I have been adjusting my trading plan these past couple of weeks and have taken some time to review my trading history and where I want to go in the future.

I have looked backward to reinforce what I believe in and answered some basic questions that I have answered before, but have drifted away from for whatever reason.

Starting with what is the basic premise that I am trading?

For me it is trading with the trend. Identifying the trend on a higher time, trading that trend on a lower time frame.

Here are some questions I have written answers for again. I’m not giving you my answers because you must trade your own answers.

1) What defines a trend?

2) What defines your entry point?

3) What defines your exit point?

4) When can you re enter the market after a trade?

5) How much are you willing to lose on a trade?

6) When, if ever, do you move to break even?

7) How much are you prepared to lose in a day?

I think the most important questions for me in that group are trend identification and when can you re enter after a trade. My diabolical need to be right manifests itself in revenge trading, which is a bad thing, a very bad thing.

These questions must have answers before you enter the market. The answers to these questions must be backed up by statistics that demonstrate your trade has a statistical edge in the marketplace.

Then you trade.

If you can think of any other questions I’m missing let me know.

Today's results were 99 winning tics / 43 losing tics = RR 2.30, 4 wins, 4 losers, 2 break evens.

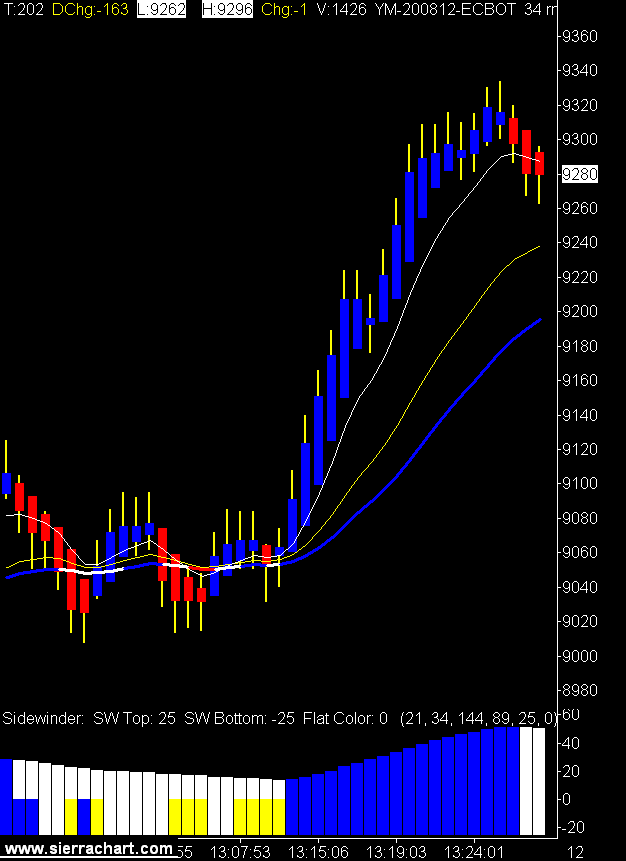

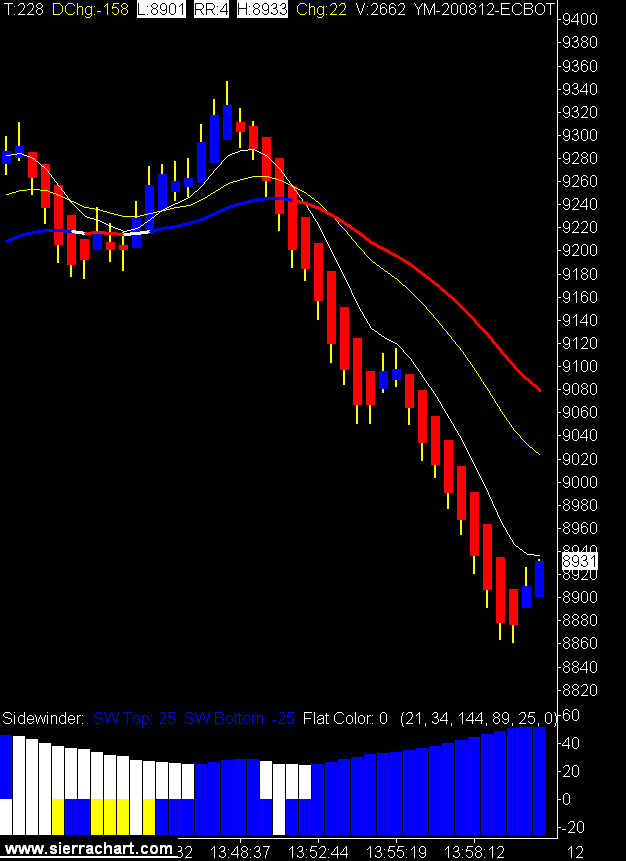

I have resurrected my 34 tic range bar chart as the trend identifier. These charts show the wild moves in the last hour of the session.

Mini DOW Futures 34 Tic Range Bar Charts

9 comments:

solf have you moved from renko to range bar charts ???

1) What defines a trend?

"I think the most important question for me in that group is trend identification"

The Irish wizard and 007 will be buying you a drink now.

Yes I am using range bars again rather than renko. I was finding renko hard to trade with the YM, might have been just me.

Other than one brief and soon to be forgotten counter trend scalp trade I have always traded with the trend.

What I got away from was the duel time frame trading. I literally close the smaller time frame chart now until I see trend on the larger time frame chart, so I am not tempted to trade until the big trend is in place.

Whether you use time, volume, tics, or range to measure that trend really doesn’t matter.

What does matter is making sure you are trading a significant move and not insignificant noise in the market.

That takes some skill to figure out.

http://tradingcrude.blogspot.com/2008/06/dual-time-frame-trading.html

solf,

Some say KISS

EG. for trend why not try the simple crossing of the 25 lsma over the 34ema on your 13 range bar chart for trend direction.

There are many ways to define trend. I want to use the higher time frame as I think it’s the best.

Every other trader on earth will have a very different, or slightly different way to do the same thing.

Which is why every other trader on earth must answer the trading questions for themselves?

Yes solf,

Everyone will have their ideas on trend ----- was just a suggestion (hope you do not mind)

I don't mind at all. If we all traded the same it would be a very strange market. Acutally there would be no market.

Solfest,

I gather your question 5 takes into account contract sizes/ leverage, and whether the trade's going to be a scalp, a daytrade or a swing trade?

For me, these have been the most difficult questions.

I'll use FX as an example, since I was just revisiting my trading plan (if I could call it a plan in the first place) earlier today. What prompted me to do that was that I noticed that while I made around 11% one day, I took a drawdown of 33% in the trades that followed. I had gone for a swing when my margin really only allowed me to scalp, or daytrade. I was trading with the higher timeframe trend (monthly, weekly, daily) but as soon as I entered, the hourly trend turned against me. 12 hours later, even the daily trend showed that the pairs were retracing. Now I won't know if that's a retracement or reversal until such time that the trend presents itself on the (daily) chart. I could wait, and risk getting a margin call. Had my account been properly funded (definitely intending to do so after I'm comfortable with the broker), I might have waited a little longer.

Anyway, I switched from entering on hourly chart to entering on 5min while monitoring the hourly as well. But I would only take a trade in the direction of the trend on the higher timeframe (monthly, weekly and daily).

I'm going to trade only 5,000 units instead of 20,000 to bring the leverage down to 1:2 (after the loss on Oct 28, my account balance stands at 2350 now). Using a 5min chart allows me to cut loss quickly (am allowing myself only 2% drawdown per day). I gave it a shot at USD/CHF - cut loss 3 times and took a tiny profit for 1 trade. It's laughable, I know, but it's a model I'm going to be transferring to my futures trading. Before this, I never knew when I should cut loss for NQ (and even for ER2).

For me, how much I want to lose is not a matter of preference. It's about not having the kind of drawdowns that we (D and I) have been seeing. In one week, I've witnessed a horrendous drawdown of 32% in the account we're using to trade emini futures. Not my doing, but am going to have to out up a plan for D. 2% per day. If our average number of trades per day is 10, then for each trade, the risk cannot be more than $100. And $100 will determine how many contracts we can trade for that particular trade.

That's for daytrading. For scalping, I'm still working out something.

"I gather your question 5 takes into account contract sizes/ leverage, and whether the trade's going to be a scalp, a daytrade or a swing trade?"

It takes all of those things into account. What size of stop will allow "normal" oscillation but be small enough to insure profitability in the long run.

Can that stop always be the same size?

How do you know when to change it?

Average True Range?

Dr. Elder, Come into My Trading Room, uses a triple screen method much as you describe. The question for day trading is how big of a picture can you look at before it becomes irrelevant to the time frame you ultimately trade.

If this was easy everyone would do it.

Post a Comment