Just for fun let us consider 3 different trading days, days that we have all lived through if we are in this business of trading. These days could happen any time in no particular order. So let's just call them all Mondays, Mondays that start off 3 different and random weeks in the year.

Monday #1) We start off our day with a winning trade, let's say net $300. We followed our system, we took the signal, and we were rewarded with a winning trade. The next signal comes along and we enter again, result, losing trade net -$100. Signal again, loser again net -$100. Signal again, loser again net -$100.

Day ends with the net result of, ZERO.

Monday #2) We sit in front of our computer for the entire day, we see no signals and we do nothing all day.

Day ends with the net result of, ZERO.

Monday #3) We start off the day with a valid signal and a losing trade, net -$100. Next signal, net -$100. Next signal, net -$100. Next signal, aha, a winner for $300.

Day ends with the net result of, ZERO.

Now you may say, Solfest those results and outcomes are all the same, all ZERO. True the results are all ZERO but the outcome I'm talking about is what happens the Tuesday after one of those random Mondays.

Let's start with Monday #1, our first trade was a winner, we have started the week demonstrating the genius we know we are. We then proceed to see all that genius disappear throughout the rest of the day. We end the day feeling defeated and angry.

Now comes Tuesday, first trade is again a winner, ya baby, the next signal comes along and.... we don't want to push the button, we remember Monday, we don't want to lose those profits again, we don't want to lose this feeling of genius again. We don't push the button. In fact we don't push the button again all day, we have our little genius in the bank and we're not letting go. What happens that day? You know, it's a given, all the signals work and you would have made thousands not hundreds.

Ok now Monday #2, we have sat for an entire day, that's right one whole day, and done nothing, nothing. It's terrible, we are a trader we should trade. People ask what you did today, answer, I did nothing.

Now comes Tuesday, again no signals, no signals, no signals, almost a signal, ah close enough, I've seen this work before, let's go, nothing ventured nothing gained. Result, loser.

Is there a worse result then a non signal loser? Yes, a non signal winner. That leads to more non signal trades as I am now smarter than the market, smarter than my system, I am a genius discretionary trader. I have read about these people, they can feel the market.

Right?

Wrong, the result ultimately is a string of losers with no rational thought behind any of the trades.

Lastly, Monday #3. We followed our plan and we were rewarded. We took our losers and we stayed focused and "traded our way out of this mess". Surely this means I have arrived as a trader.

Now Tuesday. First trade loser, second trade, loser, third trade, loser, fourth trade, loser, fifth trade, loser, BLOODY STUPID MOTHER OF ALL &!&@%$&!%. Solfest smashes new 24 inch monitor with coffee cup and quits trading for a month, or changes the trading plan for a month because it obviously doesn’t work, or does any number of other juvenile things.

Of course the next month would have been the most profitable month his system has ever seen.

So, our 3 Mondays all had the same result, ZERO, but our 3 Tuesdays all take different turns based on the different ways we got to ZERO on the previous Monday.

Sound familiar?

What do we do?

Hire LW to trade our plan for us? Yes he has had his emotion chip removed so that would work. However I asked him and he said no as his gardening keeps him very busy.

So now what?

I have often thought that I could hire a 12 year old, train him to follow the blue bars, pay him minimum wage to sit there for the 5.5 hours, offer him a $20 bonus for every valid signal he takes, and deduct $20 from his pay for every non valid trade he takes.

I think the 12 year old's trading results might be better than mine. (gasp)

So maybe what we need to do is frame our trading success or failure outside monetary results. Not a new idea I know. The question is how? I have tried to grade the day based on how well I followed the system. But soon I stopped the grading and just looked at the money.

Maybe it has to be tangible, remember humans are stupid. We like shiny things, but they cost alot of money. Hmmmm, what else do humans like?

Sex and food.

That's it, no sex on days with non valid entries. (Freudian slip)

Ah but that would be punishing your innocent spouse, hehe, only a man would say that.

Ok then, food.

Every day I follow all signals perfectly I go out and buy myself an ice cream treat of some kind. That starts the anticipation chip in our brain, we want the ice cream at the end of the trading day. The kicker is we must deny ourselves the ice cream if we fail to follow the plan.

So that’s my new reward system. Like a dog, do a trick, get a treat.

Its "stupid" enough it just might work.

Showing posts with label trading plan. Show all posts

Showing posts with label trading plan. Show all posts

3/20/2010

11/10/2009

The Two Faces of Solfest

Daytrader 233 wrote a blog post about his mental status during and after a successful trade.

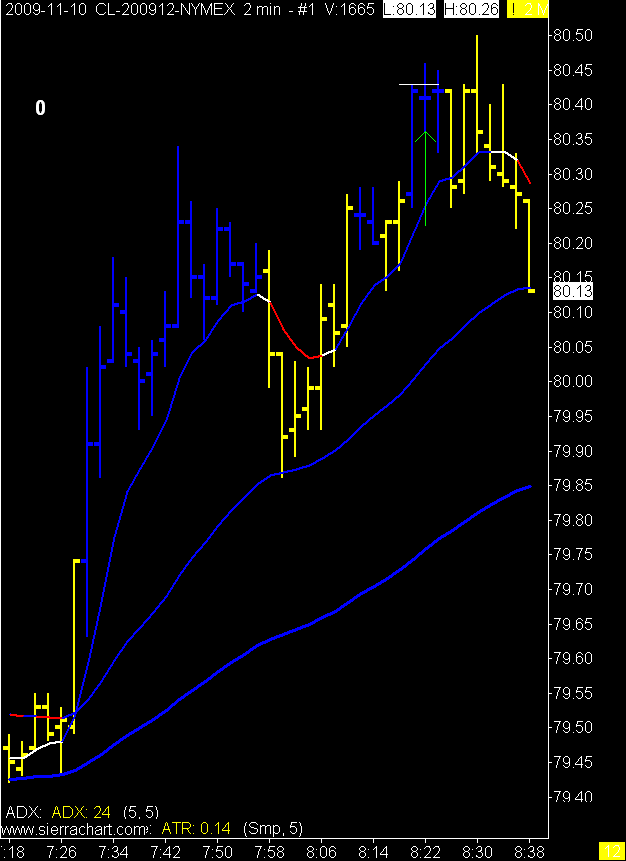

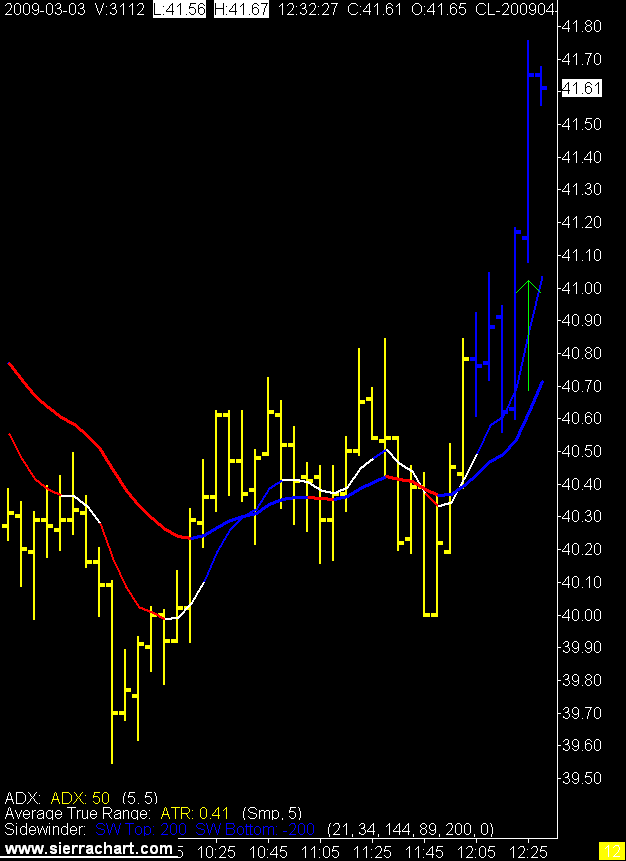

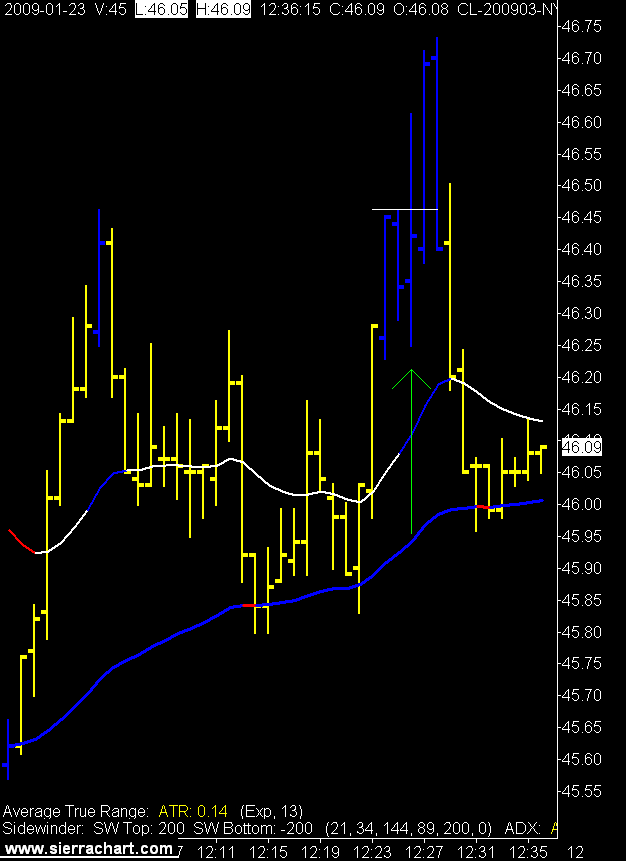

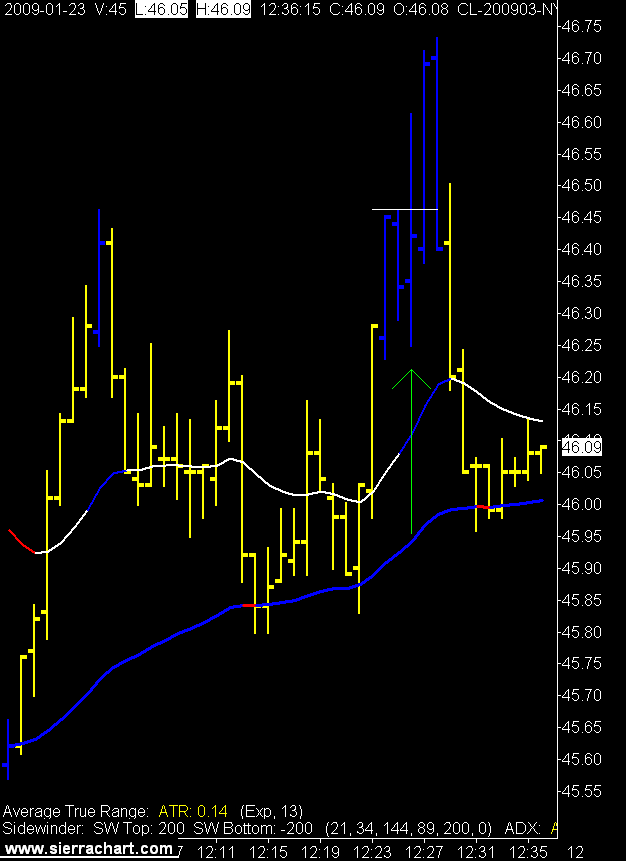

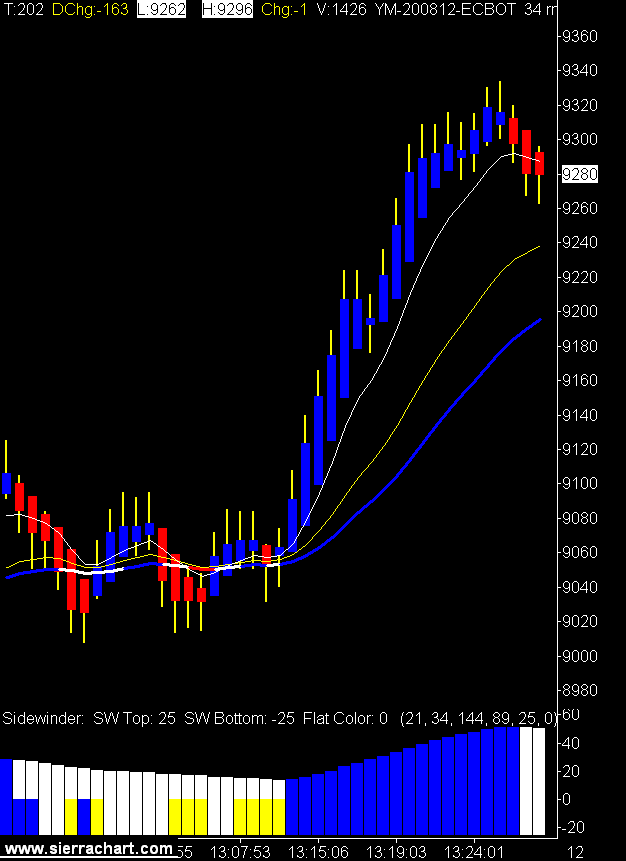

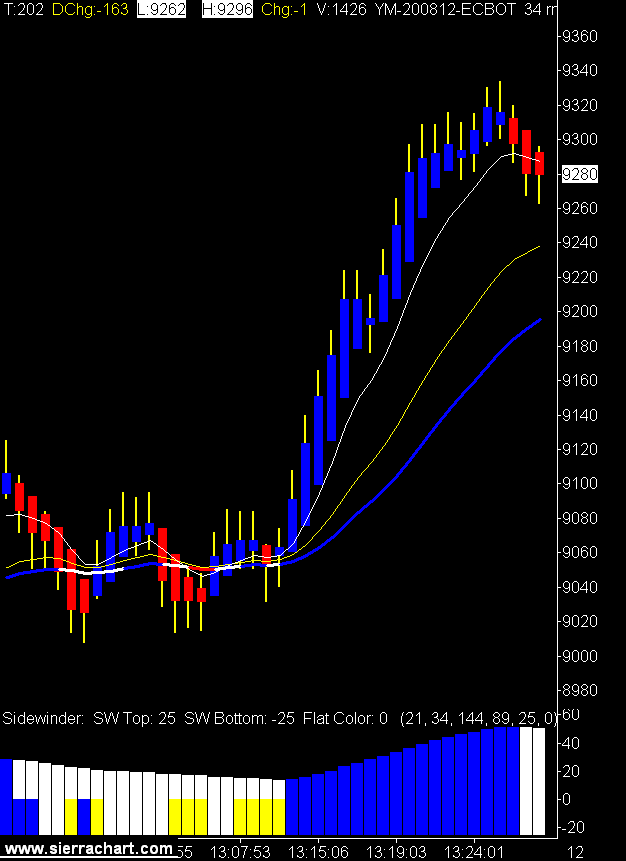

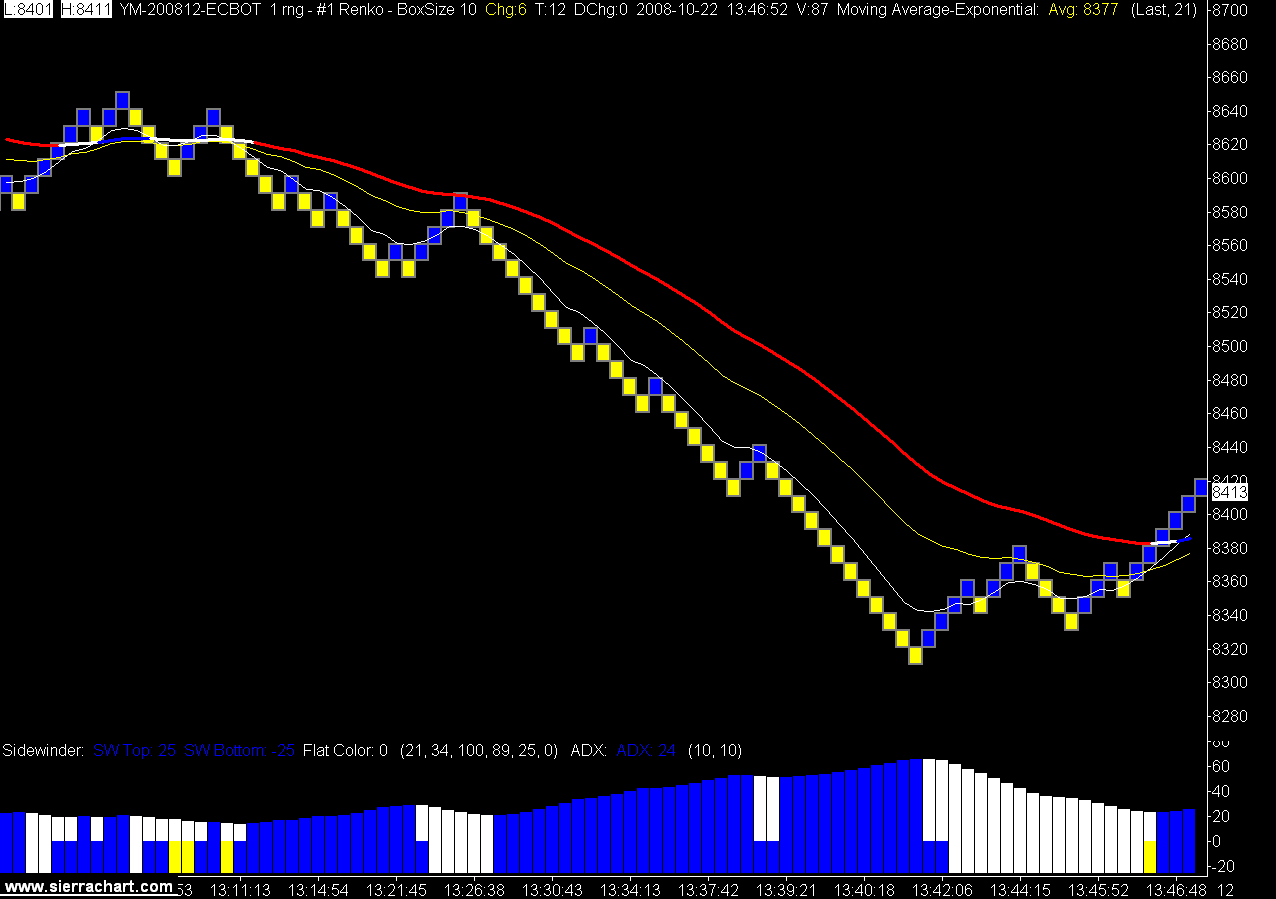

I thought I would add to the conversation with my two trades today. Trade number 1, which I have titled, I am moron, shows a big up move with many blue bars and the cheers of successful traders along the way.

Solfest's entry endured heckling from the peanut gallery and ended with tears and the gnashing of teeth.

I am moron.

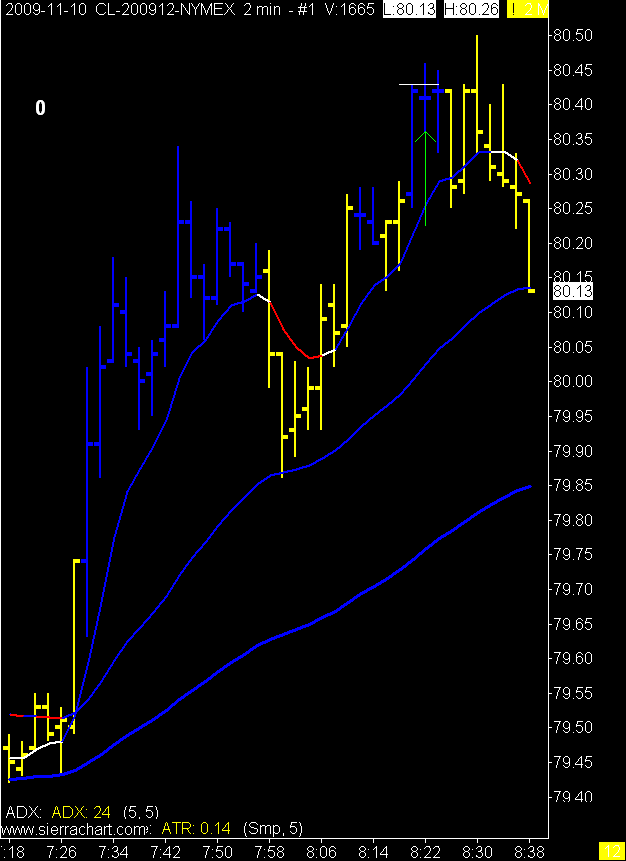

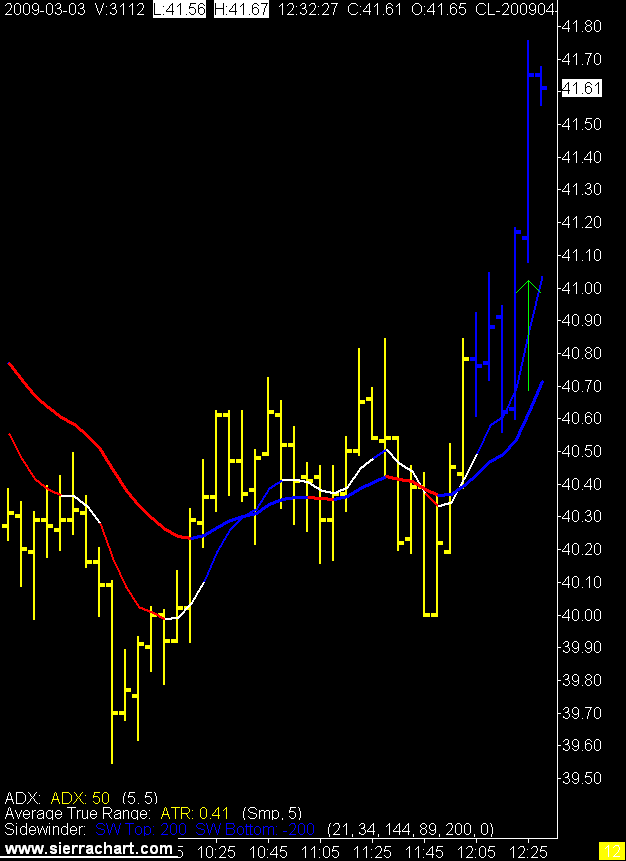

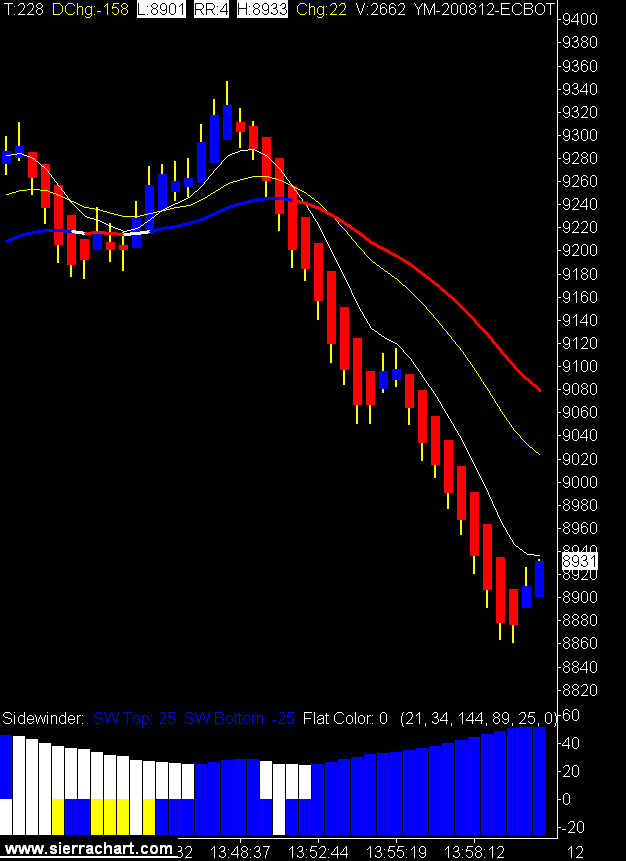

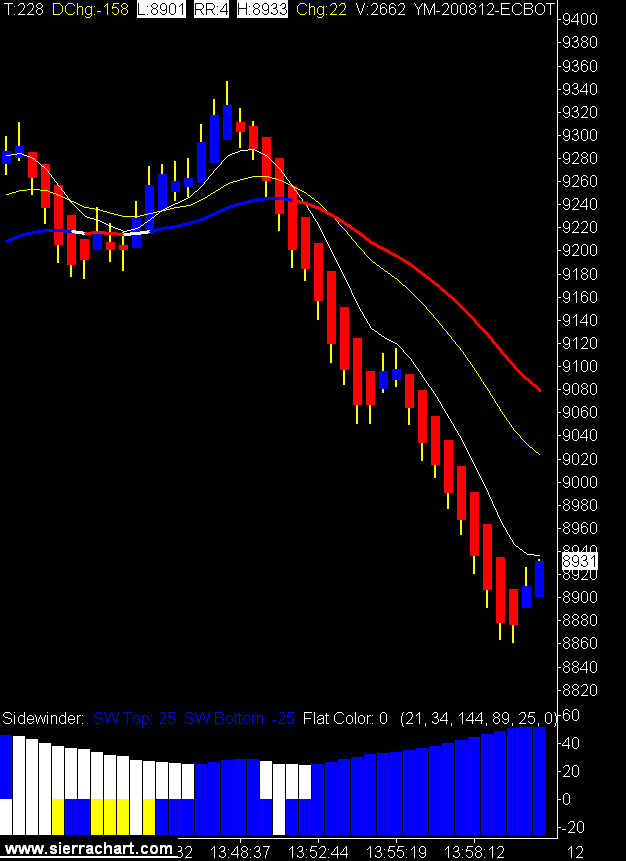

Trade number 2 which I have titled, I am genius, shows a nice downtrend, a thoughtful entry, and target reached.

Trade number 2 which I have titled, I am genius, shows a nice downtrend, a thoughtful entry, and target reached.

I am genius.

The truth of the two trades is that both were successful. Both trades met my guidelines completely, I took both trades and executed the in flight plan perfectly, and I accepted the outcome from both as part of the business.

The truth of the two trades is that both were successful. Both trades met my guidelines completely, I took both trades and executed the in flight plan perfectly, and I accepted the outcome from both as part of the business.

Money management took 13 ticks on one and money management gave 55 ticks on the other.

The moral of the story is I am neither moron or genius, (although I am human and therefore could be stupid) I am simply following a plan that has statistical merit.

It's just that easy.

HA!

It's never easy, unless you can somehow get into the Long & Wrong robotic mindset and stay there. I get there, but I don't always stay there. I guess I am stupid.

But I'm not a moron or a genius, I'm a trader.

I thought I would add to the conversation with my two trades today. Trade number 1, which I have titled, I am moron, shows a big up move with many blue bars and the cheers of successful traders along the way.

Solfest's entry endured heckling from the peanut gallery and ended with tears and the gnashing of teeth.

I am moron.

Trade number 2 which I have titled, I am genius, shows a nice downtrend, a thoughtful entry, and target reached.

Trade number 2 which I have titled, I am genius, shows a nice downtrend, a thoughtful entry, and target reached. I am genius.

The truth of the two trades is that both were successful. Both trades met my guidelines completely, I took both trades and executed the in flight plan perfectly, and I accepted the outcome from both as part of the business.

The truth of the two trades is that both were successful. Both trades met my guidelines completely, I took both trades and executed the in flight plan perfectly, and I accepted the outcome from both as part of the business.Money management took 13 ticks on one and money management gave 55 ticks on the other.

The moral of the story is I am neither moron or genius, (although I am human and therefore could be stupid) I am simply following a plan that has statistical merit.

It's just that easy.

HA!

It's never easy, unless you can somehow get into the Long & Wrong robotic mindset and stay there. I get there, but I don't always stay there. I guess I am stupid.

But I'm not a moron or a genius, I'm a trader.

8/16/2009

Whose Game are You Playing?

After a few years of trading I have come to the realization that the key to winning is all in my head. This is a psychological battle with myself. The market participants are irrelevant. There is no giant war against the big banks or hedge funds or you my fellow independents. The game (war sounds so nasty) is me against me. Or as I once penned Bad Solfest against Good Solfest.

I have an edge and the key to success is to only trade within that edge. Good Solfest follows that plan, Bad Solfest wants to make up new rules every time he has a losing trade. Bad Solfest tries to play everyone’s game, Good Solfest only wants to play his game.

Let me put this another way, wander over to your bookshelf and pick up your well thumbed copy of Trading in the Zone, by Mark Douglas. Douglas has a great analogy on page 102 about casinos. He states a casino has a 4.5% edge over all the players in the game of blackjack. A small edge. The casino is very confident in their edge, they don't question it, they don't get concerned if they lose money to some players. They know they have an edge and if the game is played by their rules they will win in the long run. How do they know this? They have stats, millions and millions of games played.

They know.

If someone comes into their house and tries to change the rules (they call it cheating) they take them into a room with no windows and break their kneecaps. That's how we know if we want to play we have to play by their rules. We also know that if we play enough we will lose and they will win. Why people play a game with that reality is beyond me. Or is it the same reason people keep trading even though they are losing money every month?

The successful trader has to be "the house". The game has to be yours not someone else’s. It's your game because you set the rules, your plan is the rule book, and you have set the standards for the game.

There are two issues that must be done right in order for your "casino" to be profitable, your plan must have an edge and you must never deviate from the plan.

How do you know what your edge is? Stats, stats, and more stats. It's all you have; it's the only way to know. Do you have them? If you don't have the stats to back up your plan and you are trading live you are a dead man. You are not the casino, you are the drunk tourist from Hoboken, and let me repeat, you are a dead man.

Get the simulator out of the closet and get yourself a database of trades that means something. If the edge is not there with the current plan you have some work to do.

Now let's assume the stats are there, the edge is solid, now all you have to do is execute. Why is that so hard? Recency bias? We humans are stupid? No, no that's a little harsh, we're just emotional, and the emotions that come roaring out when we are dealing with money are ego, fear, and greed.

How do we combat these emotions? How do we act like the casino with the small edge? We keep our stats and we measure our success based on something other than money.

We know what we have to do, so let's measure our success on how well we do it. It’s our game and we keep the score. The game is not scored by profit or loss but by how many plan certified trades you take. You lose points by missing qualified trades and by taking muts (made up trades).

You can figure out the scoreboard any way you want along those lines. Make adherence to the plan the only thing that matters.

You are the house, the casino, so when you let the other players into your establishment make sure you only play against them by your rules.

If you cheat (don't play by your own rules) I will come to your house, take you into a windowless room and break your kneecaps.

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

I have an edge and the key to success is to only trade within that edge. Good Solfest follows that plan, Bad Solfest wants to make up new rules every time he has a losing trade. Bad Solfest tries to play everyone’s game, Good Solfest only wants to play his game.

Let me put this another way, wander over to your bookshelf and pick up your well thumbed copy of Trading in the Zone, by Mark Douglas. Douglas has a great analogy on page 102 about casinos. He states a casino has a 4.5% edge over all the players in the game of blackjack. A small edge. The casino is very confident in their edge, they don't question it, they don't get concerned if they lose money to some players. They know they have an edge and if the game is played by their rules they will win in the long run. How do they know this? They have stats, millions and millions of games played.

They know.

If someone comes into their house and tries to change the rules (they call it cheating) they take them into a room with no windows and break their kneecaps. That's how we know if we want to play we have to play by their rules. We also know that if we play enough we will lose and they will win. Why people play a game with that reality is beyond me. Or is it the same reason people keep trading even though they are losing money every month?

The successful trader has to be "the house". The game has to be yours not someone else’s. It's your game because you set the rules, your plan is the rule book, and you have set the standards for the game.

There are two issues that must be done right in order for your "casino" to be profitable, your plan must have an edge and you must never deviate from the plan.

How do you know what your edge is? Stats, stats, and more stats. It's all you have; it's the only way to know. Do you have them? If you don't have the stats to back up your plan and you are trading live you are a dead man. You are not the casino, you are the drunk tourist from Hoboken, and let me repeat, you are a dead man.

Get the simulator out of the closet and get yourself a database of trades that means something. If the edge is not there with the current plan you have some work to do.

Now let's assume the stats are there, the edge is solid, now all you have to do is execute. Why is that so hard? Recency bias? We humans are stupid? No, no that's a little harsh, we're just emotional, and the emotions that come roaring out when we are dealing with money are ego, fear, and greed.

How do we combat these emotions? How do we act like the casino with the small edge? We keep our stats and we measure our success based on something other than money.

We know what we have to do, so let's measure our success on how well we do it. It’s our game and we keep the score. The game is not scored by profit or loss but by how many plan certified trades you take. You lose points by missing qualified trades and by taking muts (made up trades).

You can figure out the scoreboard any way you want along those lines. Make adherence to the plan the only thing that matters.

You are the house, the casino, so when you let the other players into your establishment make sure you only play against them by your rules.

If you cheat (don't play by your own rules) I will come to your house, take you into a windowless room and break your kneecaps.

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

8/11/2009

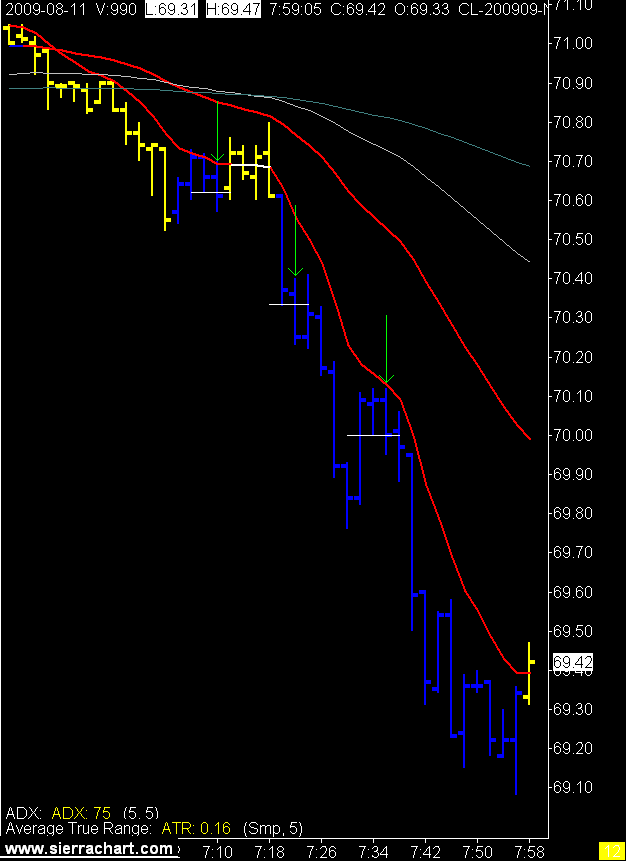

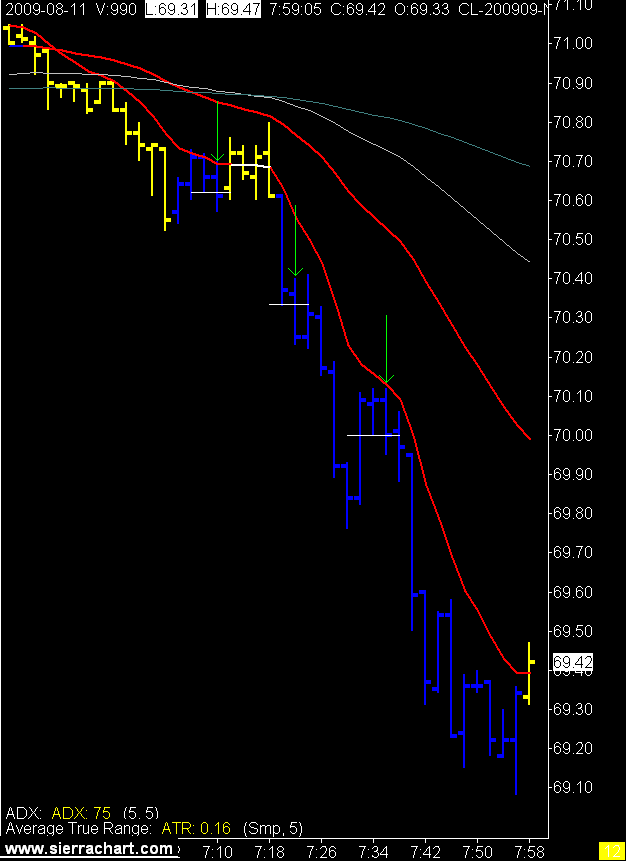

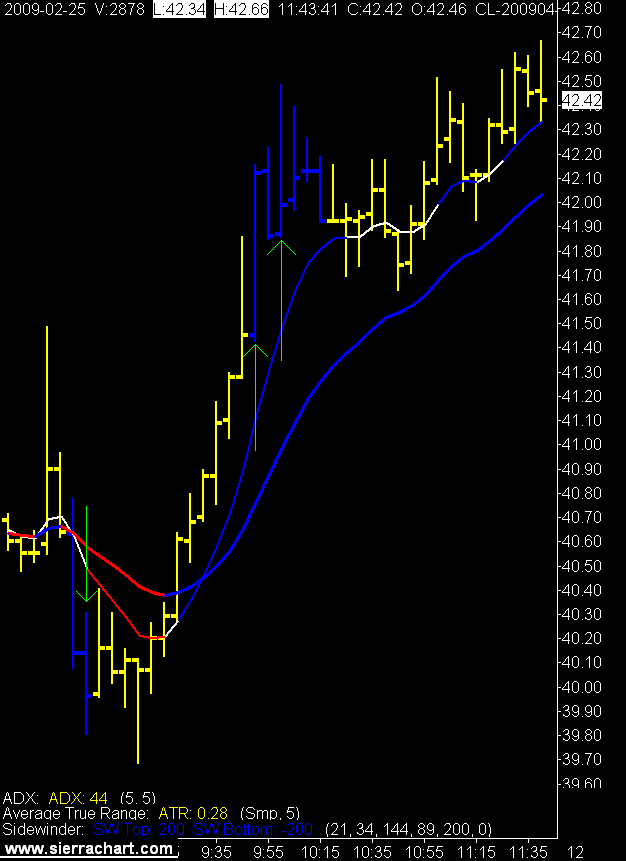

Beautiful

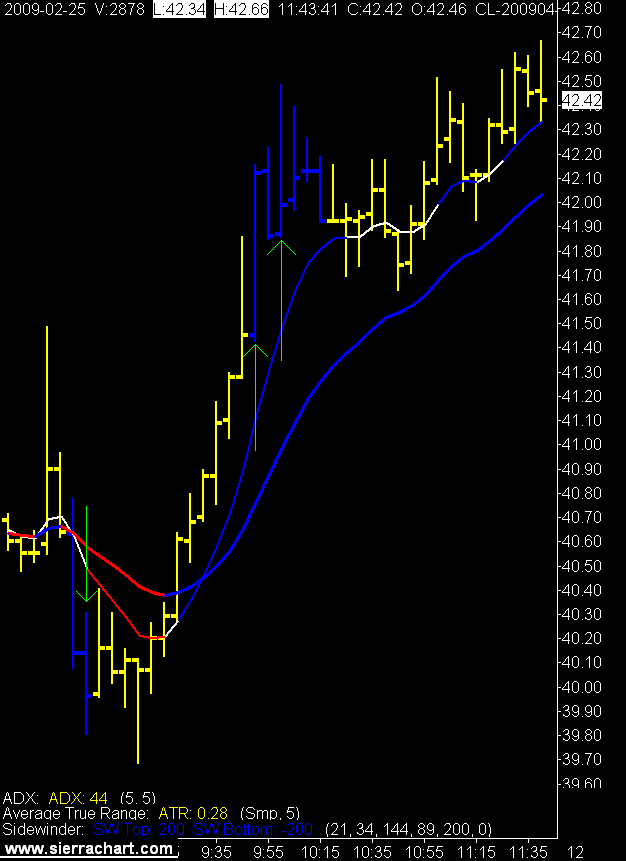

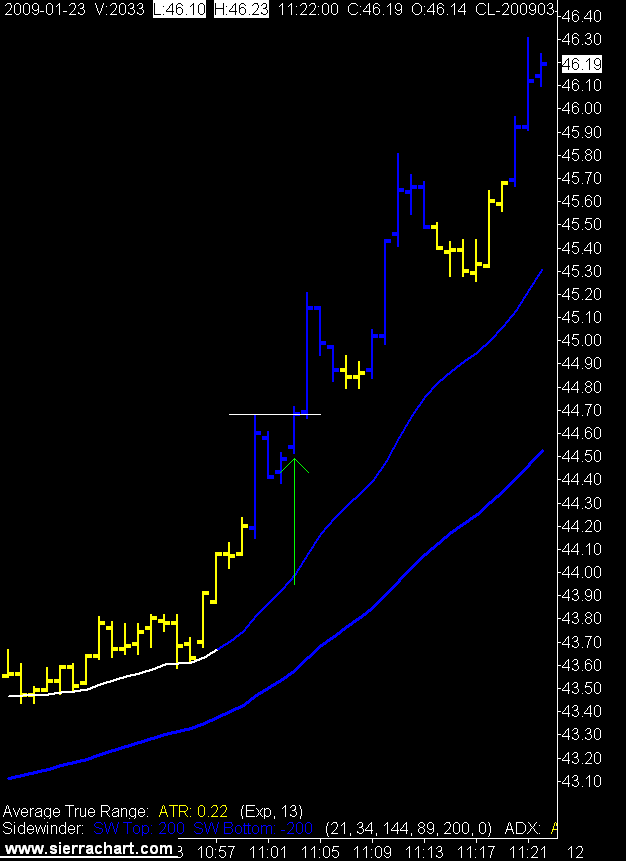

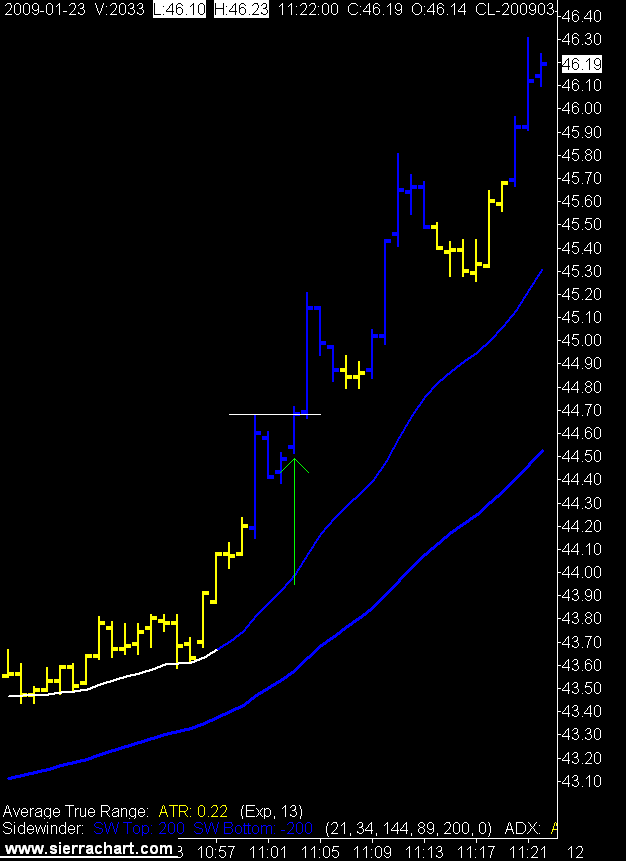

2 Minute Crude Oil Chart

Those are some nice signals. Right? The first one was a stop out but the other 2 are things of beauty. Right? Solfest the "genius" must be counting his crude dollars. Right?

Those are some nice signals. Right? The first one was a stop out but the other 2 are things of beauty. Right? Solfest the "genius" must be counting his crude dollars. Right?

Wrong.

What happened? Remember how smart you were yesterday. Yes I do. In fact that was the problem. Recency bias reared its ugly head yet again, recency bias, we place more meaning on the most recent events rather than our historical results. Remember yesterday I was bragging about my brilliant reading of the ADX. So did the ADX let you down today you ask?

No. The ADX levels were through the roof. The problem was I didn't take it in. I saw it but I traded like I did yesterday. I moved stops too soon today. In yesterday's weak trend that was the right move, but today, in the monster trend the thing to do was hit the entry button and let the pre programmed stops do there thing.

I didn't do that. I let my "recent" success from yesterday cloud my decision making today. Result being I hit my daily stop and had to shut it down.

Trading is hard. :)

Those are some nice signals. Right? The first one was a stop out but the other 2 are things of beauty. Right? Solfest the "genius" must be counting his crude dollars. Right?

Those are some nice signals. Right? The first one was a stop out but the other 2 are things of beauty. Right? Solfest the "genius" must be counting his crude dollars. Right?Wrong.

What happened? Remember how smart you were yesterday. Yes I do. In fact that was the problem. Recency bias reared its ugly head yet again, recency bias, we place more meaning on the most recent events rather than our historical results. Remember yesterday I was bragging about my brilliant reading of the ADX. So did the ADX let you down today you ask?

No. The ADX levels were through the roof. The problem was I didn't take it in. I saw it but I traded like I did yesterday. I moved stops too soon today. In yesterday's weak trend that was the right move, but today, in the monster trend the thing to do was hit the entry button and let the pre programmed stops do there thing.

I didn't do that. I let my "recent" success from yesterday cloud my decision making today. Result being I hit my daily stop and had to shut it down.

Trading is hard. :)

Labels:

day trading,

recency bias,

trading plan,

trading stops

3/11/2009

Curve Fitting

When you start messing with your trading system there is always a danger that you will catch the horrible disease known as constantinkeritis.

This is a nasty affliction which you should recognize if you are making 3:00 AM MACD adjustments and mumbling to yourself throughout the day.

The only known cure is the blue screen of death on your computer that causes you to toss it in the garbage and buy a new one. This clean slate provides the opportunity to begin life anew.

Three trades today, one on a time frame that shall remain nameless for now. Caught a partial stop, partial target, and full target.

The second trade shown here did not have blue on the entry bar, but did on the longer time frame chart. I thought the 1 minute bar would turn blue if the trade went my way. It didn't, but the trade worked anyway.

1 Minute Crude Oil Charts

This is a nasty affliction which you should recognize if you are making 3:00 AM MACD adjustments and mumbling to yourself throughout the day.

The only known cure is the blue screen of death on your computer that causes you to toss it in the garbage and buy a new one. This clean slate provides the opportunity to begin life anew.

Three trades today, one on a time frame that shall remain nameless for now. Caught a partial stop, partial target, and full target.

The second trade shown here did not have blue on the entry bar, but did on the longer time frame chart. I thought the 1 minute bar would turn blue if the trade went my way. It didn't, but the trade worked anyway.

1 Minute Crude Oil Charts

3/03/2009

Don't Blink

To continue with my counting of the seconds theme today I watched charts for 19,645 seconds, traded for 46 seconds, and then congratulated myself for the remaining 109 seconds in the session.

I got full target on the trade as the peak of the move was 1 tic above my target.

Is that skill or dumb luck?

It's been a slow couple of days, let's call it skill.

I also deployed the retirement cash into stock so yes this is officially the bottom.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

I got full target on the trade as the peak of the move was 1 tic above my target.

Is that skill or dumb luck?

It's been a slow couple of days, let's call it skill.

I also deployed the retirement cash into stock so yes this is officially the bottom.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

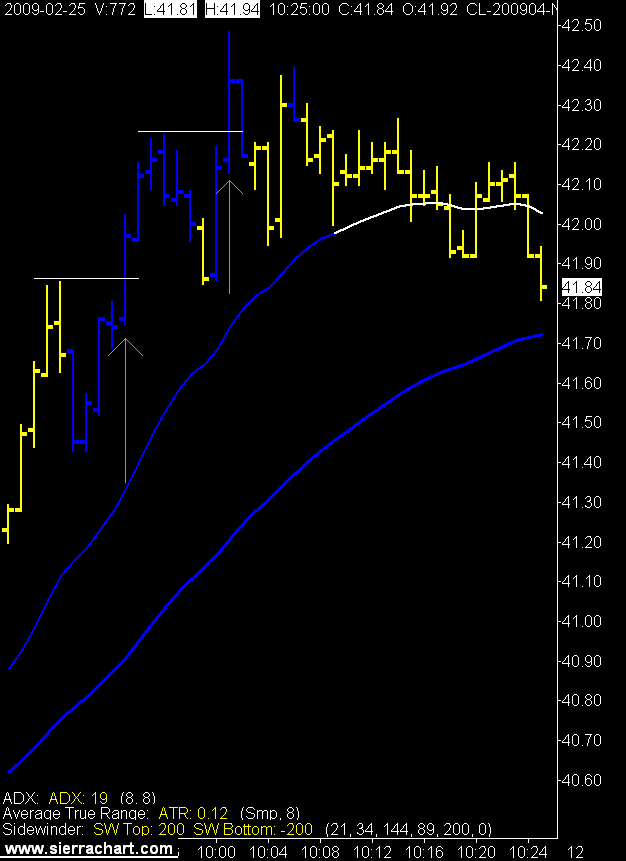

2/25/2009

A Slight Tweaking

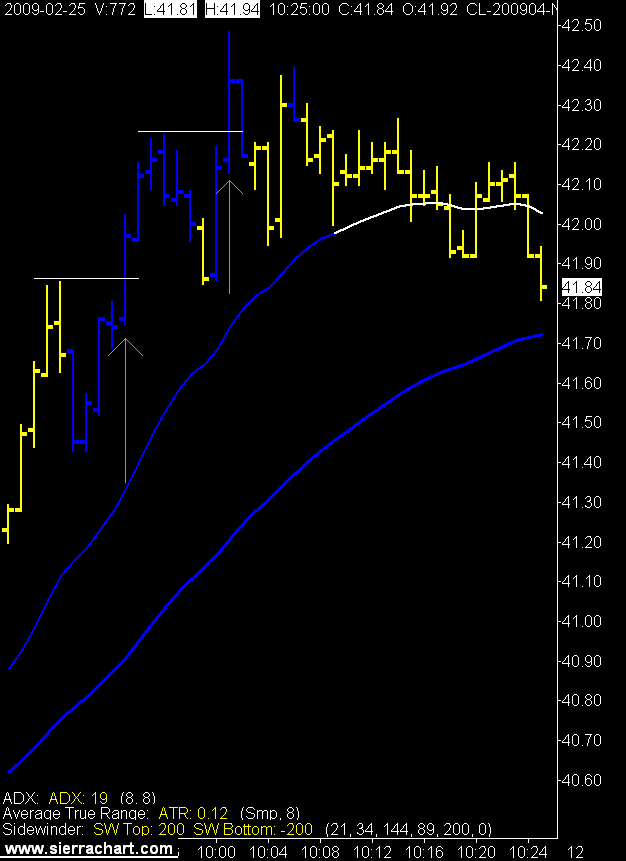

I have made a few slight adjustments to the magic blue bars as I have been suffering a major lack of magic these last few weeks. The parameters for the indicators are roughly the same but I have shortened the length required to obtain those parameters.

For example the 5 minute ATR and ADX are now a 5 period instead of an 8 period.

Barrel count today and you see the crazy price action on the 1 minute chart at 8:30 MST. That kind of price action is tame compared to how it used to act, back in the good old days.

I missed the first trade and caught the next 2, one for full target and one partial.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

For example the 5 minute ATR and ADX are now a 5 period instead of an 8 period.

Barrel count today and you see the crazy price action on the 1 minute chart at 8:30 MST. That kind of price action is tame compared to how it used to act, back in the good old days.

I missed the first trade and caught the next 2, one for full target and one partial.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

2/17/2009

I Can't Get No

No signals, no trades.

Another name for this post, not this song, could be the art of doing nothing. I have trouble with the art of doing nothing. Those of you who are familiar with GB007 will remember his quote, "the urge to trade is stronger than the urge to trade profitably".

Very true.

Especially if you have spent most of your youth and adulthood working your you know what off. It just doesn't feel right to do nothing. I'm here, I'm a trader, I should trade.

Most of us grew up with the knowledge that if you want something you have to work for it. Work harder, work harder, work harder.

It doesn't work that way in trading.

I guess we call it working smarter.

2/06/2009

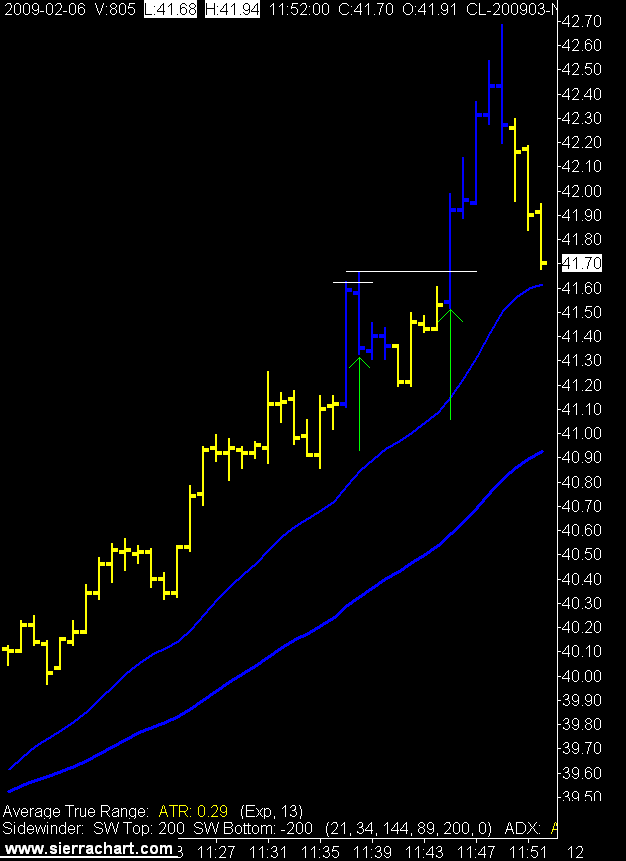

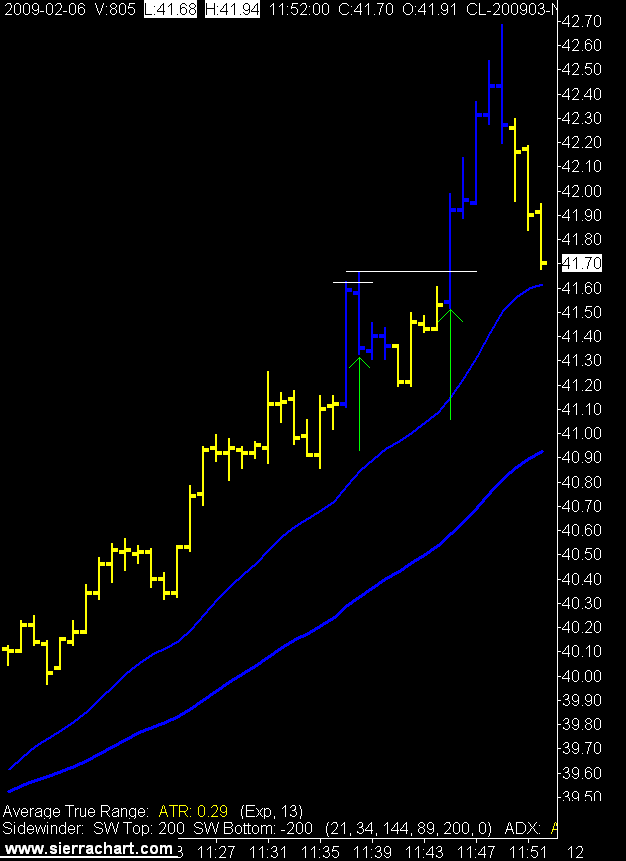

Pride and Joy

Got into a big fight with my plan this week. It was ugly, yelling, screaming, crying, and then the neighbors called the police. I threatened to leave my plan, I told her I found a new faster version, one that looked up to me as the trading master I am. I am ashamed to admit I even tried out the "other" plan. But, in the end my plan did not fail me, and she remains as always, my pride and joy.

1 Minute Crude Oil Chart

1 Minute Crude Oil Chart

2/04/2009

Adaptation

"Adaptation is the change in living organisms that allow them to live successfully in an environment. Adaptations enable living organisms to cope with environmental stresses and pressures. Adaptations can be structural, behavioral or physiological. Structural adaptations are special body parts of an organism that help it to survive in its natural habitat (e.g., skin colour, shape, body covering). Behavioral adaptations are special ways a particular organism behaves to survive in its natural habitat (e.g., phototropism). Physiological adaptations are systems present in an organism that allow it to perform certain biochemical reactions (e.g., making venom, secreting slime, homeostasis)." Wikipedia

Uncle Rain (RR) told me I need to adapt my trading to the current market conditions. He thinks I don't listen to him so let's keep this between us.

He told me this as I was on a multiple post rant on the lack of signals for me in crude oil. Ok maybe multiple post doesn't quite cover the extent of the rant. "The Thrill is Gone" does summarize it nicely though.

Anyway where was I, oh yes, adaptation. The question is do you change your trading plan to fit the current market conditions or do you sit on the sidelines and wait for the market to come back to you?

Hmmm.

Changing your plan could also be described as curve fitting. Continually looking backward to find parameters that would have worked and then hoping they still work when applied to the hard right edge of the chart.

Sitting around for days and days doing nothing also doesn't sound like intelligence in action. Or does it? The turtles used to play a lot of ping pong according to Curtis Faith. This is trading, trading is not normal, normal behavior doesn't work in this business. We all know that, if it did there would be more success stories.

I am a human. I have taken my human emotional brain and created a machine to trade with. The machine does what I told it to do. I told it this based on hundreds of trades and my experience in those trades.

The plan is the result of that work.

But, the market has changed since then.

The 5 day ATR in crude is pathetic. Since there is less range you should be able to use smaller stops and smaller targets and still maintain the 3:1 RR target.

The problem with that is I based my ATR, EMA, LSMA, ADX criteria on levels where we see rapid price movement. If I accept lower levels we have more sideways price action. In other words I don't believe the smaller stop would work.

Let's go back to that humanness. This is February 4th. January of 2009 was a pretty good month for me. LOL It sounds absurd now that I have written it down.

ITS FEBRUARY 4TH MORON!!

Four days into the month and you want to change what was 5 days ago a great plan and system.

Oh my.

I think I have my answer.

The best part is the less I trade the more I can come up with annoying posts in the EIT's trading room. I know how much they love that. They can't get enough of my witty banter.

I'm glad we had this talk.

I feel better now.

Uncle Rain (RR) told me I need to adapt my trading to the current market conditions. He thinks I don't listen to him so let's keep this between us.

He told me this as I was on a multiple post rant on the lack of signals for me in crude oil. Ok maybe multiple post doesn't quite cover the extent of the rant. "The Thrill is Gone" does summarize it nicely though.

Anyway where was I, oh yes, adaptation. The question is do you change your trading plan to fit the current market conditions or do you sit on the sidelines and wait for the market to come back to you?

Hmmm.

Changing your plan could also be described as curve fitting. Continually looking backward to find parameters that would have worked and then hoping they still work when applied to the hard right edge of the chart.

Sitting around for days and days doing nothing also doesn't sound like intelligence in action. Or does it? The turtles used to play a lot of ping pong according to Curtis Faith. This is trading, trading is not normal, normal behavior doesn't work in this business. We all know that, if it did there would be more success stories.

I am a human. I have taken my human emotional brain and created a machine to trade with. The machine does what I told it to do. I told it this based on hundreds of trades and my experience in those trades.

The plan is the result of that work.

But, the market has changed since then.

The 5 day ATR in crude is pathetic. Since there is less range you should be able to use smaller stops and smaller targets and still maintain the 3:1 RR target.

The problem with that is I based my ATR, EMA, LSMA, ADX criteria on levels where we see rapid price movement. If I accept lower levels we have more sideways price action. In other words I don't believe the smaller stop would work.

Let's go back to that humanness. This is February 4th. January of 2009 was a pretty good month for me. LOL It sounds absurd now that I have written it down.

ITS FEBRUARY 4TH MORON!!

Four days into the month and you want to change what was 5 days ago a great plan and system.

Oh my.

I think I have my answer.

The best part is the less I trade the more I can come up with annoying posts in the EIT's trading room. I know how much they love that. They can't get enough of my witty banter.

I'm glad we had this talk.

I feel better now.

2/03/2009

Bored Traders

What do you do when there is nothing to trade?

If you are an exceptional Irish trader and an exceptional Irish painter.

You paint.

If you can't paint?

If you can't paint?

You look for strange you tube videos.

That is, of course, after you finished lining your office walls with aluminium foil so the FBI cannot spy on you.

Of course.

If I don't get a trading signal soon we will be going back to the rather disturbing, The Shining, videos.

Although shuffle board does look like alot of fun.

If you are an exceptional Irish trader and an exceptional Irish painter.

You paint.

If you can't paint?

If you can't paint?You look for strange you tube videos.

That is, of course, after you finished lining your office walls with aluminium foil so the FBI cannot spy on you.

Of course.

If I don't get a trading signal soon we will be going back to the rather disturbing, The Shining, videos.

Although shuffle board does look like alot of fun.

1/29/2009

Guess What

When I wasn't learning how to knit today I saw this little nugget. The French have found the cure for the world's economic crisis.

Have your entire country go on strike.

Oh my that's good, I haven't laughed like that for a long time.

1/28/2009

redrum

A day with no trades. No signals, no trades. You plan, you prepare, you wait, and nothing.

Nothing.

No trades.

It could cause a man to, well, go a little nutty.

Nothing.

No trades.

It could cause a man to, well, go a little nutty.

1/26/2009

Machine Beats Man, Again

The machine had 2 trades, 1 full target and 1 full stop, gross RR 3.00. The man had 3 trades, 1 full target and 2 full stops, gross RR 1.64.

The first 2 trades were the same for the man and the machine, the third trade was a pure experiential, intuitional, humanoid, run for the roses. Yes I do realize one of those words is brand new to the world.

I won't bore you with charts as they will just depress you with their randomness. Instead I'll bore you with the exact times (MST) and stats from the day.

Trade 1: Long, Entry 8:06:09 $47.44, Exit 8:07:03 $47.32, MAE 12, MFE 9, Gross (12)

Trade 2: Long, Entry 8:08:38 $47.56, Exit 8:09:27 $47.92, MAE 3, MFE 36, Gross 36

Trade 3: Short, Entry 12:14:40 $45.89, Exit 12:14:54 $45.99, MAE 10, MFE 3, Gross (10)

If resistance really is futile why do I continue to resist?

The first 2 trades were the same for the man and the machine, the third trade was a pure experiential, intuitional, humanoid, run for the roses. Yes I do realize one of those words is brand new to the world.

I won't bore you with charts as they will just depress you with their randomness. Instead I'll bore you with the exact times (MST) and stats from the day.

Trade 1: Long, Entry 8:06:09 $47.44, Exit 8:07:03 $47.32, MAE 12, MFE 9, Gross (12)

Trade 2: Long, Entry 8:08:38 $47.56, Exit 8:09:27 $47.92, MAE 3, MFE 36, Gross 36

Trade 3: Short, Entry 12:14:40 $45.89, Exit 12:14:54 $45.99, MAE 10, MFE 3, Gross (10)

If resistance really is futile why do I continue to resist?

1/24/2009

1/23/2009

I am Not a Human

I am a trader.

An emotionless, humourless, colourless, heartless, trader.

I sit and I wait. I wait for the machine to tell me it's time to trade.

Then I press a button.

The machine places the order, the stop, and the target.

The machine moves the stop to break even.

I sit and watch, expressionless, eyes glazed over.

I accept the outcome of the machine's work.

I have no joy or sorrow with that outcome.

I am a trader.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

1 Minute Crude Oil Charts

Trade number one result: Target achieved and accepted.

Trade number two result: Break Even achieved and accepted.

An emotionless, humourless, colourless, heartless, trader.

I sit and I wait. I wait for the machine to tell me it's time to trade.

Then I press a button.

The machine places the order, the stop, and the target.

The machine moves the stop to break even.

I sit and watch, expressionless, eyes glazed over.

I accept the outcome of the machine's work.

I have no joy or sorrow with that outcome.

I am a trader.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

1 Minute Crude Oil Charts

Trade number one result: Target achieved and accepted.

Trade number two result: Break Even achieved and accepted.

1/15/2009

1/14/2009

Two Signals, Three Trades

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

I will not take a trade without a signal.

10/29/2008

The Bear is Alive!

Whatever.

I have been adjusting my trading plan these past couple of weeks and have taken some time to review my trading history and where I want to go in the future.

I have looked backward to reinforce what I believe in and answered some basic questions that I have answered before, but have drifted away from for whatever reason.

Starting with what is the basic premise that I am trading?

For me it is trading with the trend. Identifying the trend on a higher time, trading that trend on a lower time frame.

Here are some questions I have written answers for again. I’m not giving you my answers because you must trade your own answers.

1) What defines a trend?

2) What defines your entry point?

3) What defines your exit point?

4) When can you re enter the market after a trade?

5) How much are you willing to lose on a trade?

6) When, if ever, do you move to break even?

7) How much are you prepared to lose in a day?

I think the most important questions for me in that group are trend identification and when can you re enter after a trade. My diabolical need to be right manifests itself in revenge trading, which is a bad thing, a very bad thing.

These questions must have answers before you enter the market. The answers to these questions must be backed up by statistics that demonstrate your trade has a statistical edge in the marketplace.

Then you trade.

If you can think of any other questions I’m missing let me know.

Today's results were 99 winning tics / 43 losing tics = RR 2.30, 4 wins, 4 losers, 2 break evens.

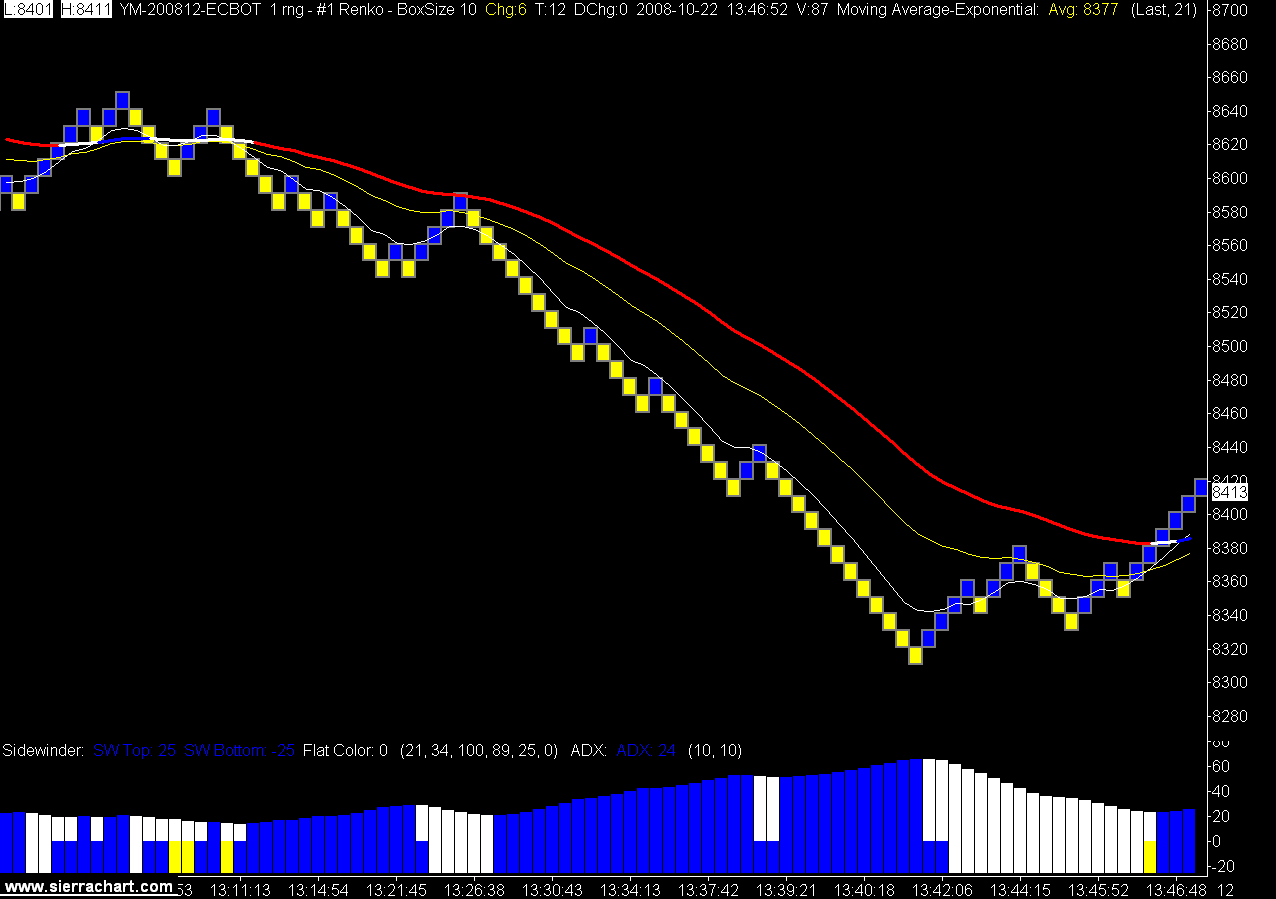

I have resurrected my 34 tic range bar chart as the trend identifier. These charts show the wild moves in the last hour of the session.

Mini DOW Futures 34 Tic Range Bar Charts

I have been adjusting my trading plan these past couple of weeks and have taken some time to review my trading history and where I want to go in the future.

I have looked backward to reinforce what I believe in and answered some basic questions that I have answered before, but have drifted away from for whatever reason.

Starting with what is the basic premise that I am trading?

For me it is trading with the trend. Identifying the trend on a higher time, trading that trend on a lower time frame.

Here are some questions I have written answers for again. I’m not giving you my answers because you must trade your own answers.

1) What defines a trend?

2) What defines your entry point?

3) What defines your exit point?

4) When can you re enter the market after a trade?

5) How much are you willing to lose on a trade?

6) When, if ever, do you move to break even?

7) How much are you prepared to lose in a day?

I think the most important questions for me in that group are trend identification and when can you re enter after a trade. My diabolical need to be right manifests itself in revenge trading, which is a bad thing, a very bad thing.

These questions must have answers before you enter the market. The answers to these questions must be backed up by statistics that demonstrate your trade has a statistical edge in the marketplace.

Then you trade.

If you can think of any other questions I’m missing let me know.

Today's results were 99 winning tics / 43 losing tics = RR 2.30, 4 wins, 4 losers, 2 break evens.

I have resurrected my 34 tic range bar chart as the trend identifier. These charts show the wild moves in the last hour of the session.

Mini DOW Futures 34 Tic Range Bar Charts

10/22/2008

Humbug

I have a feeling I'll be looking at this tomorrow. (click on chart to view)

Counter Trend Scalp Test

Gross RR 1.59

Win 59%

Net Average Trade $4.97

Winners 58

Losers 40

Total Trades 98

Net Income $486.60

Average Trades Per Day 20

Days 5

Average Daily Net Income $97.32

Traded it live today and our old friend Mr. Slippage took his cut.

Bottom line is it's not good enough. This trade was my adaptation of someone else's trading plan. It reinforces my renewed belief that you can't trade someone else's plan with your money.

The "exceptional Irish trader" is still poking me in the eye with a sharp stick, but apparently I'm a slow learner.

Back to work tomorrow, and I get to keep my turtle trading fan club membership.

Counter Trend Scalp Test

Gross RR 1.59

Win 59%

Net Average Trade $4.97

Winners 58

Losers 40

Total Trades 98

Net Income $486.60

Average Trades Per Day 20

Days 5

Average Daily Net Income $97.32

Traded it live today and our old friend Mr. Slippage took his cut.

Bottom line is it's not good enough. This trade was my adaptation of someone else's trading plan. It reinforces my renewed belief that you can't trade someone else's plan with your money.

The "exceptional Irish trader" is still poking me in the eye with a sharp stick, but apparently I'm a slow learner.

Back to work tomorrow, and I get to keep my turtle trading fan club membership.

Subscribe to:

Posts (Atom)