Daily Price Limit

"Daily price limits and trading halts of the CBOT DJIA Index ($5 Multiplier) futures contract shall be coordinated with trading halts of the underlying stocks listed for trading in the securities markets.

Price Limits: For each calendar quarter, there shall be three successive price limits: Level 1, Level 2, and Level 3. The limit thresholds that define Levels 1, 2, and 3 shall be calculated at the beginning of the pertinent calendar quarter, using the average daily closing value of the DJIA for the calendar month prior to the beginning of such calendar quarter. The Level 1 limit threshold shall equal 10% of such average daily closing value, the Level 2 limit threshold shall equal 20% of such average daily closing value, and the Level 3 limit threshold shall equal 30% of such average daily closing value. Each limit threshold shall be rounded to the nearest fifty DJIA index points.

These three limit thresholds, so computed, shall remain in effect throughout the pertinent calendar quarter, until the next calculation. These limit thresholds shall be used to calculate price limits for each trading session within the pertinent calendar quarter, as follows:

Level 1 shall equal the settlement price of the preceding regular trading session minus the Level 1 limit threshold.

Level 2 shall equal the settlement price of the preceding regular trading session minus the Level 2 limit threshold.

Level 3 shall equal the settlement price of the preceding regular trading session minus the Level 3 limit threshold.

Price Limits During Regular Trading Hours: The following price limits and trading halts shall apply to open outcry and electronic trading, in the primary contract expiration month only, during the Exchange’s regular trading hours. For purposes of this rule, “regular trading hours” are defined for CBOT DJIA Index ($5 Multiplier) futures to begin with the time of the open for open outcry trading in DJIA futures, and to end with the later of the time of the close of open outcry trading, or the conclusion of any daytime electronic trading session that is part of the same trading day.

(a) Level 1: When the primary futures contract is limit offered at the Level 1 Price Limit, a 10-minute period shall commence. If the primary futures contract is limit offered at the end of the 10-minute period, trading shall terminate for a period of two minutes, after which time the market shall reopen. The next applicable price Limit shall apply to such reopening.

(b) Level 2: When the primary futures contract is limit offered at the Level 2 Price Limit, a 10-minute period shall commence. If the primary futures contract is limit offered at the end of the 10-minute period, trading shall terminate for a period of two minutes, after which time the market shall reopen. The next applicable price Limit shall apply to such reopening.

(c) Level 3: The Level 3 price limit shall be in effect during all regular trading hours.

In the event that trades on the electronic trading platform occur through the price limits described above, any such trades may be busted by the Exchange.

Trading Halts: If there is an NYSE Rule 80B trading halt declared in the primary securities market, trading shall be halted. Once trading in the primary securities market resumes after an NYSE Rule 80B trading halt, trading on the CBOT DJIA (DJIA) Index ($5 Multiplier) futures contract shall resume.

If an NYSE Rule 80B trading halt becomes inapplicable, the corresponding Price Limit shall likewise become inapplicable. E.g., if an NYSE Rule 80B trading halt, triggered by a 10% or a 20% decline in the Dow Jones Industrial Average, has been declared in the primary securities market, and trading in the primary securities market has recommenced, then the 10.0% or 20.0% Price Limits shall become inapplicable, respectively. E.g., when the NYSE Rule 80B 10.0% price limit provisions are suspended after 2:30 p.m. Eastern time, then the 10.0% Price Limit shall become inapplicable. Trading on the CBOT DJIA (DJIA) Index ($5 Multiplier) futures contract shall continue and the next applicable Price Limit shall apply.

Opening Time: If either a trading halt was in effect or the primary futures contract was locked at a limit at the close of trading, then the opening time of trading on GLOBEX® shall be delayed until 6:00 p.m.

During Electronic Trading Hours (ETH), there shall be no trading of CBOT DJIA Index ($5 Multiplier) futures at a price more than the 5.0% Price Limit above or below the Reference RTH Price. If the market is limit bid or limit offered during a period commencing two minutes prior to the opening of RTH, there shall be a trading halt in effect until the commencement of Regular Trading Hours (RTH). Once RTH commences, the next applicable trading limit shall be in effect.

The 5.0% Price Limit shall be calculated as one-half of the Level 1 or 10% price limit rounded down to the nearest integral multiple of 10 index points."

Source CBOT Web site

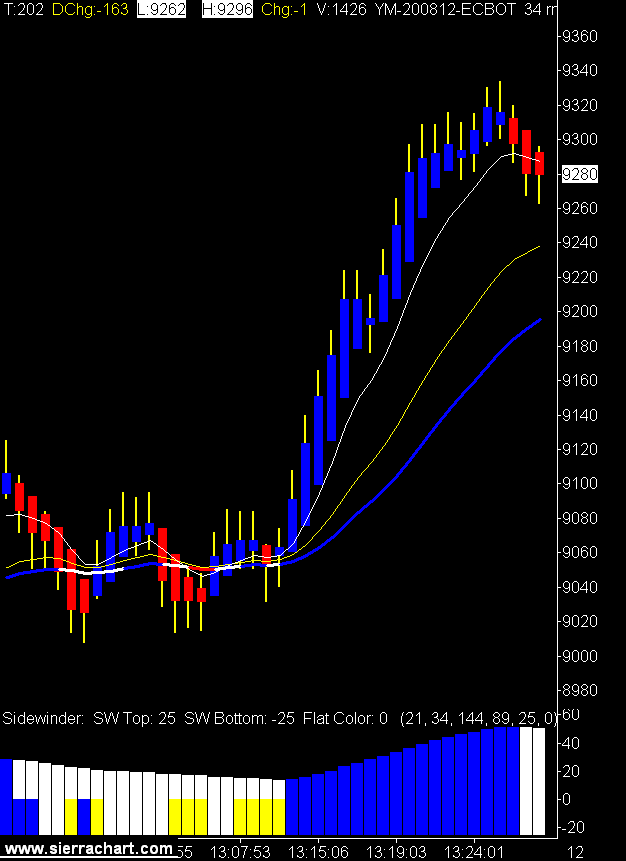

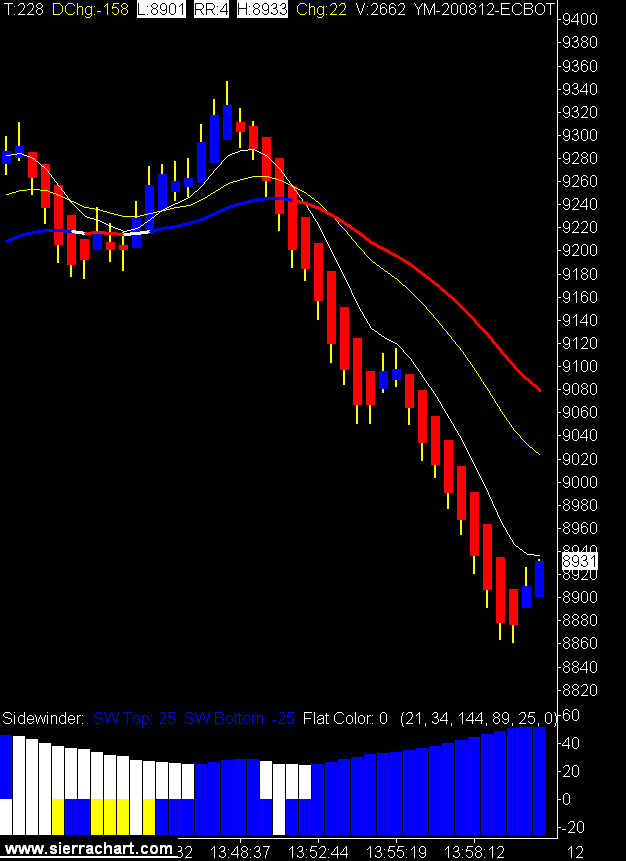

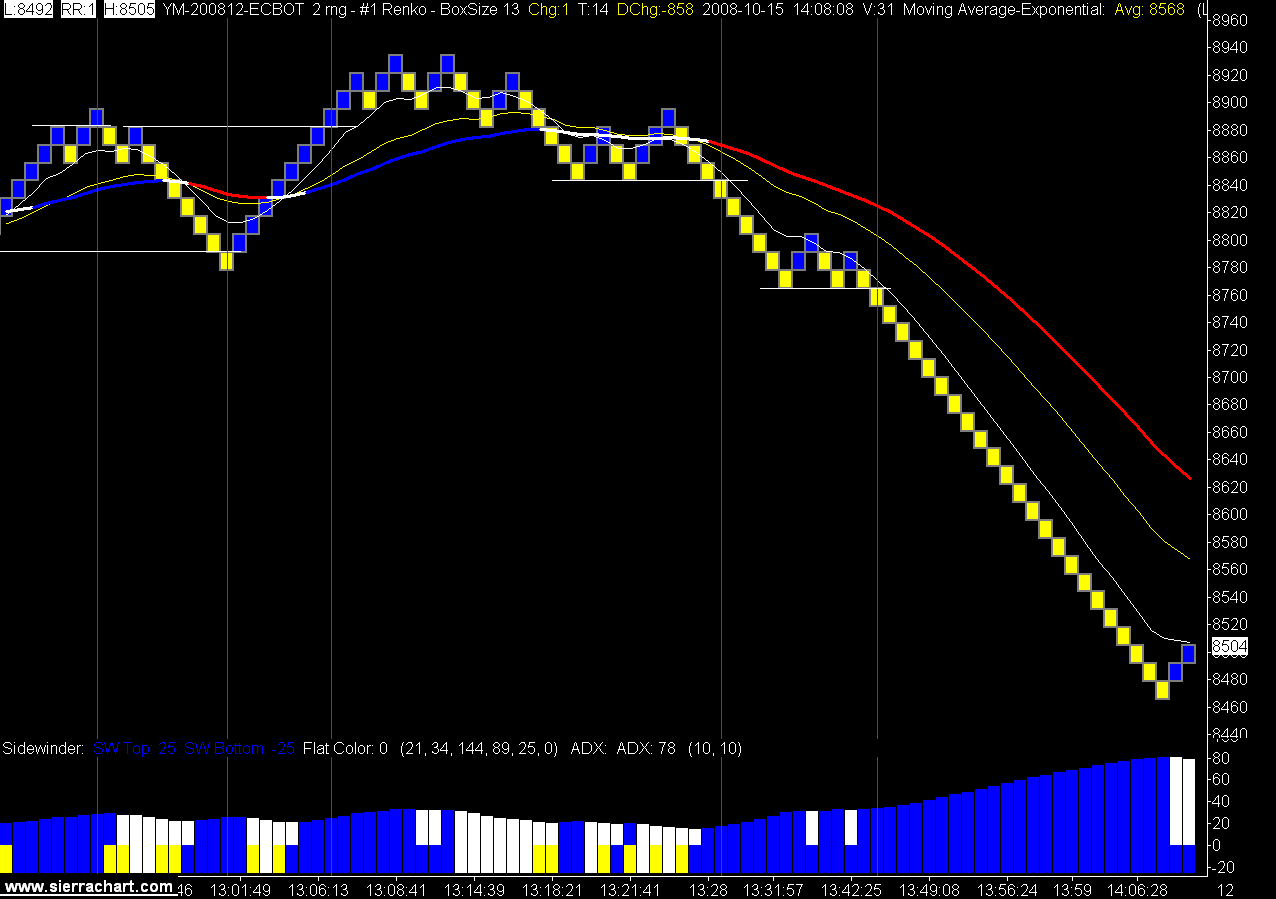

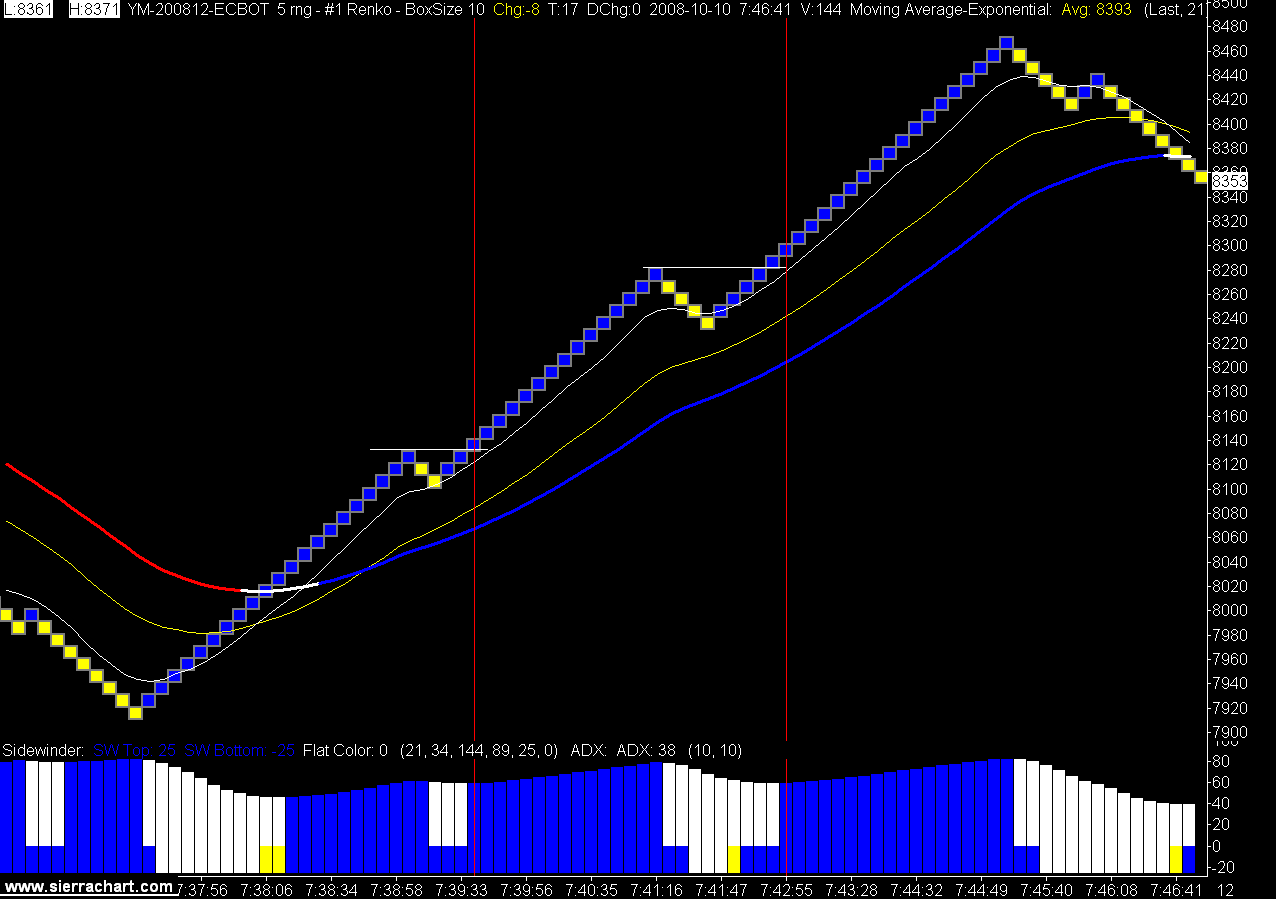

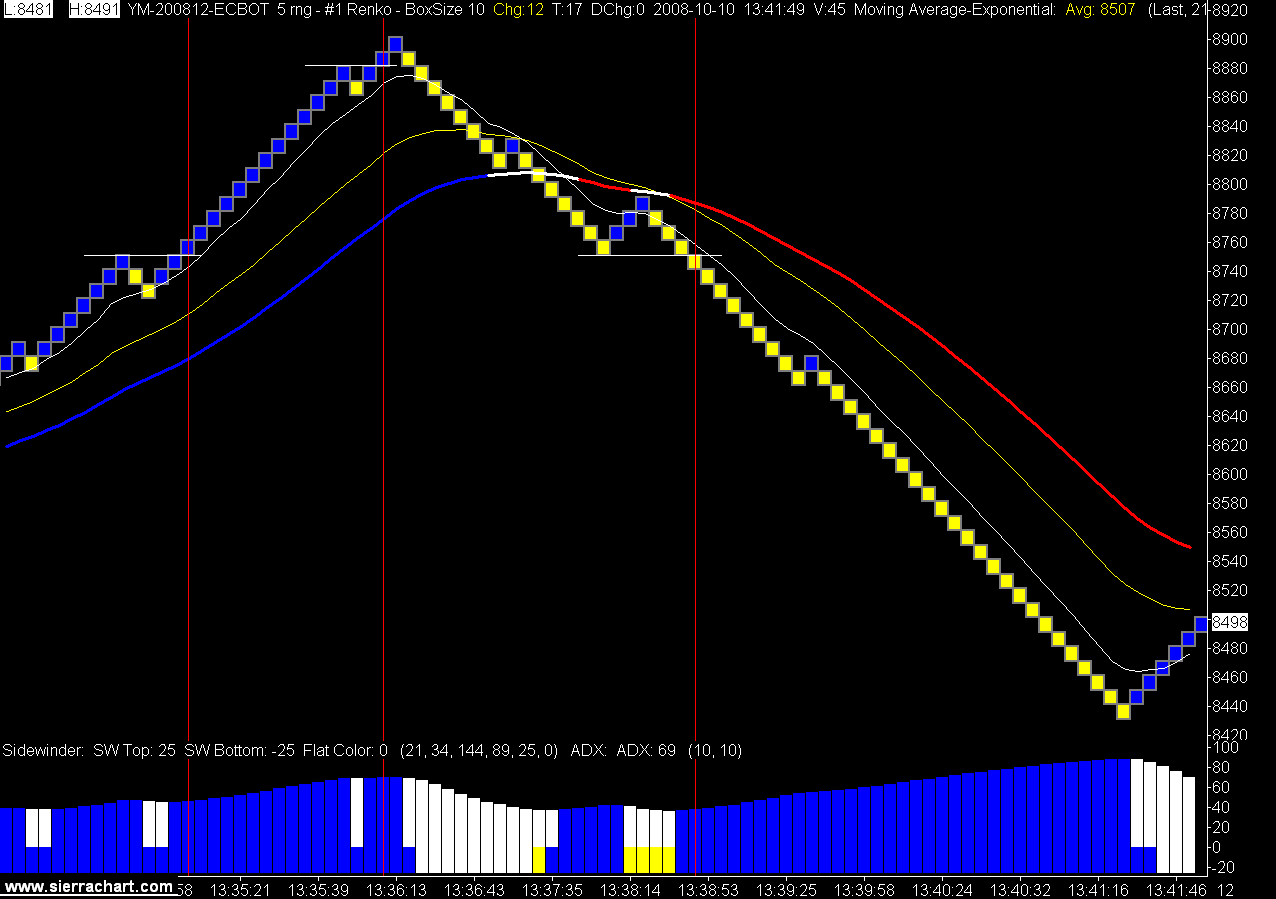

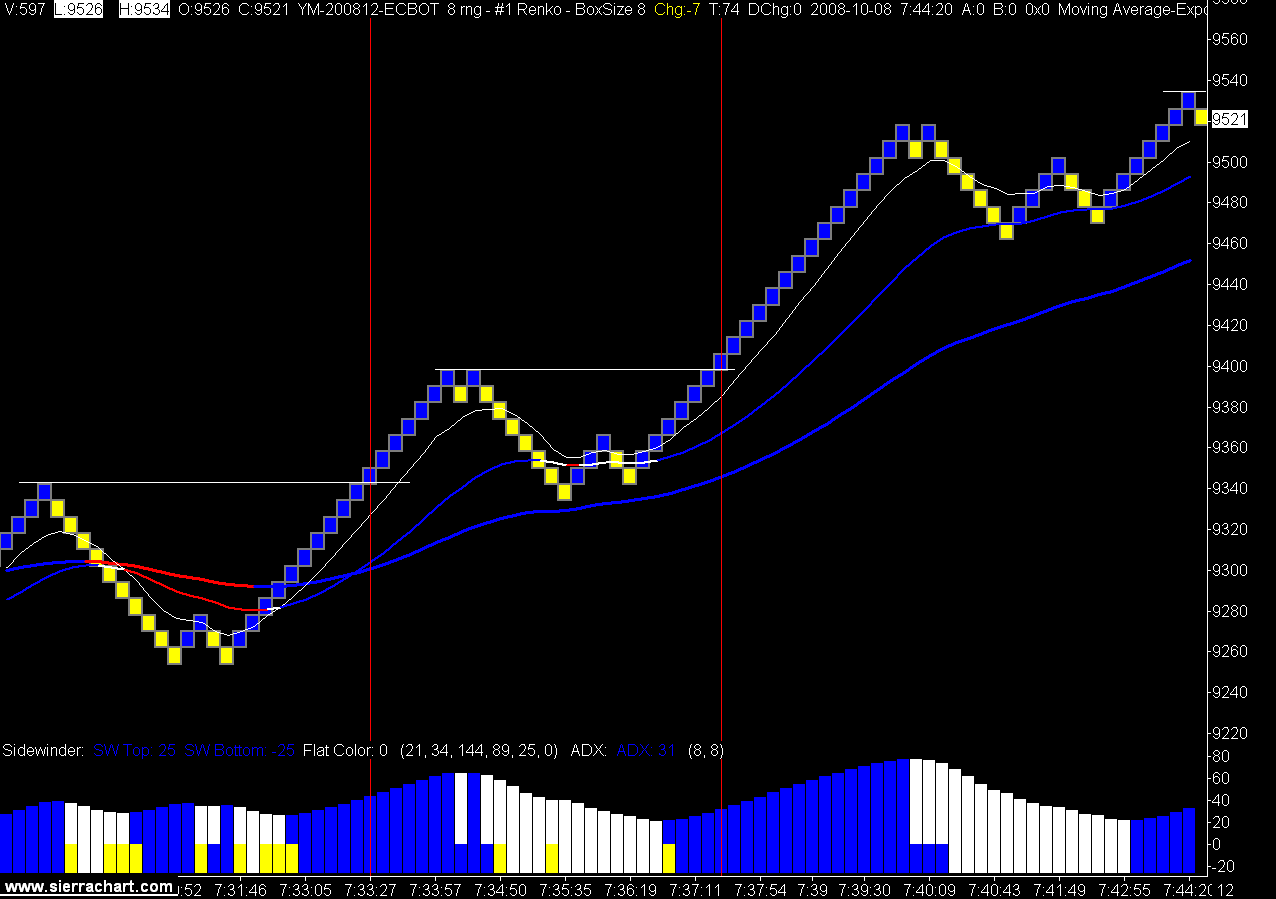

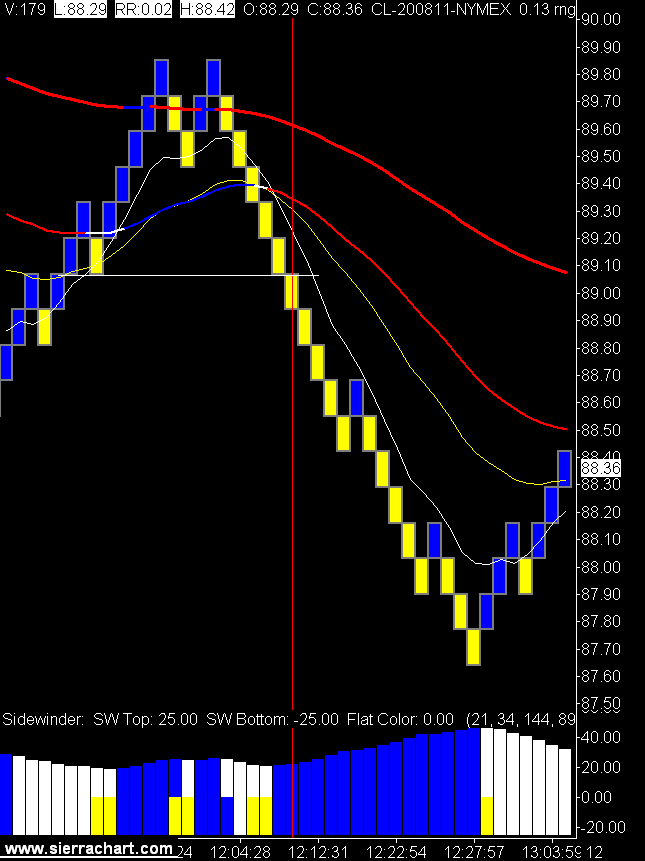

Today's trades, 6 winners, 3 losers, and 4 break evens, for 157 winning tics / 29 losing tics = RR 5.41

Today's trades, 6 winners, 3 losers, and 4 break evens, for 157 winning tics / 29 losing tics = RR 5.41