I have been adjusting my trading plan these past couple of weeks and have taken some time to review my trading history and where I want to go in the future.

I have looked backward to reinforce what I believe in and answered some basic questions that I have answered before, but have drifted away from for whatever reason.

Starting with what is the basic premise that I am trading?

For me it is trading with the trend. Identifying the trend on a higher time, trading that trend on a lower time frame.

Here are some questions I have written answers for again. I’m not giving you my answers because you must trade your own answers.

1) What defines a trend?

2) What defines your entry point?

3) What defines your exit point?

4) When can you re enter the market after a trade?

5) How much are you willing to lose on a trade?

6) When, if ever, do you move to break even?

7) How much are you prepared to lose in a day?

I think the most important questions for me in that group are trend identification and when can you re enter after a trade. My diabolical need to be right manifests itself in revenge trading, which is a bad thing, a very bad thing.

These questions must have answers before you enter the market. The answers to these questions must be backed up by statistics that demonstrate your trade has a statistical edge in the marketplace.

Then you trade.

If you can think of any other questions I’m missing let me know.

Today's results were 99 winning tics / 43 losing tics = RR 2.30, 4 wins, 4 losers, 2 break evens.

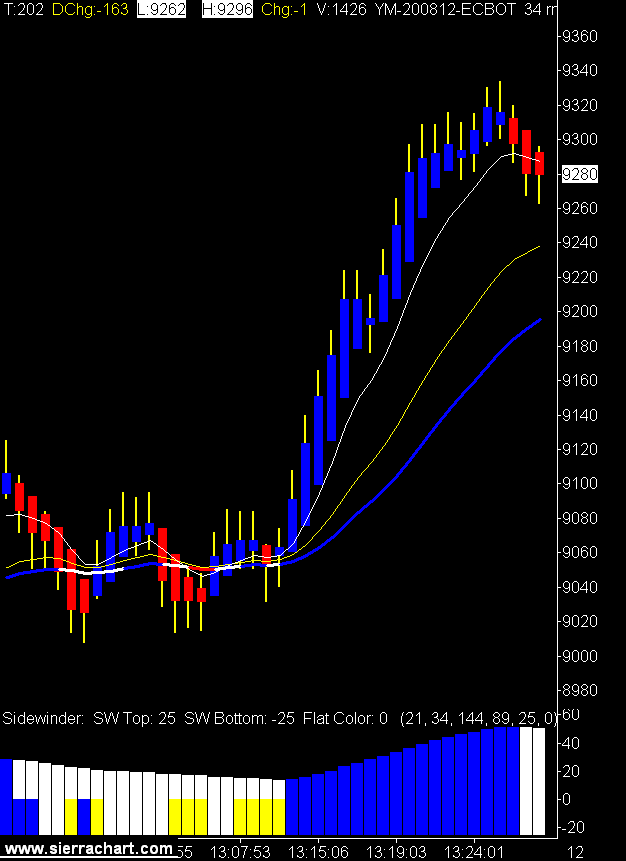

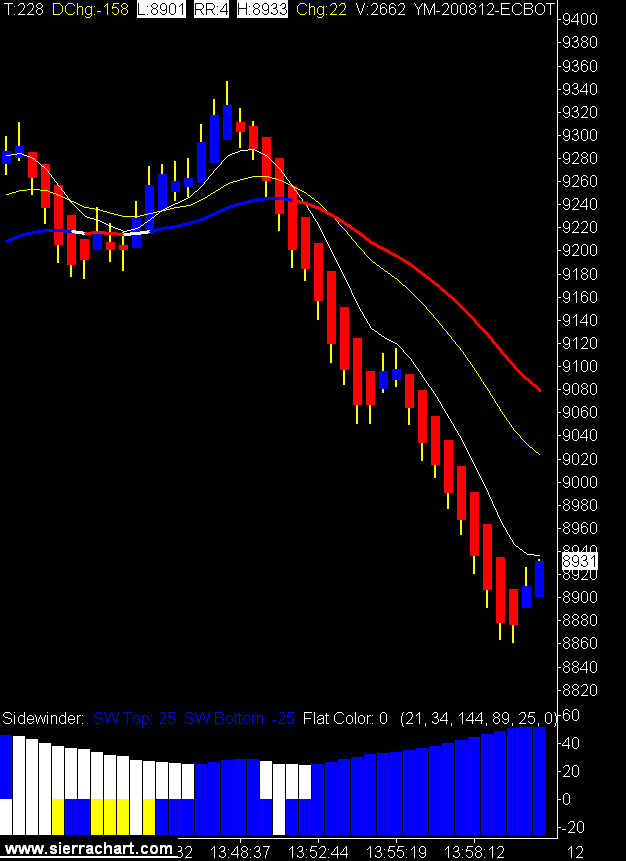

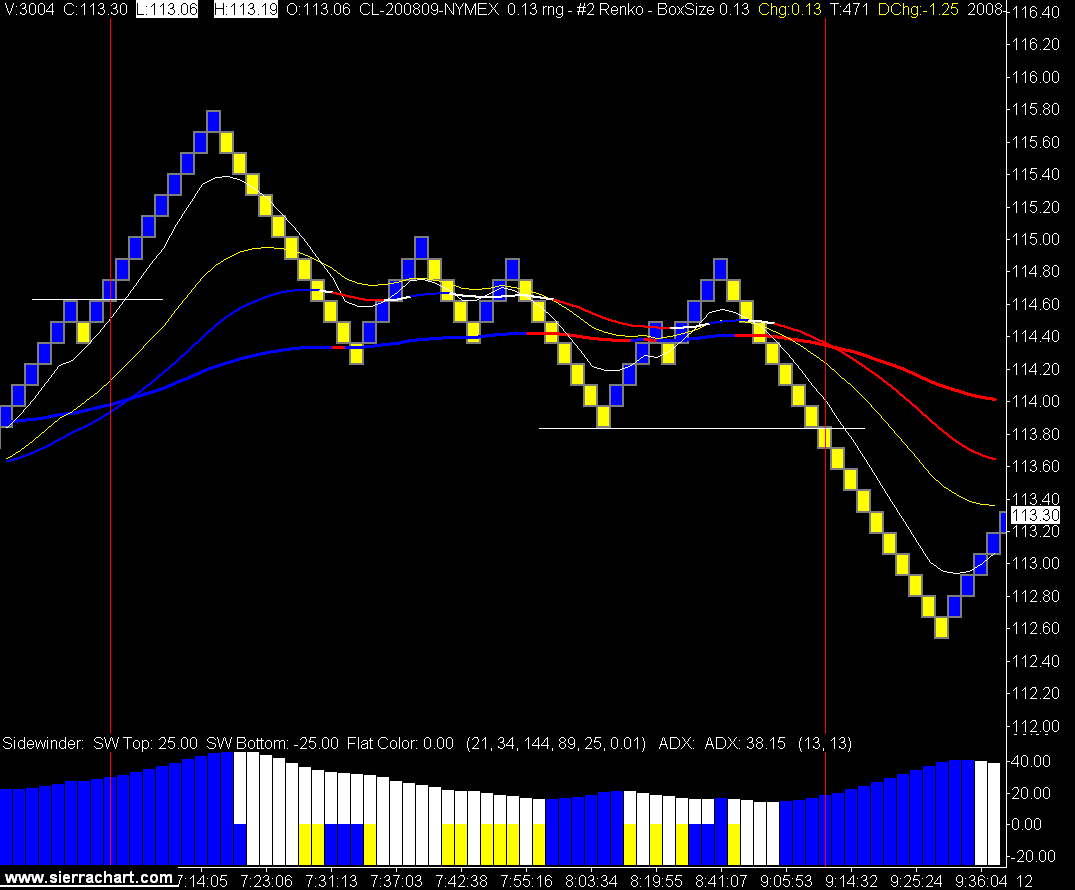

I have resurrected my 34 tic range bar chart as the trend identifier. These charts show the wild moves in the last hour of the session.

Mini DOW Futures 34 Tic Range Bar Charts