb trade. We need more range. We need LW to start moving his massively leveraged liquidity into the crude oil pit.

Something, anything, just make it move.

Please.

2 Minute Crude Oil Chart

1/13/2010

Wednesday

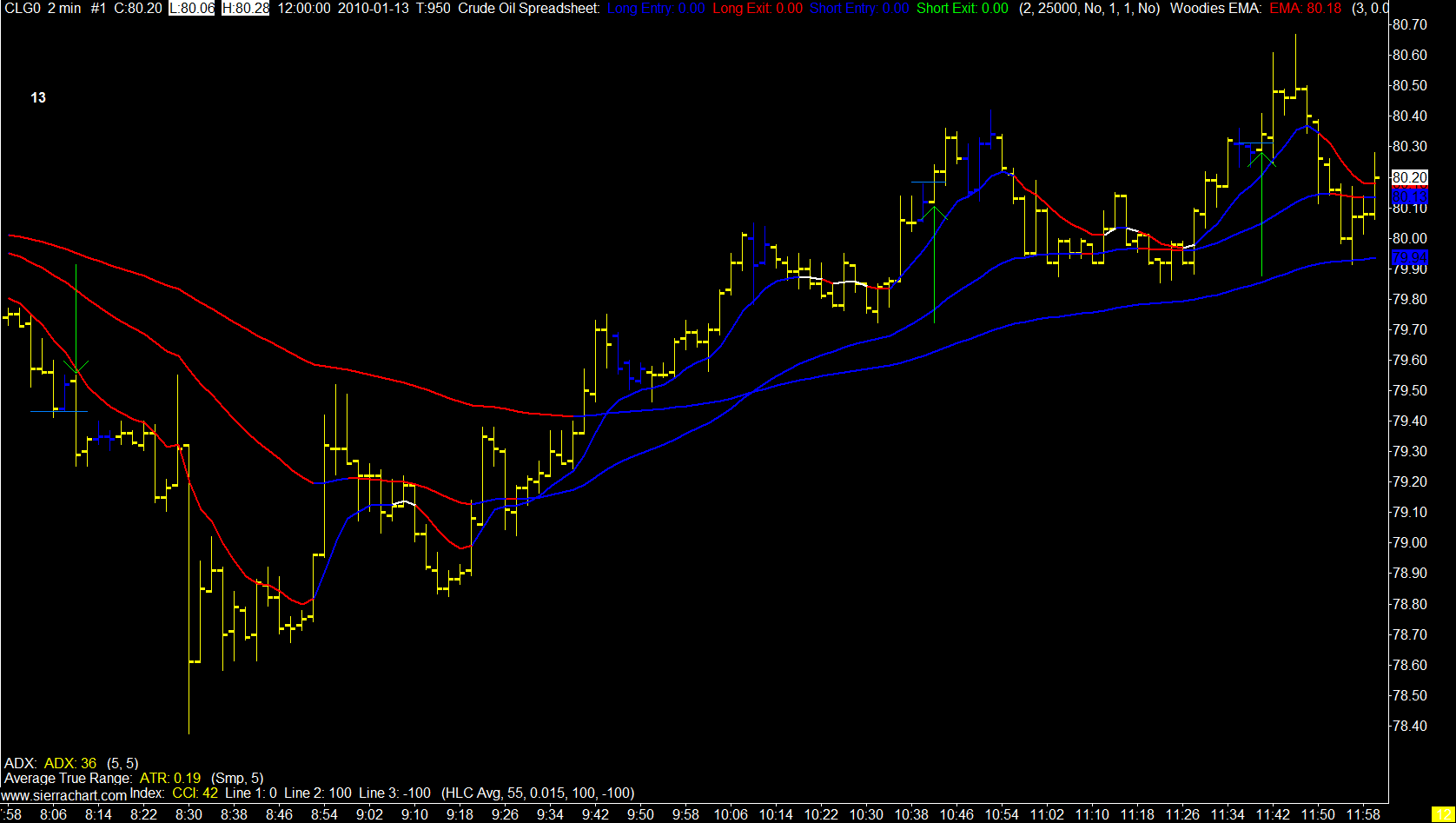

2 Minute Crude Oil Chart

Three trades today with the barrel count providing a catalyst. First trade caught my trailing stop for a net tick, second trade I bailed just before target as we were having a tough time getting through the HOD to get to target, and the third trade hit target.

There have been a few changes to the magic blue bars. You may notice there are not as many of them as before. That is due to some coding that drops the signal as price moves a certain distance away from the 8 EMA, and or the 3 EMAs spread gets to wide.

So if I get a signal bar and enter I want to see the blue bars disappear as that means price is moving my way fast.

I am also using a factor of the 5 day ATR for my target now.

Seems to make sense.

That 5 day ATR is still very low and any trading in this market is muted at best. Anybody who is relatively new to the crude oil pit should know that this is not the "normal" price action we usually see.

Hopefully we see the volatility pick up soon.

Three trades today with the barrel count providing a catalyst. First trade caught my trailing stop for a net tick, second trade I bailed just before target as we were having a tough time getting through the HOD to get to target, and the third trade hit target.

There have been a few changes to the magic blue bars. You may notice there are not as many of them as before. That is due to some coding that drops the signal as price moves a certain distance away from the 8 EMA, and or the 3 EMAs spread gets to wide.

So if I get a signal bar and enter I want to see the blue bars disappear as that means price is moving my way fast.

I am also using a factor of the 5 day ATR for my target now.

Seems to make sense.

That 5 day ATR is still very low and any trading in this market is muted at best. Anybody who is relatively new to the crude oil pit should know that this is not the "normal" price action we usually see.

Hopefully we see the volatility pick up soon.

1/06/2010

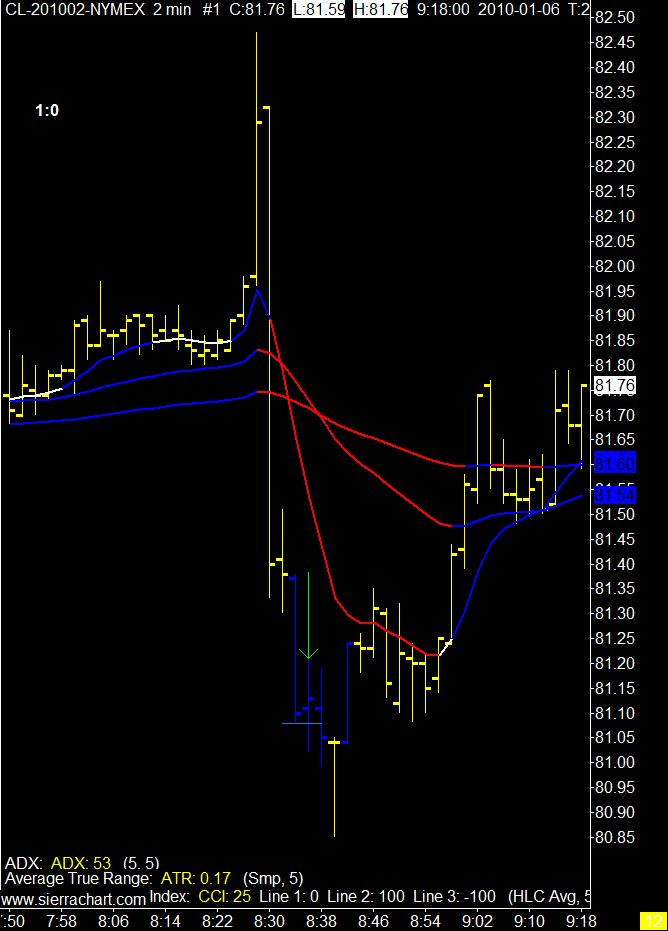

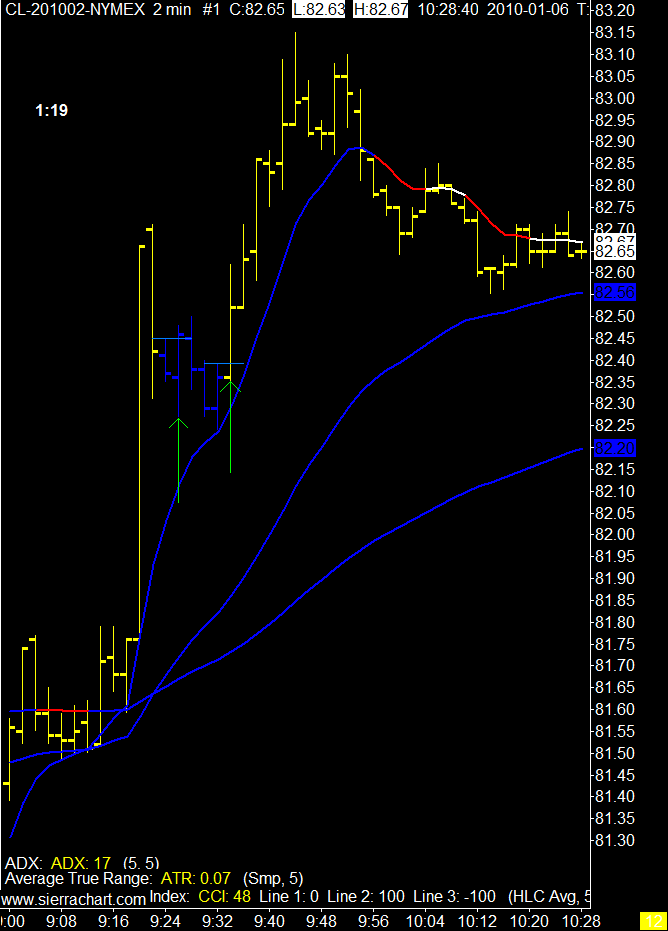

Sign of Life

The barrel count woke up the crude oil market today and I took a couple of trades. Hopefully we see the daily ATR increase.

2 Minute Crude Oil Chart

2 Minute Crude Oil Chart

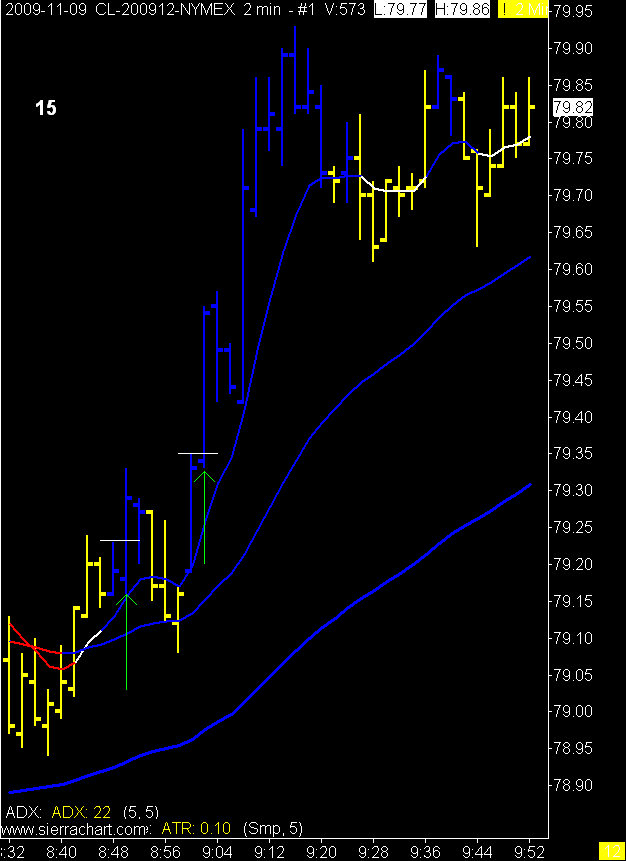

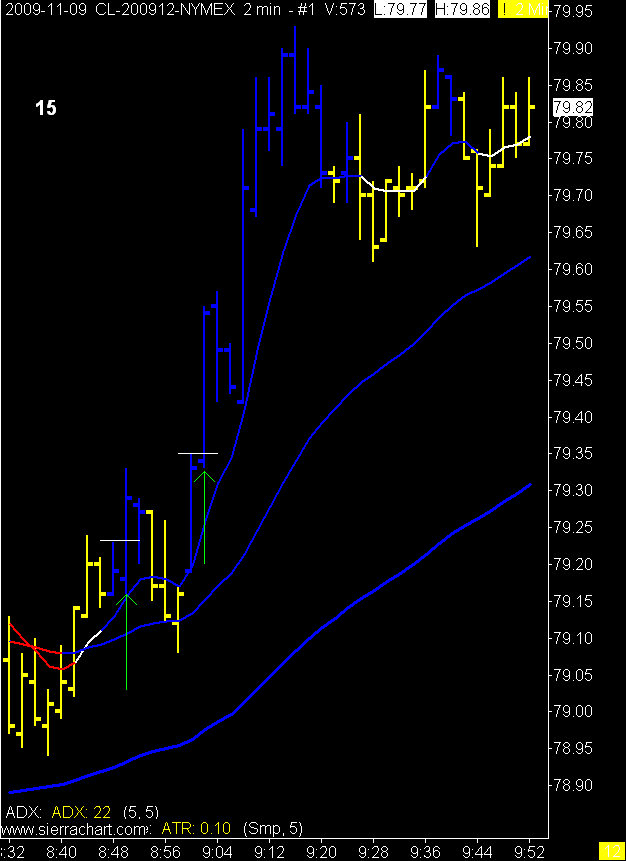

11/09/2009

A Blog About......

Trading crude oil!

Right, right, trading crude oil. That's why we're all here. That's why tens of people show up every day, hoping for a glimpse into the exciting world of crude oil trading.

Indeed.

Well here you go, a couple of trades today.

I am working with an old filter for the blue bars. One that I can't figure how to code into the blue bars so I am currently watching 2 charts again.

If it shows any promise I'll let you know.

Hint, part of it appears and disappears off my blue bar chart.

2 Minute Crude Oil Chart

Right, right, trading crude oil. That's why we're all here. That's why tens of people show up every day, hoping for a glimpse into the exciting world of crude oil trading.

Indeed.

Well here you go, a couple of trades today.

I am working with an old filter for the blue bars. One that I can't figure how to code into the blue bars so I am currently watching 2 charts again.

If it shows any promise I'll let you know.

Hint, part of it appears and disappears off my blue bar chart.

2 Minute Crude Oil Chart

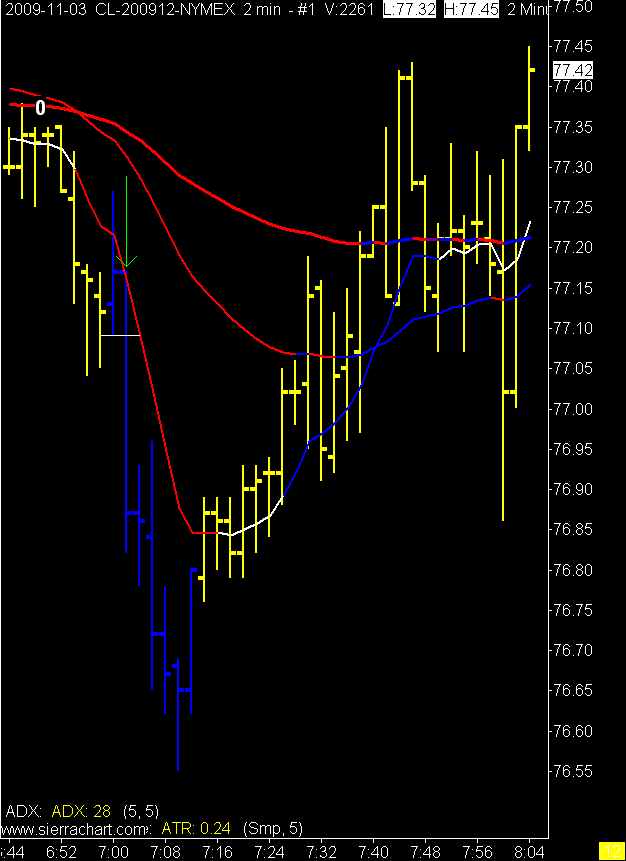

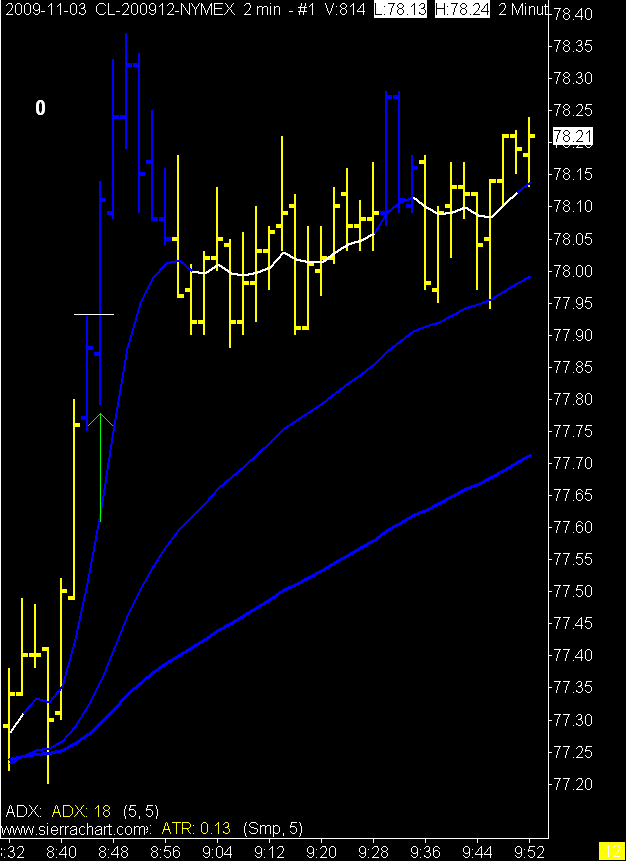

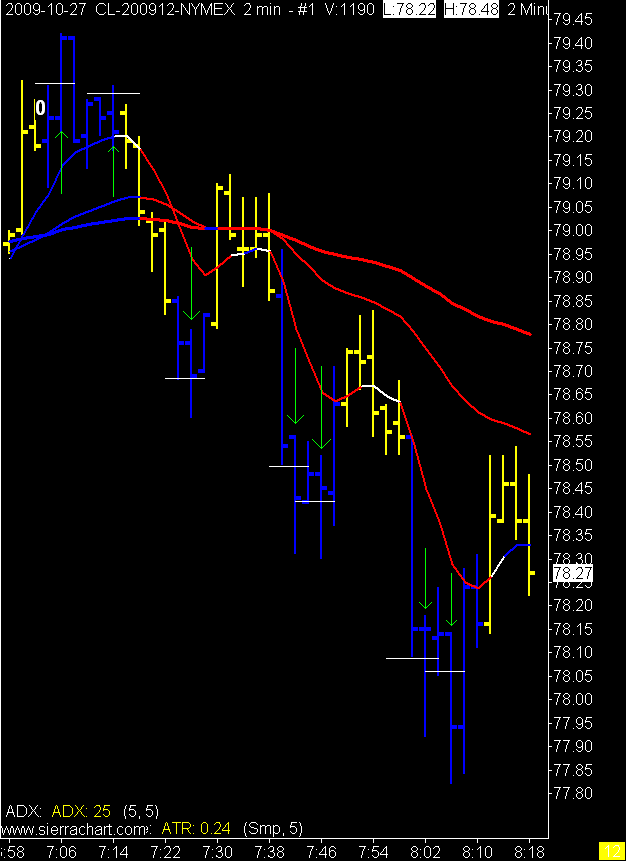

11/03/2009

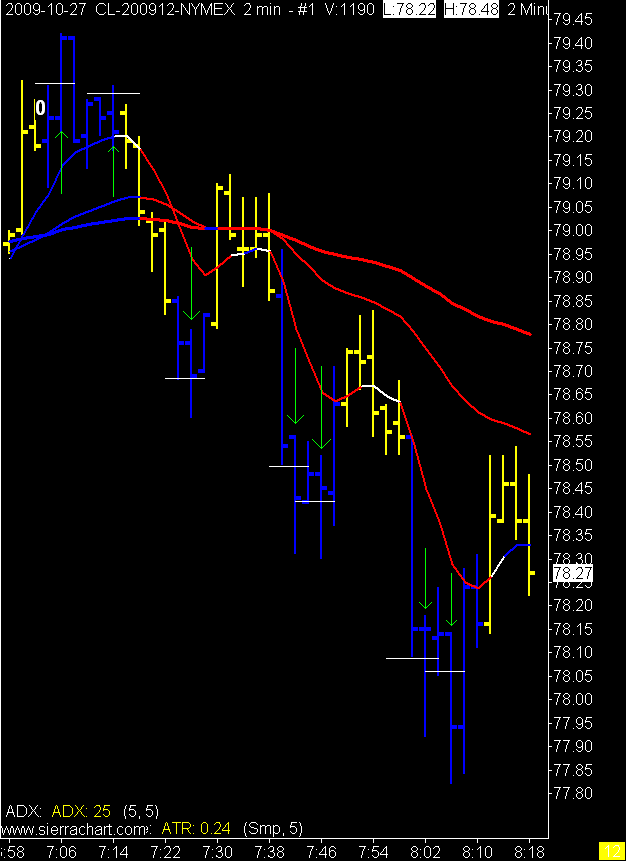

A Tale of Two Tuesdays

Trading is a strange business.

As of Tuesday October 27th, 2009 the Solfest Magic Blue Bar System was about to be thrown in the garbage and Solfest was about to don the Magic Blue Fireproof Coveralls and start work as a derrick hand on an oil rig.

As of Tuesday November 3rd, 2009 the Solfest Magic Blue Bars are proudly displayed to the public so his adoring fans can shower him with praise recognizing his complete domination of the crude oil pit.

2 Minute Crude Oil Charts

As for Wednesday November 4th, 2009.

As for Wednesday November 4th, 2009.

Who knows.

As of Tuesday October 27th, 2009 the Solfest Magic Blue Bar System was about to be thrown in the garbage and Solfest was about to don the Magic Blue Fireproof Coveralls and start work as a derrick hand on an oil rig.

As of Tuesday November 3rd, 2009 the Solfest Magic Blue Bars are proudly displayed to the public so his adoring fans can shower him with praise recognizing his complete domination of the crude oil pit.

2 Minute Crude Oil Charts

As for Wednesday November 4th, 2009.

As for Wednesday November 4th, 2009.Who knows.

10/26/2009

Give us Trades

World: Enough of your obtuse ramblings blogger boy, we demand trades, we demand charts, we demand the Holy Grail, and we demand it now!

Solfest: Yes masters, coming right up, a relative plethora of trades.

2 Minute Crude Oil Charts

I hit my daily stop with a small profit and then simmed my way to a much larger imaginary profit.

I hit my daily stop with a small profit and then simmed my way to a much larger imaginary profit.

Imagine that.

Solfest: Yes masters, coming right up, a relative plethora of trades.

2 Minute Crude Oil Charts

I hit my daily stop with a small profit and then simmed my way to a much larger imaginary profit.

I hit my daily stop with a small profit and then simmed my way to a much larger imaginary profit.Imagine that.

10/01/2009

9/17/2009

I take all signals except........

To take them all or to not take them all?

This was the question of the day in the trading room the other day. I seemed to be standing alone with my premise that I do not take them all. After two full stops I quit for the day, or at least go sim for the rest of the day. This caused much abuse to be heaped upon me from the take all signal boys.

Well taking all signals sounds good and in theory I'm all for it. However I don't trade theory I trade money and my experience has been that my trading goes significantly downhill as the consecutive losses stack up. So, for me, I have found it beneficial to stop at 2 full stops.

Beside my personal trading issues I also think that stopping for the day runs along the lines of cutting your losers and letting your winners run. Ok I admit that's a bit of a stretch. Yes I also used to quit after 2 full targets hit in the day. That was a stupid idea, why didn't you speak up.

All professional traders have risk management limits that they must live under. My question for the take all signal boys is, at what point do you quit? Never? You would just keep taking loser after loser, and this has no affect on your execution?

I doubt it.

With my system I need momentum to keep moving, and there are days where you get just enough to produce a signal and then it reverses. Sometimes this happens over and over all day. Do some days just find that range and stay in it? The answer as always in trading is sometimes.

Now the take all signal boys want my stats to prove that this is a financially sound idea. I must admit I don't have them. After quitting or going to sim my record keeping had been going out the door with my interest level. This was a mistake on my behalf, and that mistake has been rectified.

I am now keeping all live and sim stats along with another technical setup that I want to see the results from.

We shall see.

Today was all live as I had 1 full target, 1 full stop, and 3 bes.

2 Minute Crude Oil Charts

This was the question of the day in the trading room the other day. I seemed to be standing alone with my premise that I do not take them all. After two full stops I quit for the day, or at least go sim for the rest of the day. This caused much abuse to be heaped upon me from the take all signal boys.

Well taking all signals sounds good and in theory I'm all for it. However I don't trade theory I trade money and my experience has been that my trading goes significantly downhill as the consecutive losses stack up. So, for me, I have found it beneficial to stop at 2 full stops.

Beside my personal trading issues I also think that stopping for the day runs along the lines of cutting your losers and letting your winners run. Ok I admit that's a bit of a stretch. Yes I also used to quit after 2 full targets hit in the day. That was a stupid idea, why didn't you speak up.

All professional traders have risk management limits that they must live under. My question for the take all signal boys is, at what point do you quit? Never? You would just keep taking loser after loser, and this has no affect on your execution?

I doubt it.

With my system I need momentum to keep moving, and there are days where you get just enough to produce a signal and then it reverses. Sometimes this happens over and over all day. Do some days just find that range and stay in it? The answer as always in trading is sometimes.

Now the take all signal boys want my stats to prove that this is a financially sound idea. I must admit I don't have them. After quitting or going to sim my record keeping had been going out the door with my interest level. This was a mistake on my behalf, and that mistake has been rectified.

I am now keeping all live and sim stats along with another technical setup that I want to see the results from.

We shall see.

Today was all live as I had 1 full target, 1 full stop, and 3 bes.

2 Minute Crude Oil Charts

7/29/2009

I am Genius

Barrel count today.

I took a couple of trades before the inventory report and got 2 break evens. Then the report. Wow, I guess they found a few more barrels lying around and price fell off the map. I didn't take the last one as per my plan but it worked as well.

Nice day.

Beans seem awfully quiet this summer but I'm glad I look at both and take whichever is moving.

2 Minute Crude Oil Chart

2 Minute Crude Oil Chart

1 Minute Soybean Chart

I took a couple of trades before the inventory report and got 2 break evens. Then the report. Wow, I guess they found a few more barrels lying around and price fell off the map. I didn't take the last one as per my plan but it worked as well.

Nice day.

Beans seem awfully quiet this summer but I'm glad I look at both and take whichever is moving.

2 Minute Crude Oil Chart

2 Minute Crude Oil Chart

1 Minute Soybean Chart

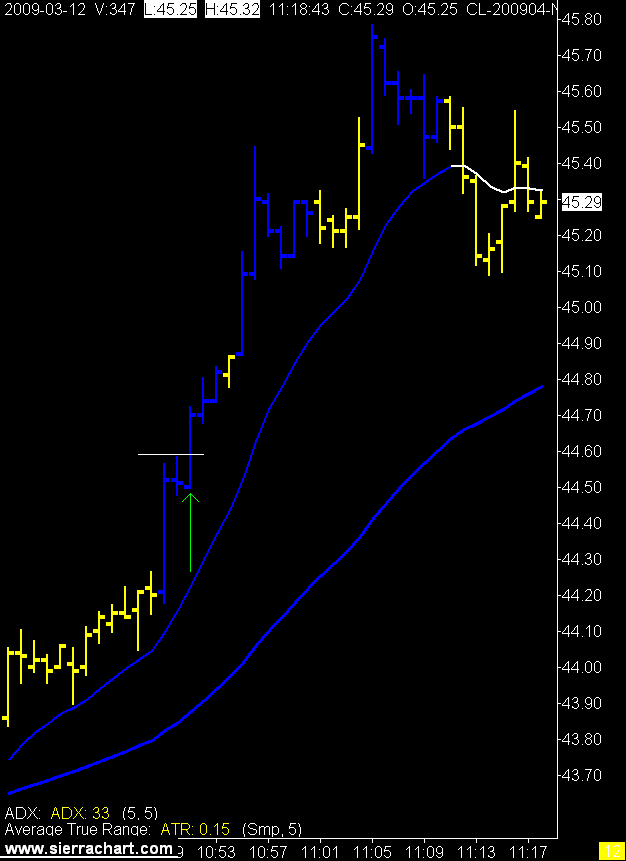

3/12/2009

A Sad Day

A helicopter carrying 18 oil workers to an off shore rig went down off the coast of Newfoundland today. So far they have only found one survivor. This tragedy reminded me of the Ocean Ranger, an off shore rig that sank on Feb 14, 1982 with 84 crew on board. There were no survivors.

Drilling for oil is a dangerous enough job on land, when you add the Atlantic Ocean in the winter time it gets even worse.

My wife and I met a lady from Newfoundland last summer who's Father died on the Ocean Ranger. Kind of brings it home.

Trading doesn't really matter.

1 Minute Crude Oil Chart

Drilling for oil is a dangerous enough job on land, when you add the Atlantic Ocean in the winter time it gets even worse.

My wife and I met a lady from Newfoundland last summer who's Father died on the Ocean Ranger. Kind of brings it home.

Trading doesn't really matter.

1 Minute Crude Oil Chart

Subscribe to:

Posts (Atom)