2/27/2009

Doing Time

Let's see, five and a half hours in the crude oil session. That's 19,800 seconds. I had one trade that lasted for 67 seconds. I stare at charts for 19,800 seconds so I can trade 0.34% of the trading day.

Strange job.

At least I got paid.

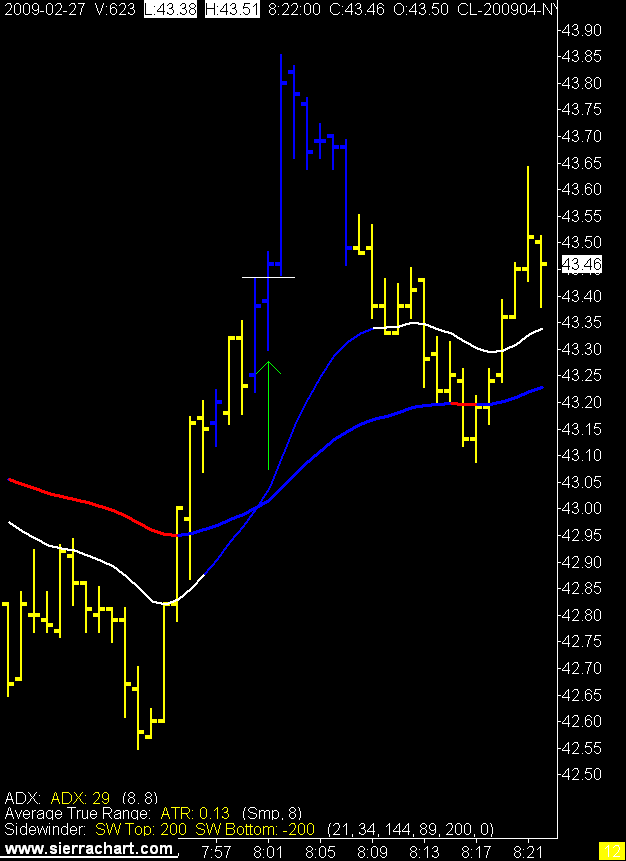

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

Interesting story from the Globe and Mail on Albertans working in Iraq.

Strange job.

At least I got paid.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

Interesting story from the Globe and Mail on Albertans working in Iraq.

2/25/2009

I Think I'm in Love

Don't tell Mrs. Solfest.

This is priceless.

Why is this woman not Prime Minister or President for that matter.

You must watch this.

No debt and 700 million in reserves, my o my.

This is priceless.

Why is this woman not Prime Minister or President for that matter.

You must watch this.

No debt and 700 million in reserves, my o my.

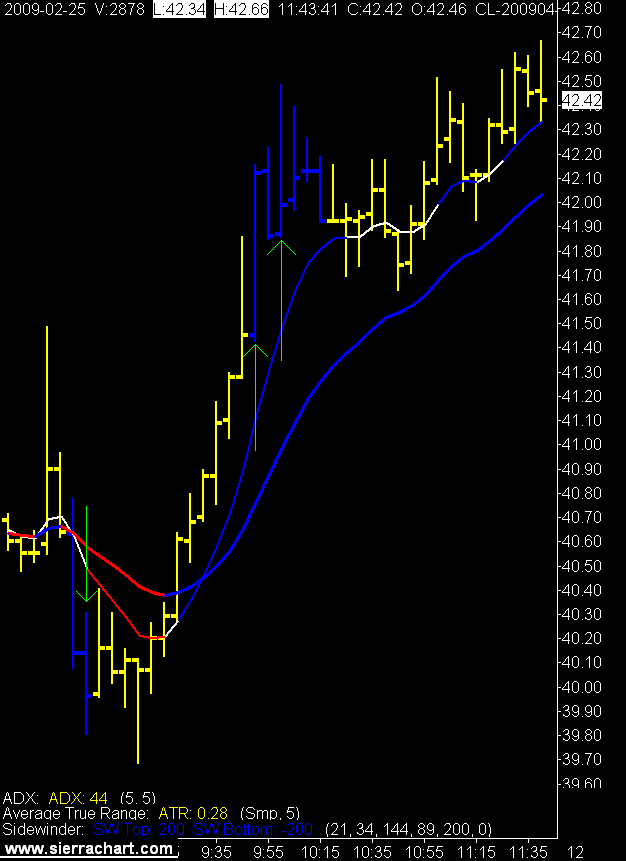

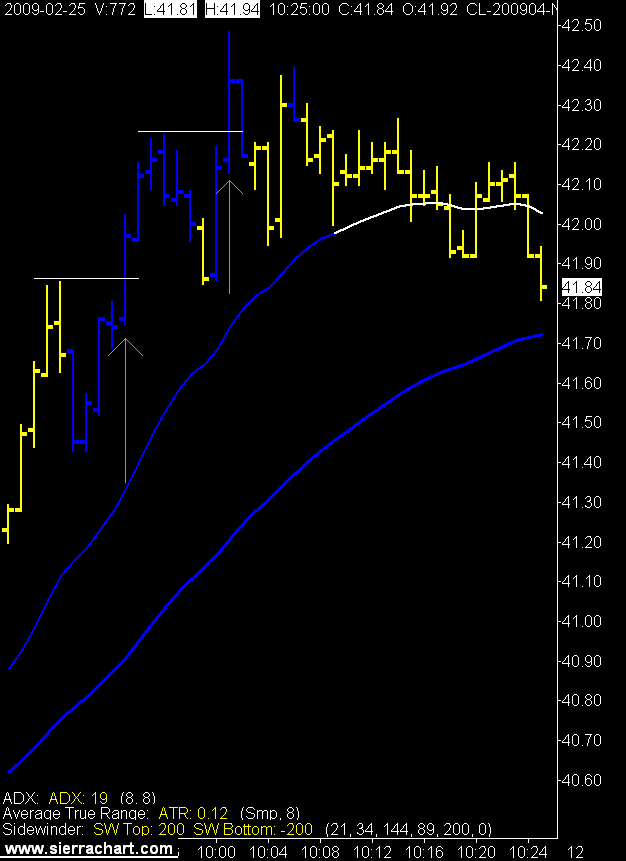

A Slight Tweaking

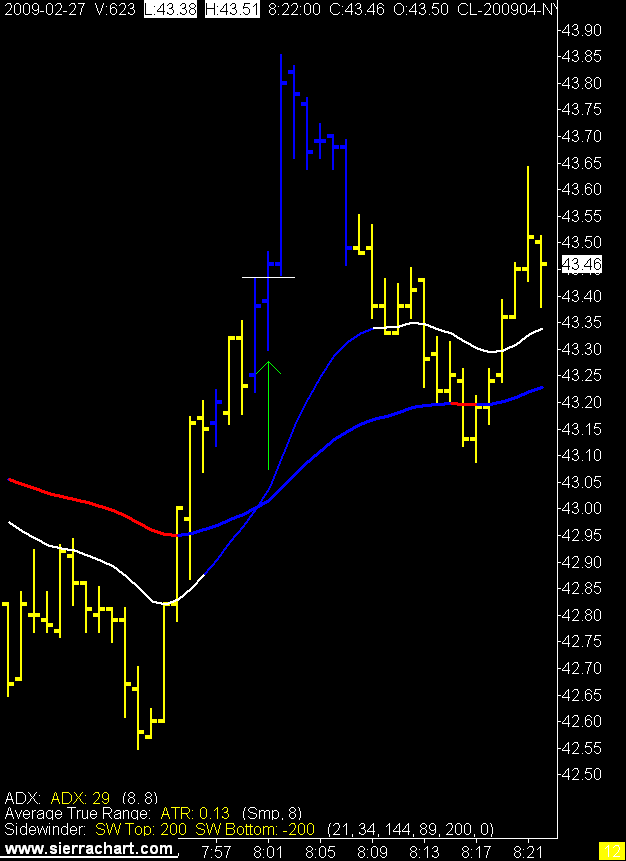

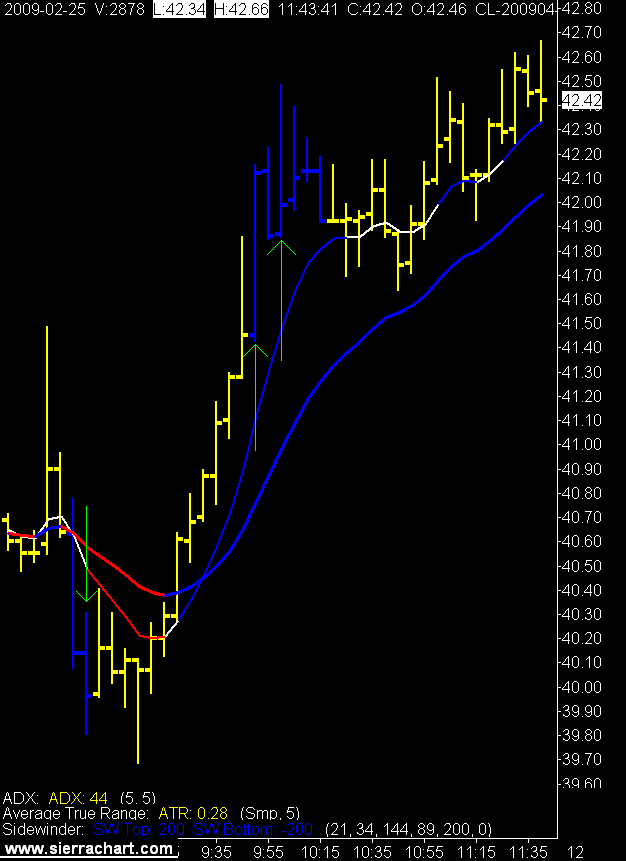

I have made a few slight adjustments to the magic blue bars as I have been suffering a major lack of magic these last few weeks. The parameters for the indicators are roughly the same but I have shortened the length required to obtain those parameters.

For example the 5 minute ATR and ADX are now a 5 period instead of an 8 period.

Barrel count today and you see the crazy price action on the 1 minute chart at 8:30 MST. That kind of price action is tame compared to how it used to act, back in the good old days.

I missed the first trade and caught the next 2, one for full target and one partial.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

For example the 5 minute ATR and ADX are now a 5 period instead of an 8 period.

Barrel count today and you see the crazy price action on the 1 minute chart at 8:30 MST. That kind of price action is tame compared to how it used to act, back in the good old days.

I missed the first trade and caught the next 2, one for full target and one partial.

5 Minute Crude Oil Chart

1 Minute Crude Oil Charts

2/24/2009

The Best Fight Ever

Have not posted a daily YM chart in a while, now I know why. It's just a tad depressing. Big up move today and we didn't even get back to the November lows. The equity markets are now down 50% from their highs. The last time that happened was 1931.

Like I said, depressing.

It will be quite a fight to get this thing turned around. Maybe we need Marvin Hagler to run the Fed instead of Ben Bernanke.

Daily DOW Futures Chart (click on chart to view)

Like I said, depressing.

It will be quite a fight to get this thing turned around. Maybe we need Marvin Hagler to run the Fed instead of Ben Bernanke.

Daily DOW Futures Chart (click on chart to view)

2/20/2009

The Alberta Disgrace II

Now the disgrace comes home to roost. This makes me so angry I could just.....just.....I don't know.....vote Liberal.

Yes it's that bad.

At least then I could live without the expectation of the government doing the right thing.

"The touchstone of their concern is the single largest pool of money under de Bever's control: the Alberta Heritage Savings Trust Fund. The fund was established 33 years ago to store up oil profits for the benefit of future generations. But successive Conservative governments first stopped funding it, then began skimming its profits. As of Sept. 30, it stood at $15.8 billion—20% lower than it was 20 years ago (adjusted for inflation). Now, with resource revenues poised to fall sharply and remain depressed for the next few years at least, Alberta could soon face humbling fiscal challenges it should have headed off when times were rosy. By the time de Bever has fixed AIMCo, the province could very well be mired in a full-blown fiscal crisis on par with that of the 1980s—leaving it no choice but to tap the Heritage Fund or run up massive deficits. It's hard to believe, but Alberta, the Wonderland of Canada—with its oil sands, no sales tax and debt-free balance sheet—has pissed away another oil boom." Sean Silcoff, Globe and Mail

Yes Mr. Silcoff it is hard to believe.

Very hard.

The question is how bad will it get?

Read the full Globe and Mail story here.

Yes it's that bad.

At least then I could live without the expectation of the government doing the right thing.

"The touchstone of their concern is the single largest pool of money under de Bever's control: the Alberta Heritage Savings Trust Fund. The fund was established 33 years ago to store up oil profits for the benefit of future generations. But successive Conservative governments first stopped funding it, then began skimming its profits. As of Sept. 30, it stood at $15.8 billion—20% lower than it was 20 years ago (adjusted for inflation). Now, with resource revenues poised to fall sharply and remain depressed for the next few years at least, Alberta could soon face humbling fiscal challenges it should have headed off when times were rosy. By the time de Bever has fixed AIMCo, the province could very well be mired in a full-blown fiscal crisis on par with that of the 1980s—leaving it no choice but to tap the Heritage Fund or run up massive deficits. It's hard to believe, but Alberta, the Wonderland of Canada—with its oil sands, no sales tax and debt-free balance sheet—has pissed away another oil boom." Sean Silcoff, Globe and Mail

Yes Mr. Silcoff it is hard to believe.

Very hard.

The question is how bad will it get?

Read the full Globe and Mail story here.

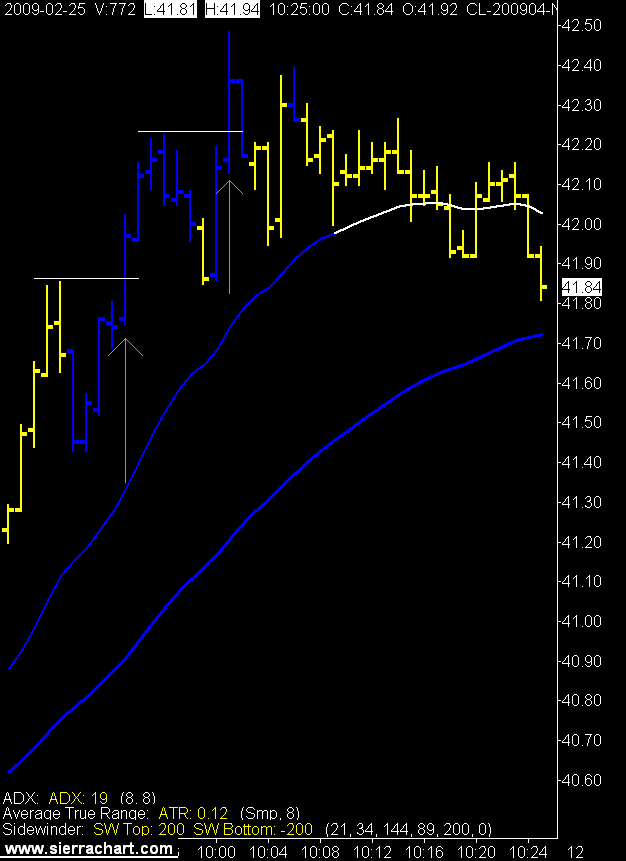

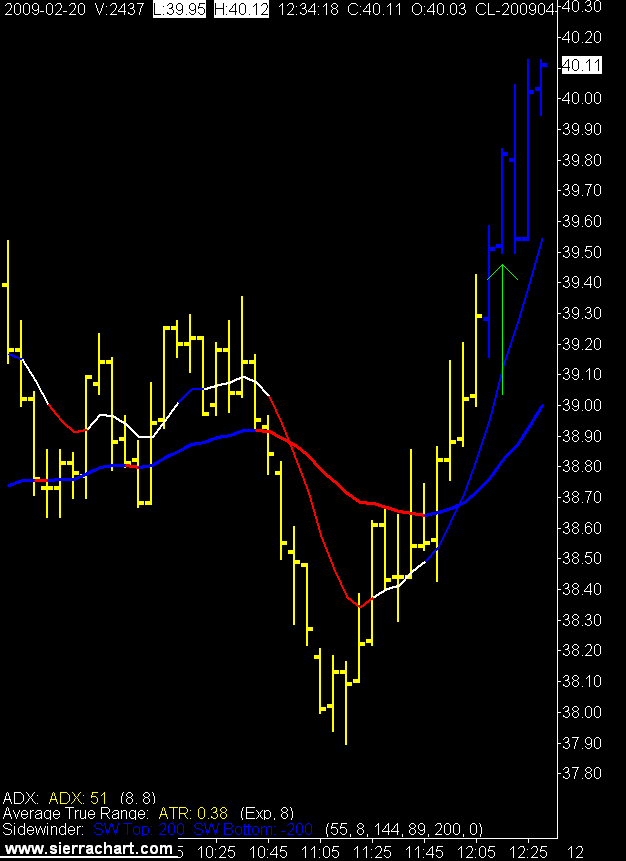

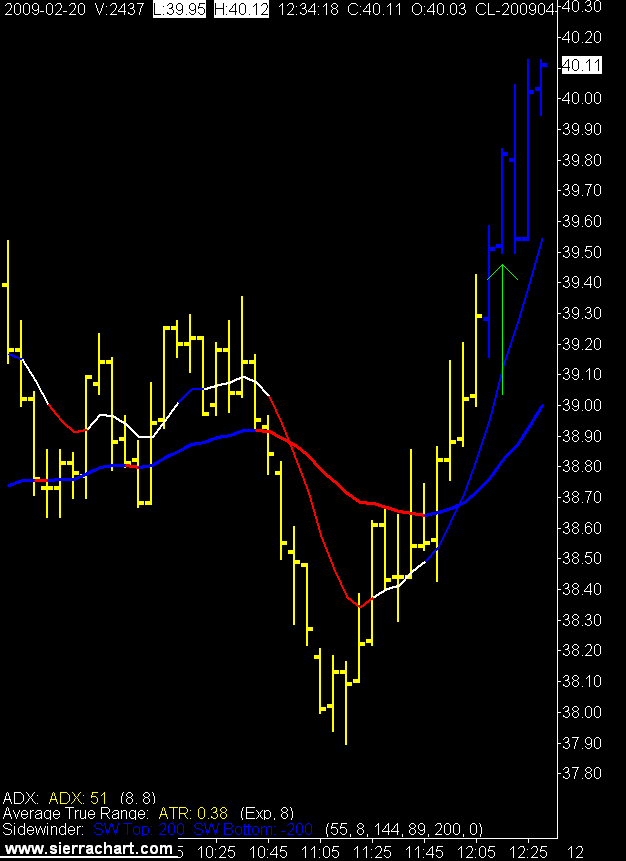

Another Long Day

One signal two trades. :)

The non signal trade was blue on the 1 minute but not on the 5 minute. You have my sincere apologies. The signal trade was a slow one and came within 3 tics of target. Trailing stop exit.

Yes indeed, a rather long day for little reward.

I wonder what blue bars look like on a gold chart?

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

Some good video on the old blog this week. Have a nice weekend and give them a watch.

The non signal trade was blue on the 1 minute but not on the 5 minute. You have my sincere apologies. The signal trade was a slow one and came within 3 tics of target. Trailing stop exit.

Yes indeed, a rather long day for little reward.

I wonder what blue bars look like on a gold chart?

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

Some good video on the old blog this week. Have a nice weekend and give them a watch.

Fires of Kuwait

If you ever get a chance to see this Imax film on the big screen don't pass it up. Until then you get to watch it on a very small screen.

2/19/2009

Crude Oil Contango Explained

Not by me.

The EIT (Exceptional Irish Trader) sent me the link, is that an Irish accent in the video?

Hmmmm.

The EIT (Exceptional Irish Trader) sent me the link, is that an Irish accent in the video?

Hmmmm.

Startled into Action

A couple of signals today, not sure if I just didn't trade them well or if I got all my system can give. Got a break even and a trailing stop for a small positive day.

Felt like I should have done better based on the the post trade review. That could be due to the shortage of signals lately as you feel the need to cash in when something does show up.

Hopefully tomorrow is as active as the last 2 Fridays.

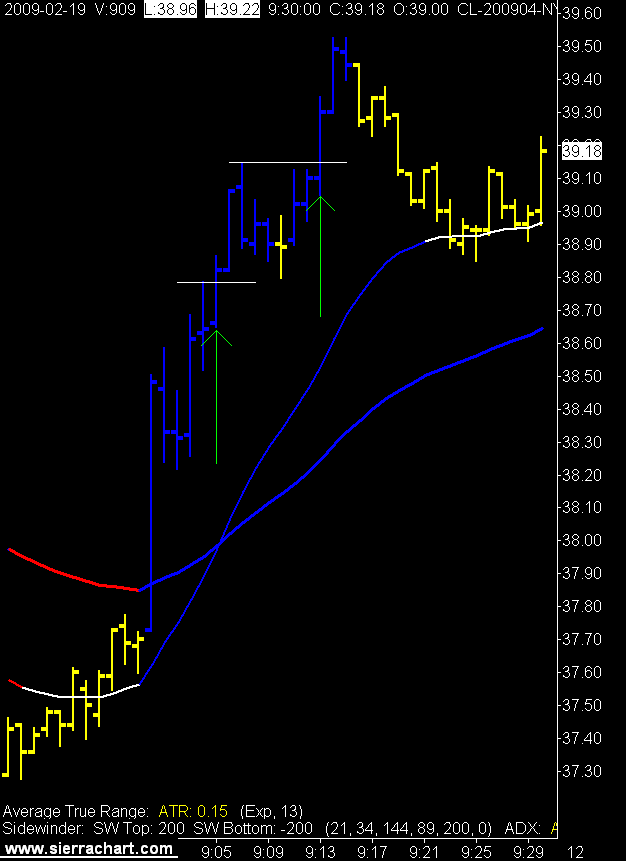

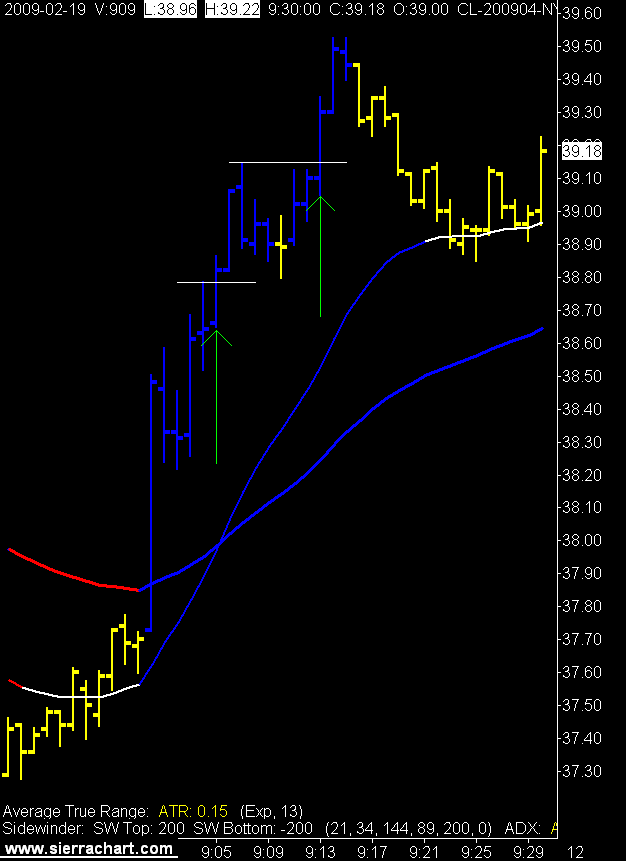

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

Felt like I should have done better based on the the post trade review. That could be due to the shortage of signals lately as you feel the need to cash in when something does show up.

Hopefully tomorrow is as active as the last 2 Fridays.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

2/18/2009

Recession Bits

A few morsels I came across this week. Feel free to add your own witty commentary.

Labels:

alberta oil sands,

fort mcmurray,

Milton Friedman,

recession,

stimulis

Fear

Two core emotions in the human psyche are fear and greed. Mr. Buffett says we should be greedy when others are fearful and fearful when others are greedy.

It seems the vast majority of people are simply not capable of doing this. We have just stopped being greedy and instead become fearful.

Do the media incite fear? Does the "madness of crowds" start with perceptions delivered by the media, or are they just cold portrayers of facts?

The scariest thing of all is the fact that my tax dollars paid for this film.

Sigh.

2/17/2009

I Can't Get No

No signals, no trades.

Another name for this post, not this song, could be the art of doing nothing. I have trouble with the art of doing nothing. Those of you who are familiar with GB007 will remember his quote, "the urge to trade is stronger than the urge to trade profitably".

Very true.

Especially if you have spent most of your youth and adulthood working your you know what off. It just doesn't feel right to do nothing. I'm here, I'm a trader, I should trade.

Most of us grew up with the knowledge that if you want something you have to work for it. Work harder, work harder, work harder.

It doesn't work that way in trading.

I guess we call it working smarter.

2/13/2009

Another Unique Moment in Time

Nice day to trade today with a power move up in the afternoon session. That's two nice Fridays in a row.

Strange.

In this business you have to expect anything and everything at anytime. No bias allowed.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

I did a little culling in the blog list today. I don't mind if you don't reciprocate a link, but if you don't post, you're just taking up space.

If anyone knows of a great trading blog let me know. I would like to add day traders who trade crude oil or any other futures contracts. Preferably ones that don't feel the need to drop the f bomb every second word. Yes I'm speaking to you Dinosaur Trader. Great trader, great writer, why diminish when you have the ability to distinguish.

While your at it feel free to tell me anything else you would like to see more of, or less of on the blog.

Have a nice long weekend.

Strange.

In this business you have to expect anything and everything at anytime. No bias allowed.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

I did a little culling in the blog list today. I don't mind if you don't reciprocate a link, but if you don't post, you're just taking up space.

If anyone knows of a great trading blog let me know. I would like to add day traders who trade crude oil or any other futures contracts. Preferably ones that don't feel the need to drop the f bomb every second word. Yes I'm speaking to you Dinosaur Trader. Great trader, great writer, why diminish when you have the ability to distinguish.

While your at it feel free to tell me anything else you would like to see more of, or less of on the blog.

Have a nice long weekend.

2/12/2009

Ethanol, Just Recently a Savior, Is Struggling

A VeraSun Energy plant in Dyersville, Iowa, opened in early September 2008 and closed two months later. Now it is for sale. Photo by Mark Hirsch for The New York Times

A VeraSun Energy plant in Dyersville, Iowa, opened in early September 2008 and closed two months later. Now it is for sale. Photo by Mark Hirsch for The New York Times"Barely a year after Congress enacted an energy law meant to foster a huge national enterprise capable of converting plants and agricultural wastes into automotive fuel, the goals lawmakers set for the ethanol industry are in serious jeopardy." Clifford Krauss, NY Times

Your tax dollars at work.

Click on the read more icon for the full NY Times story.

read more | digg story

2/11/2009

You're Going the Wrong Way!

It seems like everyone wants to go long crude oil.

Why?

Because it's gone down a bunch, I guess. So has the DOW and I don't see a big line up to get long on that wagon.

I don't swing trade so the long term trend is irrelevant to me. My attempts at predicting crude oil prices are always wrong, but, it looks to me if you're going long crude, you're going the wrong way.

Daily Crude Oil Chart

2/10/2009

Super Genius

Some days you can research, plan, execute your plan, think happy thoughts, and you still don't catch the road runner. Timothy Geithner's plan had the same kind of day.

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

5 Minute Crude Oil Chart

1 Minute Crude Oil Chart

2/06/2009

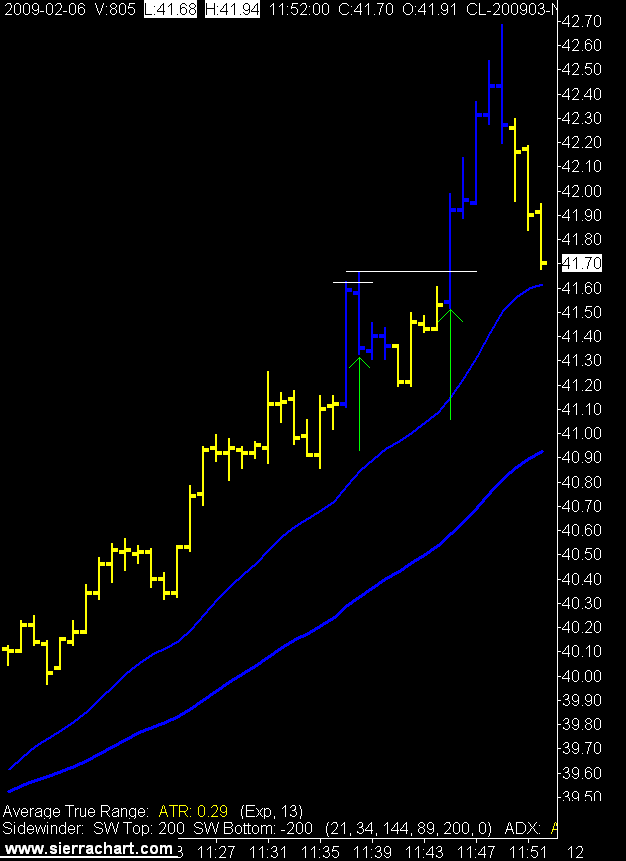

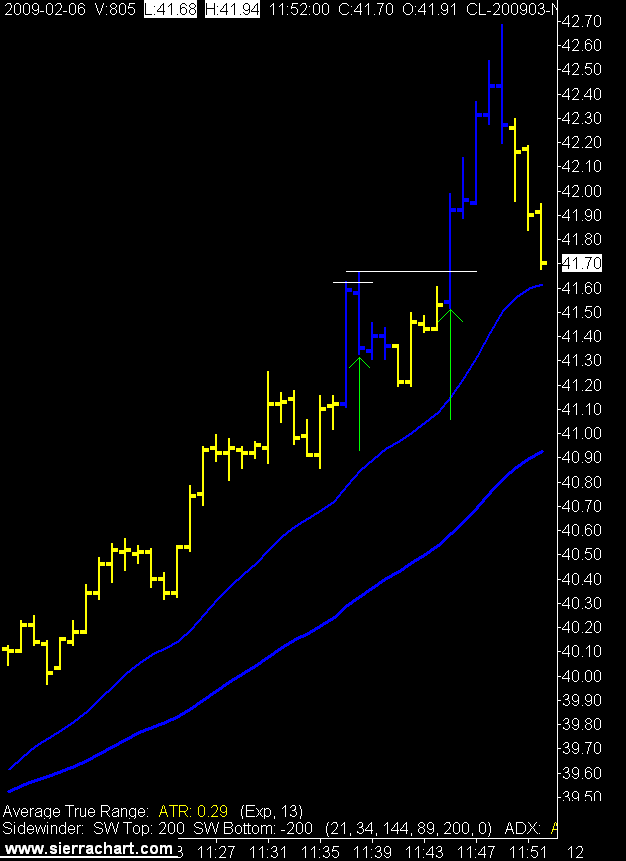

Pride and Joy

Got into a big fight with my plan this week. It was ugly, yelling, screaming, crying, and then the neighbors called the police. I threatened to leave my plan, I told her I found a new faster version, one that looked up to me as the trading master I am. I am ashamed to admit I even tried out the "other" plan. But, in the end my plan did not fail me, and she remains as always, my pride and joy.

1 Minute Crude Oil Chart

1 Minute Crude Oil Chart

2/05/2009

2/04/2009

Adaptation

"Adaptation is the change in living organisms that allow them to live successfully in an environment. Adaptations enable living organisms to cope with environmental stresses and pressures. Adaptations can be structural, behavioral or physiological. Structural adaptations are special body parts of an organism that help it to survive in its natural habitat (e.g., skin colour, shape, body covering). Behavioral adaptations are special ways a particular organism behaves to survive in its natural habitat (e.g., phototropism). Physiological adaptations are systems present in an organism that allow it to perform certain biochemical reactions (e.g., making venom, secreting slime, homeostasis)." Wikipedia

Uncle Rain (RR) told me I need to adapt my trading to the current market conditions. He thinks I don't listen to him so let's keep this between us.

He told me this as I was on a multiple post rant on the lack of signals for me in crude oil. Ok maybe multiple post doesn't quite cover the extent of the rant. "The Thrill is Gone" does summarize it nicely though.

Anyway where was I, oh yes, adaptation. The question is do you change your trading plan to fit the current market conditions or do you sit on the sidelines and wait for the market to come back to you?

Hmmm.

Changing your plan could also be described as curve fitting. Continually looking backward to find parameters that would have worked and then hoping they still work when applied to the hard right edge of the chart.

Sitting around for days and days doing nothing also doesn't sound like intelligence in action. Or does it? The turtles used to play a lot of ping pong according to Curtis Faith. This is trading, trading is not normal, normal behavior doesn't work in this business. We all know that, if it did there would be more success stories.

I am a human. I have taken my human emotional brain and created a machine to trade with. The machine does what I told it to do. I told it this based on hundreds of trades and my experience in those trades.

The plan is the result of that work.

But, the market has changed since then.

The 5 day ATR in crude is pathetic. Since there is less range you should be able to use smaller stops and smaller targets and still maintain the 3:1 RR target.

The problem with that is I based my ATR, EMA, LSMA, ADX criteria on levels where we see rapid price movement. If I accept lower levels we have more sideways price action. In other words I don't believe the smaller stop would work.

Let's go back to that humanness. This is February 4th. January of 2009 was a pretty good month for me. LOL It sounds absurd now that I have written it down.

ITS FEBRUARY 4TH MORON!!

Four days into the month and you want to change what was 5 days ago a great plan and system.

Oh my.

I think I have my answer.

The best part is the less I trade the more I can come up with annoying posts in the EIT's trading room. I know how much they love that. They can't get enough of my witty banter.

I'm glad we had this talk.

I feel better now.

Uncle Rain (RR) told me I need to adapt my trading to the current market conditions. He thinks I don't listen to him so let's keep this between us.

He told me this as I was on a multiple post rant on the lack of signals for me in crude oil. Ok maybe multiple post doesn't quite cover the extent of the rant. "The Thrill is Gone" does summarize it nicely though.

Anyway where was I, oh yes, adaptation. The question is do you change your trading plan to fit the current market conditions or do you sit on the sidelines and wait for the market to come back to you?

Hmmm.

Changing your plan could also be described as curve fitting. Continually looking backward to find parameters that would have worked and then hoping they still work when applied to the hard right edge of the chart.

Sitting around for days and days doing nothing also doesn't sound like intelligence in action. Or does it? The turtles used to play a lot of ping pong according to Curtis Faith. This is trading, trading is not normal, normal behavior doesn't work in this business. We all know that, if it did there would be more success stories.

I am a human. I have taken my human emotional brain and created a machine to trade with. The machine does what I told it to do. I told it this based on hundreds of trades and my experience in those trades.

The plan is the result of that work.

But, the market has changed since then.

The 5 day ATR in crude is pathetic. Since there is less range you should be able to use smaller stops and smaller targets and still maintain the 3:1 RR target.

The problem with that is I based my ATR, EMA, LSMA, ADX criteria on levels where we see rapid price movement. If I accept lower levels we have more sideways price action. In other words I don't believe the smaller stop would work.

Let's go back to that humanness. This is February 4th. January of 2009 was a pretty good month for me. LOL It sounds absurd now that I have written it down.

ITS FEBRUARY 4TH MORON!!

Four days into the month and you want to change what was 5 days ago a great plan and system.

Oh my.

I think I have my answer.

The best part is the less I trade the more I can come up with annoying posts in the EIT's trading room. I know how much they love that. They can't get enough of my witty banter.

I'm glad we had this talk.

I feel better now.

The Thrill is Gone

The thrill is most definitely gone. No signals, no trades.

I may never trade again.

I may never trade again.

2/03/2009

Bored Traders

What do you do when there is nothing to trade?

If you are an exceptional Irish trader and an exceptional Irish painter.

You paint.

If you can't paint?

If you can't paint?

You look for strange you tube videos.

That is, of course, after you finished lining your office walls with aluminium foil so the FBI cannot spy on you.

Of course.

If I don't get a trading signal soon we will be going back to the rather disturbing, The Shining, videos.

Although shuffle board does look like alot of fun.

If you are an exceptional Irish trader and an exceptional Irish painter.

You paint.

If you can't paint?

If you can't paint?You look for strange you tube videos.

That is, of course, after you finished lining your office walls with aluminium foil so the FBI cannot spy on you.

Of course.

If I don't get a trading signal soon we will be going back to the rather disturbing, The Shining, videos.

Although shuffle board does look like alot of fun.

"Make me a Trader II"

Hopefully I will have better things to do than watch videos today. I will trade the plan, I will follow the machine's orders, I will bathe in the warmth of my positivity.

2/02/2009

"Make me a Trader"

This is an interesting piece of television, a British reality show on trading. Watch the emotion in these rookie traders. That very normal and oh so human emotion. I wonder if there is some way to surgically remove it?

Subscribe to:

Comments (Atom)