We lost money, but we were one.

Actually did trade well, took the first set up as it appeared, and then another swing as the trend stayed in place. Missed one target by 3 tics which would have made the day green.

That's trading.

I did not revenge trade, I did not pass up opportunities, I did my job.

Some days you do it all right and you lose.

On another note it turns out the EIT (Exceptional Irish Trader) is also a EIP (Exceptional Irish Painter) take a look at his gallery.

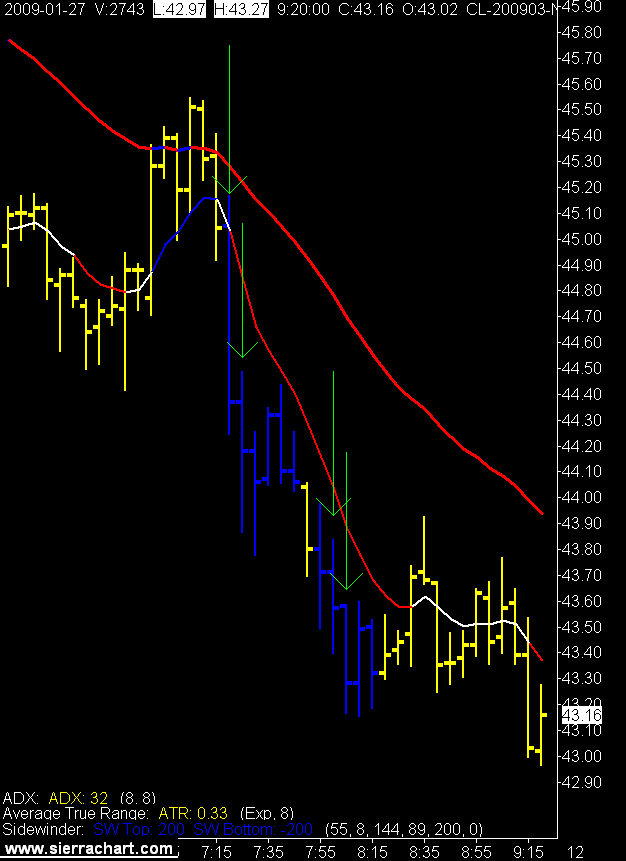

5 Minute Crude Oil Chart

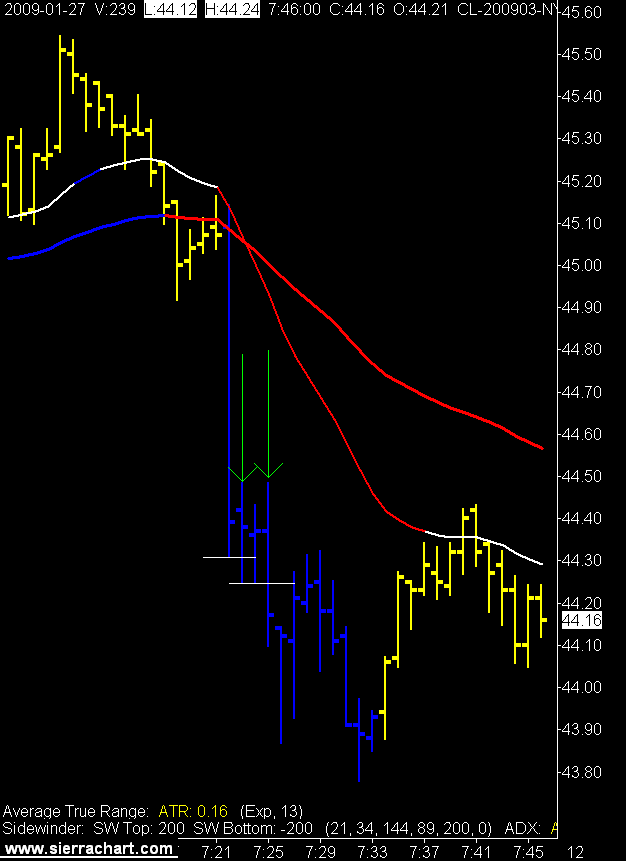

1 Minute Crude Oil Charts

9 comments:

can you please tell me your entries and exits on both trades. I am having trouble understanding your chart. Confused James

James the arrows on the 5 minute chart show the 5 minute bar I entered on.

The arrows on the 1 minute charts show the actual entry point right where the price bar crosses the horizontal white line.

For these short trades I entered a limit short order 2 tics below the low of the previous 1 minute bar. So if the next 1 minute bar breaks that swing low I'm in, if it doesn't I'm not.

But you are not going to trade like me because you are not me. You are going to read all the Solfest recommended trading books, then you are going to write a business plan, a trading plan, and a risk management policy. The you will sim trade the great trade plan you come up with.

You are going to sim 100 trades to determine if your plan works. Then after all the reading, all the simming, then and only then are you going to venture forth a trade with real money.

And after all that you will lose money.

Why?

Because you will break your rules, you will get angry, impatient, you will revenge trade, you will make up trades, you will stop trading.

Then you will read more books, re do your trading plan, sim another 100 trades, and then.....

Who knows you might make it.

James don’t let that wise ol Sol discourage you, he has a special way with words. Without sour we would have no sweet.

He is looking to buy a pullback in an uptrend or sell a pullback in a downtrend, he has proprietary software to paint his price bars blue when trend is determined. When a trend is in place he then looks for a break of a previous swing hi or low for a trigger to enter. He tries to keep his winners larger than his losers. His target and stop are determined from his stats of previous trades. If he then wins half his trades he is profitable. Fairly simple.

Play around with it, take some stats and see if it works for you. But what ever you do keep it simple. Realize though that a setup is the least important aspect of trading, after it’s all said and done trading is an exercise in self control.

Management of your ego and emotion

Management of your capital

Management of your setups

Determination, Confidence, Discipline, Focus and Patience.

These are the traits needed for success in any field including trading.

Sol is right, it is long journey, but don’t bother counting the steps, just keep putting one foot in front of the other. Have a goal just to last, your experience will grow and you will find your place.

RR

Isn't that what I said. :)

why yes, except for the 'might' make it part . . .

and the 'will break' your rules part . . .

and the 'will get angry' part . . .

and the 'impatient' part

and the . . .

_|: )-

Must be my rough upbringing. My first day on my first job in the dead of winter my new fellow employees took me out in the bush, stripped me to my civies, duct taped me to a tree, and left me for dead.

After I chewed my way free, killed a deer with my bare hands, skinned it with a stick, made a coat, and walked back to camp they looked at me and said, I guess this guy will be ok.

I'm so with you on this, Solfest!

Hi,

I know this is an old subject, but was thinking perhaps you were doing some trade strategy coding using Sierra Chart?

Was actually interested if you had done any Renko coding, to get me started in the right direction.

I did read Renko isn't what you are using now because of the time element doesn't suit..

A very clever blog, thanks for the education

Jeff,

Not sure what you mean by Renko coding?

I have always traded the trend, looked for acceleration into that trend, and then tried to find the right exit.

Exits are harder then entries and Renko was great for riding the trend to the end.

As long as you have a lot of patience that is, as to get this ride you have to take the retraces which of course can take you out leaving mucho MFE unrealized.

Peace

Post a Comment