If the government is going to bail out companies then the government has the right to change the rules of the game going forward. Free enterprise is not going to be quite as free.

They should have let them go down.

Enough of that, I'll leave most of the Wall Street / U.S. government bashing to others and focus on the oil market.

I traded the 8 tick renko again today, and again had too many trades with 12.

I must admit I opened the 13 tick again and started looking. You should not trade if you are not sure of your time frame. So I'm in the trading plan dog house right now.

One time frame may not meet all market conditions, and watching both may be the way to go. The good thing is I'm not changing the plan other than the size of the renko bar. Too many trades to post charts, the total was 8 BE + 2s, 2 full stops, and 2 winners. 42 winning ticks / 29 losing ticks = RR of 1.45.

I hate it when the broker makes more money than me.

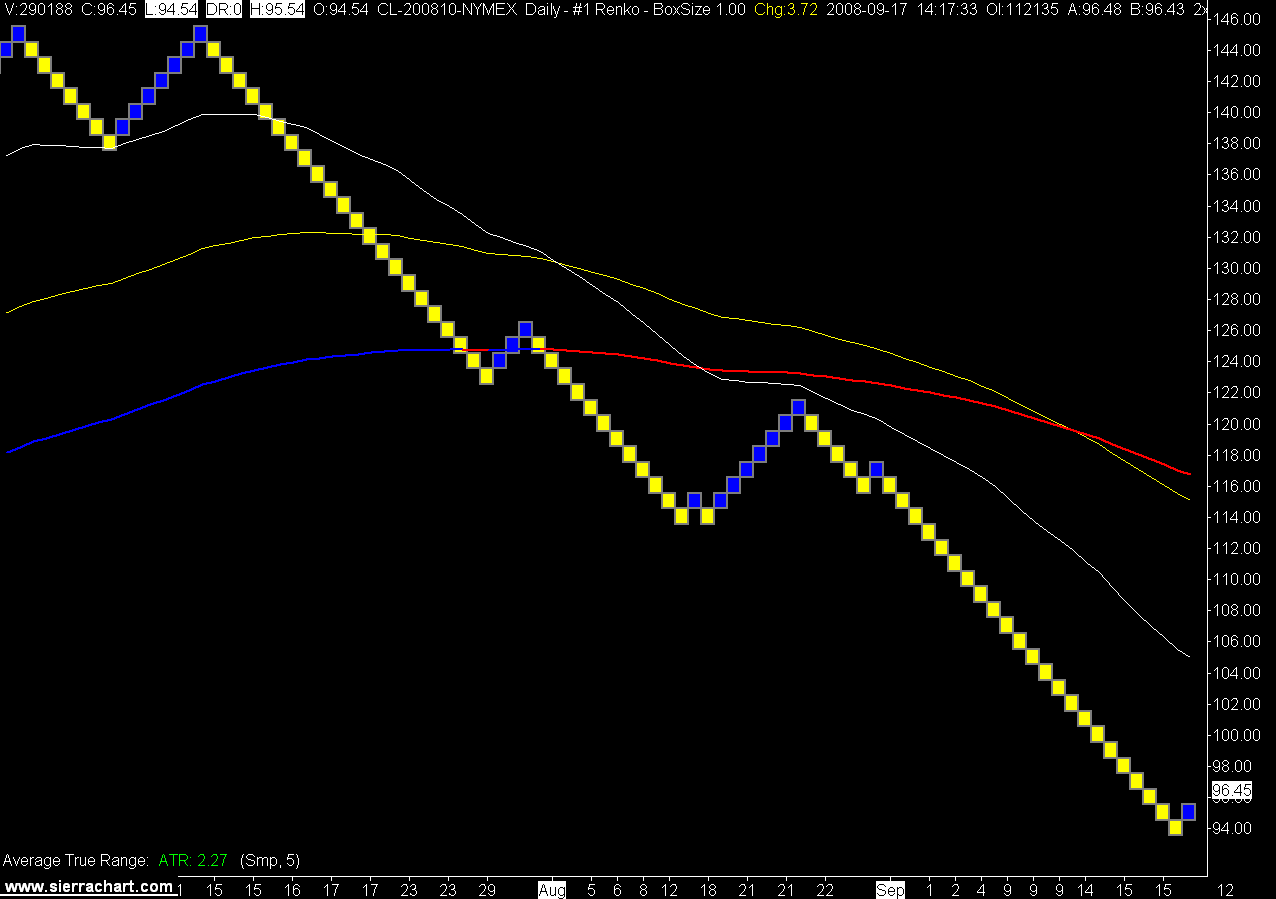

On another note I thought it would be interesting to see the difference between a regular candlestick daily chart and a renko daily chart. The renko looks alot easier to trade to me.

That is if you can live with the volatility and the size of stop required to stay with these types of swing trades.

Daily Crude Oil Chart

Daily Crude Oil Renko Chart

Don't miss the Warren Buffet post below. This is the guy who should have been running the U.S. treasury.

If the markets today have you feeling down watch the SNL post below, maybe you can have a laugh to help choke down your investment losses.

3 comments:

As painful as it would have been, I agree. They should have let them go down. I complain about the double standard to my wife all the time -- when they are up, they are champions of laissez faire capitalism. When they are down, they are gritty socialists snarling at the public trough.

I say let them go down, but I would have been wincing the whole way..."Ooh! Wow. Oh, OWEE! Holy CRAP that looked like it hurt!" Etc. Etc. And I would have been not a little bit nervous about the broader impact, and wondering when one of those broad swings would swoop around and knock me on the noggin.

And I agree on the apparent ease of the renko charts...haven't traded with them though. They seem to render market structure much more clearly, but it could just be a matter of cognitive biases and innate heuristic pattern seeking. I dunno. Maybe I should study them more.

I utterly hate it when my broker earns more than me from MY work!

Candlestick charts were not so bad before. But these days, you can hardly trust the patterns that used to be so reliable.

In a crazy market, anything goes.

I am contemplating trading without a chart and see if it will make any difference LOL!!

In fact, I'm swing trading mini yen futures (paper trading - shorted yen). It's day 3 now: it was profit on day 1, loss on day 2, then huge profit today (expected, after the 400 over point rise in DOW). I haven't opened my chart since day 1....

Post a Comment