I'll leave the new President alone for now (so LT doesn't get mad at me) and concentrate on the new crude month.

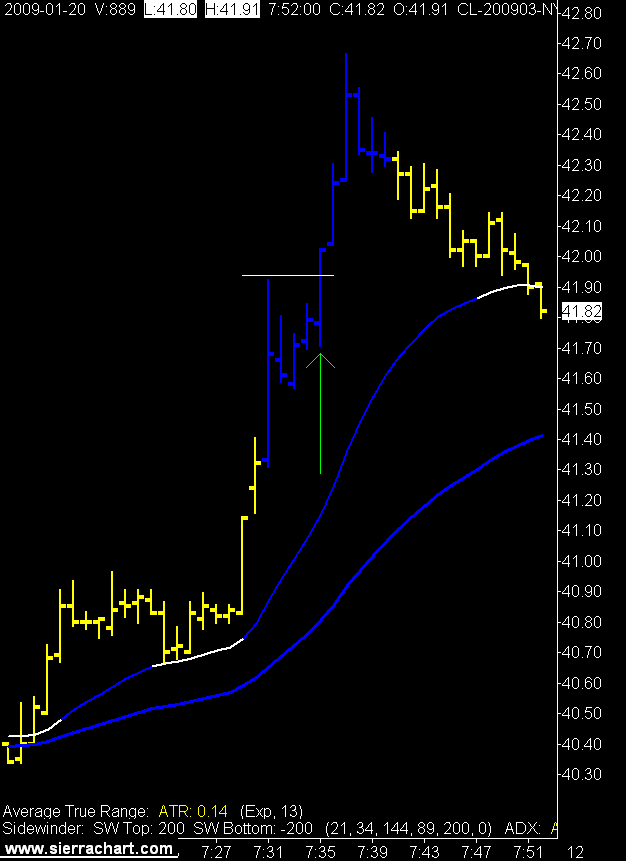

A very strong up move in the morning brought forth a plethora of 5 minute blue bars. I took the first trade, bagged my target, and congratulated myself for the very self evident genius at work.

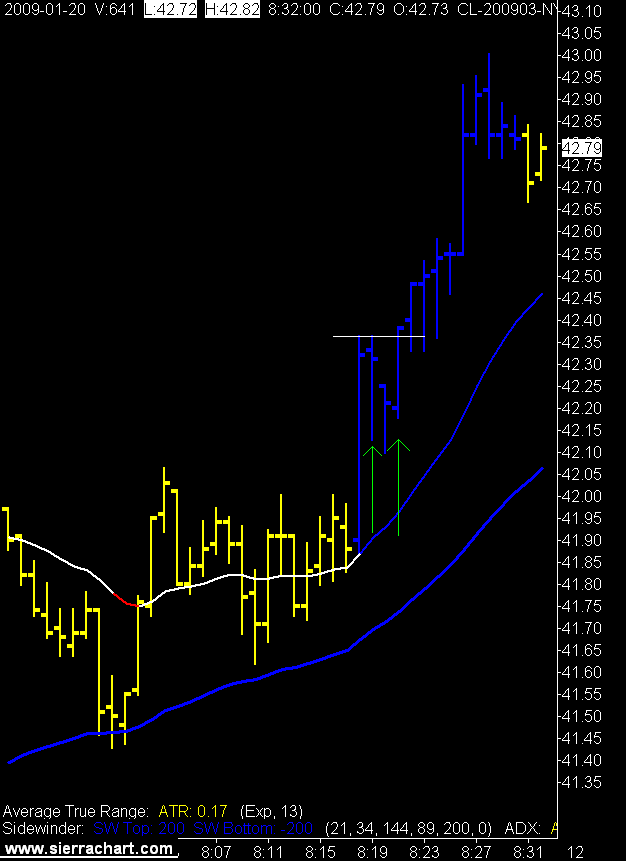

Then came the second trade.

Twas not my fault, I swear.

Limit long at 42.38, price on the chart does not go over .36, I get filled at .37, price then plummets through my stop and I bail for a 25 tic loser.

Nice.

The signal was still intact, and technically my entry price was not hit so I went again at 42.38 and got a BE + 1. Well this is crude oil, so the fill was BE - 1.

Sheesh.

These things happen, I want a product that moves, and I got one. Day was net positive so I guess it could have been worse.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

5 comments:

HI my name is James and I am new to trading crude and trading in general. What do you mean the bars turned blue? And how did you determine your exit there on the first trade? On second trade do you mean a 25 cent loser? What do yo mean by BE? Sorry to be a bother. James

James I'll assume you are serious and tie my sarcastic tongue behind by left ear. Ouch.

The price bars turned blue because they are programmed to turn blue when my technical indicators reach a certain level.

My exit is a fixed target and is a function of the size of stop I use. The target is roughly 3 times the stop, plus a few tics for commission and slippage.

I only trade for that target when the Average True Range tells me I have a good chance of obtaining it.

In crude oil a tic is equal to a one cent move in price. Each tic is worth $10.00.

BE is break even.

Please read all the books that Solfest recommends before trading anything.

Then sim trade.

Then think long and hard about risking money.

I can untie my tongue now.

what does it take for your techinical indicators to make it turn blue.

Magic

A wise man once said.

You must trade your own beliefs in the market, not someone else's.

Trading is money and money is emotion and when these emotions are put to the fire you will fail if you are not dealing with your own belief system.

In order to stick with “the plan” in a drawdown you must believe in your plan and this belief can only come from the very core of who you are and your psychological relationship with your money at risk in the marketplace.

You must develop, design, and build your own system based on your own research. You can then build a database of trades that provide the trader a statistical basis on which they validate their trading system.

Post a Comment